Omada Health's IPO: A Deep Dive Into The Andreessen Horowitz-Backed Digital Health Company

Table of Contents

Omada Health's Business Model: Preventing Chronic Diseases Through Digital Programs

Omada Health's core offering revolves around delivering virtual care programs designed to prevent and manage chronic diseases, primarily type 2 diabetes and hypertension. Their approach leverages a sophisticated blend of technology and human interaction, creating a personalized and engaging experience for patients.

- Remote Patient Monitoring: Omada Health utilizes connected devices and mobile apps to continuously monitor patients' vital signs and activity levels, providing real-time data to healthcare providers. This allows for proactive interventions and adjustments to treatment plans.

- Personalized Interventions: The programs are highly personalized, adapting to each individual's needs, preferences, and progress. This tailored approach enhances engagement and improves treatment adherence.

- Engaging Content and Support: Omada Health employs a multi-faceted approach to patient engagement, including educational materials, interactive tools, and ongoing support from certified health coaches. This helps to foster a sense of community and motivation among participants.

- Telehealth Consultations: Patients have access to telehealth consultations with healthcare professionals, allowing for convenient and remote access to medical advice and support.

Omada Health's digital therapeutics platform represents a significant advancement in the field of chronic disease management, offering a scalable and cost-effective solution to a growing global health challenge. Keywords like Omada Health programs, digital therapeutics, remote patient monitoring, telehealth platform, and chronic disease management are crucial to understanding their approach.

Financial Performance and IPO Details: Assessing Omada Health's Valuation

Prior to the IPO, Omada Health demonstrated consistent revenue growth, fueled by increasing adoption of its digital health programs. While profitability might have been a focus initially, the company likely prioritized scaling its operations and expanding its market reach. Analyzing the pre-IPO financial statements reveals key metrics like revenue growth rates, operating margins, and customer acquisition costs. The Omada Health IPO valuation reflected investor confidence in the company's future potential within the burgeoning telehealth market.

- IPO Valuation: The specific valuation achieved during the IPO will be a key indicator of investor sentiment and the market's perception of Omada Health's long-term prospects. Analyzing the amount of capital raised will show investors' commitment and the potential for future growth.

- Market Capitalization: The market capitalization following the IPO offers insight into the company's overall worth and its standing within the digital health landscape.

- Stock Performance (Post-IPO): Tracking the stock's performance in the post-IPO period will provide valuable information about investor confidence and market acceptance. Early performance can indicate whether the IPO was appropriately priced and how the market values the company's long-term potential.

Understanding these Omada Health financials, IPO valuation, revenue growth, market capitalization, and investor interest is vital for any analysis of the company's success and future prospects.

The Role of Andreessen Horowitz and Other Investors: Strategic Partnerships and Funding

Andreessen Horowitz's involvement in Omada Health extends beyond mere financial investment. Their expertise in the technology and healthcare sectors provides valuable strategic guidance and opens doors to a vast network of industry connections. This strategic partnership has been instrumental in shaping Omada Health's trajectory and facilitating its growth.

- Venture Capital Funding: The significant venture capital funding received by Omada Health underscores investor belief in its business model and market potential. This funding has likely been crucial for scaling operations, developing new technologies, and expanding into new markets.

- Strategic Partnerships: Analyzing Omada Health's investor base reveals a network of strategic partners who provide expertise, resources, and market access. Identifying these Omada Health investors and understanding their contributions to the company’s success is critical.

The analysis of Andreessen Horowitz investment, venture capital funding, and strategic partnerships provides valuable insights into the factors that have contributed to Omada Health's success.

Competitive Landscape and Future Outlook: Challenges and Opportunities in the Digital Health Space

Omada Health operates within a dynamic and competitive digital health market. Analyzing the digital health competition is essential to understanding its challenges and opportunities. Key competitors include other telehealth providers offering similar programs for chronic disease management.

- Market Adoption: Widespread adoption of digital health solutions depends on factors such as patient awareness, physician acceptance, and reimbursement policies.

- Reimbursement Models: The sustainability of Omada Health's business model relies on securing favorable reimbursement rates from insurers and healthcare providers.

- Regulatory Landscape: Navigating the evolving regulatory environment for digital health technologies presents both challenges and opportunities.

- Expansion Opportunities: Omada Health's future growth may involve expanding into new therapeutic areas, geographic markets, or integrating its platform with other healthcare systems.

The telehealth market is experiencing rapid growth, presenting significant opportunities for companies like Omada Health. However, successfully navigating the digital health competition, addressing reimbursement challenges, and adapting to the evolving regulatory landscape are crucial for long-term success. Analyzing the future outlook and Omada Health expansion potential is essential for a complete understanding.

Conclusion: Investing in the Future of Omada Health IPO and Digital Healthcare

The Omada Health IPO represents a significant development in the digital health sector, showcasing the growing potential of digital therapeutics in managing chronic diseases. While the company faces competition and challenges, its strong business model, impressive growth trajectory, and strategic partnerships position it for continued success. Investors should carefully weigh the potential risks and rewards before making any investment decisions.

The Omada Health IPO is not just about a single company; it's a testament to the transformative power of digital health. Understanding the Omada Health IPO's implications is crucial for anyone interested in the future of healthcare. Stay informed on the evolving landscape of the Omada Health IPO and the future of digital healthcare. Learn more and make informed investment decisions based on your own due diligence.

Featured Posts

-

Adae Fyraty Me Alerby Thlyl Bed Antqalh Mn Alahly

May 10, 2025

Adae Fyraty Me Alerby Thlyl Bed Antqalh Mn Alahly

May 10, 2025 -

Fox News Hosts Sharp Rebuttal To Colleagues Trump Tariff Stance

May 10, 2025

Fox News Hosts Sharp Rebuttal To Colleagues Trump Tariff Stance

May 10, 2025 -

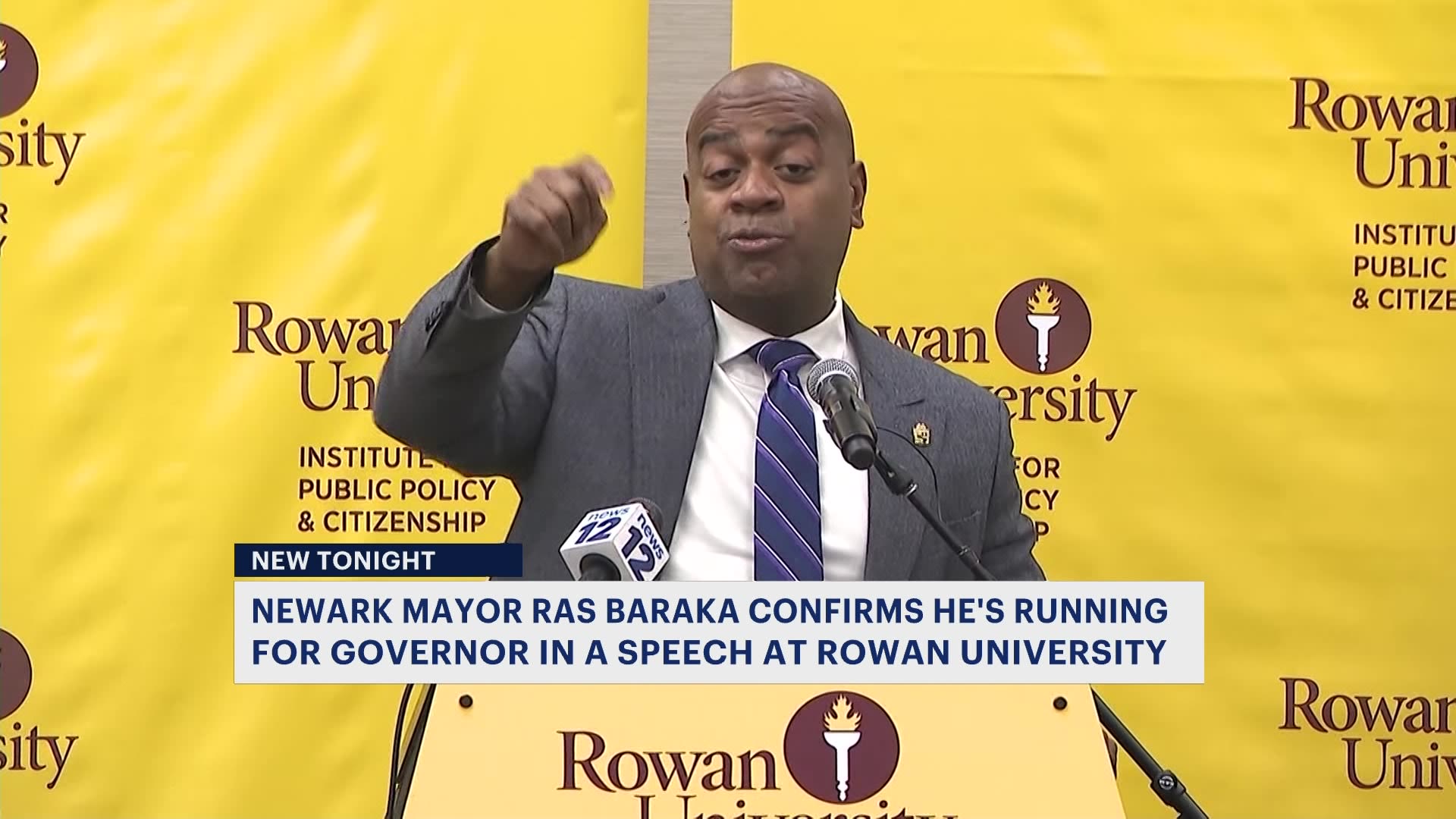

Ice Protest Leads To Newark Mayor Ras Barakas Arrest

May 10, 2025

Ice Protest Leads To Newark Mayor Ras Barakas Arrest

May 10, 2025 -

2025 Nhl Trade Deadline Predicting The Post Deadline Playoff Picture

May 10, 2025

2025 Nhl Trade Deadline Predicting The Post Deadline Playoff Picture

May 10, 2025 -

Palantir Stock Before May 5th Is It A Buy Or Sell

May 10, 2025

Palantir Stock Before May 5th Is It A Buy Or Sell

May 10, 2025