Nicki Chapman's £700,000 Country Home Investment: A Smart Property Move

Table of Contents

The Allure of Country Living and its Investment Potential

The demand for country properties in the UK is soaring. More and more individuals are seeking a lifestyle change, trading the hustle and bustle of city life for the peace and tranquility of the countryside. This shift in preference directly impacts property values, making rural property investment an increasingly attractive option. The benefits extend beyond simple aesthetics; the peace and quiet, the proximity to nature, and the sense of community contribute significantly to the enhanced quality of life that drives up property prices.

- Strong rental yield potential: Desirable rural locations often command high rental yields, providing a consistent income stream for investors.

- Limited supply: The supply of country properties is inherently limited compared to urban areas, creating a competitive market and driving up prices.

- Increased demand: The continuous migration from urban centers fuels demand, pushing property values higher.

- Capital growth: Country properties tend to appreciate in value over the long term, offering substantial capital growth potential.

Analyzing Nicki Chapman's £700,000 Investment

While precise details of Nicki Chapman's property remain private, its £700,000 price tag suggests a significant investment in a desirable location. Several factors likely influenced the purchase price. The specific location, for example, will play a crucial role. A property situated in a picturesque village with good transport links and access to amenities will naturally command a higher price than one in a more isolated area. The size, condition, and unique features of the property also contribute to its overall value. A larger property with period features or historical significance could justify a higher price tag.

- Geographical location: Proximity to major cities, transport networks, and local amenities significantly impacts property value.

- Property size and features: A comparison to other similar properties in the area will provide insights into the reasonableness of the £700,000 price.

- Renovation potential: The possibility of future renovations or extensions to increase the property's size and value is a key consideration.

- Celebrity effect: The association with a celebrity owner might influence the property's future value, making it a more attractive proposition for buyers.

Strategic Considerations for Similar Property Investments

Nicki Chapman's investment serves as a case study for those considering venturing into the country property market. However, success requires careful planning and due diligence. Thorough market research is crucial, and professional advice from surveyors, solicitors, and financial advisors is highly recommended.

- Thorough property inspection: Employ a qualified surveyor to conduct a comprehensive inspection before committing to a purchase.

- Understanding planning regulations: Be aware of local planning regulations and potential limitations on development or extensions.

- Rental income and expenses: Accurately assess potential rental income and associated expenses to determine the property's financial viability.

- Long-term vs. short-term: Develop a long-term investment strategy rather than focusing solely on short-term gains.

- Portfolio diversification: Diversifying your investment portfolio across different property types and locations is essential for risk mitigation.

The Future of the UK Country Property Market

The UK country property market shows considerable promise. However, several factors will shape its future trajectory. Economic conditions, government policies, and broader global trends all influence market dynamics.

- Brexit's lingering impact: The long-term effects of Brexit on the UK property market are still unfolding, potentially affecting buyer confidence and investment decisions.

- Interest rate fluctuations: Changes in interest rates directly impact mortgage affordability and can influence demand.

- Future property price growth: Predictions suggest continued, albeit potentially moderated, growth in rural property prices over the coming years.

Conclusion: Investing in Your Country Dream – Following Nicki Chapman's Lead

Nicki Chapman's £700,000 country home investment exemplifies the potential rewards of strategic property investment in the UK's rural areas. However, it's vital to remember that success requires careful planning, thorough due diligence, and professional guidance. Inspired by Nicki Chapman's smart country home investment? Start your own journey towards securing your dream rural property today! Explore the UK's flourishing country property market and find your perfect investment opportunity in a smart country home investment. Don't delay – the opportunity to benefit from the growing demand for country properties and secure a lucrative rural property investment awaits.

Featured Posts

-

Nemecke Firmy A Hromadne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025

Nemecke Firmy A Hromadne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025 -

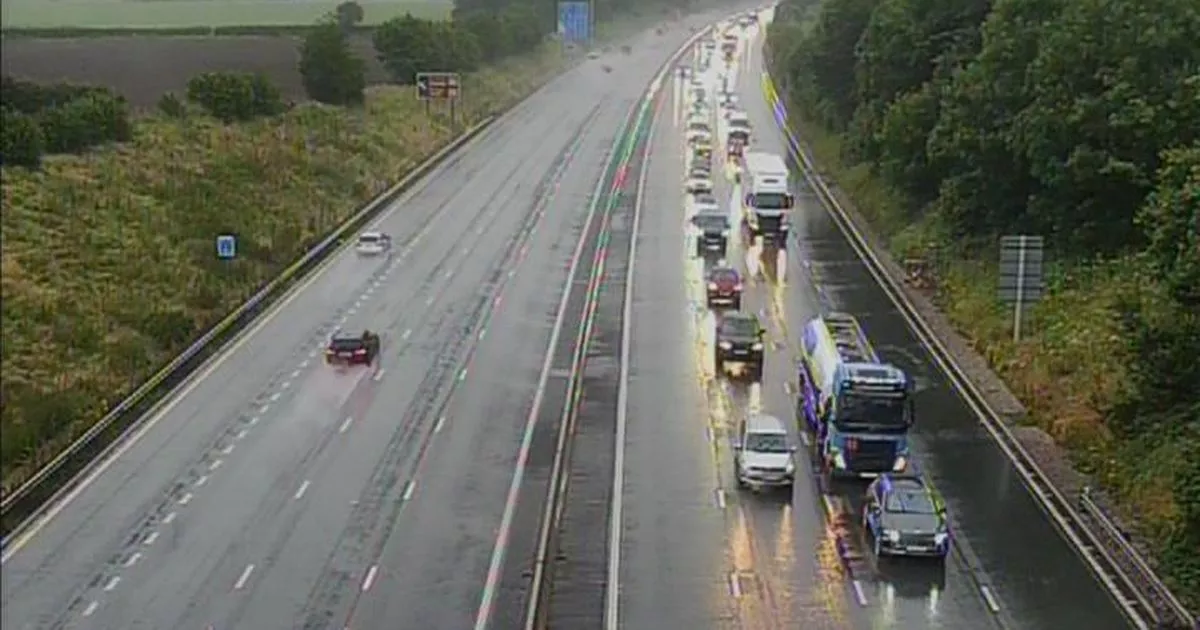

Live M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025

Live M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025 -

Escape To The Country Top Destinations And What To Expect

May 24, 2025

Escape To The Country Top Destinations And What To Expect

May 24, 2025 -

H Nonline Sk Nemecke Hospodarstvo V Krize Straty Pracovnych Miest Rastu

May 24, 2025

H Nonline Sk Nemecke Hospodarstvo V Krize Straty Pracovnych Miest Rastu

May 24, 2025

Latest Posts

-

Can Bardella Unite Frances Opposition Election Analysis

May 24, 2025

Can Bardella Unite Frances Opposition Election Analysis

May 24, 2025 -

Chine La Repression Des Dissidents Francais

May 24, 2025

Chine La Repression Des Dissidents Francais

May 24, 2025 -

Frances Next Election Bardella And The Challengers Field

May 24, 2025

Frances Next Election Bardella And The Challengers Field

May 24, 2025 -

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025 -

Bardellas Presidential Bid A Contender Emerges

May 24, 2025

Bardellas Presidential Bid A Contender Emerges

May 24, 2025