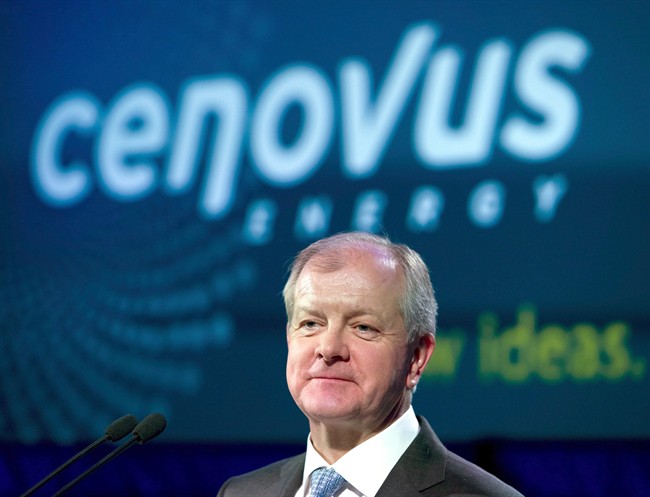

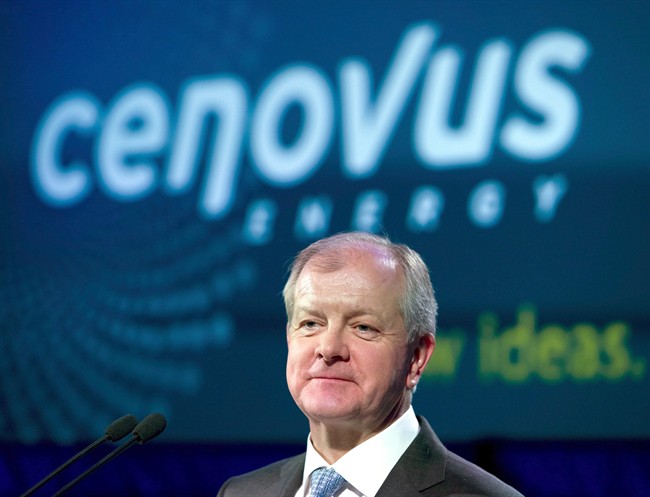

Organic Growth Strategy Leads Cenovus CEO To Dismiss MEG Bid

Table of Contents

Cenovus's Organic Growth Strategy: A Deep Dive

Cenovus's decision is rooted in a meticulously crafted organic growth strategy focused on several key pillars. This strategy prioritizes maximizing existing assets and operational efficiency while embracing sustainable and responsible growth initiatives and strategic investments in key projects.

Focus on Existing Assets and Operational Efficiency

Cenovus is committed to extracting maximum value from its current assets. This involves a multi-pronged approach:

- Enhanced Oil Recovery (EOR) Techniques: Implementing advanced EOR methods to increase oil extraction from mature fields. This includes techniques like steam-assisted gravity drainage (SAGD) and waterflooding, maximizing the lifespan and profitability of existing reserves.

- Improved Operational Efficiency: Streamlining operations, optimizing workflows, and leveraging technology to reduce costs and boost production. This includes investing in digitalization and automation technologies to enhance efficiency across the entire value chain.

- Specific Examples: Cenovus has publicly reported significant improvements in its operating costs, reducing expenses by [Insert Percentage or Specific Amount] over the past [Time Period]. They've also highlighted successful implementations of EOR techniques at specific oil sands projects, resulting in [Quantifiable Data, e.g., increased production by X barrels per day].

- Cost-Saving Initiatives: This includes initiatives such as supply chain optimization, waste reduction programs, and leveraging economies of scale across their operations.

Sustainable and Responsible Growth Initiatives

Cenovus recognizes the importance of environmental, social, and governance (ESG) factors. Their organic growth strategy integrates sustainability into its core:

- Investments in Renewable Energy: Cenovus is exploring and investing in renewable energy sources, potentially diversifying their energy portfolio and reducing their carbon footprint.

- Carbon Capture Technologies: The company is actively investigating and investing in carbon capture, utilization, and storage (CCUS) technologies to mitigate the environmental impact of its operations. This aligns with global efforts to reduce greenhouse gas emissions.

- Long-Term Value Creation: These initiatives not only reduce environmental impact but also enhance the company's long-term value by attracting environmentally conscious investors and meeting evolving regulatory requirements.

- Partnerships and Collaborations: Cenovus is actively engaging in partnerships and collaborations with other companies and research institutions to advance sustainable energy technologies and practices.

Strategic Investments in Key Projects

Cenovus is allocating significant capital to expand existing projects and explore new ventures:

- Capital Expenditures: The company has outlined a detailed capital expenditure plan focusing on high-return projects designed to significantly increase production capacity. [Insert specific examples of projects and associated investment figures if available].

- Production Growth: These investments are expected to drive substantial increases in oil and natural gas production over the next [Timeframe], strengthening Cenovus's market position.

- Exploration Activities: Cenovus is actively exploring new opportunities to expand its resource base, potentially through exploration and appraisal activities in promising geological areas.

- Specific Examples and Data: Cenovus’s plans for [Specific Project Name] are projected to increase production by [Quantifiable Data] by [Date]. This demonstrates a tangible commitment to tangible growth.

Why Cenovus Rejected the MEG Bid: A Strategic Perspective

Cenovus's rejection of MEG's bid underscores its unwavering faith in its organic growth strategy.

Organic Growth Over Acquisition

Cenovus’s leadership believes that its organic growth strategy offers superior returns compared to an acquisition. Internal growth allows for greater control over project execution, risk management, and alignment with the company's long-term vision.

Valuation Concerns and Synergies

Cenovus likely had concerns about MEG's valuation, potentially deeming it overpriced compared to the anticipated synergies. A thorough due diligence process might have revealed integration challenges or insufficient potential for cost savings.

Risk Mitigation and Focus on Core Competencies

An organic growth strategy minimizes the risks associated with large-scale acquisitions, such as integration difficulties, cultural clashes, and unexpected liabilities. It allows Cenovus to concentrate on its core competencies and leverage existing expertise.

Market Reaction and Future Outlook for Cenovus

Investor Sentiment and Stock Performance

The market's reaction to Cenovus's decision has been [Describe the market's reaction – positive, negative, neutral – and provide supporting data such as stock price changes]. This reflects investor sentiment towards the company's long-term strategic direction.

Long-Term Growth Potential

Cenovus's organic growth strategy positions the company for significant long-term growth. The focus on efficiency, sustainability, and strategic investments sets the stage for sustained production increases and profitability.

Competitor Analysis

Cenovus's commitment to organic growth allows it to compete effectively with other energy companies by focusing on operational excellence and sustainable practices. This strategy differentiates it in a rapidly evolving energy landscape.

Conclusion: The Power of Cenovus's Organic Growth Strategy

Cenovus's rejection of MEG's bid underscores the power and effectiveness of its chosen organic growth strategy. By prioritizing operational efficiency, sustainable practices, and strategic investments, Cenovus aims for sustained, profitable growth while minimizing risk. This approach not only enhances shareholder value but also positions the company as a leader in the evolving energy industry. Learn more about how Cenovus’s strategic focus on organic growth is shaping the future of the energy sector.

Featured Posts

-

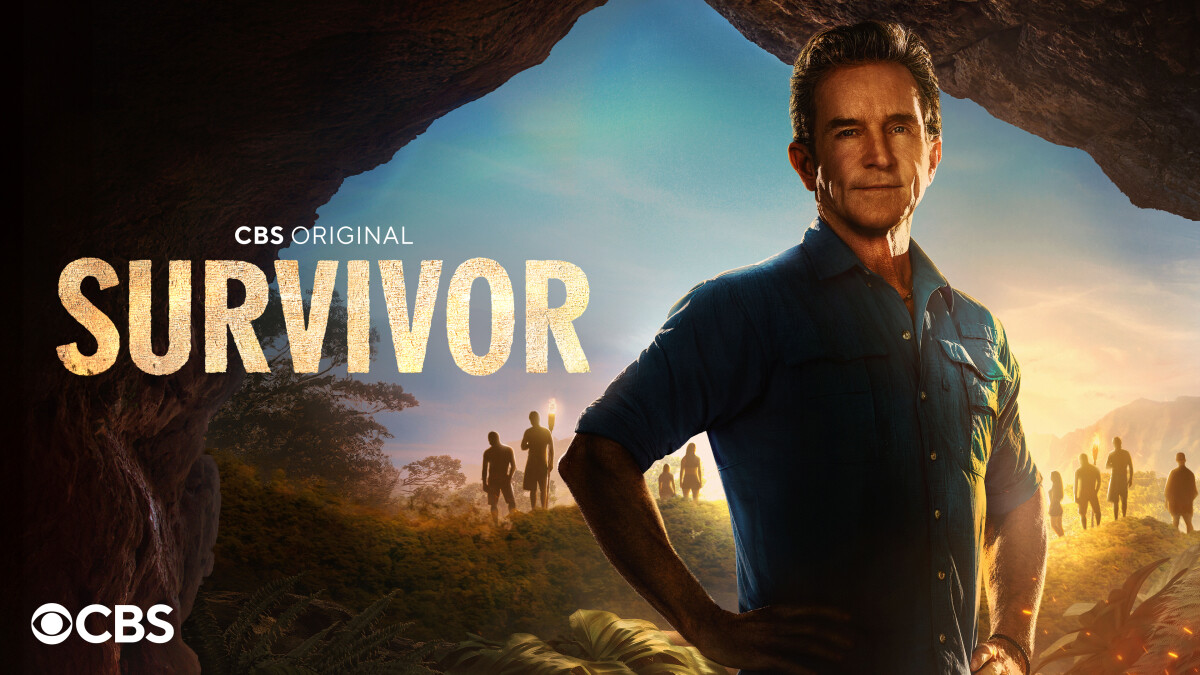

How To Watch Survivor Season 48 Episode 13 For Free A Streaming Guide

May 27, 2025

How To Watch Survivor Season 48 Episode 13 For Free A Streaming Guide

May 27, 2025 -

Domenica 23 Marzo Almanacco Eventi Storici Compleanni E Proverbio

May 27, 2025

Domenica 23 Marzo Almanacco Eventi Storici Compleanni E Proverbio

May 27, 2025 -

Acquisition Update Paramount Investigative Services Inc

May 27, 2025

Acquisition Update Paramount Investigative Services Inc

May 27, 2025 -

Marjorie Taylor Greene Senate Or Governor In 2026 A Look At Her Options

May 27, 2025

Marjorie Taylor Greene Senate Or Governor In 2026 A Look At Her Options

May 27, 2025 -

Guccis Shanghai Exhibition A Closer Look

May 27, 2025

Guccis Shanghai Exhibition A Closer Look

May 27, 2025

Latest Posts

-

Idojaras Jelentes Belfoeld Csapadek Toebb Hullamban Tavaszias Homerseklettel

May 31, 2025

Idojaras Jelentes Belfoeld Csapadek Toebb Hullamban Tavaszias Homerseklettel

May 31, 2025 -

Tavaszias Meleg Es Hullamzo Csapadek Belfoeldi Idojaras Jelentes

May 31, 2025

Tavaszias Meleg Es Hullamzo Csapadek Belfoeldi Idojaras Jelentes

May 31, 2025 -

Guelsen Bubikoglu 50 Yillik Esi Tuerker Inanoglu Nu Boeyle Andi

May 31, 2025

Guelsen Bubikoglu 50 Yillik Esi Tuerker Inanoglu Nu Boeyle Andi

May 31, 2025 -

Lavender Milk Nails Der Sanfte Nageltrend Des Jahres

May 31, 2025

Lavender Milk Nails Der Sanfte Nageltrend Des Jahres

May 31, 2025 -

Tuerker Inanoglu Nu Kaybeden Guelsen Bubikoglu Nun Acili Anilari

May 31, 2025

Tuerker Inanoglu Nu Kaybeden Guelsen Bubikoglu Nun Acili Anilari

May 31, 2025