Nvidia CEO Seeks Trump Intervention On AI Chip Export Restrictions

Table of Contents

The Impact of AI Chip Export Restrictions on Nvidia's Business

The restrictions on exporting advanced AI chips, particularly to China, pose a significant threat to Nvidia's financial stability and operational capabilities. This is because China represents a substantial market for Nvidia's high-performance GPUs (Graphics Processing Units), crucial for powering AI development and applications.

Financial Repercussions

The immediate and most visible impact is financial. Restricting sales to China, a major revenue generator for Nvidia's high-end GPUs, directly translates to substantial financial losses.

- Decreased revenue projections: Analysts predict a significant downturn in Nvidia's revenue forecasts due to the lost Chinese market. These projections vary, but several reports suggest potential losses in the billions of dollars.

- Potential for stock price decline: The uncertainty surrounding the export restrictions has already impacted Nvidia's stock price, reflecting investor concerns about the company's future profitability. Continued restrictions could lead to further declines.

- Impact on R&D investments: Reduced revenue streams could force Nvidia to cut back on crucial research and development investments, potentially hindering future innovations in AI chip technology. This could have a ripple effect, slowing down the overall pace of AI advancement. Reliable financial news sources should be consulted for the most up-to-date figures.

Supply Chain Disruptions

Beyond immediate financial impacts, the export restrictions create significant supply chain disruptions. Nvidia's manufacturing processes are deeply intertwined with a global network of suppliers and manufacturers.

- Dependence on specific components or manufacturing locations: The production of advanced AI chips relies on complex and specialized components sourced from various global locations. Restrictions can disrupt these supply chains, leading to delays and increased costs.

- Potential delays in product launches: Disruptions to the supply chain could lead to significant delays in launching new products, impacting Nvidia's competitiveness in the rapidly evolving AI chip market.

- Increased production costs: Sourcing alternative components or relocating manufacturing could significantly increase production costs, further impacting Nvidia's profitability and competitiveness. The globalized nature of the semiconductor industry makes it particularly vulnerable to geopolitical instability.

Geopolitical Implications of the Export Controls

The export restrictions are not simply a business issue; they are deeply embedded in the complex geopolitical landscape, particularly the intensifying technological rivalry between the US and China.

US-China Technological Competition

The restrictions are a clear manifestation of the US government's efforts to contain China's rise as a global technological power, especially in the crucial field of artificial intelligence.

- Concerns over China's AI advancements: The US government worries that China's rapid progress in AI could pose a national security threat, leading to increased efforts to limit the flow of advanced technologies to China.

- National security implications: The application of AI in military technology and other sensitive areas is a major concern, driving the need for tighter export controls. The strategic importance of semiconductors in modern warfare cannot be overstated.

- The strategic importance of semiconductors: Semiconductors are considered crucial to national security and economic competitiveness, making control over their production and export a key element in geopolitical strategy.

Impact on Global AI Development

Restricting access to advanced AI chips impacts not only Nvidia but also the global trajectory of AI development.

- Slowdown in AI innovation: Limiting access to advanced computing power in China could slow down the pace of AI innovation globally, as China is a significant contributor to AI research and development.

- Potential for technological disparity: The restrictions could exacerbate existing technological disparities between countries, concentrating advancements in certain regions while hindering progress in others.

- Impact on global collaboration in AI research: The restrictions could discourage international collaboration in AI research, ultimately hindering the collective progress of the field. This could lead to a "two-speed" AI world, with uneven technological advancement across different regions.

Trump's Potential Role and the Likelihood of Intervention

Given Jensen Huang's direct appeal, it's crucial to examine former President Trump's potential role and the likelihood of his intervention.

Trump's Stance on Trade and Technology

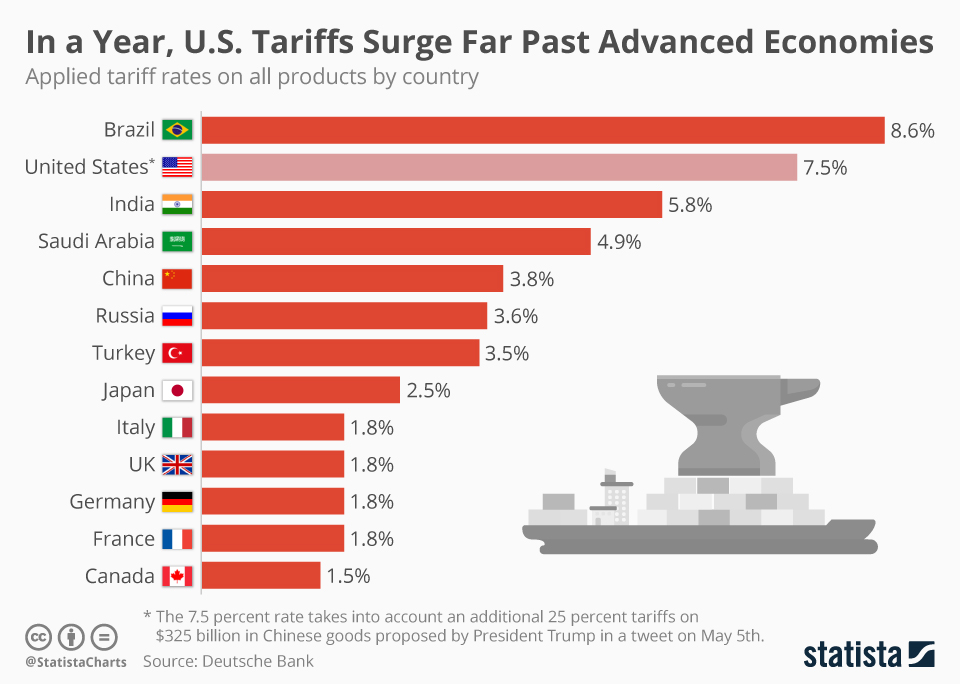

Trump's presidency was characterized by aggressive trade policies and a focus on American technological dominance.

- History of trade disputes: Trump initiated several trade disputes with China, employing tariffs and other trade restrictions to pressure Beijing on various issues.

- Focus on "America First": Trump's "America First" approach prioritized American interests, often at the expense of global cooperation. This approach influenced his stance on technological competition.

- Potential for shifting alliances: Trump's unpredictable foreign policy could lead to unexpected shifts in alliances and trade relationships, potentially affecting his response to Nvidia's request.

Legal and Political Ramifications of Intervention

Any intervention by Trump would face significant legal and political hurdles.

- Current administration's policies: The current administration's policies on China and technology export controls could clash with any attempt by Trump to overturn or modify them.

- Legal challenges: Any attempt to influence or reverse the export restrictions could face legal challenges from various stakeholders, including competitors and government agencies.

- Potential backlash from different stakeholders: Trump's intervention could trigger significant backlash from various groups, including those who support the existing restrictions on national security grounds. There are also potential conflicts of interest and ethical considerations to be addressed.

Conclusion

The AI chip export restrictions represent a complex challenge with far-reaching consequences for Nvidia, the AI industry, and the global technological landscape. The potential financial impact on Nvidia is substantial, and the geopolitical implications are even more profound. While the likelihood of Trump's intervention remains uncertain, his past actions and statements offer some clues about his potential response. The situation demands careful consideration of both the economic and strategic dimensions. Ultimately, the outcome will significantly shape the future trajectory of AI development and the global technological balance of power. Follow the developments in this critical situation surrounding Nvidia's AI chip export restrictions to stay informed about the future of this crucial technology.

Featured Posts

-

England Vs Spain Womens World Cup Preview Predicted Lineups And Score Prediction

May 02, 2025

England Vs Spain Womens World Cup Preview Predicted Lineups And Score Prediction

May 02, 2025 -

Michael Sheens Philanthropy A 1 Million Debt Relief For 900

May 02, 2025

Michael Sheens Philanthropy A 1 Million Debt Relief For 900

May 02, 2025 -

The Bank Of Canada And Trump Tariffs Examining The April Interest Rate Discussion

May 02, 2025

The Bank Of Canada And Trump Tariffs Examining The April Interest Rate Discussion

May 02, 2025 -

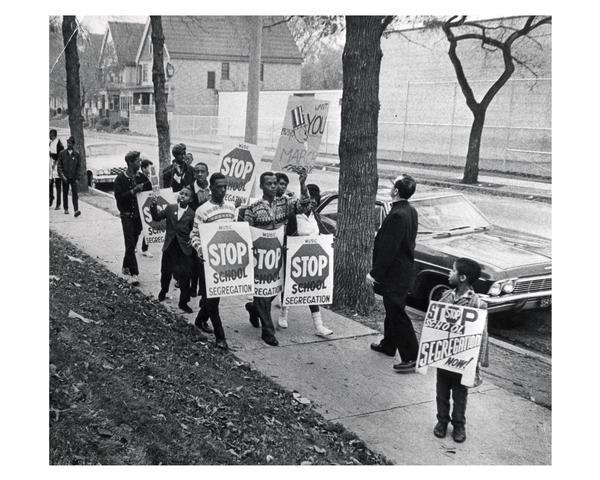

School Desegregation The End Of An Era Examining The Dojs Decision

May 02, 2025

School Desegregation The End Of An Era Examining The Dojs Decision

May 02, 2025 -

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price

May 02, 2025

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price

May 02, 2025

Latest Posts

-

Great Yarmouth Responds Public Sentiment On The Rupert Lowe Issue

May 02, 2025

Great Yarmouth Responds Public Sentiment On The Rupert Lowe Issue

May 02, 2025 -

The Rupert Lowe Debate Voices From Great Yarmouth

May 02, 2025

The Rupert Lowe Debate Voices From Great Yarmouth

May 02, 2025 -

Great Yarmouths Rupert Lowe Row A Community Speaks Out

May 02, 2025

Great Yarmouths Rupert Lowe Row A Community Speaks Out

May 02, 2025 -

Public Opinion Divided On Rupert Lowe Controversy In Great Yarmouth

May 02, 2025

Public Opinion Divided On Rupert Lowe Controversy In Great Yarmouth

May 02, 2025 -

Medvedev Russofobia E L Escalation Nucleare Un Analisi Della Situazione In Europa

May 02, 2025

Medvedev Russofobia E L Escalation Nucleare Un Analisi Della Situazione In Europa

May 02, 2025