Pakistan Economic Crisis: IMF Review And Implications For India Relations

Table of Contents

The Current State of Pakistan's Economy

Pakistan's economy is teetering on the brink of collapse, burdened by a confluence of interconnected challenges. High inflation, dwindling foreign exchange reserves, and unsustainable levels of debt paint a grim picture. Political instability and internal conflicts further exacerbate the crisis, hindering effective policy implementation and investor confidence. This perfect storm threatens not only Pakistan's domestic stability but also regional security and the South Asian economy as a whole.

- Inflation in Pakistan: Currently hovering at [Insert Current Inflation Rate], inflation is crippling the purchasing power of ordinary Pakistanis, leading to widespread hardship and social unrest.

- Pakistan Debt Crisis: The level of foreign debt is [Insert Approximate Figure], with a repayment schedule that strains the already depleted national coffers. This debt burden restricts the government's ability to invest in vital sectors like infrastructure and education.

- Foreign Exchange Reserves Pakistan: Foreign exchange reserves are critically low at [Insert Approximate Figure], severely limiting the country's capacity to import essential goods, further fueling inflation and hindering economic activity. This situation is severely impacting Pakistan's ability to fund essential imports, impacting everything from food to fuel.

The IMF Review and its Conditions

The ongoing IMF review is crucial for Pakistan's survival. Securing further financial assistance hinges on Pakistan's commitment to meeting stringent conditions imposed by the IMF. These conditions typically involve painful structural adjustment programs and austerity measures, which often lead to reduced government spending and social safety nets. The success of these measures is far from guaranteed, considering the political and social sensitivities involved.

- Key conditions imposed by the IMF: These typically include fiscal consolidation, structural reforms in key sectors, and improvements in governance and transparency. Specific details are often confidential but usually involve revenue generation measures and spending cuts.

- Potential social and political consequences of implementing these conditions: Austerity measures can lead to social unrest and political instability, potentially undermining the government's ability to implement the reforms necessary for the bailout to succeed.

- Likelihood of Pakistan meeting the IMF's requirements: The likelihood of Pakistan successfully meeting the IMF's stringent conditions remains uncertain. The depth of the crisis and the political will to implement unpopular reforms will be determining factors.

Implications for India-Pakistan Relations

Pakistan's economic crisis has significant implications for its relationship with India. While increased regional instability is a distinct possibility, there's also potential for unexpected cooperation. The crisis could create a shared interest in regional stability, potentially leading to renewed dialogue and cooperation on economic issues, particularly regarding trade. However, the negative impacts are equally significant.

- Impact on cross-border trade and commerce: Pakistan's economic instability could disrupt cross-border trade and commerce, impacting both economies. Reduced import capacity might hinder trade between the two countries.

- Potential for increased cross-border tensions or cooperation: The crisis could heighten tensions, particularly if it leads to increased regional instability. However, it could also incentivize cooperation on issues of mutual concern, such as tackling shared economic challenges.

- Role of international actors in mediating the relationship: International actors like the US and China will undoubtedly play a crucial role in mediating the relationship, potentially influencing the cooperation or competition between India and Pakistan.

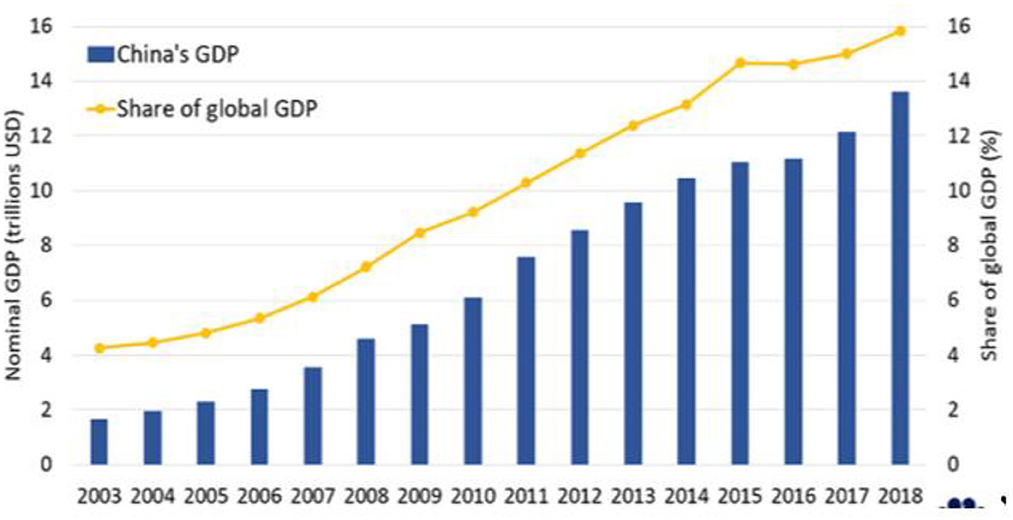

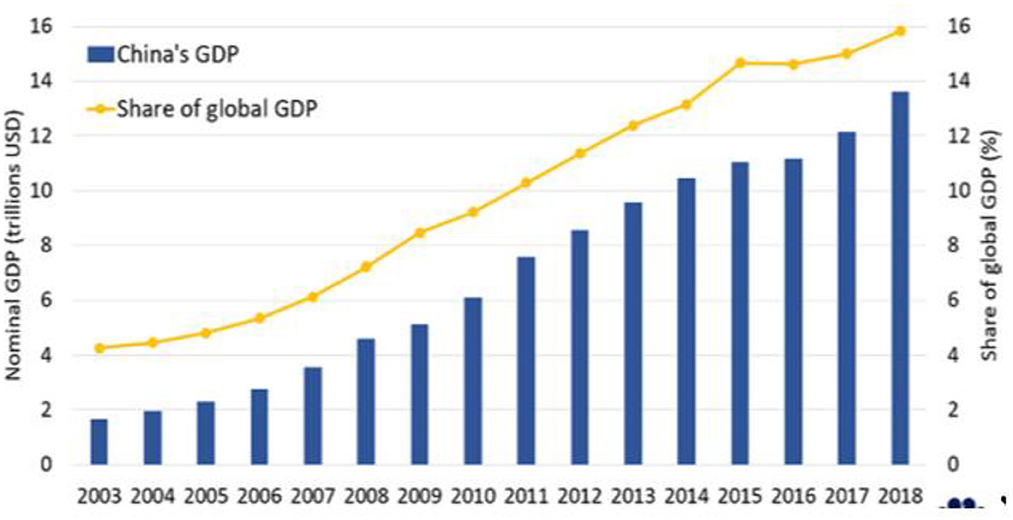

The Role of Regional Powers

China's involvement through the China Pakistan Economic Corridor (CPEC) significantly complicates the situation. CPEC's impact on Pakistan's debt burden and its geopolitical implications for the region influence India's perception of the crisis and its potential responses. The interplay between these regional powers adds another layer of complexity to the already volatile dynamics of the region.

Conclusion: Pakistan Economic Crisis: IMF Review and its Impact on India Relations

The Pakistan economic crisis is severe and multifaceted. The ongoing IMF review process presents both opportunities and challenges. The outcome will not only determine Pakistan's economic future but also significantly shape its relationship with India. The potential for increased regional instability is undeniable, but the crisis might also inadvertently foster cooperation on shared economic concerns. However, the interplay of regional powers, including China's influence through CPEC, significantly complicates matters.

Stay updated on the evolving Pakistan economic crisis and its consequences for regional relations by following reputable news sources and analytical reports. Understanding this crisis is crucial for comprehending the future of South Asian geopolitical dynamics.

Featured Posts

-

Fox News Jeanine Pirro Exploring Her Life And Career Behind The Camera

May 10, 2025

Fox News Jeanine Pirro Exploring Her Life And Career Behind The Camera

May 10, 2025 -

Nottingham Nhs Data Breach Families Anger Over Accessed A And E Records

May 10, 2025

Nottingham Nhs Data Breach Families Anger Over Accessed A And E Records

May 10, 2025 -

Bbc Strictly Come Dancing Wynne Evanss Statement On Potential Return

May 10, 2025

Bbc Strictly Come Dancing Wynne Evanss Statement On Potential Return

May 10, 2025 -

Jeanine Pirros Market Warning Ignore Stocks For Weeks

May 10, 2025

Jeanine Pirros Market Warning Ignore Stocks For Weeks

May 10, 2025 -

Politique Nucleaire Europeenne Le Point De Vue Du Ministre Francais

May 10, 2025

Politique Nucleaire Europeenne Le Point De Vue Du Ministre Francais

May 10, 2025