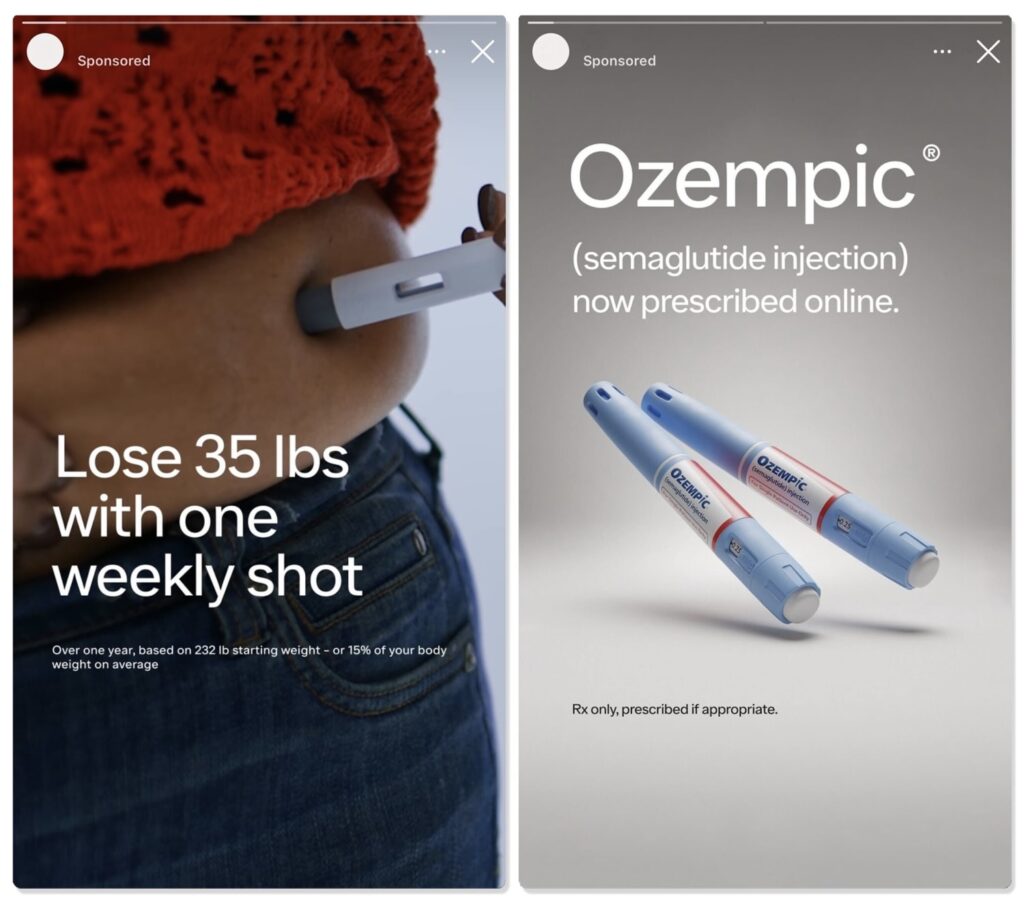

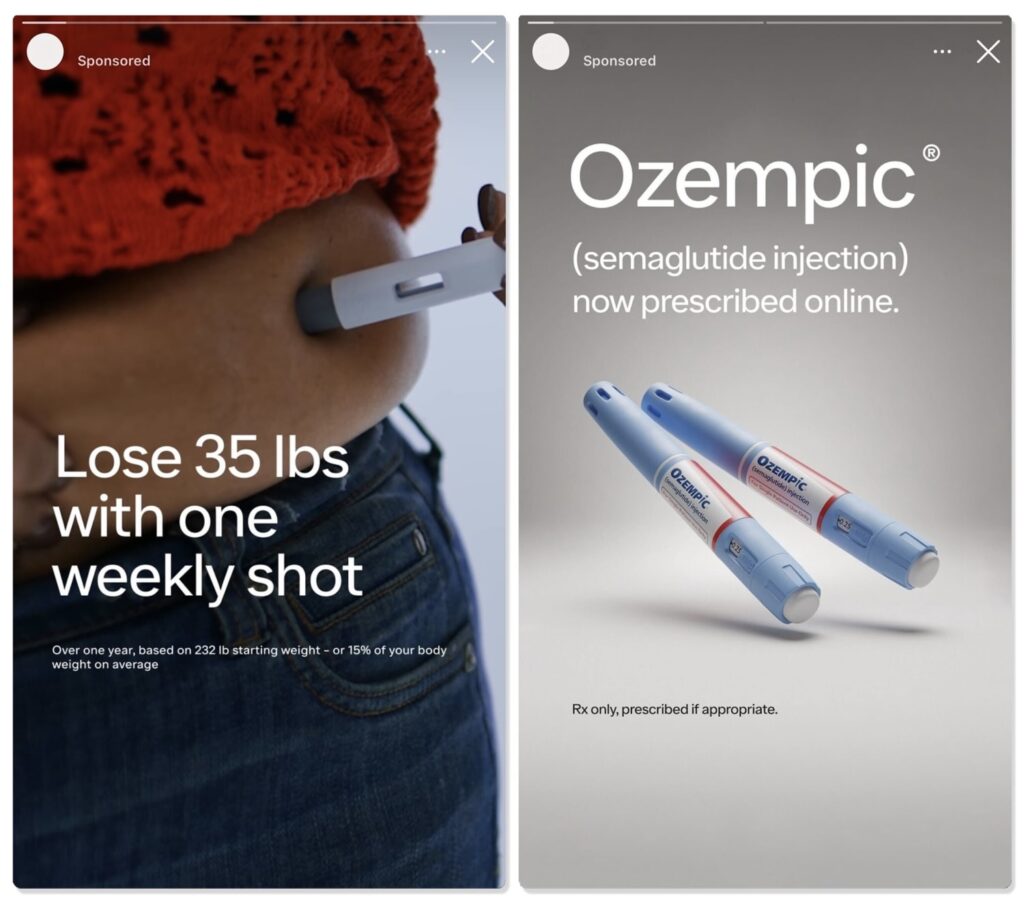

Novo Nordisk Ozempic weight loss competition is facing a significant challenge from a surge of new competitors. Drugs like Wegovy and Mounjaro are rapidly gaining ground, forcing Novo Nordisk to re-evaluate its strategy. This article will delve into the factors contributing to Ozempic's seemingly diminishing market share and explore the future of Novo Nordisk in this fiercely competitive landscape.

Novo Nordisk And Ozempic: Falling Behind In The Competitive Weight-Loss Drug Landscape

Table of Contents

Increased Competition in the GLP-1 Receptor Agonist Market

The GLP-1 receptor agonist market is experiencing explosive growth, fueled by the increasing prevalence of obesity and the proven efficacy of these drugs in weight management. Ozempic, while initially a leader, now faces a wave of new entrants boasting compelling advantages.

- Mounjaro (tirzepatide): This drug has demonstrated superior weight loss compared to Ozempic in clinical trials, making it a strong competitor. Its dual mechanism of action, targeting both GLP-1 and GIP receptors, contributes to its effectiveness.

- Wegovy (semaglutide): While also a GLP-1 receptor agonist like Ozempic, Wegovy is available in higher doses, leading to potentially greater weight loss in some patients. Its established track record adds to its market appeal.

- Other emerging competitors: Several other GLP-1 receptor agonists and related drugs are in various stages of development, further intensifying the competition. This burgeoning market ensures ongoing innovation and increased options for patients.

Market share projections indicate a significant shift away from Ozempic's previously dominant position. While precise figures fluctuate, analysts predict a continuing erosion of Ozempic's market share in favor of newer, potentially more effective and better-tolerated alternatives. The competitive landscape is rapidly evolving, requiring constant monitoring and strategic adaptation by Novo Nordisk.

Ozempic's Supply Chain Challenges and Accessibility Issues

The overwhelming demand for Ozempic has exposed vulnerabilities in Novo Nordisk's supply chain. Production bottlenecks and capacity constraints have led to significant shortages, impacting patient access and negatively affecting the company's reputation.

- Production Bottlenecks: Scaling up production to meet the unexpectedly high demand has proven challenging, resulting in ongoing supply limitations.

- Impact on Patient Access: Shortages have forced many patients to wait for extended periods or switch to alternative medications, hindering the growth of Ozempic's user base.

- Novo Nordisk's Response: Novo Nordisk has acknowledged these issues and announced initiatives to increase production capacity. However, the full impact of these efforts on market availability remains to be seen. These supply challenges have significantly damaged the brand's perception and trustworthiness.

Pricing Strategies and Market Positioning of Ozempic

Novo Nordisk's pricing strategy for Ozempic plays a crucial role in its competitiveness. Compared to emerging competitors, its price point may be perceived as less attractive, especially considering the potential for superior weight loss results offered by some alternatives.

- Price Competitiveness: The price of Ozempic relative to Wegovy and Mounjaro needs careful consideration. A higher price point coupled with supply limitations creates a less appealing proposition for many patients and healthcare providers.

- Potential for Price Adjustments: To maintain market share, Novo Nordisk might need to adjust its pricing strategy, potentially making Ozempic more affordable.

- Insurance Coverage and Affordability: Insurance coverage and patient affordability are crucial factors influencing market access. Limitations in insurance reimbursement further compound Ozempic's challenges in competing with newer entrants.

Future Outlook and Novo Nordisk's Strategic Response

The future of Ozempic within the Novo Nordisk Ozempic weight loss competition hinges on Novo Nordisk's ability to adapt and innovate. The company needs a robust strategy to regain market leadership and maintain its position in the expanding GLP-1 agonist market.

- R&D Efforts: Investing in research and development of next-generation weight loss drugs is crucial to maintaining competitiveness. This might involve exploring new drug targets or improving existing formulations.

- Marketing and Promotional Strategies: Refined marketing and promotional campaigns emphasizing Ozempic's strengths and addressing patient concerns are vital. A strong focus on safety and efficacy profiles will be paramount.

- Partnerships and Acquisitions: Strategic partnerships or acquisitions could enhance Novo Nordisk's position, providing access to new technologies or expanding their market reach.

Conclusion:

The once dominant Ozempic faces a stiff challenge from increased competition, supply chain issues, and pricing concerns. The Novo Nordisk Ozempic weight loss competition is a dynamic landscape, demanding constant adaptation and innovation. While Novo Nordisk has taken steps to address these issues, the future of Ozempic's market share depends on successful implementation of strategic initiatives. To stay abreast of developments in this evolving sector, continue researching Novo Nordisk Ozempic weight loss competition and follow industry news closely. Understanding the competitive landscape is crucial for patients, healthcare providers, and investors alike.

Featured Posts

-

San Diego County Sizzles Under Record Breaking Heat Relief In Sight

May 30, 2025

San Diego County Sizzles Under Record Breaking Heat Relief In Sight

May 30, 2025 -

La Bestia Sudamericana Agassi Rememora Sus Enfrentamientos Con Rios

May 30, 2025

La Bestia Sudamericana Agassi Rememora Sus Enfrentamientos Con Rios

May 30, 2025 -

Post Credits Scenes Are They Worth It In Marvel And Sinner

May 30, 2025

Post Credits Scenes Are They Worth It In Marvel And Sinner

May 30, 2025 -

111 Degree Heat Expected In Texas Urgent Warning Issued

May 30, 2025

111 Degree Heat Expected In Texas Urgent Warning Issued

May 30, 2025 -

Poy Na Deite Tis Tileoptikes Metadoseis Toy Pasxa 2024 E Thessalia Gr

May 30, 2025

Poy Na Deite Tis Tileoptikes Metadoseis Toy Pasxa 2024 E Thessalia Gr

May 30, 2025

Latest Posts

-

Manitoba Wildfires Crews Fight Deadly Spreading Blazes

May 31, 2025

Manitoba Wildfires Crews Fight Deadly Spreading Blazes

May 31, 2025 -

Hudbay Minerals Flin Flon Operations Shut Down Due To Wildfire Evacuation

May 31, 2025

Hudbay Minerals Flin Flon Operations Shut Down Due To Wildfire Evacuation

May 31, 2025 -

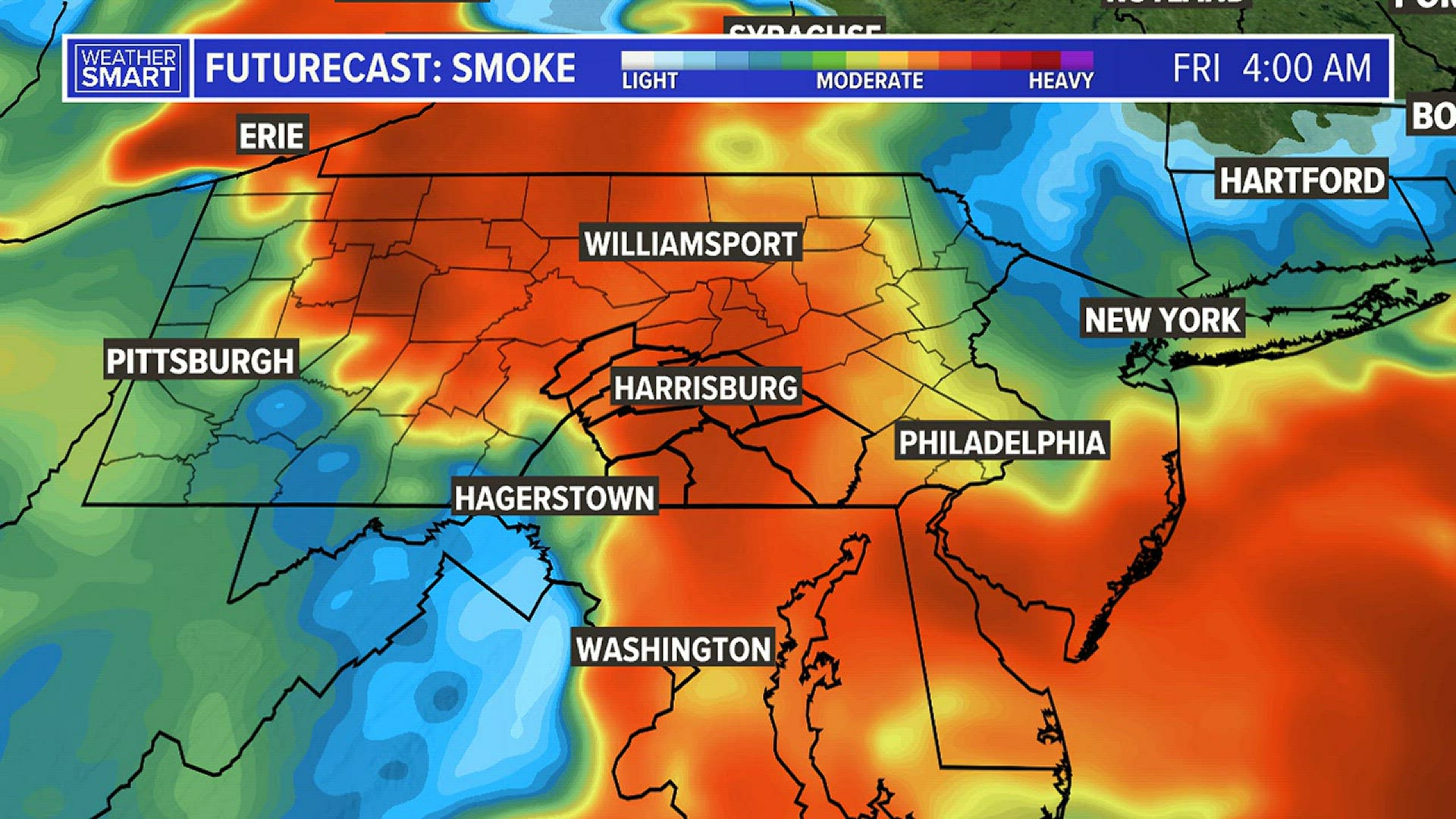

Wildfires In Canada Unprecedented Evacuations And Transborder Smoke Impact

May 31, 2025

Wildfires In Canada Unprecedented Evacuations And Transborder Smoke Impact

May 31, 2025 -

Canadian Wildfire Smoke Blankets Us Amidst Unprecedented Evacuations

May 31, 2025

Canadian Wildfire Smoke Blankets Us Amidst Unprecedented Evacuations

May 31, 2025 -

Canada Wildfires Record Evacuations Send Smoke Pouring Into Us

May 31, 2025

Canada Wildfires Record Evacuations Send Smoke Pouring Into Us

May 31, 2025