Note To Mr. Carney: Why Canadians Avoid 10-Year Mortgages

Table of Contents

The Perceived Risk of Long-Term Commitment

Committing to a 10-year mortgage represents a significant financial and life commitment. Many Canadians prioritize flexibility, understandably fearing the unforeseen circumstances that life can throw their way. This psychological barrier is a significant factor in the low uptake of 10-year mortgages.

- Job Security and Income Uncertainty: Canada's economy, while generally stable, experiences fluctuations. The fear of job loss or reduced income during a 10-year mortgage term is a major concern. Statistics Canada reports a significant level of job mobility across various sectors, adding to this anxiety.

- Unexpected Life Changes: Life is unpredictable. A 10-year mortgage locks homeowners into a significant financial obligation, potentially hindering their ability to adapt to unexpected events like a job relocation, marriage, divorce, or the birth of a child.

- Interest Rate Fluctuations: While fixed-rate mortgages provide some stability, the possibility of significant interest rate changes during a 10-year term adds to the perceived risk. This uncertainty can make a long-term commitment feel daunting.

Financial Constraints and Affordability

10-year mortgages often present higher upfront costs compared to shorter-term options. This can include potentially higher down payments or, in some cases, slightly higher initial interest rates. These increased financial demands significantly impact affordability for many Canadians.

- Higher Initial Payments: The monthly payments on a 10-year mortgage will be considerably higher than those on a 5-year or even a 25-year mortgage, due to the shorter amortization period. This can strain monthly budgets, especially for those already dealing with high household debt levels. The average Canadian household debt-to-income ratio remains a significant concern.

- Qualifying for a Mortgage: Lenders often assess borrowers' financial capacity more stringently for longer-term mortgages. This can make qualifying for a 10-year mortgage more difficult compared to shorter terms, even for those with strong credit histories.

- Payment Comparisons: For example, a $500,000 mortgage at a 5% interest rate over 25 years would have a monthly payment significantly lower than the same mortgage amortized over 10 years. This difference in monthly payments needs careful consideration.

Lack of Awareness and Understanding

A significant barrier to the adoption of 10-year mortgages is a lack of understanding about their benefits and drawbacks. Many Canadians are simply unaware of the intricacies of different mortgage terms and the potential long-term financial advantages of a longer-term commitment.

- Limited Educational Resources: There's a noticeable gap in accessible and easy-to-understand resources explaining the nuances of 10-year mortgages compared to shorter-term options.

- Misconceptions about Penalties: Many potential borrowers misunderstand the complexities of prepayment penalties and refinancing options associated with longer-term mortgages.

- Influence of Mortgage Brokers: Mortgage brokers, while offering valuable advice, often steer clients towards shorter-term mortgages, which can be less complex to manage and potentially lead to more commission opportunities. More transparent guidance on the merits of different mortgage terms is needed.

The Appeal of Shorter-Term Mortgages

The popularity of shorter-term mortgages, primarily 5-year terms, stems from their perceived flexibility and alignment with shorter-term financial planning horizons.

- Flexibility and Refinancing: Shorter-term mortgages offer the flexibility to refinance every 5 years, allowing homeowners to take advantage of potentially lower interest rates or adjust their mortgage terms based on their evolving financial circumstances.

- Lower Initial Payments: The lower monthly payments associated with longer amortization periods provide immediate budget relief, making shorter-term mortgages more appealing to many Canadians.

- Shorter-Term Financial Planning: Aligning mortgage terms with shorter financial planning horizons can make budgeting and financial management more manageable, especially during times of economic uncertainty.

Conclusion: Rethinking the 10-Year Mortgage in Canada

Canadians avoid 10-year mortgages primarily due to perceived risks, financial constraints, and a lack of understanding. However, it's crucial to acknowledge that 10-year mortgages can offer significant long-term savings through lower overall interest payments. Before dismissing a 10-year mortgage outright, consider the potential advantages and disadvantages carefully. Consider a 10-year mortgage if it aligns with your financial goals and risk tolerance. Explore the advantages of 10-year mortgages and consult with a qualified financial advisor to determine the best mortgage term for your individual circumstances. Perhaps with increased financial literacy and a clearer understanding of the benefits, Canadians will begin to re-evaluate their approach to 10-year mortgages, opening up a pathway to significant long-term savings. The future of mortgage terms in Canada may depend on this shift in perspective.

Featured Posts

-

Pratt On Schwarzeneggers Bold Performance A Full Frontal Scene

May 06, 2025

Pratt On Schwarzeneggers Bold Performance A Full Frontal Scene

May 06, 2025 -

Jeff And Emilie Goldblums Sons Attend Como 1907 Football Match

May 06, 2025

Jeff And Emilie Goldblums Sons Attend Como 1907 Football Match

May 06, 2025 -

Celtics Vs Suns Game Time Tv Schedule And Streaming Options April 4th

May 06, 2025

Celtics Vs Suns Game Time Tv Schedule And Streaming Options April 4th

May 06, 2025 -

Venices Future Addressing The Threat Of Rising Sea Levels

May 06, 2025

Venices Future Addressing The Threat Of Rising Sea Levels

May 06, 2025 -

Jeff Goldblums Best Performances A Retrospective

May 06, 2025

Jeff Goldblums Best Performances A Retrospective

May 06, 2025

Latest Posts

-

Smokey Robinson Comments On Diana Ross Affair Song Speculation

May 06, 2025

Smokey Robinson Comments On Diana Ross Affair Song Speculation

May 06, 2025 -

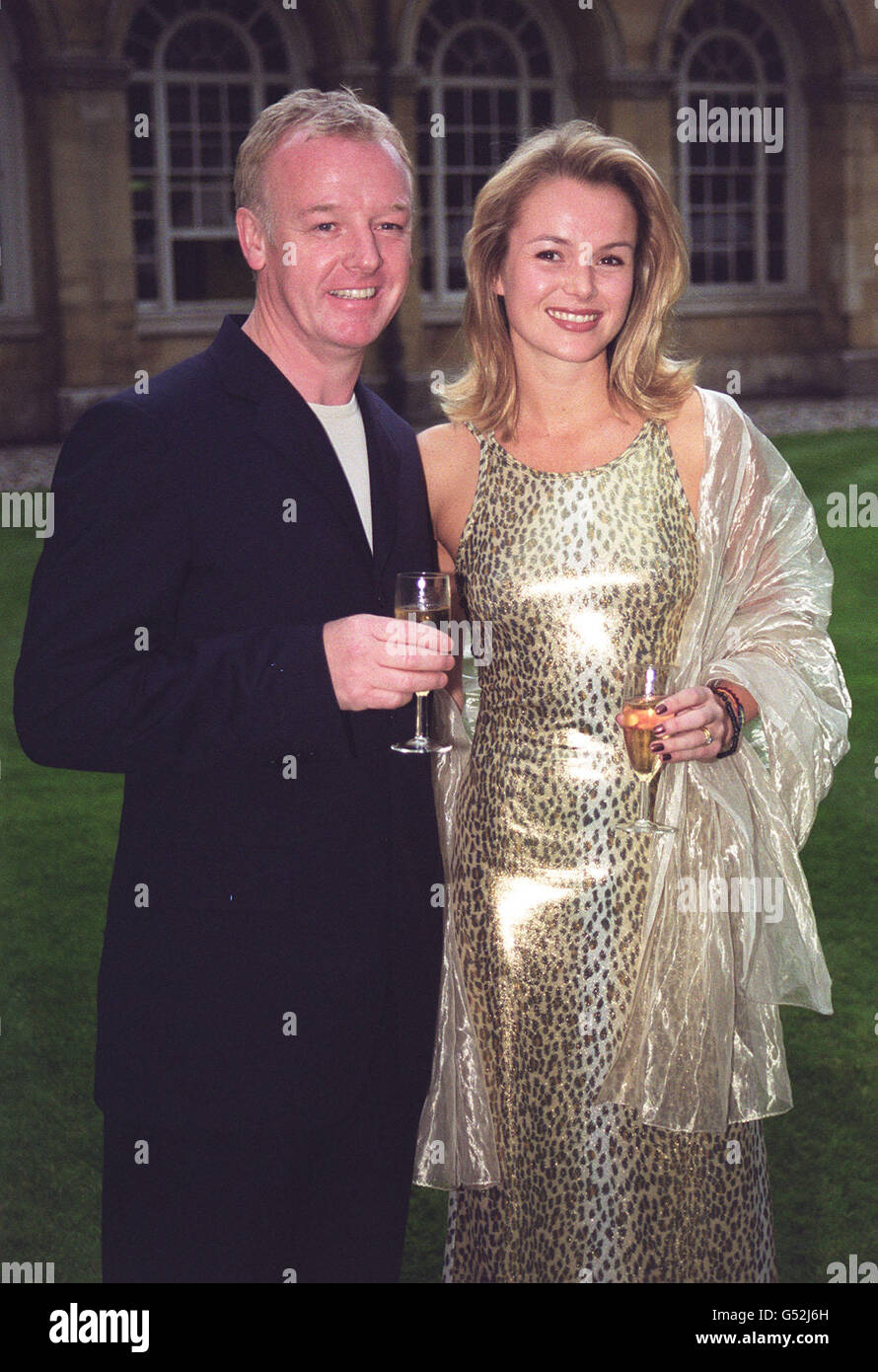

Amanda Holden Speaks Out Addressing The Buzz After Her Separation From Les Dennis

May 06, 2025

Amanda Holden Speaks Out Addressing The Buzz After Her Separation From Les Dennis

May 06, 2025 -

Amanda Holden Breaks Silence On Post Les Dennis Split Rumours

May 06, 2025

Amanda Holden Breaks Silence On Post Les Dennis Split Rumours

May 06, 2025 -

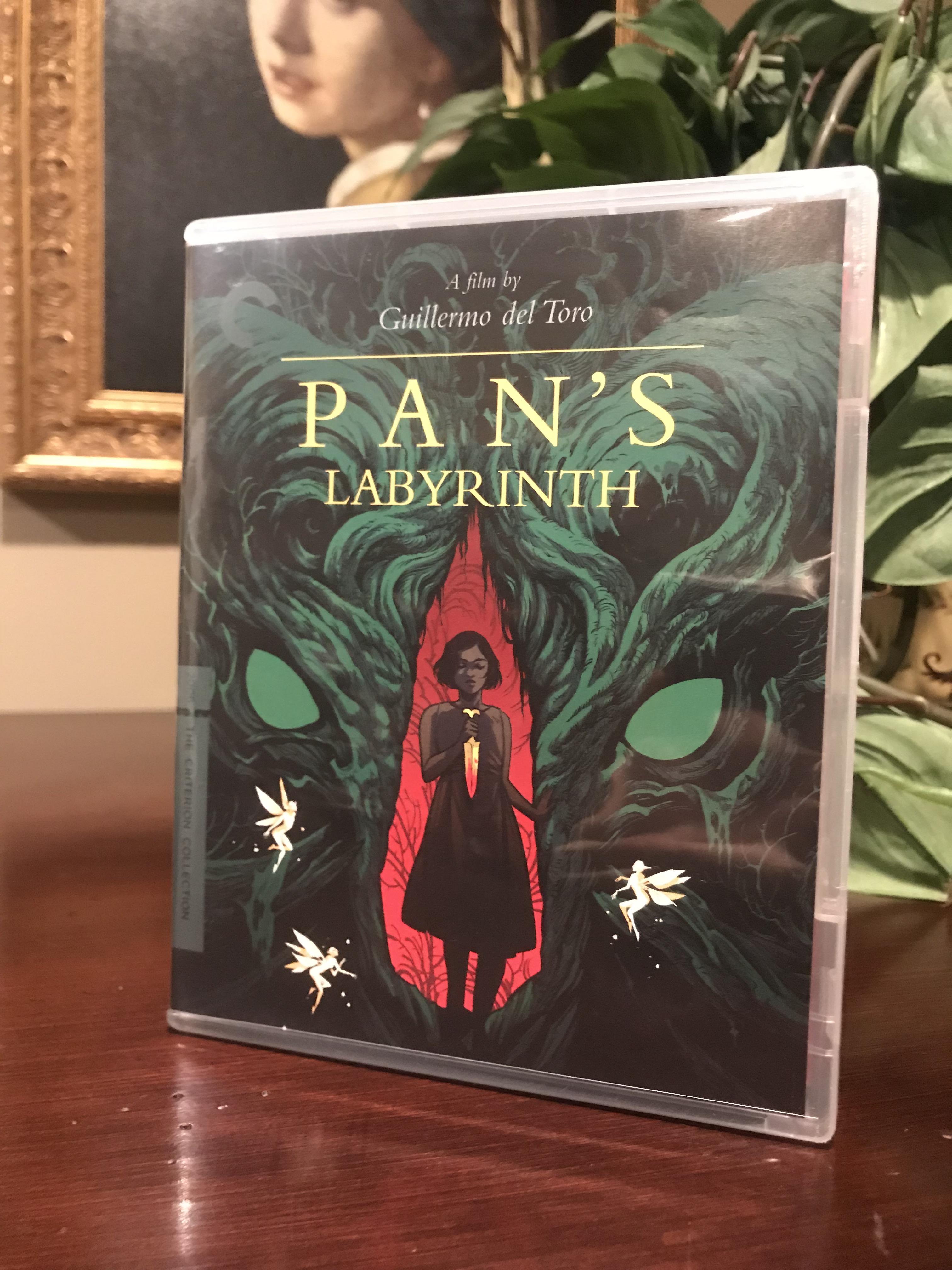

The Wiz Junes Highly Anticipated Criterion Release

May 06, 2025

The Wiz Junes Highly Anticipated Criterion Release

May 06, 2025 -

Criterion Collection Adds The Wiz In June Release

May 06, 2025

Criterion Collection Adds The Wiz In June Release

May 06, 2025