Palantir Stock: A 40% Target In 2025 – Is This Realistic?

Table of Contents

Palantir's Current Market Position and Financial Performance

Palantir, a leading data analytics company, offers two primary platforms: Gotham, focused on government clients, and Foundry, targeting the commercial sector. Understanding Palantir's current market capitalization and financial performance is crucial to evaluating the 40% growth prediction. Let's examine the current landscape:

- Current PLTR Stock Price and Market Cap: (Insert current stock price and market cap data here – this needs to be updated regularly). This figure provides a baseline for assessing potential growth.

- Year-over-Year Revenue Growth: (Insert data on year-over-year revenue growth. Source the data with a link to a reputable financial website). This metric demonstrates the company's ability to expand its business.

- Profitability (or lack thereof) and projected profitability: Palantir’s path to profitability is a key consideration. (Include information on current profitability, operating margins, and projections for future profitability). This is critical for long-term investor confidence in Palantir stock.

- Key Competitors and Palantir's Market Share: Palantir faces competition from established players like Microsoft, Amazon, and Google, as well as specialized analytics firms. (Discuss Palantir’s competitive advantages and estimated market share in the data analytics space).

Growth Drivers and Catalysts for a 40% Increase

Several factors could contribute to a significant increase in Palantir's stock price. The potential for growth is substantial, though reaching 40% by 2025 is ambitious.

- Increased Government Contracts (US and International): Palantir's Gotham platform is heavily reliant on government contracts. (Discuss potential for increased contracts, both domestically and internationally, citing specific examples where possible). Securing large-scale government contracts is vital for achieving substantial revenue growth.

- Growth Potential in the Commercial Sector: The success of Foundry in the commercial sector will be a key driver of growth. (Analyze the potential for expansion into key commercial sectors such as healthcare, finance, and energy, providing specific examples). The commercial market offers significant growth potential, but it is also highly competitive.

- New Product Launches and Technological Advancements: (Discuss the impact of new product releases and technological advancements on Palantir's ability to gain market share and drive revenue growth). Innovation is vital for maintaining a competitive edge.

- Strategic Acquisitions or Partnerships: (Discuss the potential for strategic acquisitions or partnerships that could accelerate Palantir's growth and market penetration). Strategic moves can significantly impact future performance.

Risks and Challenges to Achieving the 40% Target

While the potential for growth is significant, several risks and challenges could hinder Palantir's progress toward a 40% stock price increase by 2025.

- Economic Downturns: (Analyze the potential impact of economic downturns on Palantir's revenue, particularly in the commercial sector). Economic uncertainty can significantly affect spending on data analytics solutions.

- Increased Competition: (Discuss the competitive landscape and potential for increased competition from established tech giants and emerging players). Maintaining a competitive edge requires continuous innovation and strategic adaptation.

- Regulatory Risks: (Analyze regulatory risks and potential changes in government spending that could negatively impact Palantir's business). Government regulations and changes in policy can significantly impact revenue streams.

- Geopolitical Instability: (Discuss the impact of geopolitical instability on Palantir's international operations and revenue streams). Geopolitical events can create uncertainty and disrupt business operations.

Analyst Opinions and Predictions on Palantir Stock

Analyst opinions on Palantir's future performance vary widely. Understanding the range of predictions and their underlying assumptions is crucial for a balanced assessment.

- Summary of Analyst Ratings (Buy, Hold, Sell): (Summarize the consensus view among financial analysts, including the proportion of buy, hold, and sell ratings). Analyst ratings provide valuable insights but should not be the sole basis for investment decisions.

- Price Targets from Different Analysts: (List price targets from various reputable sources, noting the timeframe and underlying assumptions). Price targets represent the analysts' expectation of the future PLTR stock price.

- Underlying Assumptions of the Different Predictions: (Analyze the key assumptions underpinning different analysts' predictions, highlighting any significant differences). Understanding the rationale behind different predictions helps assess their credibility.

Conclusion: Is a 40% Palantir Stock Price Increase Realistic by 2025?

A 40% increase in Palantir's stock price by 2025 is a bold prediction. While the company possesses significant growth potential driven by increasing government contracts, expansion in the commercial sector, and technological advancements, substantial risks remain, including economic downturns, intensifying competition, and geopolitical uncertainties. The diverse range of analyst predictions reflects this inherent uncertainty. A balanced assessment suggests that while significant growth is possible, achieving a 40% increase by 2025 is ambitious and hinges on successful execution of its strategic plan and favorable market conditions.

Therefore, before making any investment decisions concerning Palantir stock (PLTR), it's crucial to conduct thorough due diligence. Consider consulting reputable financial resources and seeking professional advice to understand the risks and rewards involved in investing in Palantir stock predictions and forecasts. Remember that past performance is not indicative of future results, and all investments carry inherent risks.

Featured Posts

-

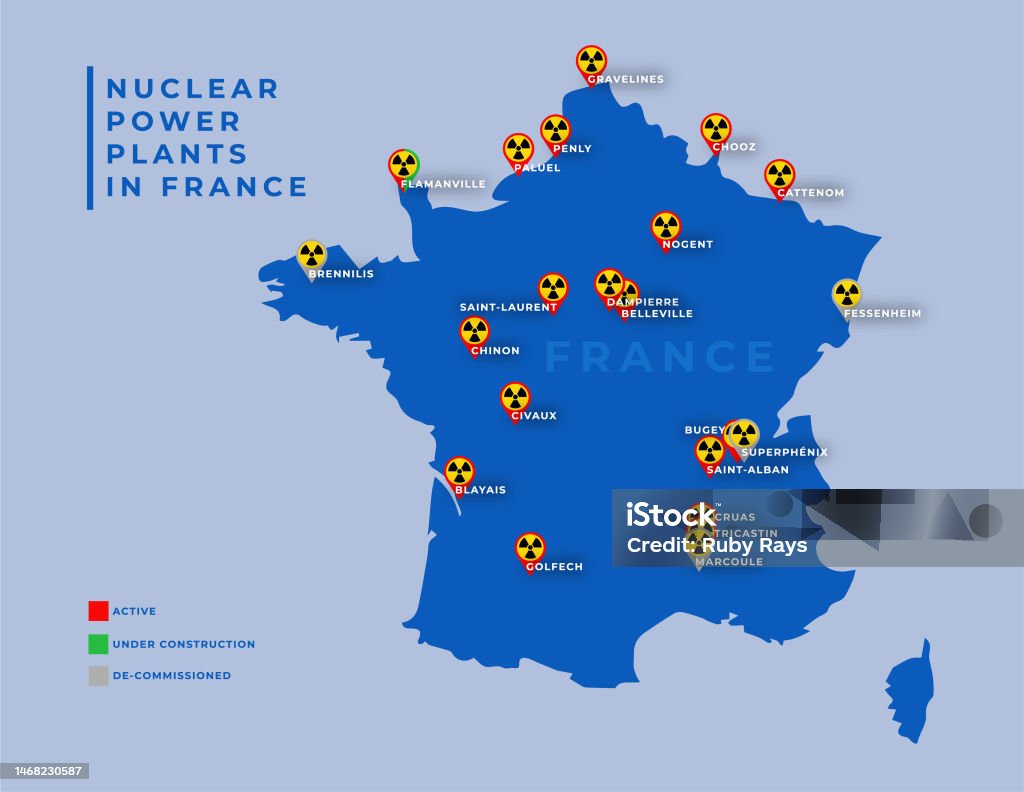

Trumps Focus On Nuclear Energy Implications For Plant Construction Speed

May 10, 2025

Trumps Focus On Nuclear Energy Implications For Plant Construction Speed

May 10, 2025 -

Abcs High Potential Season 1 Finale And Its Impact

May 10, 2025

Abcs High Potential Season 1 Finale And Its Impact

May 10, 2025 -

Edmonton Oilers Playoff Hopes Hinge On Draisaitls Recovery From Lower Body Injury

May 10, 2025

Edmonton Oilers Playoff Hopes Hinge On Draisaitls Recovery From Lower Body Injury

May 10, 2025 -

Streaming Guide Potential Roman Fate Replacement Show And Season 2 Spoilers

May 10, 2025

Streaming Guide Potential Roman Fate Replacement Show And Season 2 Spoilers

May 10, 2025 -

Charlz Iii I Stiven Fray Istoriya Rytsarskogo Posvyascheniya

May 10, 2025

Charlz Iii I Stiven Fray Istoriya Rytsarskogo Posvyascheniya

May 10, 2025