OECD Predicts Flat Canadian Economic Growth In 2025: Recession Avoided

Table of Contents

Factors Contributing to Stagnant Canadian Economic Growth in 2025

Several intertwined factors contribute to the OECD's prediction of flat Canadian economic growth in 2025. These factors represent a complex interplay of domestic and global economic forces.

High Inflation and Interest Rates

Persistent high inflation and the Bank of Canada's subsequent aggressive interest rate hikes are major culprits. This tightening monetary policy, while aimed at curbing inflation, has inadvertently dampened economic activity. The impact is multifaceted:

- Reduced consumer spending: Increased prices and higher borrowing costs have reduced consumer purchasing power, leading to decreased spending on non-essential goods and services. This reduced consumer confidence directly impacts economic growth.

- Increased borrowing costs for businesses: Higher interest rates make it more expensive for businesses to borrow money for investment and expansion. This can lead to delayed projects, reduced hiring, and slower overall business growth. This impacts job creation and the overall health of the Canadian economy.

- A potential slowdown in the housing market: Higher mortgage rates are already cooling the once-hot Canadian housing market, potentially leading to a significant slowdown in construction and related economic activity. This sector is a significant contributor to Canadian GDP.

Global Economic Uncertainty

The forecast also considers the broader global economic climate, characterized by significant uncertainty. Potential recessions in other major economies and ongoing geopolitical instability create ripple effects felt across the Canadian economy:

- Canadian exports and trade relationships: Reduced global demand and trade disruptions negatively impact Canadian exports, a vital component of the Canadian economy. This weakens economic growth and impacts various sectors.

- Investor confidence in the Canadian market: Global uncertainty can lead to decreased investor confidence, resulting in reduced foreign investment and potentially hindering economic expansion. Foreign investment is critical for supporting growth initiatives.

- The overall stability of the Canadian dollar: Global economic fluctuations can impact the value of the Canadian dollar, influencing import and export costs and overall economic stability. Exchange rate volatility can severely complicate economic forecasting and business planning.

Supply Chain Disruptions Lingering Effects

While supply chain disruptions have eased somewhat, their lingering effects continue to exert upward pressure on production costs and constrain economic output.

- Increased input costs for businesses: Many businesses still face elevated input costs due to ongoing supply chain bottlenecks, squeezing profit margins and hindering investment. This restricts the capacity of businesses to grow and contribute to economic expansion.

- Continued shortages of certain goods and materials: Although less prevalent than during the peak of the disruptions, shortages of specific goods and materials can still disrupt production schedules and limit overall economic output. This leads to decreased productivity and higher prices for consumers.

- Potential inflationary pressure despite central bank actions: The lingering effects of supply chain issues can contribute to persistent inflationary pressure, even as central banks attempt to control inflation through interest rate hikes. This necessitates a more complex approach to managing inflation.

Implications of Flat Canadian Economic Growth for Businesses and Consumers

The predicted flat growth carries significant implications for both businesses and consumers in Canada.

Business Impact

Businesses across various sectors face a challenging landscape:

- Decreased consumer demand: Reduced consumer spending directly impacts businesses' revenues and profitability, forcing them to adapt their strategies. This necessitates careful financial planning and potentially cost-cutting measures.

- Increased operational costs: Higher input costs, interest rates, and energy prices increase businesses' operational expenses, squeezing profit margins further. Managing these rising costs becomes paramount for survival.

- Difficulty accessing credit: Higher interest rates and a potentially less favorable economic outlook can make it more difficult for businesses to access credit for expansion or working capital, hindering growth. Access to financing is crucial for business sustainability and innovation.

Consumer Impact

Consumers will likely experience a squeeze on their finances:

- Reduced disposable income: Higher prices and stagnant wages reduce consumers' disposable income, limiting spending and potentially impacting their overall quality of life. This necessitates careful budgeting and prioritization of spending.

- Increased cost of living: The combined effect of inflation and reduced income leads to an increased cost of living, making it more challenging for many Canadians to make ends meet. This may lead to reduced savings rates and increased reliance on credit.

- Potential job market uncertainty: Slow economic growth can lead to uncertainty in the job market, potentially impacting employment levels and causing anxieties among workers. Adaptability and upskilling are crucial in navigating this uncertainty.

OECD's Recommendations and Potential Mitigation Strategies

The OECD likely recommends a multi-pronged approach to mitigate the impact of stagnant growth and stimulate the Canadian economy. These recommendations might include:

- Targeted fiscal stimulus measures: Government spending on infrastructure projects and social programs can help boost demand and stimulate economic activity. Well-targeted spending ensures effective allocation of resources and impactful results.

- Investment in infrastructure projects: Investing in infrastructure can create jobs, stimulate economic activity, and improve long-term productivity. Strategic infrastructure development addresses critical needs and lays the groundwork for sustainable growth.

- Policies to support business investment and job creation: Government policies aimed at reducing regulatory burdens, providing tax incentives, and supporting innovation can encourage businesses to invest, expand, and create jobs. Such policies foster a business-friendly environment and drive economic expansion.

- Measures to address inflation and stabilize interest rates: The Bank of Canada's actions to control inflation are critical, but complementary government policies may be needed to address the underlying causes of inflation and ensure sustainable price stability. This requires a comprehensive and coordinated approach.

Conclusion

The OECD's prediction of flat Canadian Economic Growth in 2025, while avoiding a recession, highlights the importance of proactive measures to address the challenges ahead. High inflation, global uncertainty, and lingering supply chain issues contribute to this stagnant forecast. Understanding the implications for both businesses and consumers is vital for navigating this economic landscape. Staying informed about future forecasts regarding Canadian economic growth in 2025 and beyond is essential for strategic planning. By actively monitoring the situation and implementing appropriate strategies, individuals and organizations can better position themselves for success despite the predicted flat growth. Learn more about the potential impacts of the predicted flat Canadian Economic Growth in 2025 and plan your strategies accordingly.

Featured Posts

-

Close Freeway Series Win For Angels Against Dodgers

May 28, 2025

Close Freeway Series Win For Angels Against Dodgers

May 28, 2025 -

Ipswich Towns Week In Review Mc Kenna Shines Phillips And Cajuste Struggle

May 28, 2025

Ipswich Towns Week In Review Mc Kenna Shines Phillips And Cajuste Struggle

May 28, 2025 -

Winns Blast Leads Cardinals To Series Victory Over Diamondbacks

May 28, 2025

Winns Blast Leads Cardinals To Series Victory Over Diamondbacks

May 28, 2025 -

Rezhisser Ues Anderson Noviy Film V Razrabotke

May 28, 2025

Rezhisser Ues Anderson Noviy Film V Razrabotke

May 28, 2025 -

Abd De Tueketici Kredileri Mart Ayi Artisinin Ekonomik Etkileri

May 28, 2025

Abd De Tueketici Kredileri Mart Ayi Artisinin Ekonomik Etkileri

May 28, 2025

Latest Posts

-

Report Apple To Overhaul Os Naming Conventions

May 30, 2025

Report Apple To Overhaul Os Naming Conventions

May 30, 2025 -

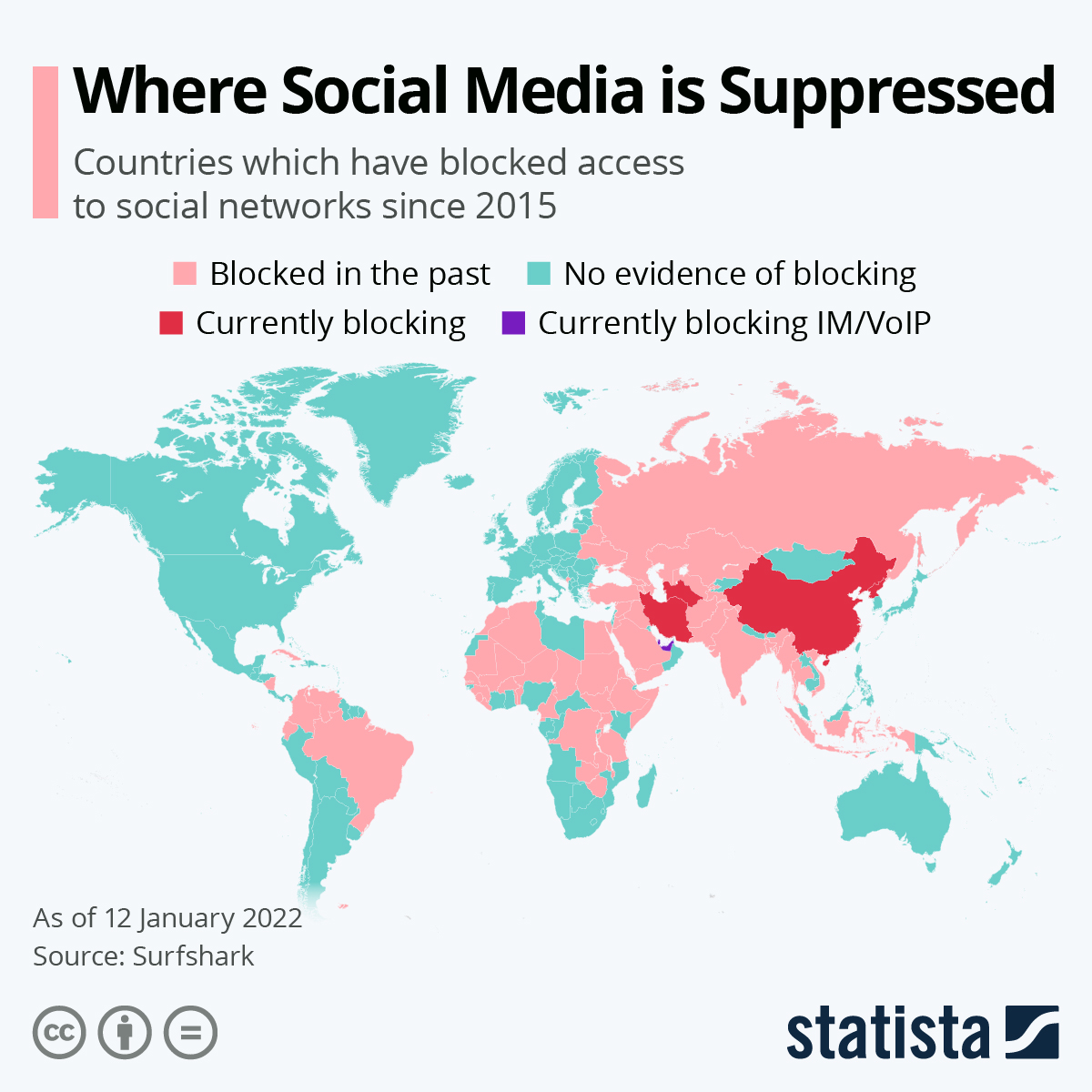

Us To Restrict Foreign Officials Over Social Media Policies

May 30, 2025

Us To Restrict Foreign Officials Over Social Media Policies

May 30, 2025 -

Us Ban On Foreign Officials Retaliation For Social Media Censorship

May 30, 2025

Us Ban On Foreign Officials Retaliation For Social Media Censorship

May 30, 2025 -

Apples Operating System Rename What We Know

May 30, 2025

Apples Operating System Rename What We Know

May 30, 2025 -

Debris From Glacier Buries Swiss Village Search Underway

May 30, 2025

Debris From Glacier Buries Swiss Village Search Underway

May 30, 2025