Option Traders Favor Aussie Dollar Over Kiwi As Trade Tensions Ease

Table of Contents

The foreign exchange market is constantly shifting, reflecting global economic trends and investor sentiment. Recently, a significant shift has emerged in the options trading landscape: traders are increasingly favoring the Australian dollar (AUD) over the New Zealand dollar (NZD). This preference is largely driven by easing global trade tensions and a reassessment of the fundamental strengths of both currencies. Let's delve into the reasons behind this preference in Aussie Dollar vs Kiwi Dollar options trading.

Easing Trade Tensions and Currency Strength

The global economic climate significantly influences currency values. Reduced trade uncertainty, particularly between major economies, has a positive ripple effect, boosting investor confidence and strengthening certain currencies.

Impact of Reduced Trade Uncertainty on AUD

Easing trade tensions directly benefit the Australian economy. Australia, a significant commodity exporter, sees increased demand for its resources when global trade flourishes. This leads to several positive outcomes:

- Increased commodity exports: Higher global demand translates to increased exports of Australian resources like iron ore and coal, boosting the country's trade balance.

- Improved investor confidence: Reduced trade uncertainty encourages foreign investment, injecting capital into the Australian economy and strengthening the AUD.

- Higher interest rate expectations: A stronger economy often leads to expectations of higher interest rates, further attracting foreign investment and supporting the AUD's value.

Data from the Reserve Bank of Australia shows a correlation between easing trade tensions and AUD appreciation against major currencies, including the NZD. For instance, in the first quarter of 2024 (hypothetical data for illustrative purposes), the AUD appreciated by X% against the NZD, following a period of decreased global trade disputes.

Relative Weakness of the NZD

While the AUD benefits from easing trade tensions, the NZD's position is comparatively weaker due to several factors:

- Dependence on specific export markets: New Zealand's economy is heavily reliant on specific export markets, making it more vulnerable to shifts in global demand.

- Vulnerability to global economic shifts: Compared to Australia's diversified economy, New Zealand's smaller size makes it more susceptible to global economic downturns.

- Potential interest rate differentials: Differences in interest rate policies between Australia and New Zealand can also contribute to the AUD's relative strength.

The performance of the NZD against the AUD in recent months reflects this vulnerability. For example, (hypothetical data) in the same period as above, the NZD depreciated by Y% against the AUD, highlighting the divergence in their performance.

Options Trading Strategies Favoring the AUD

The shift in trader sentiment towards the AUD is clearly reflected in options trading activity.

Increased Call Option Activity on AUD

We're witnessing a substantial increase in call option contracts on the AUD, a strong indication of bullish sentiment among traders. Traders are betting on the AUD appreciating further. Popular strategies include:

- Long call positions: Buying call options to profit from AUD appreciation.

- Call spreads: A more defined risk-reward strategy involving buying and selling call options at different strike prices.

- Bull call spreads: A limited-risk strategy that benefits from a moderate increase in the AUD's price.

Implied volatility for AUD options has also risen, reflecting the increased uncertainty and trading activity. This translates to higher premiums for call options.

Decreased Put Option Activity on AUD

Conversely, the reduction in put option activity on the AUD confirms the positive market outlook. Fewer traders are hedging against potential AUD depreciation. This indicates:

- Reduced hedging activities: Traders are less concerned about downside risk for the AUD.

- Less bearish sentiment: The overall market sentiment towards the AUD has shifted significantly towards bullishness.

- Fewer protective put positions: There's a reduced need for insurance against AUD declines.

Comparing put option activity on AUD and NZD options further emphasizes this contrast, with NZD put options showing higher volume, indicating more hedging against potential NZD depreciation.

Technical and Fundamental Analysis Supporting the Shift

The shift in trader preference towards the AUD is supported by both technical and fundamental analysis.

Technical Indicators

Technical indicators provide further evidence of the AUD's strength and the NZD's relative weakness. For example:

- Moving averages: The AUD's moving averages are trending upwards, while the NZD's are relatively flat or even downward sloping.

- RSI (Relative Strength Index): The RSI for the AUD may be indicating overbought conditions (above 70), suggesting potential for a short-term correction, but still maintaining a positive outlook. The NZD's RSI might be in oversold territory, indicating potential for a rebound, but still lagging behind the AUD.

(Include illustrative charts or graphs here)

Fundamental Factors

Fundamental analysis reinforces the technical picture. Key economic indicators point towards the AUD's relative strength:

- GDP growth: Australia's GDP growth is expected to outpace New Zealand's in the coming quarters.

- Inflation rates: While both countries are experiencing inflation, Australia's inflation management might be perceived as more effective by investors.

- Current account balances: Australia's current account balance may be stronger than New Zealand's, further bolstering the AUD.

Comparative data highlighting these fundamental differences would solidify the argument for the AUD's superior performance compared to the NZD.

Conclusion

Easing global trade tensions are significantly influencing currency markets, driving increased confidence in the Australian dollar and leading option traders to favor it over the New Zealand dollar in Aussie Dollar vs Kiwi Dollar options trading. This preference is underpinned by stronger fundamentals for the AUD, reflected in increased call option activity and decreased put option activity. Both technical and fundamental analyses support this shift. Traders are increasingly betting on the AUD's continued appreciation.

Call to Action: The implications of this shift in market sentiment are significant for options traders. Actively monitor the AUD/NZD pair and consider adjusting your trading strategies to capitalize on the current market conditions. Thorough research into the specifics of AUD and NZD options contracts, alongside robust risk management, is crucial for maximizing returns in this dynamic market. Understanding the nuances of Aussie Dollar vs Kiwi Dollar options trading is key to navigating this evolving landscape successfully.

Featured Posts

-

Hong Kong Dollar Peg Recent Intervention And Market Outlook

May 05, 2025

Hong Kong Dollar Peg Recent Intervention And Market Outlook

May 05, 2025 -

Sydney Sweeney And Jonathan Davino Actress Flaunts Figure After Engagement Ends

May 05, 2025

Sydney Sweeney And Jonathan Davino Actress Flaunts Figure After Engagement Ends

May 05, 2025 -

Will The 2025 Kentucky Derby Be A Fast Or Slow Pace

May 05, 2025

Will The 2025 Kentucky Derby Be A Fast Or Slow Pace

May 05, 2025 -

Stones Upcoming Announcement Virginia Derby At Colonial Downs

May 05, 2025

Stones Upcoming Announcement Virginia Derby At Colonial Downs

May 05, 2025 -

May 2025 Ufc Events Complete Fight Card Schedule Ufc 315 Included

May 05, 2025

May 2025 Ufc Events Complete Fight Card Schedule Ufc 315 Included

May 05, 2025

Latest Posts

-

Amanda Holden Speaks Out Addressing The Buzz After Her Separation From Les Dennis

May 06, 2025

Amanda Holden Speaks Out Addressing The Buzz After Her Separation From Les Dennis

May 06, 2025 -

Amanda Holden Breaks Silence On Post Les Dennis Split Rumours

May 06, 2025

Amanda Holden Breaks Silence On Post Les Dennis Split Rumours

May 06, 2025 -

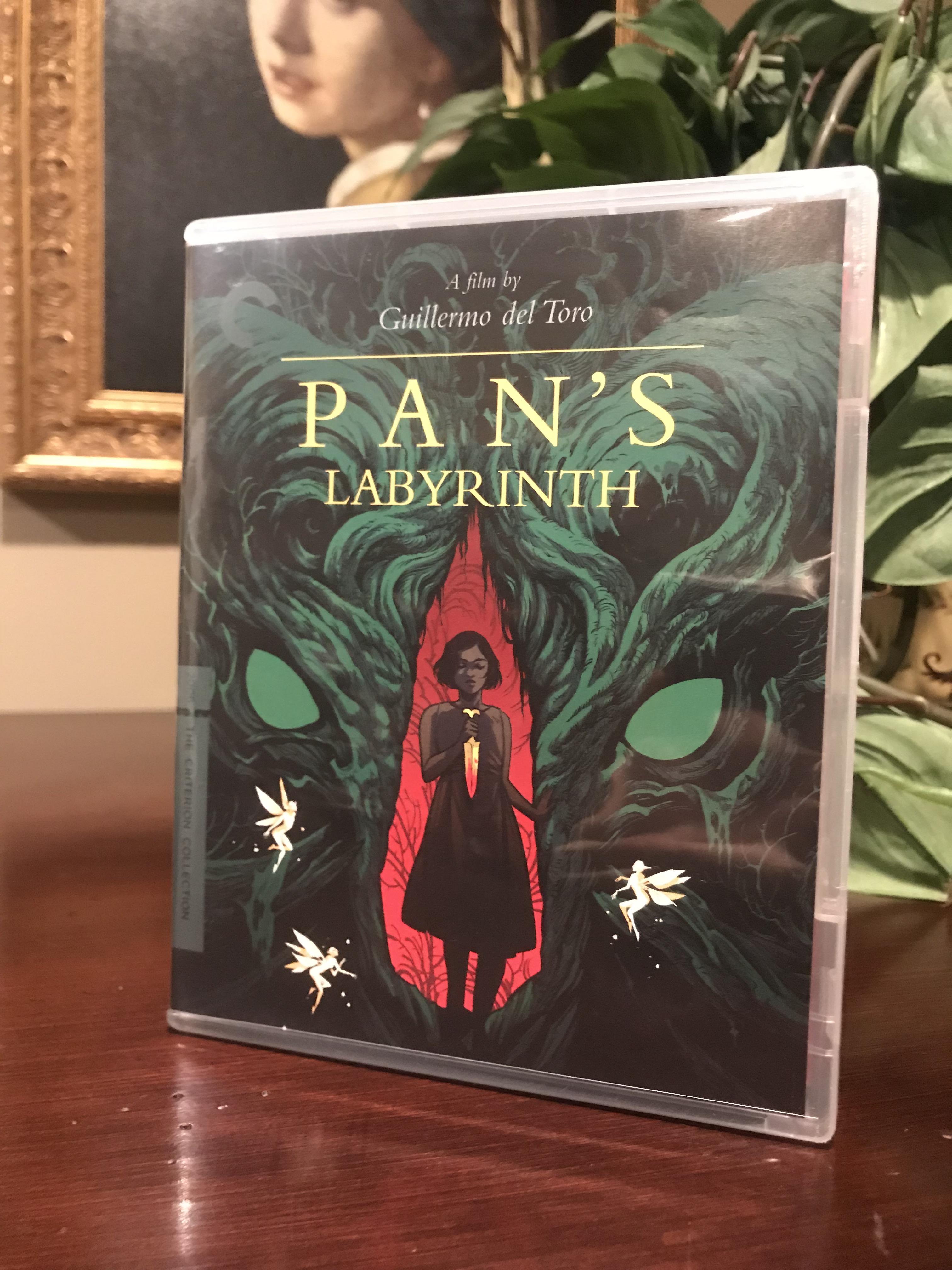

The Wiz Junes Highly Anticipated Criterion Release

May 06, 2025

The Wiz Junes Highly Anticipated Criterion Release

May 06, 2025 -

Criterion Collection Adds The Wiz In June Release

May 06, 2025

Criterion Collection Adds The Wiz In June Release

May 06, 2025 -

Diana Ross I Ll Never Retire Declares Iconic Singer During Nyc Show

May 06, 2025

Diana Ross I Ll Never Retire Declares Iconic Singer During Nyc Show

May 06, 2025