Norway's Sovereign Wealth Fund And The Trump Tariff Challenge

Table of Contents

The Structure and Scope of Norway's Sovereign Wealth Fund

The GPFG's success is built on a foundation of prudent diversification and a long-term investment horizon. Its massive scale and global reach make it a significant player in international financial markets.

The GPFG's Investment Strategy and Global Exposure

The fund's investment mandate prioritizes maximizing returns over the long term while maintaining a high level of risk management. Its portfolio is spread across a diverse range of asset classes, including:

- Equities: A substantial portion is invested in global equities, representing a significant ownership stake in numerous multinational corporations.

- Fixed Income: Government bonds and corporate bonds provide stability and income generation.

- Real Estate: Direct investments in properties globally offer diversification and potential for long-term appreciation.

- Renewable Energy: A growing portion of the portfolio is allocated to renewable energy investments, reflecting Norway's commitment to sustainability.

A significant portion of the GPFG's holdings are in US companies, making it particularly susceptible to US trade policies. The fund's ethical considerations, focusing on environmental, social, and governance (ESG) factors, also influence its investment decisions. This ethical lens can sometimes conflict with purely financial objectives, adding another layer of complexity to its management.

- Size of the GPFG: The fund's size is comparable to the GDP of many countries, highlighting its importance to the Norwegian economy.

- Geographic Diversification: While globally diversified, a considerable portion of its portfolio is exposed to the US market.

- Ethical Considerations: The GPFG screens investments based on ESG criteria, leading to exclusion of companies involved in controversial activities.

The Impact of Trump-Era Tariffs on the GPFG

The Trump administration's protectionist trade policies, particularly the imposition of tariffs on imported goods, directly and indirectly affected the GPFG's performance.

Direct Impacts of Tariffs on US-based Investments

Tariffs imposed on specific sectors, such as aluminum and steel, directly impacted Norwegian holdings in US companies operating within those industries.

- Affected Sectors: The tariffs disproportionately affected companies in sectors like aluminum, steel, and certain manufactured goods, causing decreased profitability and share price drops.

- Financial Losses: While the precise financial losses are difficult to isolate, the overall market reaction to the tariffs undoubtedly reduced the GPFG's returns.

- Fund Response: The fund's response likely involved a combination of strategies, such as hedging against further tariff increases and potentially divesting from some heavily impacted companies.

Indirect Impacts Through Global Market Volatility

The broader economic consequences of the tariffs extended beyond specific sectors. Global market volatility, triggered by trade uncertainty and retaliatory measures from other countries, negatively affected the GPFG's overall portfolio returns.

- Ripple Effects: Trade disputes created uncertainty, impacting investor confidence and causing fluctuations in various asset classes.

- Market Uncertainty: Increased volatility translated into lower returns for the GPFG across its diverse investments.

- Risk Management Adjustments: The fund likely adjusted its risk management strategies in response to increased market uncertainty, perhaps by reducing exposure to more volatile asset classes.

Norway's Response and Mitigation Strategies

Faced with the challenges posed by the Trump tariffs, Norway adopted several strategies to mitigate the negative impacts on its Sovereign Wealth Fund.

Government Policy Adjustments

The Norwegian government, recognizing the potential threat to its economy, implemented several policy adjustments. These included focusing on diversification beyond the US market and supporting Norwegian businesses affected by retaliatory tariffs.

- New Investment Strategies: The GPFG likely shifted its investment allocation towards regions and sectors less affected by US trade policies.

- Support for Norwegian Businesses: Government initiatives aimed to help companies impacted by retaliatory tariffs, including financial aid and assistance with market diversification.

- Long-Term Focus: Maintaining a long-term perspective on investments remained crucial, acknowledging that short-term market fluctuations are part of the investment landscape.

International Cooperation and Diplomacy

Norway actively engaged in international forums and diplomatic efforts to address trade disputes and promote free and fair trade practices.

- International Cooperation: Norway participated in multilateral efforts to resolve trade disagreements and advocated for a rules-based international trading system.

- Diplomatic Efforts: Norway likely engaged in bilateral discussions to influence trade policy decisions and reduce the negative effects of protectionist measures.

- Collaboration with Allies: Norway likely collaborated with other countries facing similar challenges to share best practices and coordinate responses.

Conclusion

Norway's Sovereign Wealth Fund, a cornerstone of the Norwegian economy, faced significant challenges due to the Trump administration's tariffs. The direct and indirect impacts on the GPFG's portfolio underscored the vulnerability of even the most diversified funds to global trade shocks. Norway's response involved a combination of policy adjustments, risk management strategies, and active participation in international cooperation. The experience highlights the importance of adaptable investment strategies and the need for proactive engagement in shaping the global economic landscape. To learn more about the intricacies of Norway's Sovereign Wealth Fund management, the global trade impact on SWFs, and managing risk in sovereign wealth funds, explore official GPFG reports and relevant academic research.

Featured Posts

-

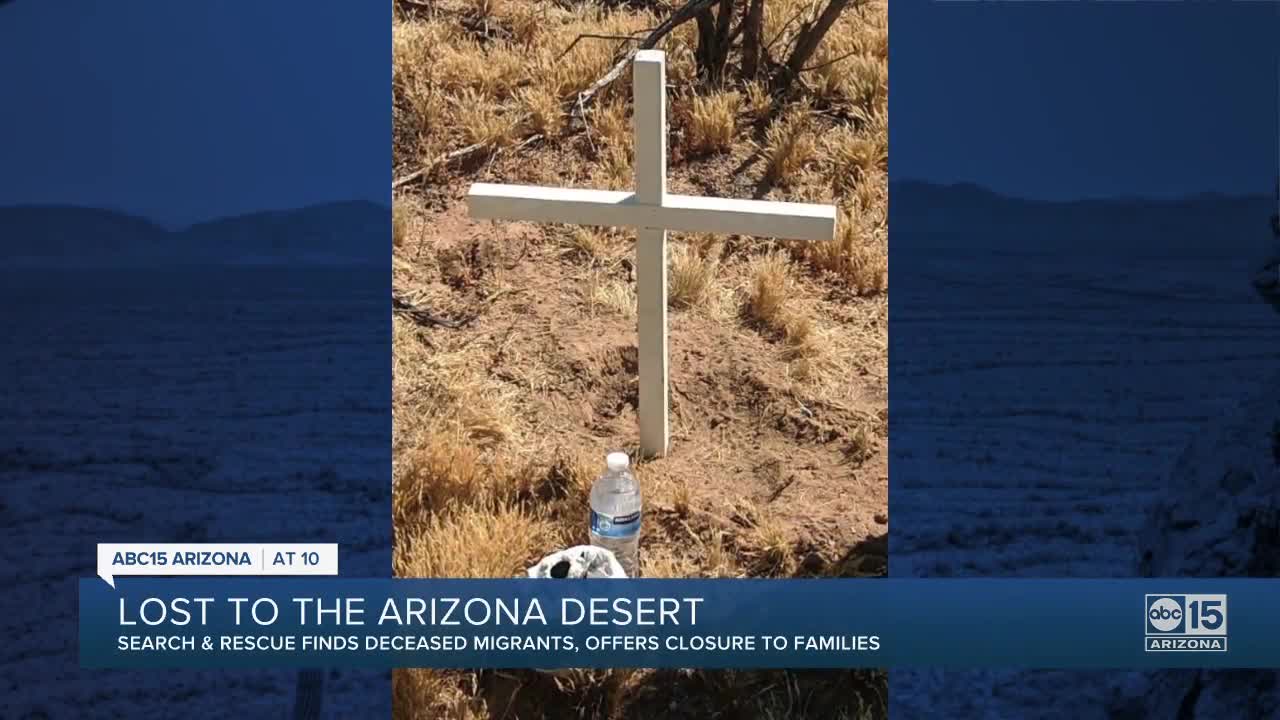

Desperate Measures Migrant Remains In Tree For Eight Hours To Avoid Ice

May 04, 2025

Desperate Measures Migrant Remains In Tree For Eight Hours To Avoid Ice

May 04, 2025 -

Fleetwood Macs Chart Topping Album A Retrospective Analysis Of Success

May 04, 2025

Fleetwood Macs Chart Topping Album A Retrospective Analysis Of Success

May 04, 2025 -

Tony Todds Farewell Performance A 25 Year Horror Enigma Concluded

May 04, 2025

Tony Todds Farewell Performance A 25 Year Horror Enigma Concluded

May 04, 2025 -

Dope Girls Review Cocaine Electronica And Glamour In A Wwi Drama

May 04, 2025

Dope Girls Review Cocaine Electronica And Glamour In A Wwi Drama

May 04, 2025 -

When Is The Partial Solar Eclipse In Nyc On Saturday

May 04, 2025

When Is The Partial Solar Eclipse In Nyc On Saturday

May 04, 2025

Latest Posts

-

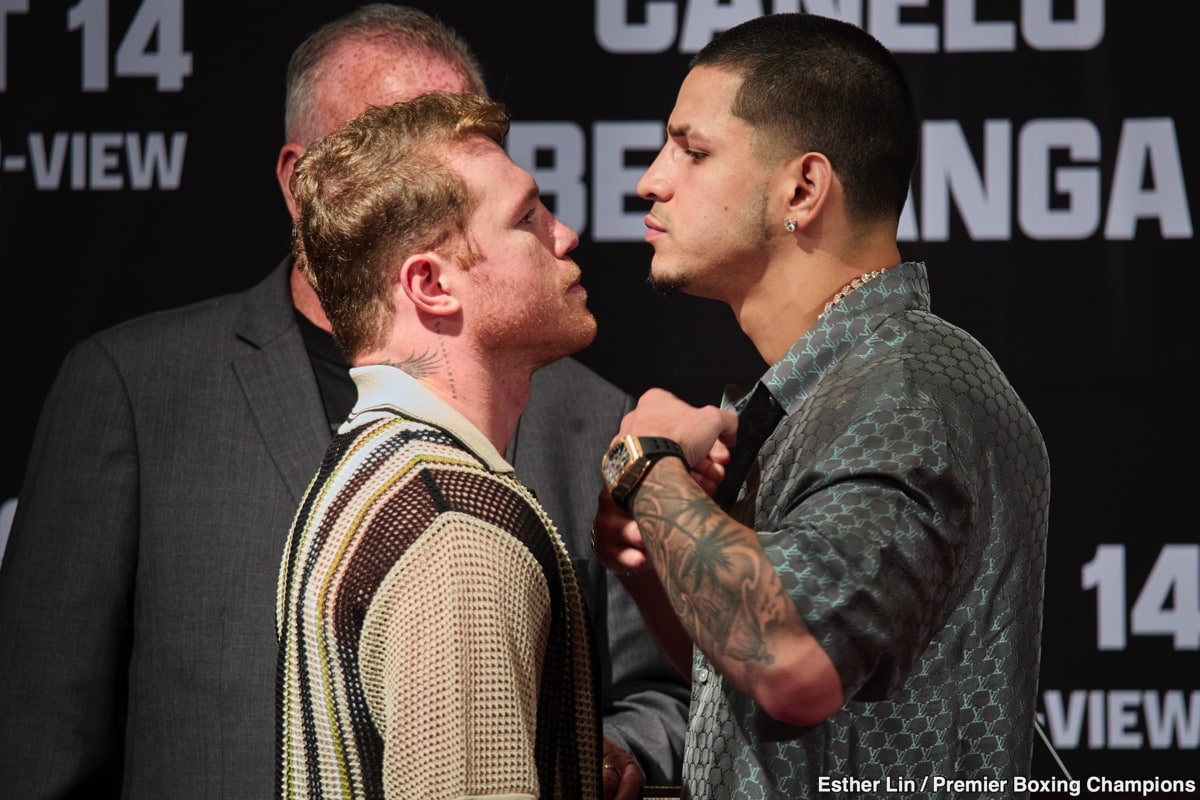

Munguia Vs Berlanga A Potential Showdown Following Edwards Revelations

May 04, 2025

Munguia Vs Berlanga A Potential Showdown Following Edwards Revelations

May 04, 2025 -

Berlanga Vows To Defeat Plant Munguia And Charlo

May 04, 2025

Berlanga Vows To Defeat Plant Munguia And Charlo

May 04, 2025 -

Berlangas Next Targets Plant Munguia And Charlo

May 04, 2025

Berlangas Next Targets Plant Munguia And Charlo

May 04, 2025 -

May 3rd Boxing Canelo Alvarez And Bruno Surace Vs Jaime Munguia 2

May 04, 2025

May 3rd Boxing Canelo Alvarez And Bruno Surace Vs Jaime Munguia 2

May 04, 2025 -

Berlangas Fight Strategy Money Over Merit An Examination Of Edwards Claims

May 04, 2025

Berlangas Fight Strategy Money Over Merit An Examination Of Edwards Claims

May 04, 2025