OECD 2025 Forecast: Slow Growth For Canadian Economy, Recession Averted

Table of Contents

Slow Growth Projections: A Deeper Dive into the OECD 2025 Forecast for Canada

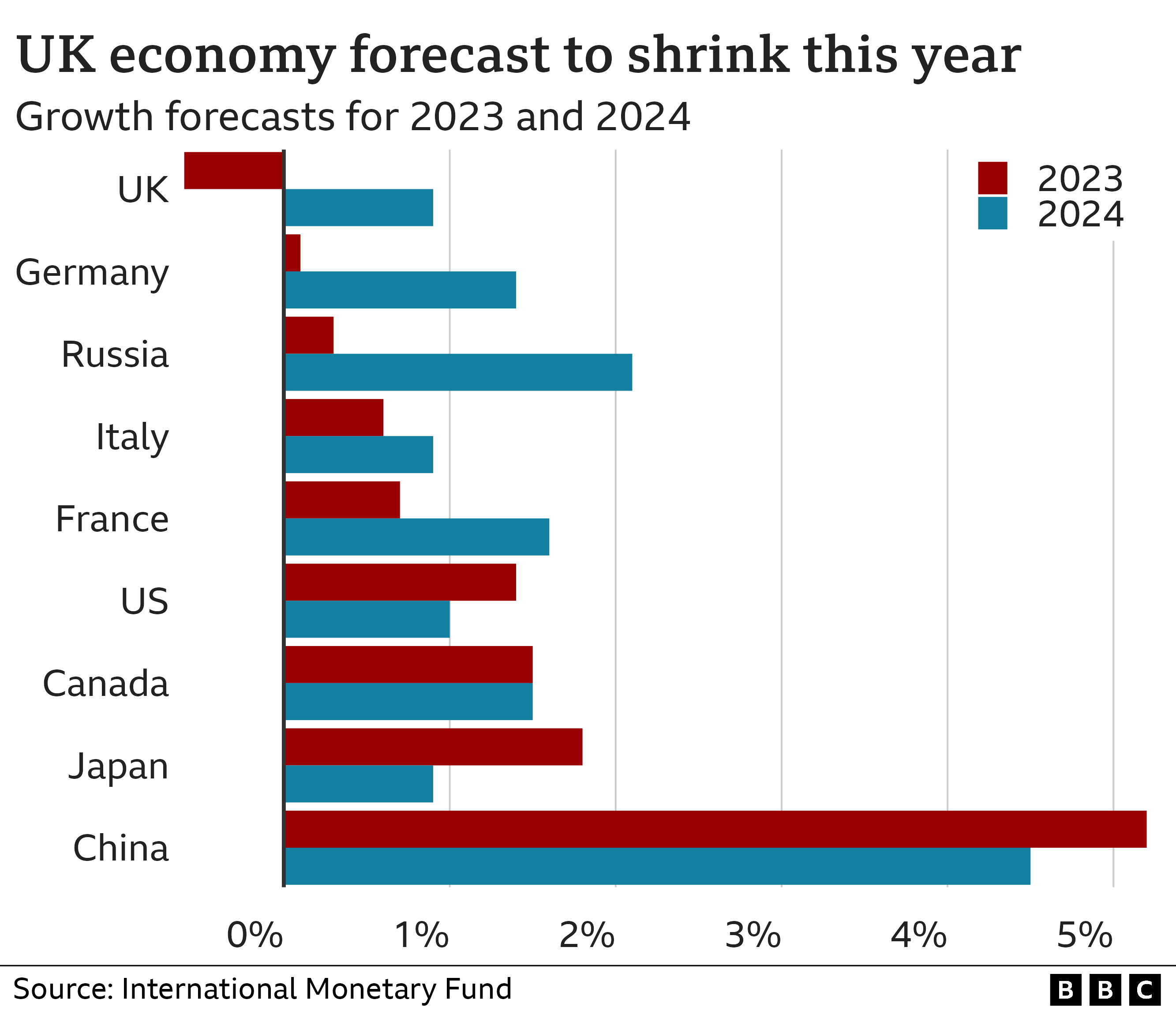

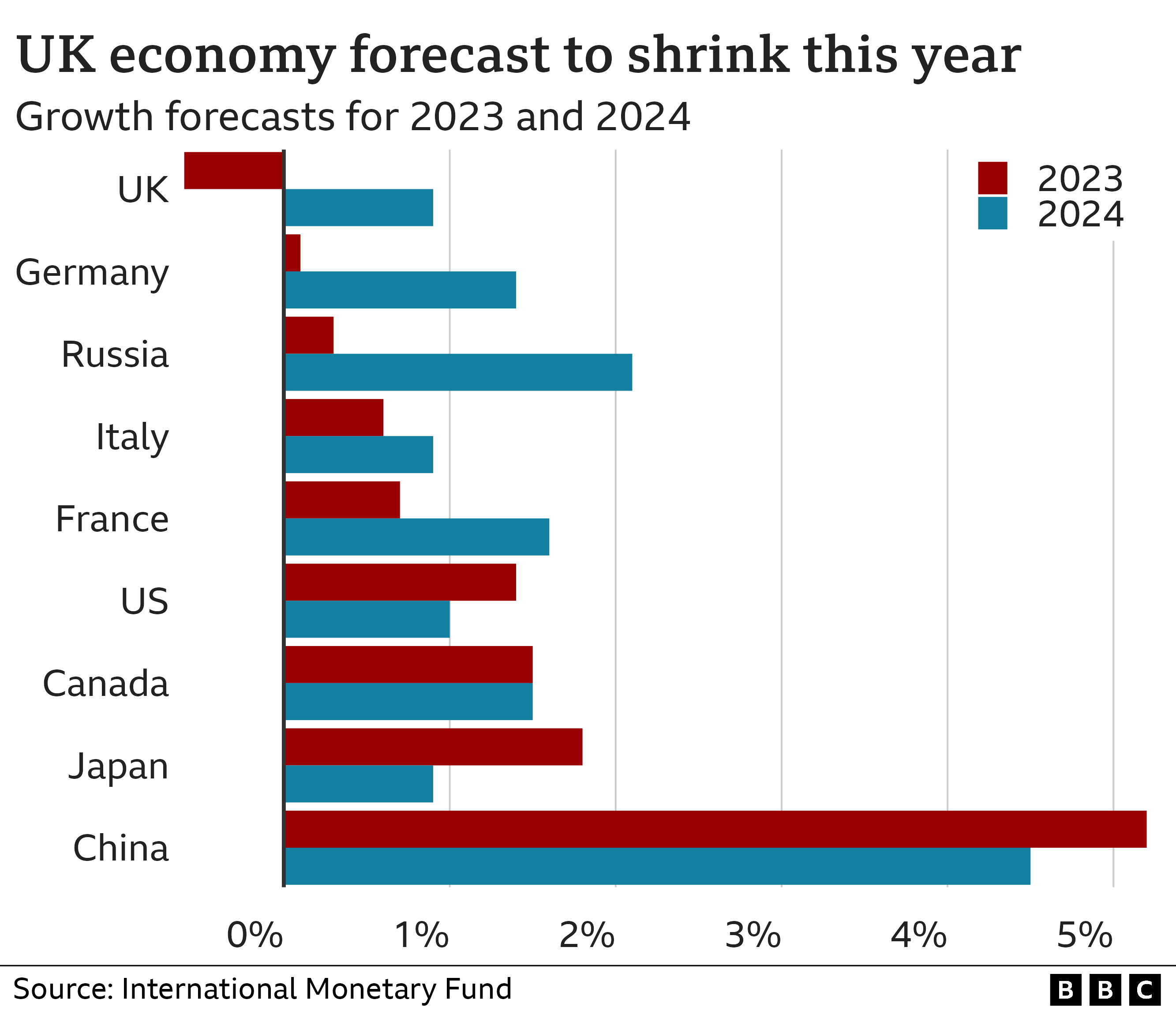

The OECD 2025 Forecast predicts a modest GDP growth rate for Canada in 2025, a significant slowdown compared to previous years. While the exact figures are subject to revision, the report points towards a considerably more subdued economic expansion than initially anticipated. This deceleration is attributed to several interconnected factors:

-

Global Economic Slowdown: The forecast reflects a broader trend of slower global growth, impacting Canadian exports and investment. Weakening demand from key trading partners directly affects Canadian economic performance.

-

Inflationary Pressures: Persistent inflationary pressures, although easing, continue to constrain consumer spending and business investment. High inflation erodes purchasing power and increases the cost of borrowing, dampening economic activity.

-

Interest Rate Hikes: The Bank of Canada's interest rate hikes, implemented to combat inflation, have increased borrowing costs for businesses and consumers, further slowing down economic growth. Higher interest rates make investments more expensive and reduce consumer confidence.

-

Supply Chain Disruptions: Although easing, lingering supply chain disruptions continue to contribute to higher production costs and reduced availability of goods, negatively impacting Canadian GDP. These disruptions lead to increased prices and reduced output across various sectors.

The OECD's "Economic Outlook" provides detailed statistics on the projected GDP growth, offering a comprehensive picture of the Canadian economic trajectory based on current trends and anticipated developments. This data is essential for understanding the scope of the projected slow growth and its potential consequences.

Recession Avoided: Understanding the OECD's Positive Outlook

Despite the projected slow growth, the OECD 2025 Forecast doesn't foresee a recession for Canada. This positive outlook stems from the resilience inherent in the Canadian economy, demonstrated through several key factors:

-

Strong Labor Market: A robust labor market, characterized by relatively low unemployment, provides a crucial buffer against a full-blown recession. Strong employment levels support consumer spending and overall economic activity.

-

Government Stimulus Measures: Targeted government stimulus measures, although potentially debated, have played a role in supporting economic activity and preventing a sharper downturn. These measures aim to boost demand and support businesses during challenging times.

-

Diversified Economy: Canada's diversified economy, encompassing various sectors from natural resources to technology, provides resilience against shocks affecting specific industries. This diversification limits the impact of sector-specific challenges on the overall economy.

The OECD highlights Canada's ability to withstand economic headwinds, emphasizing the country's strong fundamentals and capacity to adapt to changing global conditions. This resilience contributes to a positive outlook despite the projected slow growth, mitigating the risk of a recession.

Key Sectors and Their Performance in the OECD 2025 Forecast

The OECD 2025 Forecast offers sector-specific analyses, providing insights into the anticipated performance of key sectors within the Canadian economy:

-

Canadian Real Estate Market: The report acknowledges the potential for a slowdown in the real estate market, reflecting the impact of higher interest rates and reduced affordability. This sector is expected to experience moderate growth, but with increased volatility.

-

Manufacturing Sector Outlook: The manufacturing sector is projected to experience moderate growth, influenced by both global demand and domestic investment. Challenges include supply chain disruptions and increased input costs.

-

Energy Sector Forecast: The energy sector's performance is likely to be influenced by global energy prices and policy shifts. The transition to cleaner energy sources will play a significant role in shaping the sector's future trajectory.

Implications for Consumers and Businesses Based on the OECD 2025 Forecast

The OECD 2025 Forecast carries significant implications for both Canadian consumers and businesses:

For Consumers:

-

Inflationary Pressures on Household Budgets: Continued inflationary pressures will put significant strain on household budgets, potentially requiring adjustments to spending habits. Consumers may need to prioritize essential expenses and reduce discretionary spending.

-

Impact on Consumer Spending: Slow economic growth and reduced consumer confidence may lead to lower consumer spending, impacting businesses reliant on consumer demand. Businesses will need to adapt to a potentially slower consumer spending environment.

-

Potential for Job Market Changes: While the labor market remains strong, the forecast suggests a possibility of slower job creation. Workers may need to adapt to a potentially more competitive job market.

For Businesses:

-

Investment Decisions: Businesses may adopt a more cautious approach to investment decisions, given the projected slow growth and uncertainty. Strategic planning and risk assessment are crucial in making investment choices.

-

Hiring Strategies: Businesses may adjust their hiring strategies to align with the anticipated slower growth, potentially slowing down recruitment or focusing on specific skill sets. Strategic workforce planning is important to navigate the changing economic landscape.

-

Pricing Strategies: Businesses may need to carefully consider their pricing strategies to balance profitability with consumer affordability. Competitive pricing and strategic cost management will be crucial for business success.

Understanding and Preparing for the OECD 2025 Forecast for the Canadian Economy

The OECD 2025 Forecast paints a picture of slow growth for the Canadian economy, but thankfully, it does not predict a recession. Key factors contributing to this outlook include global economic conditions, inflation, interest rate hikes, and the inherent resilience of the Canadian economy. Understanding these predictions is paramount for both consumers and businesses to adapt and make informed decisions. Stay informed about the latest developments in the Canadian economy by regularly reviewing the OECD 2025 Forecast and related reports to make well-informed financial decisions. [Link to OECD Report]

Featured Posts

-

Falling Housing Permits Challenges In Boosting Construction Activity

May 28, 2025

Falling Housing Permits Challenges In Boosting Construction Activity

May 28, 2025 -

Legal Fallout E Bay Banned Chemicals And The Limits Of Section 230

May 28, 2025

Legal Fallout E Bay Banned Chemicals And The Limits Of Section 230

May 28, 2025 -

Hujan Turun Pagi Malam Di Jawa Timur Ramalan Cuaca Besok 6 5

May 28, 2025

Hujan Turun Pagi Malam Di Jawa Timur Ramalan Cuaca Besok 6 5

May 28, 2025 -

Pirati A Zeleni Obrozeni Spoluprace Pred Volbami Do Snemovny

May 28, 2025

Pirati A Zeleni Obrozeni Spoluprace Pred Volbami Do Snemovny

May 28, 2025 -

Kyle Stowers Walk Off Grand Slam Marlins Win Stowers Stays Hot

May 28, 2025

Kyle Stowers Walk Off Grand Slam Marlins Win Stowers Stays Hot

May 28, 2025

Latest Posts

-

Gilermo Del Toro Perviy Vzglyad Na Frankenshteyn Etoy Subboty

May 30, 2025

Gilermo Del Toro Perviy Vzglyad Na Frankenshteyn Etoy Subboty

May 30, 2025 -

Endgame Fallout Beloved Avenger Not Invited Back To The Mcu

May 30, 2025

Endgame Fallout Beloved Avenger Not Invited Back To The Mcu

May 30, 2025 -

Avenger Star Reveals They Havent Been Asked Back After Endgame

May 30, 2025

Avenger Star Reveals They Havent Been Asked Back After Endgame

May 30, 2025 -

Fan Favorite Avenger Snubbed No Endgame Return Invite

May 30, 2025

Fan Favorite Avenger Snubbed No Endgame Return Invite

May 30, 2025 -

Daredevil Born Again Exploring The Character Of Angela Del Toro

May 30, 2025

Daredevil Born Again Exploring The Character Of Angela Del Toro

May 30, 2025