Nine African Countries Affected By PwC's Departure: Understanding The Reasons And Consequences

Table of Contents

The recent departure of PricewaterhouseCoopers (PwC) from several African countries has sent ripples through the continent's financial landscape. This article delves into the nine affected nations, exploring the underlying reasons behind PwC's withdrawal and analyzing the potential short-term and long-term consequences for their economies and businesses. Understanding the impact of this significant event is crucial for navigating the evolving African business environment.

H2: The Nine Affected African Countries:

PwC's departure has impacted a significant number of African nations, creating uncertainty and requiring a reassessment of the auditing landscape. The nine countries directly affected include: South Africa, Nigeria, Kenya, Ghana, Angola, Egypt, Morocco, Zambia and Tanzania. The geographical distribution of these countries highlights the broad reach of PwC's operations across the continent and the extensive ramifications of its withdrawal.

[Insert a map here showing the geographical location of the nine affected African countries.]

- South Africa: PwC provided a wide range of services including audit, tax, and consulting.

- Nigeria: A major market for PwC, offering services across multiple sectors including oil and gas, banking, and telecommunications.

- Kenya: A significant hub for East African operations, covering audit, advisory and consulting services to many businesses.

- Ghana: Provided services across various sectors, including financial services and mining.

- Angola: Supported operations in the oil and gas sector, a significant part of Angola's economy.

- Egypt: A key market with broad-ranging services in multiple sectors including financial services and infrastructure.

- Morocco: Services covered auditing, tax, and consulting to businesses.

- Zambia: Provided auditing services to key industries in the country's economy.

- Tanzania: A growing market with services provided in key business sectors.

H2: Reasons Behind PwC's Departure:

PwC's withdrawal from these nine African countries is a complex issue with multiple contributing factors. While the firm hasn't explicitly stated a single reason, several key elements likely played a significant role.

H3: Ethical Concerns and Scandals:

Ethical breaches and scandals can severely damage an accounting firm's reputation and erode public trust. Allegations of misconduct, particularly involving conflicts of interest or non-compliance with auditing standards, can trigger regulatory investigations and lead to significant financial and reputational penalties.

- Specific instances of alleged misconduct (if publicly available, cite sources and details).

- Impact on public trust and the need for transparency and accountability within the auditing profession in Africa.

- Outcomes of regulatory investigations and resulting sanctions (if any).

H3: Regulatory Changes and Increased Scrutiny:

The African continent is experiencing a wave of regulatory changes and increased scrutiny within its financial sector. Stringent new regulations aimed at enhancing corporate governance, combating financial crime, and improving auditing standards are increasing the compliance burden for firms like PwC.

- Key regulatory changes and their implications for accounting firms in Africa (e.g., increased capital requirements, stricter penalties for non-compliance).

- The potential increase in compliance costs and the strain on profitability.

- The impact of increased regulatory oversight on PwC's operational efficiency and decision-making.

H3: Business Strategy and Restructuring:

PwC's decision might also stem from a broader global restructuring or strategic shift. Internal factors, such as a reassessment of market profitability or a focus on specific regions, could contribute to this strategic repositioning.

- Potential internal factors contributing to the decision to withdraw from certain African markets.

- Assessment of the long-term profitability of operating in specific African countries.

- PwC's potential strategic focus on other regions or service areas.

H2: Consequences for Affected Countries:

The departure of PwC from several African countries carries both short-term and long-term consequences.

H3: Short-Term Impacts:

The immediate impact includes disruption to auditing services for many businesses. This necessitates finding alternative audit firms, potentially leading to increased costs, project delays, and temporary uncertainty in financial markets.

- Disruptions to auditing services and the potential for delays in financial reporting.

- Increased costs for businesses seeking alternative auditing services.

- Potential for temporary uncertainty in financial markets and investor sentiment.

H3: Long-Term Implications:

Long-term effects may include the need for strengthened regulatory frameworks to ensure the stability and integrity of the auditing profession. Investor confidence may be affected, potentially impacting foreign direct investment.

- Need for robust regulatory frameworks to safeguard the integrity of the financial sector.

- Potential impact on investor confidence and foreign direct investment in affected countries.

- The importance of building a strong and reliable domestic auditing capacity.

H3: Opportunities for Local and Regional Firms:

PwC's departure presents opportunities for smaller African audit firms to expand their client base and gain market share. This is a chance to develop expertise in specific areas, strengthening the local capacity within the auditing industry.

- Increased market share and revenue opportunities for local and regional audit firms.

- The opportunity to develop expertise in niche service areas.

- Potential for greater collaboration and knowledge sharing amongst African audit firms.

3. Conclusion:

The departure of PwC from nine African countries marks a significant turning point for the continent's financial landscape. The reasons behind this decision, encompassing ethical concerns, regulatory changes, and strategic business shifts, have created both challenges and opportunities. Understanding these factors is crucial for navigating the evolving African business environment. To stay informed on the ongoing implications of PwC's departure and the future of the African audit market, continue to follow reputable news sources for updates on financial regulations, industry news, and analysis of the PwC Africa situation. Stay informed about the changes affecting PwC's departure impact on the African continent's economic development.

Featured Posts

-

Watch Untucked Ru Pauls Drag Race Season 17 Episode 8 Free Streaming Guide

Apr 29, 2025

Watch Untucked Ru Pauls Drag Race Season 17 Episode 8 Free Streaming Guide

Apr 29, 2025 -

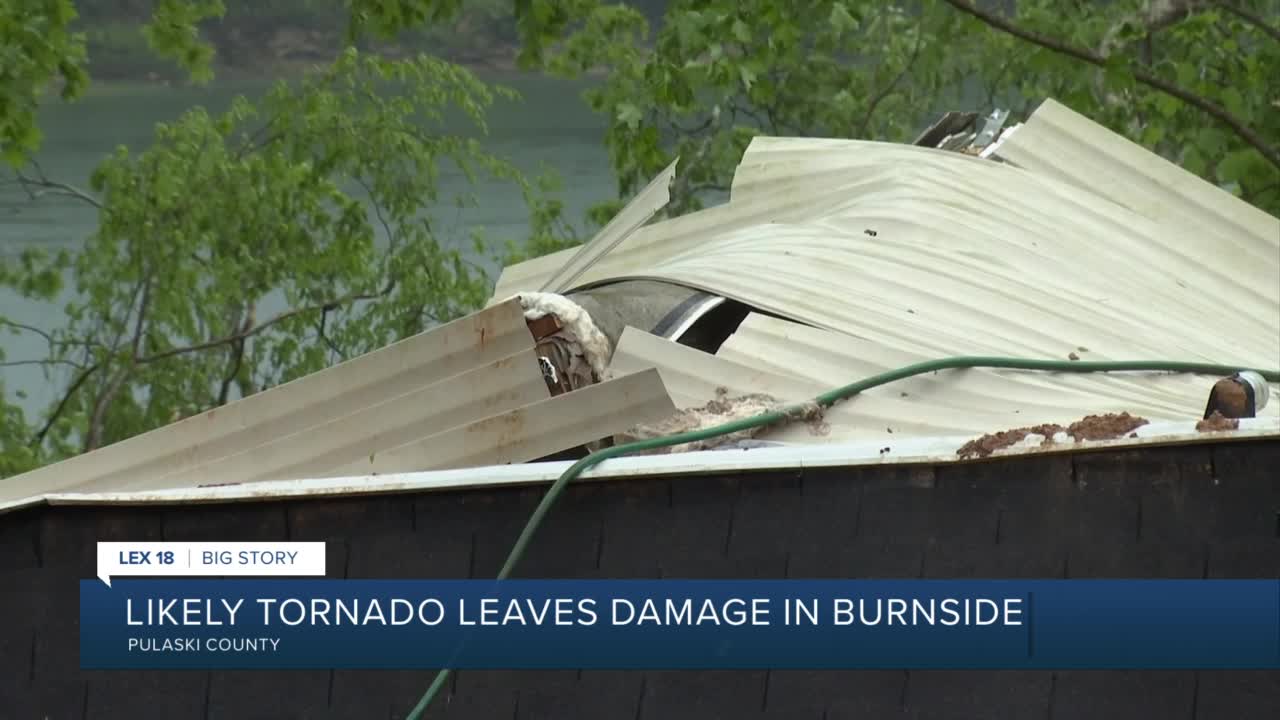

Delays In Kentucky Storm Damage Assessments Explained

Apr 29, 2025

Delays In Kentucky Storm Damage Assessments Explained

Apr 29, 2025 -

Willie Nelson New Album And Family Drama

Apr 29, 2025

Willie Nelson New Album And Family Drama

Apr 29, 2025 -

Quick Facts About Willie Nelson His Music Family And Legacy

Apr 29, 2025

Quick Facts About Willie Nelson His Music Family And Legacy

Apr 29, 2025 -

Urgent Evacuation Israeli Airstrike Strikes Southern Beirut

Apr 29, 2025

Urgent Evacuation Israeli Airstrike Strikes Southern Beirut

Apr 29, 2025