Nvidia Stock: Positive Outlook Amidst China Market Challenges

Table of Contents

Strong Global Demand Fuels Nvidia's Growth Potential

Nvidia's growth isn't solely reliant on the Chinese market. The company's impressive performance stems from a diversified revenue stream, with particularly strong growth in key sectors.

Data Center Dominance

Nvidia's GPUs are integral to the booming data center market, powering the rapid expansion of artificial intelligence (AI) and high-performance computing (HPC). This dominance is a significant factor supporting a positive outlook for NVDA stock.

- Unprecedented demand for GPUs: AI training and inference require immense computational power, fueling insatiable demand for Nvidia's high-end GPUs.

- Cloud computing expansion: The continued growth of cloud computing services relies heavily on powerful GPUs, solidifying Nvidia's position.

- Market share leadership: Nvidia holds a commanding market share in accelerated computing, significantly outpacing its competitors. Recent reports show [insert specific data and statistics on market share from a reputable source].

Gaming Market Resilience

While economic headwinds impact various sectors, the gaming GPU market remains relatively resilient. Several factors contribute to its continued strength, further bolstering the NVDA stock outlook.

- New game releases: The steady release of high-profile video games continues to drive demand for powerful gaming GPUs.

- Esports growth: The expanding esports industry necessitates high-performance hardware, contributing to sustained demand.

- Technological advancements: Features like ray tracing and DLSS (Deep Learning Super Sampling) enhance gaming experiences, driving upgrades and purchases of Nvidia's latest GPUs.

- Potential Challenges: While the gaming market shows strength, potential risks such as economic downturns and shifting consumer spending habits warrant monitoring.

Mitigating China Market Risks: Strategies and Diversification

While the Chinese market remains significant, Nvidia is actively mitigating risks through strategic diversification and adaptation.

Diversification Across Key Markets

Nvidia is proactively reducing its reliance on any single market, focusing on expansion in key regions globally.

- North American and European Expansion: Significant investments are being made in expanding operations and partnerships in North America and Europe to diversify its revenue streams.

- Strategic Partnerships: Collaborations with major technology companies across various sectors further broaden Nvidia's reach and market access.

- Focus on Non-China Based Clients: A strategic shift towards securing clients outside of China is underway to mitigate potential disruptions from geopolitical uncertainties.

Adapting to Regulatory Changes

Nvidia is actively navigating the evolving regulatory landscape in China, demonstrating adaptability and compliance.

- Compliance Measures: The company is committed to adhering to all relevant export controls and regulations.

- R&D Investment: Investment in research and development of alternative technologies provides flexibility and resilience in the face of changing market conditions.

- Lobbying Efforts: Nvidia engages in proactive lobbying efforts to advocate for policies that support its business interests.

Long-Term Growth Opportunities in China

Despite current challenges, Nvidia recognizes the long-term growth potential of the Chinese market.

- Future Growth of AI and Data Center Infrastructure: The continued expansion of AI and data center infrastructure in China promises future growth opportunities once market conditions stabilize.

- Potential for Easing of Restrictions: There's potential for future easing of export controls and regulatory hurdles, unlocking significant market access.

Financial Performance and Analyst Predictions for Nvidia Stock

Analyzing Nvidia's recent financial reports and analyst predictions provides further insight into the positive outlook for NVDA stock.

Analyzing Recent Financial Reports

Nvidia's recent earnings reports demonstrate strong financial performance, consistently exceeding expectations.

- Revenue Growth: [Insert specific revenue figures and growth rates from recent financial reports, citing the source].

- Profitability: [Insert data on profit margins and net income, citing the source].

- Year-over-Year Comparison: [Compare the current performance to previous years to highlight growth trends].

Consensus Analyst Ratings and Price Targets

The majority of financial analysts maintain a positive outlook for Nvidia stock.

- Positive Ratings: Many prominent rating agencies have issued "buy" or "strong buy" ratings for NVDA stock. [Cite specific rating agencies and their ratings].

- Price Targets: Consensus price targets for NVDA stock indicate significant upside potential. [Cite average price target and range].

Conclusion: Nvidia Stock: A Promising Investment Despite Geopolitical Headwinds

While the challenges posed by the Chinese market are undeniable, Nvidia's robust global demand, strategic diversification efforts, and impressive financial performance suggest a compelling positive outlook for Nvidia stock (NVDA). The company's dominance in the data center market, resilience in gaming, and proactive risk mitigation strategies contribute to a bullish sentiment. Consider adding Nvidia Stock to your portfolio for long-term growth potential, but always conduct thorough due diligence before making any investment decisions. Further research into NVDA stock is recommended to fully assess its potential as part of a diversified investment strategy.

Featured Posts

-

Analyzing The Home Court Advantage Unfair Treatment Of Opponents At Roland Garros

May 30, 2025

Analyzing The Home Court Advantage Unfair Treatment Of Opponents At Roland Garros

May 30, 2025 -

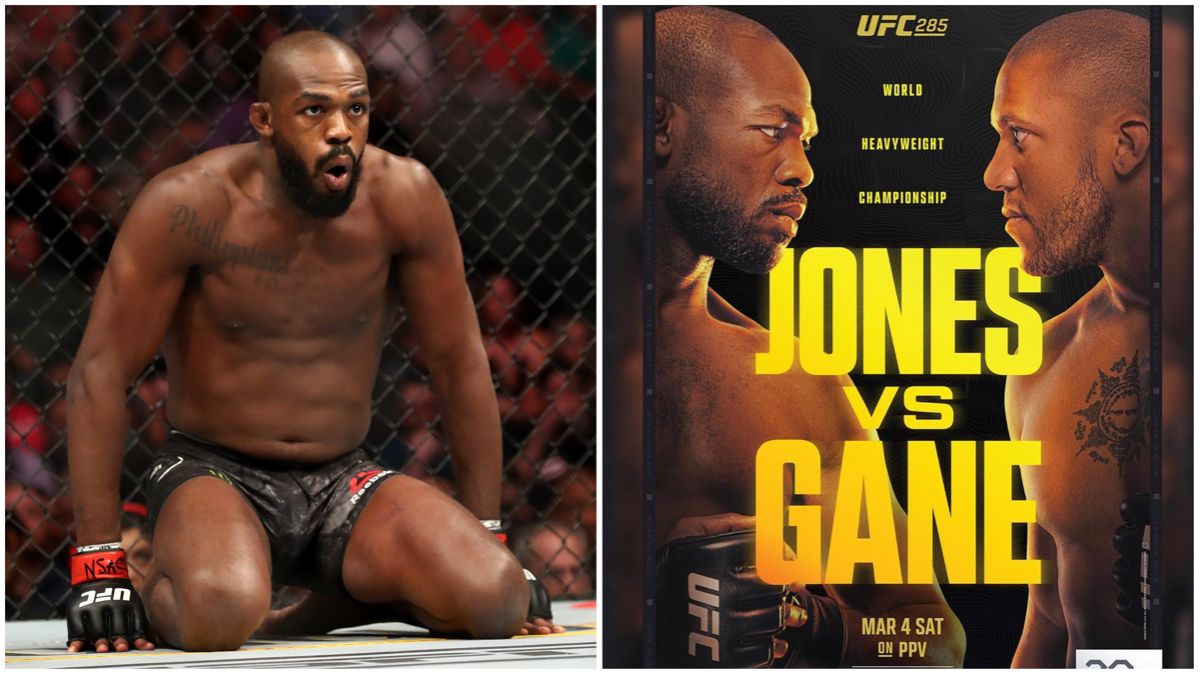

Ufc Heavyweight Unhappy With Jon Jones Latest Development

May 30, 2025

Ufc Heavyweight Unhappy With Jon Jones Latest Development

May 30, 2025 -

Air Traffic Control Blackout Cnns Pete Muntean Investigates

May 30, 2025

Air Traffic Control Blackout Cnns Pete Muntean Investigates

May 30, 2025 -

Mentzen I Wybory Prezydenckie 2025 Nieznane Dotad Aspekty Kampanii

May 30, 2025

Mentzen I Wybory Prezydenckie 2025 Nieznane Dotad Aspekty Kampanii

May 30, 2025 -

Rediscovering The Lost Voices A Hollywood Golden Age Film Critic

May 30, 2025

Rediscovering The Lost Voices A Hollywood Golden Age Film Critic

May 30, 2025