Pakistan Stock Exchange Offline: Analyzing Market Instability And Geopolitical Factors

Table of Contents

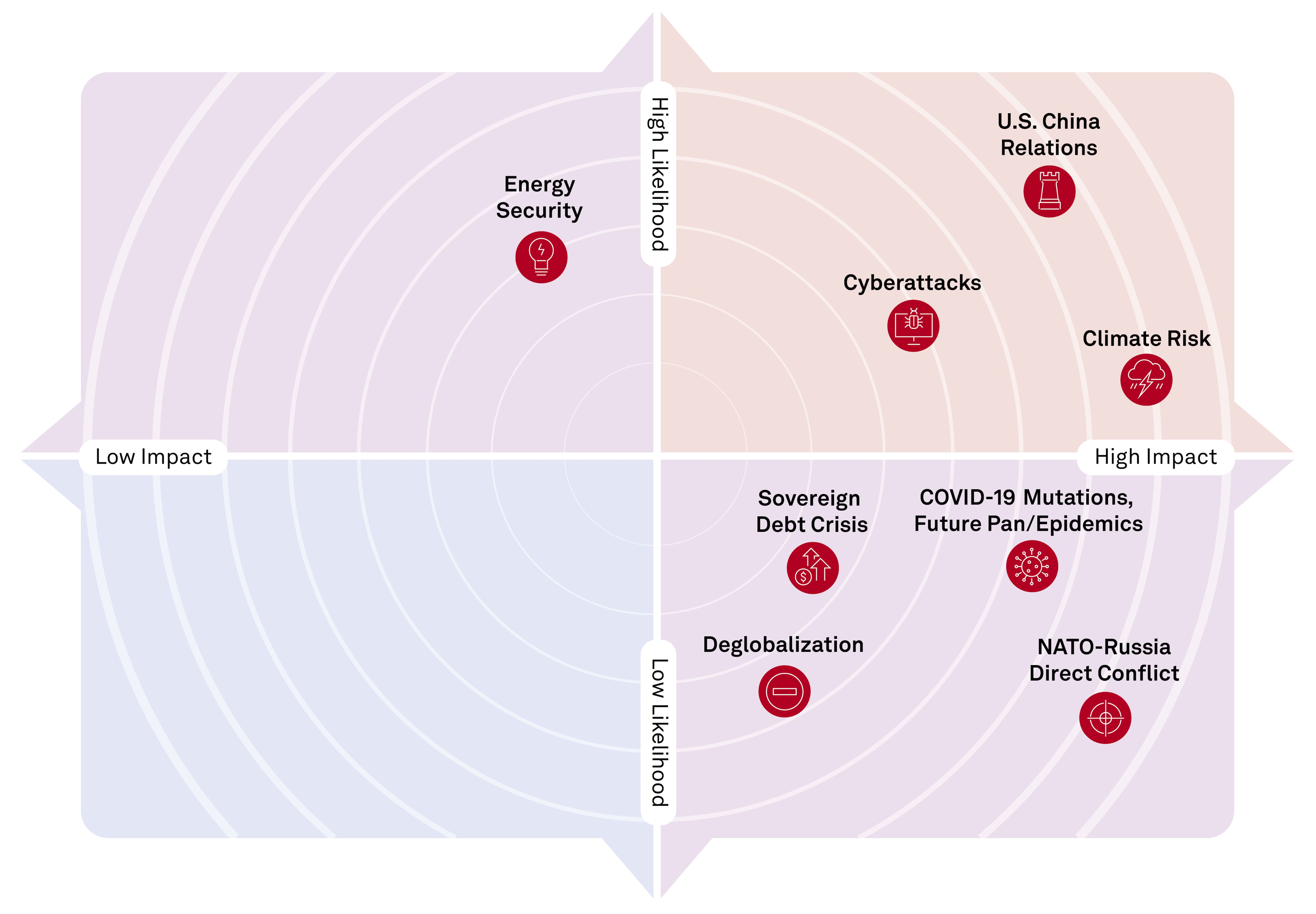

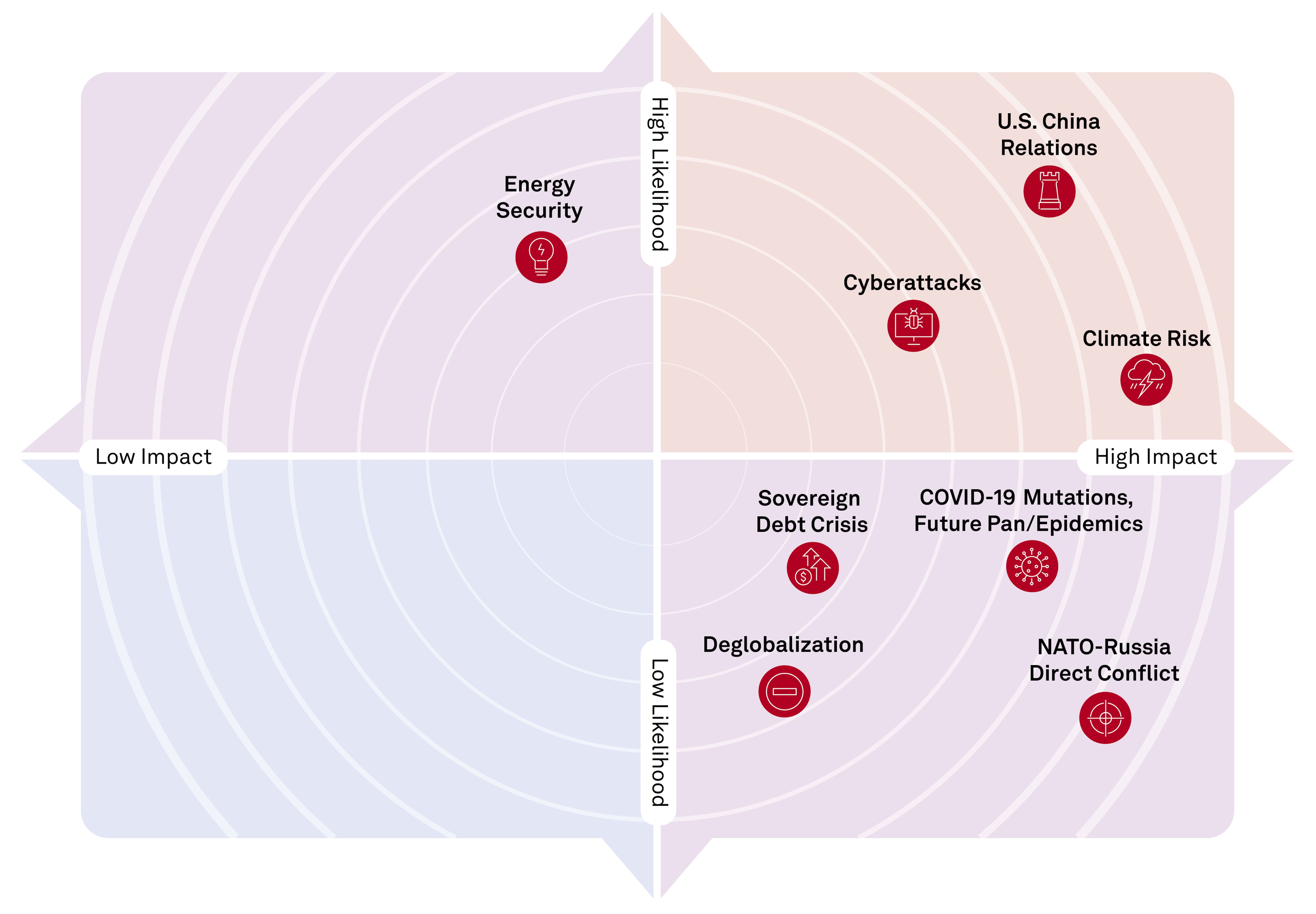

Geopolitical Factors Driving PSE Instability

Geopolitical events significantly influence investor sentiment and market stability, often leading to periods of high volatility and, in extreme cases, to the PSE going offline.

Regional Tensions and Conflicts

Regional conflicts and escalating tensions severely impact investor confidence in the PSE. Past instances demonstrate a clear correlation between heightened geopolitical risks and market downturns.

- Impact of border disputes: Ongoing border disputes with neighboring countries can create uncertainty, deterring both domestic and foreign investment. The resulting apprehension translates into sell-offs and market instability, potentially pushing the PSE offline.

- Influence of international relations on investor confidence: Strained relationships with key global players can negatively affect Pakistan's economic outlook, triggering capital flight and impacting the PSE's performance. Concerns about sanctions or reduced trade partnerships can lead to significant market volatility.

- Effect of terrorism and security concerns: Terrorist activities and security concerns within Pakistan directly impact investor confidence. Perceptions of heightened risk can lead to substantial capital outflows and market instability, potentially resulting in temporary suspension of trading on the PSE.

International Relations and Sanctions

Pakistan's international relations and its susceptibility to sanctions play a crucial role in shaping market uncertainty and PSE volatility.

- Impact of trade wars and global economic downturns: Global economic downturns and trade wars negatively affect Pakistan's exports and economic growth, leading to decreased investor confidence and impacting the PSE's performance. These external shocks can trigger substantial market declines.

- Effects of IMF loan conditions and debt repayments on market stability: Pakistan's reliance on IMF loans and the associated conditionalities often introduce uncertainty into the market. Concerns about debt repayment capacity can trigger sell-offs and volatility.

- Analysis of sanctions and their influence on foreign investment: The imposition of international sanctions can severely limit Pakistan's access to international capital markets, leading to reduced foreign investment and heightened market instability. This can create conditions where the PSE may temporarily shut down trading.

Domestic Economic Factors Contributing to PSE Volatility

Internal economic factors significantly contribute to PSE volatility and the potential for offline trading periods.

Inflation and Currency Devaluation

High inflation and currency devaluation erode investor confidence and severely impact the PSE.

- Explain the relationship between rising inflation and declining investor confidence: Rising inflation erodes purchasing power and reduces the real return on investments, leading investors to seek safer alternatives, often causing capital flight.

- Discuss the effect of currency devaluation on foreign investment: Currency devaluation makes foreign investments less attractive, leading to capital outflows and market instability. This can negatively influence the PSE's performance and potentially lead to offline periods.

- Provide data illustrating the correlation between economic indicators and stock market performance: Analyzing historical data showing the correlation between inflation rates, currency values, and PSE performance is crucial in understanding the causal relationship.

Political Uncertainty and Policy Changes

Political instability and frequent shifts in government policies create uncertainty and negatively affect investor sentiment.

- Analyze the impact of government changes and policy decisions on stock market performance: Sudden changes in government policies, especially those related to economic reforms or taxation, can lead to market volatility and uncertainty.

- Discuss the role of political risk in market volatility: Political risk, including the risk of policy reversals or social unrest, is a major factor impacting investor confidence and the PSE's stability.

- Examine the impact of regulatory changes on market liquidity and trading activity: Unclear or frequently changing regulations can negatively impact market liquidity and trading activity, potentially leading to market instability and even temporary suspension of trading on the PSE.

The Impact of PSE Offline Periods on Investors and the Economy

Periods when the PSE goes offline have far-reaching consequences for investors and the overall economy.

Loss of Investor Confidence and Capital Flight

PSE offline periods severely damage investor confidence and trigger significant capital flight.

- Explain how market disruptions lead to reduced investor confidence: Unexpected market closures erode trust in the market's stability, making investors hesitant to participate.

- Discuss the implications of capital flight for economic growth: Capital flight reduces investment in the economy, hindering economic growth and development.

- Analyze the long-term effects on foreign direct investment: Repeated disruptions can deter foreign direct investment (FDI), negatively affecting Pakistan's long-term economic prospects.

Economic Slowdown and Job Losses

The instability caused by PSE offline periods often translates into broader economic consequences.

- Analyze the impact of stock market downturns on business investment: Stock market downturns reduce the availability of capital for businesses, impacting their investment plans and potentially leading to job losses.

- Discuss the correlation between market instability and employment rates: Market instability can negatively affect employment rates as businesses react to uncertainty by reducing workforce size.

- Explore the potential for decreased economic growth due to market volatility: Persistent market volatility hinders economic growth by increasing uncertainty and discouraging investment, both domestic and foreign.

Conclusion

The Pakistan Stock Exchange's susceptibility to offline periods underscores the complex interplay of geopolitical factors and domestic economic vulnerabilities. Regional tensions, international relations, inflation, currency devaluation, and political instability all contribute to market volatility and investor uncertainty. Understanding these factors is crucial for investors, businesses, and policymakers to mitigate risks and build a more resilient and stable market. By proactively addressing these underlying issues and promoting transparency and stability, Pakistan can foster a stronger and more predictable environment for its Pakistan Stock Exchange, attracting greater investment and ensuring sustainable economic growth. Continue to monitor developments impacting the PSE to make well-informed decisions.

Featured Posts

-

Tragedie A Dijon Mort D Un Ouvrier Apres Une Chute De Quatre Etages

May 10, 2025

Tragedie A Dijon Mort D Un Ouvrier Apres Une Chute De Quatre Etages

May 10, 2025 -

Un Debut D Incendie Ravage La Mediatheque Champollion A Dijon

May 10, 2025

Un Debut D Incendie Ravage La Mediatheque Champollion A Dijon

May 10, 2025 -

Vozvraschenie Stivena Kinga V X Oskorbleniya V Adres Ilona Maska

May 10, 2025

Vozvraschenie Stivena Kinga V X Oskorbleniya V Adres Ilona Maska

May 10, 2025 -

Solve The Nyt Spelling Bee April 1 2025 Hints And Answers

May 10, 2025

Solve The Nyt Spelling Bee April 1 2025 Hints And Answers

May 10, 2025 -

Ocasio Cortez Calls Out Fox News For Trump Bias

May 10, 2025

Ocasio Cortez Calls Out Fox News For Trump Bias

May 10, 2025