New Student Loan Legislation: The GOP's Proposed Changes To Pell Grants And Repayment Options

Table of Contents

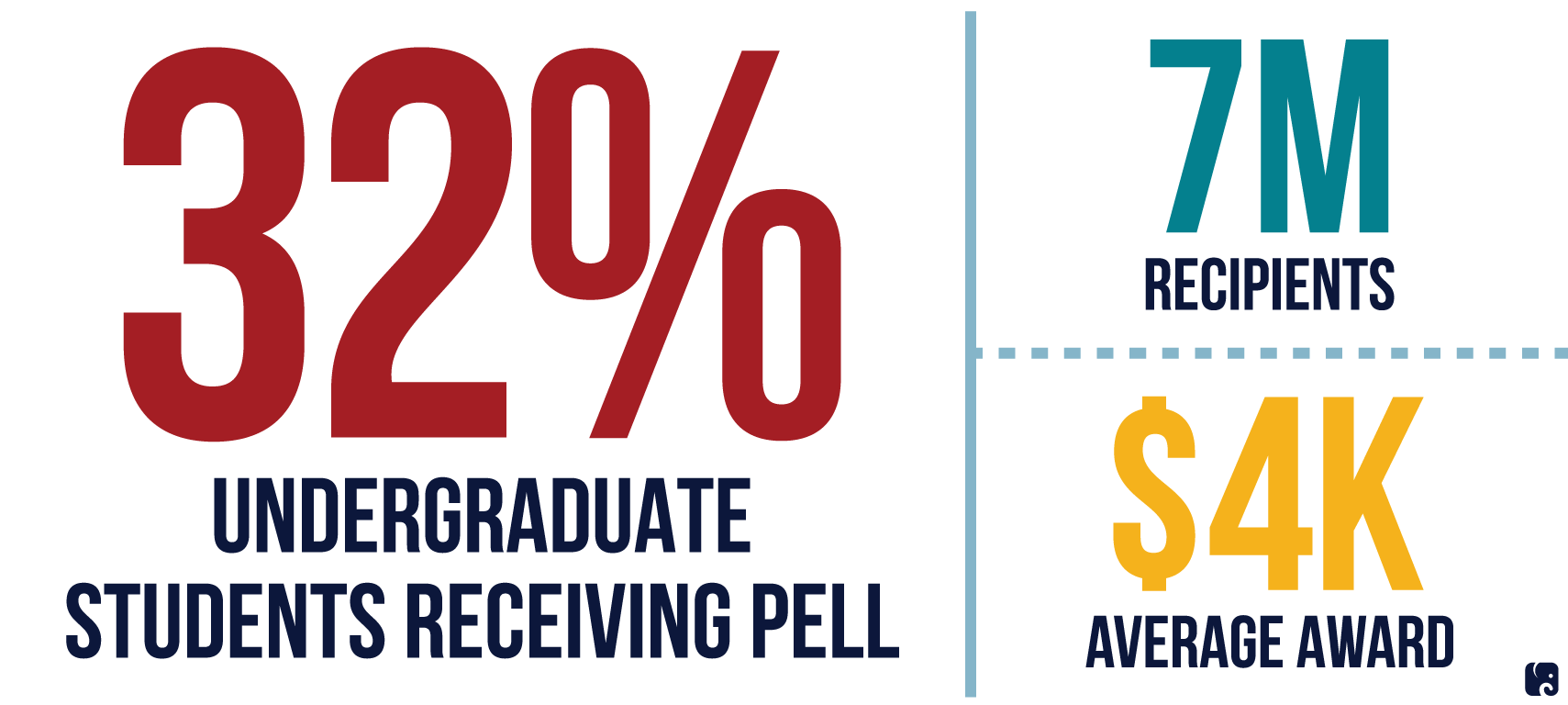

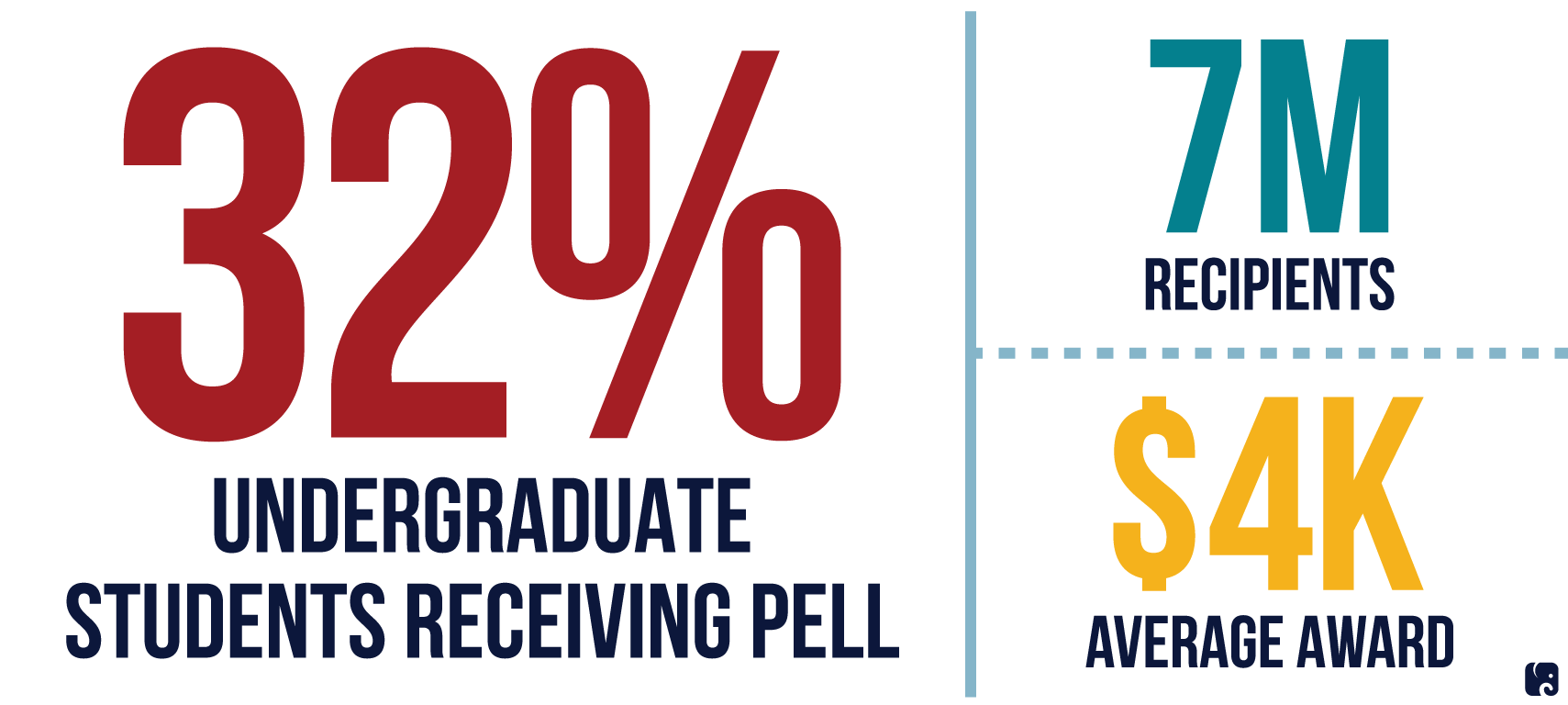

Proposed Changes to Pell Grants

The Pell Grant program is a crucial component of federal student aid, designed to make higher education accessible to low-income students. These grants, unlike loans, do not need to be repaid. Currently, Pell Grant eligibility is determined by factors such as Expected Family Contribution (EFC) and enrollment status. The GOP's proposed modifications could significantly impact this system. While specific details might vary depending on the proposed legislation, potential changes could include:

-

Modified Eligibility Requirements: The GOP may propose stricter income thresholds or introduce GPA requirements, potentially reducing the number of eligible students. This could disproportionately affect low-income students and minority groups who already face significant barriers to higher education.

-

Adjusted Grant Amounts: Proposals might involve increasing or decreasing the maximum Pell Grant amount. A decrease would significantly reduce financial aid for many students, forcing them to rely more heavily on loans, potentially increasing their debt burden.

-

Changes to Award Distribution: The GOP might suggest shifting from the current need-based system to a merit-based system, potentially rewarding academic achievement over financial need. This shift could exclude many deserving students based solely on their academic performance.

-

Consequences for Colleges and Universities: Reduced Pell Grant funding could lead to decreased enrollment at colleges and universities, forcing institutions to adjust their budgets and potentially raise tuition fees to compensate for lost revenue.

Repayment Plan Modifications Under the GOP's Proposals

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable for borrowers by basing monthly payments on their income and family size. These plans often include loan forgiveness provisions after a certain number of payments. The GOP's proposals may involve changes to these existing IDR plans or the introduction of entirely new repayment schemes. Possible modifications include:

-

Altered Repayment Terms: This might include adjustments to interest rates, loan forgiveness programs, or payment caps. Increasing interest rates or reducing forgiveness provisions would significantly increase the total amount borrowers pay over the life of their loans.

-

Impact on Monthly Payments: Changes to IDR plans could result in higher monthly payments for some borrowers, making it more difficult to manage their debt. This could lead to increased defaults and further financial hardship.

-

Effects on Long-Term Student Loan Debt: The GOP's proposals could either reduce or increase the overall student loan debt burden depending on the specific changes implemented. Reducing loan forgiveness options could lead to a significant increase in long-term debt.

-

Impact Across Income Brackets: The effects of these changes will likely vary depending on income levels. Lower-income borrowers might face disproportionately negative consequences from changes that increase repayment amounts or reduce forgiveness opportunities.

-

Changes to Loan Consolidation Programs: Potential modifications to loan consolidation programs could affect borrowers' ability to simplify their repayment process and potentially lower their monthly payments.

Political and Economic Implications of the Proposed Legislation

The political motivations behind the GOP's student loan proposals are complex and often involve debates about the size and scope of government intervention in higher education. These proposals also have significant economic implications, affecting various stakeholders including students, institutions, and the economy as a whole. Some potential consequences include:

-

Impact on the Higher Education Market: Changes to Pell Grants and repayment plans could influence college enrollment, tuition prices, and the overall financial stability of higher education institutions.

-

Effects on the National Debt: Depending on the specifics of the legislation, these proposals could impact the national debt, either by increasing or decreasing the amount of outstanding student loan debt.

-

Stakeholder Opinions: The proposed changes are likely to elicit diverse opinions from students, educators, policymakers, and other stakeholders, prompting debates about the balance between individual responsibility and government support for higher education.

-

International Comparisons: Comparing the GOP's proposals to student loan systems in other developed countries can provide valuable insights and inform the debate.

-

Long-Term Consequences: The long-term consequences of the proposed legislation are difficult to predict but could have lasting effects on educational attainment, economic opportunity, and income inequality.

Conclusion: The Future of Student Loan Legislation and the GOP's Plan

The Republican party's proposed changes to Pell Grants and student loan repayment options represent a significant shift in the landscape of higher education funding and accessibility. These proposals could drastically alter the financial burdens faced by students and the long-term stability of higher education institutions. Understanding the potential benefits and drawbacks of these changes is crucial for informed decision-making. The potential effects are far-reaching, impacting not just individual students but the national economy as well.

It is vital for students, educators, and all concerned citizens to stay informed about upcoming student loan legislation changes and actively engage in the political process to advocate for their interests concerning student loan reform, Pell Grant reform, and student debt relief. Your voice matters in shaping the future of higher education funding and access.

Featured Posts

-

Fortnite Fans Furious Over Latest Item Shop Update

May 17, 2025

Fortnite Fans Furious Over Latest Item Shop Update

May 17, 2025 -

Watch Celtics Vs Magic Nba Playoffs Game 1 Free Live Stream Options And Tv Schedule

May 17, 2025

Watch Celtics Vs Magic Nba Playoffs Game 1 Free Live Stream Options And Tv Schedule

May 17, 2025 -

Investitionen In Brasilianischen Favelas Das Interesse Der Vereinigten Arabischen Emirate

May 17, 2025

Investitionen In Brasilianischen Favelas Das Interesse Der Vereinigten Arabischen Emirate

May 17, 2025 -

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025 -

Investitsii V Industrialnye Parki Otsenka Riskov I Perspektiv

May 17, 2025

Investitsii V Industrialnye Parki Otsenka Riskov I Perspektiv

May 17, 2025