Onex's WestJet Investment: A Successful Exit Strategy

Table of Contents

Onex's Acquisition of WestJet: A Leveraged Buyout (LBO) Strategy

Onex's acquisition of WestJet in 2019 was a significant leveraged buyout (LBO). This strategy, common in private equity, involves using a significant amount of borrowed money (debt financing) to finance the acquisition, supplemented by equity investment from Onex. The purchase price reflected WestJet's strong market position and growth potential in the Canadian airline industry.

- LBO Structure: Onex employed a classic LBO structure, leveraging a combination of debt and equity to acquire WestJet. This minimized the upfront equity contribution from Onex while maximizing potential returns.

- Funding Sources: The acquisition financing was secured through a combination of bank loans, high-yield bonds, and equity contributions from Onex and its partners.

- Key Financial Metrics: While specific financial details remain confidential, the deal's size placed it among the largest LBOs in Canadian history, highlighting the scale of Onex's ambition and the perceived value of WestJet.

- Strategic Rationale: Onex recognized WestJet's strong brand, established network, and potential for growth within the Canadian market. The acquisition offered an opportunity to improve operational efficiency and unlock significant value.

Operational Improvements and Value Creation at WestJet Under Onex's Ownership

Following the acquisition, Onex implemented several strategic initiatives to improve WestJet's profitability and market value. These actions focused on enhancing operational efficiency, increasing revenue streams, and strengthening the company's overall competitive position.

- Cost-Cutting Measures: Onex focused on streamlining operations, negotiating better contracts with suppliers, and optimizing its route network to reduce costs and improve margins.

- Revenue Growth Initiatives: Strategies included expanding into new markets, developing ancillary revenue streams (e.g., baggage fees, seat selection), and enhancing customer loyalty programs.

- Key Performance Indicators (KPIs): During Onex's ownership, WestJet saw improvements in several key KPIs, including passenger load factors, on-time performance, and operational efficiency ratios, demonstrating the success of their operational strategies.

- Technological Advancements: Investment in new technologies, such as improved flight scheduling software and customer relationship management (CRM) systems, further enhanced efficiency and customer service.

The Strategic Divestiture of WestJet: Maximizing Return on Investment (ROI)

Onex's exit strategy involved a divestiture of WestJet. They achieved a highly successful outcome by choosing the right timing and method for the divestiture, maximizing their return on investment.

- Exit Strategy Choice: Onex ultimately opted for an initial public offering (IPO), allowing them to sell a substantial portion of their ownership stake to public investors while retaining some ownership in the company. The IPO raised significant capital and provided a clear liquidity event for Onex.

- Timing and Market Conditions: The timing of the IPO was carefully selected to capitalize on favorable market conditions and investor sentiment toward the airline industry. This ensured a favorable valuation for WestJet.

- Valuation at Divestiture: The IPO resulted in a substantial valuation for WestJet, reflecting the operational improvements and value creation achieved under Onex's ownership.

- Return on Investment (ROI): The successful IPO generated a significant return on investment for Onex, demonstrating the effectiveness of their LBO strategy, operational improvements, and strategic exit planning. The final ROI clearly exceeded initial projections, highlighting the success of the overall investment.

Conclusion: A Masterclass in Private Equity Exit Strategies

Onex's WestJet investment serves as a compelling case study in successful private equity exit strategies. Their approach, combining a strategic leveraged buyout (LBO), operational improvements, and a well-timed divestiture, resulted in a substantial return on investment. The key takeaways are the importance of careful due diligence in acquisition, a focus on operational efficiency, and strategic exit planning that leverages market conditions to maximize value.

Learn from Onex's successful WestJet investment. Explore how similar private equity exit strategies can be implemented to maximize returns. Research other successful private equity exit strategies for further insights into this critical area of investment management. Contact us to discuss your own private equity investment and exit strategy needs.

Featured Posts

-

Debbie Elliott A Detailed Profile

May 11, 2025

Debbie Elliott A Detailed Profile

May 11, 2025 -

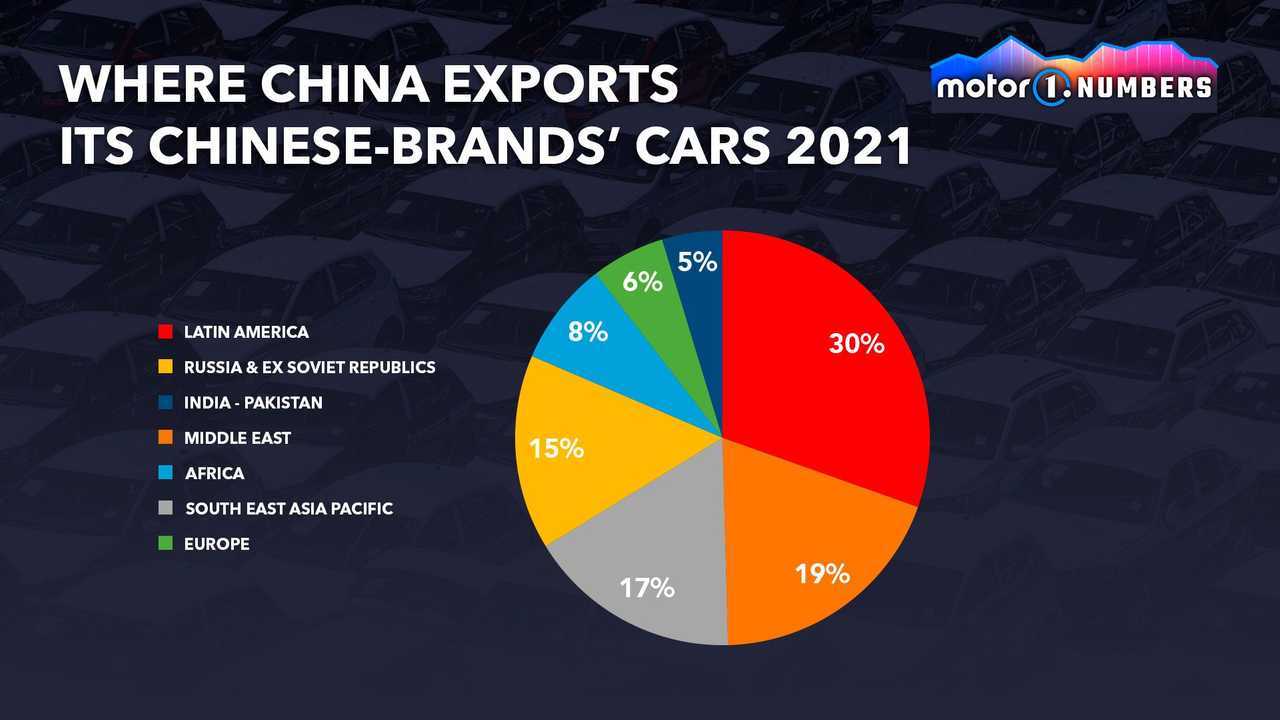

The Complexities Of The Chinese Auto Market Lessons From Bmw And Porsches Experiences

May 11, 2025

The Complexities Of The Chinese Auto Market Lessons From Bmw And Porsches Experiences

May 11, 2025 -

Gerard Hernandez Et Chantal Ladesou Leur Duo Dans Scenes De Menages Explique

May 11, 2025

Gerard Hernandez Et Chantal Ladesou Leur Duo Dans Scenes De Menages Explique

May 11, 2025 -

Chicago Bulls And New York Knicks A Look At The Injury Reports Before Tip Off

May 11, 2025

Chicago Bulls And New York Knicks A Look At The Injury Reports Before Tip Off

May 11, 2025 -

Chantal Ladesou Les Vraies Raisons De Son Absence Du Jeu Qui Rit Sort

May 11, 2025

Chantal Ladesou Les Vraies Raisons De Son Absence Du Jeu Qui Rit Sort

May 11, 2025