Optimus Robot Development: Tesla Navigates Challenges From China's Rare Earth Controls

Table of Contents

China's Dominance in Rare Earth Minerals and its Implications for Optimus

The Crucial Role of Rare Earths in Robotics

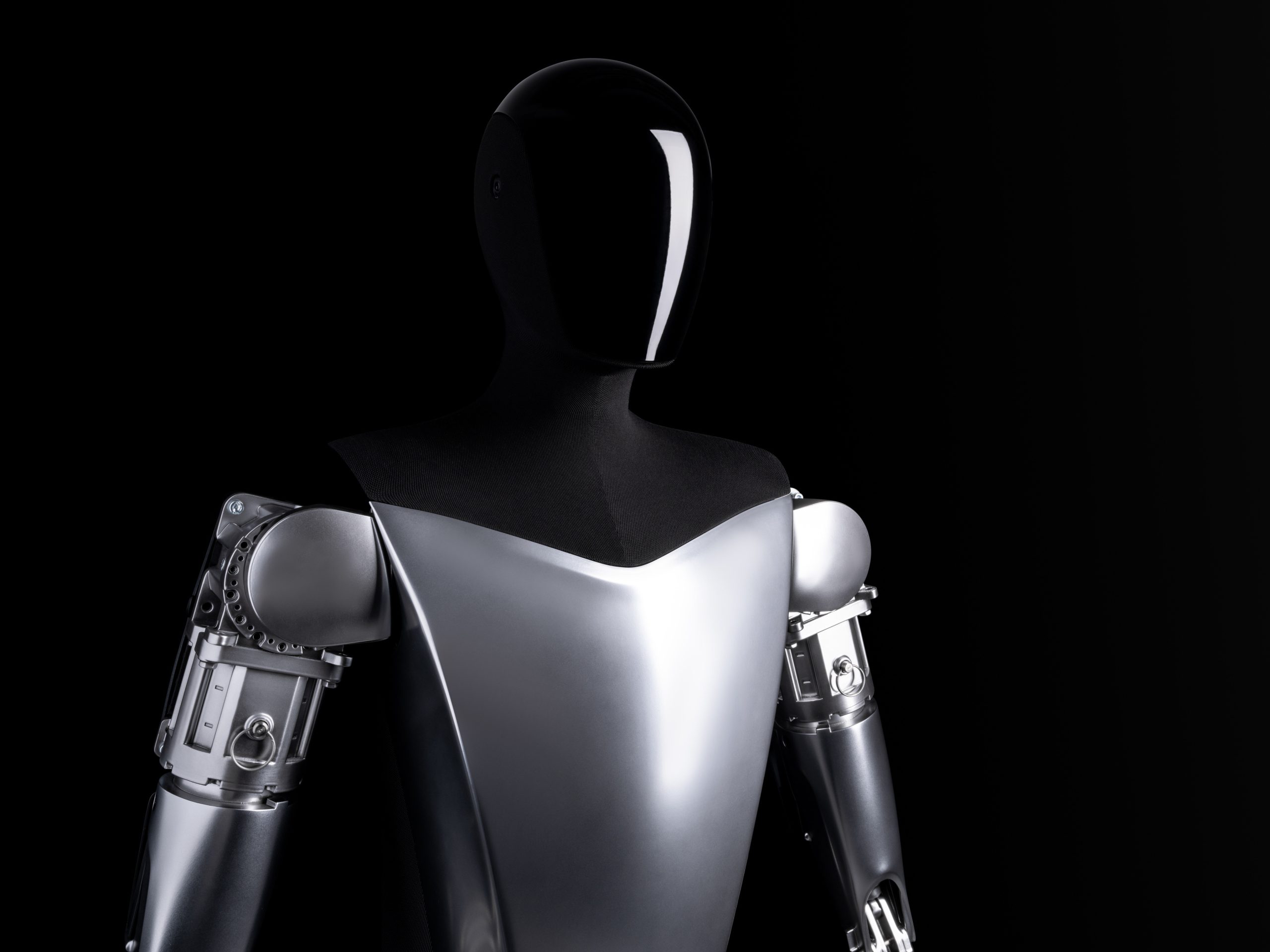

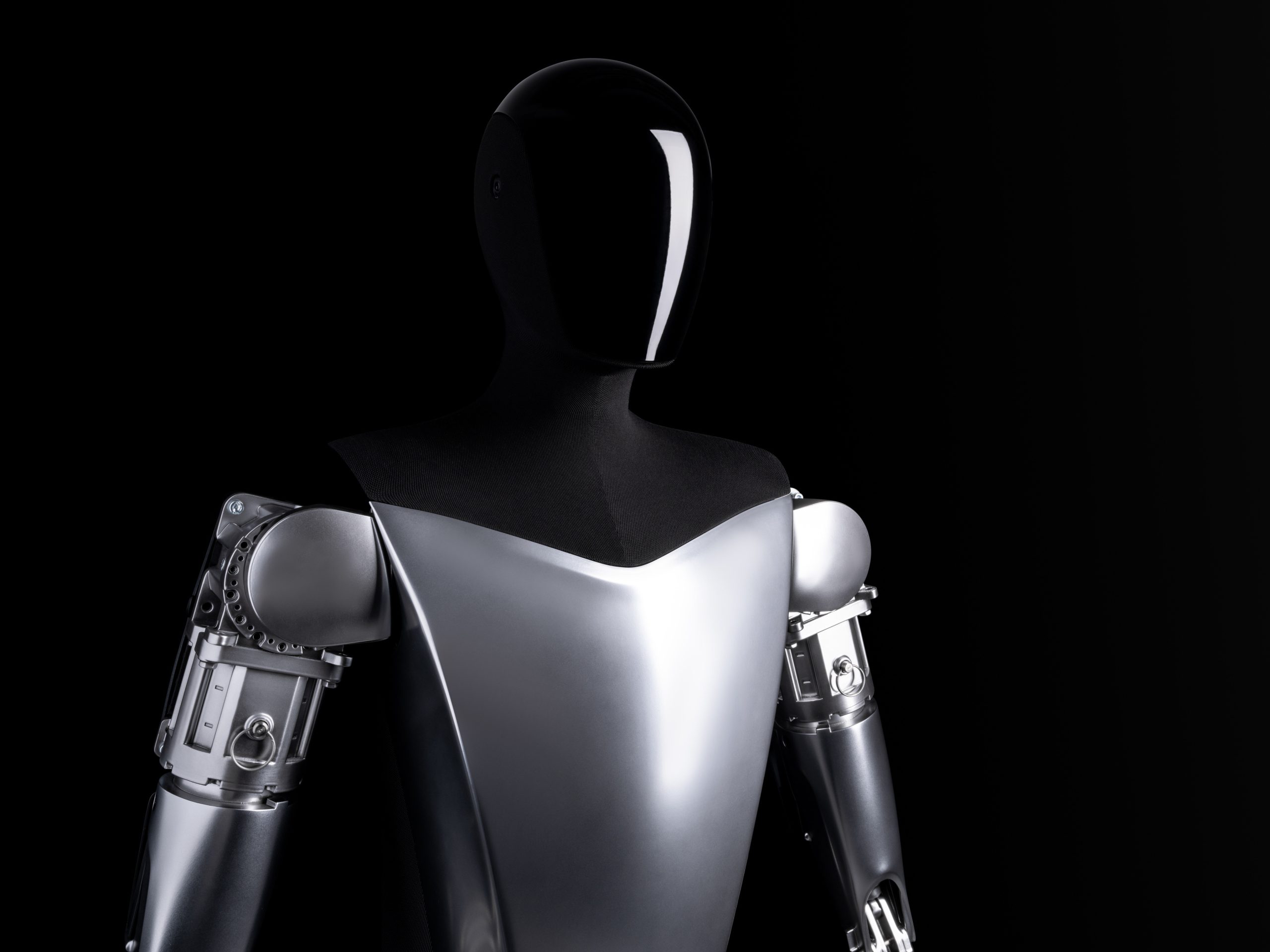

Rare earth elements (REEs) are vital components in numerous technologies, and the robotics industry is no exception. Optimus, like most advanced robots, heavily relies on these materials for optimal performance.

- Neodymium: Used in powerful and compact permanent magnets essential for robot motors, enabling precise and efficient movements.

- Dysprosium: Another critical element in high-performance magnets, enhancing their thermal stability and preventing performance degradation under high temperatures or loads.

- Praseodymium: Contributes to the strength and durability of magnets, increasing the lifespan and reliability of robotic components.

- Terbium: Plays a key role in magnetostrictive sensors, used for precise position control and feedback mechanisms within the robot.

These REEs aren't merely optional extras; they are fundamental to Optimus's functionality, impacting its strength, speed, accuracy, and overall operational efficiency. The entire robotics industry, from industrial automation to consumer robotics, shares this dependence on rare earth materials.

China's Market Control and Geopolitical Risks

China currently controls a dominant share of the global rare earth mining and processing market, holding a near-monopoly over the supply chain. This dominance presents several significant geopolitical risks for Tesla's Optimus robot development:

- Supply Chain Disruptions: Geopolitical tensions or unexpected events in China could easily disrupt the supply of crucial REEs, halting or severely impacting Optimus production.

- Price Volatility: China's market control allows for significant price fluctuations, potentially increasing the cost of Optimus production and impacting its competitiveness.

- Strategic Leverage: China's dominance gives it considerable leverage over companies like Tesla, potentially influencing production decisions or creating dependence. This impacts Tesla's long-term production strategy and requires careful geopolitical navigation.

Tesla's Strategies to Mitigate Rare Earth Dependence in Optimus Production

Tesla is undoubtedly aware of the risks associated with relying on China for rare earth materials. The company is actively pursuing several strategies to mitigate this dependence:

Diversification of Supply Chains

Tesla is actively working to diversify its supply chains, sourcing REEs from alternative locations. This involves:

- Exploration of new sources: Investing in and partnering with mining companies in countries like Australia, Canada, and the United States to secure more reliable and geographically diverse sources of rare earth materials.

- Building strategic partnerships: Collaborating with companies across the rare earth value chain, from mining to processing and refining, to ensure a stable and secure supply.

- Development of domestic processing capabilities: Investing in processing facilities within countries outside of China to reduce reliance on Chinese processing plants. However, establishing these facilities presents significant logistical and financial hurdles.

Technological Innovation and Material Substitution

Simultaneously, Tesla is heavily investing in research and development to reduce its reliance on rare earth elements:

- Exploring alternative magnet designs: Researching and developing new magnet technologies that require fewer or no rare earth elements. This includes exploring alternative materials and designs for motors and sensors.

- Developing material substitutes: Investigating and implementing substitute materials that offer comparable performance without the need for critical REEs. This requires significant breakthroughs in material science.

- Improving recycling processes: Developing more efficient methods for recycling rare earth materials from end-of-life products, thus reducing the need for new mining.

The Future of Optimus Robot Development and Global Geopolitics

Assessing the Long-Term Challenges

The future of Optimus robot development remains intertwined with global geopolitics. Continued reliance on China for critical REEs exposes Tesla to:

- Geopolitical instability: Escalating tensions between China and other nations could further restrict access to rare earth materials, leading to production delays and increased costs.

- Trade wars and sanctions: Imposition of trade restrictions or sanctions could severely disrupt the flow of rare earth materials, jeopardizing Optimus production.

- Supply chain vulnerability: Over-reliance on a single source or region for such critical materials creates significant vulnerability and susceptibility to unexpected disruptions.

The Broader Implications for the Robotics Industry

China's dominance in rare earths poses a significant challenge not just for Tesla, but for the entire global robotics industry. The need for:

- Greater diversification: The robotics industry must urgently diversify its supply chains, avoiding over-reliance on any single nation for critical components.

- International cooperation: Enhanced collaboration between countries is crucial to ensure stable and secure supplies of REEs, minimizing the risks associated with geopolitical tensions.

- Sustainable sourcing: The industry needs to adopt more sustainable sourcing practices, minimizing environmental damage and promoting responsible mining practices.

Conclusion: Navigating the Complex Landscape of Optimus Robot Development

Tesla's Optimus robot development faces a significant hurdle in China's dominance of the rare earth market. Successfully navigating this challenge requires a multi-pronged approach, combining supply chain diversification, technological innovation, and a proactive engagement with global geopolitics. The success or failure of Optimus, and indeed the broader future of the robotics industry, hinges on addressing these challenges effectively. Stay informed about the latest developments in Optimus robot development and the global race for rare earth resources to understand the evolving landscape of this critical technology.

Featured Posts

-

Chat Gpt Ceo Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025

Chat Gpt Ceo Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025 -

Powell Job Security Fuels Us Stock Futures Increase

Apr 24, 2025

Powell Job Security Fuels Us Stock Futures Increase

Apr 24, 2025 -

Tesla Q1 Profit Decline Impact Of Musks Political Involvement

Apr 24, 2025

Tesla Q1 Profit Decline Impact Of Musks Political Involvement

Apr 24, 2025 -

Ftc Appeals Microsoft Activision Ruling What Happens Next

Apr 24, 2025

Ftc Appeals Microsoft Activision Ruling What Happens Next

Apr 24, 2025 -

Is Open Ai Buying Google Chrome Speculation Following Chat Gpt Chiefs Remarks

Apr 24, 2025

Is Open Ai Buying Google Chrome Speculation Following Chat Gpt Chiefs Remarks

Apr 24, 2025