Palantir Stock: Buy Before May 5th? A Detailed Look At The Risks And Rewards

Table of Contents

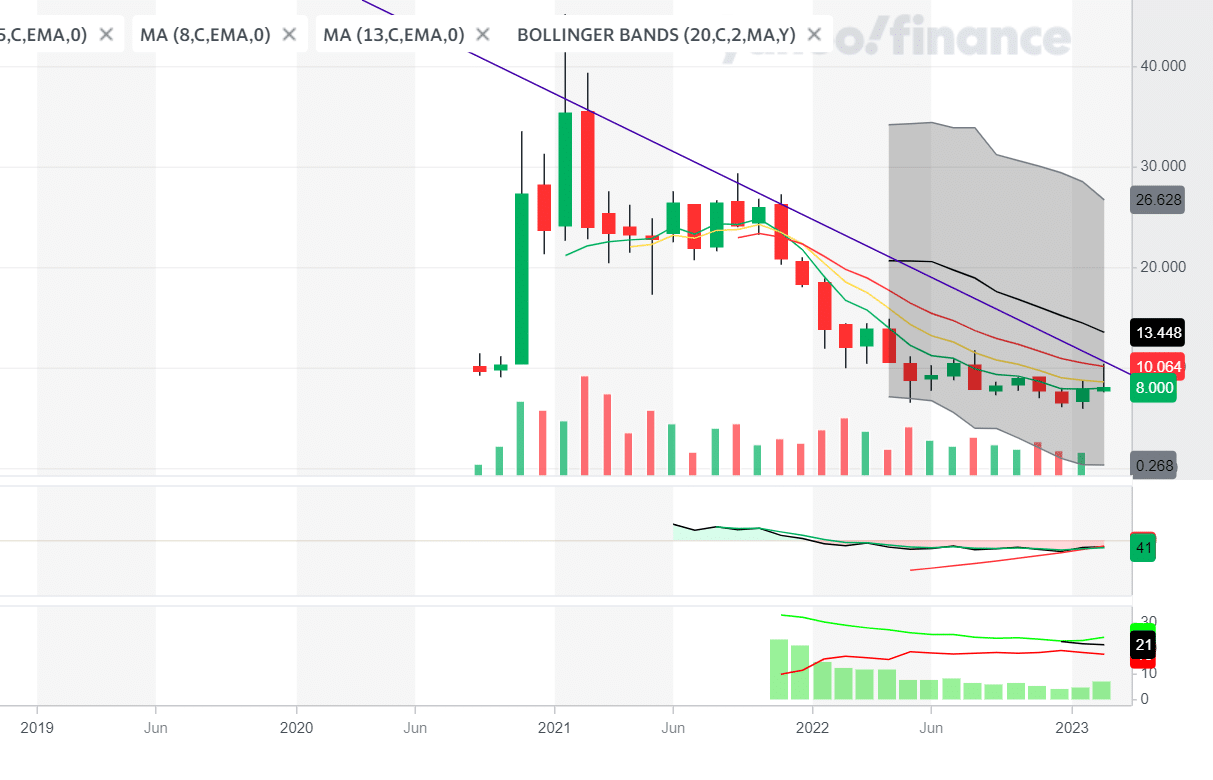

Palantir's Recent Performance and Financial Health

Understanding Palantir's financial health is crucial before considering an investment. Let's delve into its recent performance and key financial indicators.

Revenue Growth and Profitability

Palantir has shown consistent revenue growth, fueled by both its government and commercial clients. However, profitability remains a key concern. Analyzing recent quarterly and annual reports reveals a mixed picture.

- Revenue Streams: A significant portion of Palantir's revenue comes from large government contracts, particularly in defense and intelligence. However, the company is actively expanding its commercial client base, which represents a crucial element for long-term sustainable growth. This diversification strategy could mitigate risks associated with relying too heavily on government spending.

- Financial Performance: While Palantir demonstrates robust revenue growth (e.g., a reported X% increase year-over-year in Q[Quarter]), its net income and operating margins haven't consistently reflected this top-line growth. Understanding the reasons behind this discrepancy is vital for evaluating Palantir's long-term financial stability. This calls for a detailed examination of their cost structure and operating expenses. Further examination of Palantir revenue growth, profitability, and financial health from reliable financial sources is strongly recommended.

Debt Levels and Cash Flow

Assessing Palantir's debt levels and cash flow is essential for evaluating its long-term financial sustainability.

- Key Financial Ratios: Examining Palantir's debt-to-equity ratio and free cash flow will provide insights into its financial leverage and ability to generate cash from operations. These ratios, when compared to industry peers and historical trends, reveal the company's financial standing and its ability to service its debts.

- Debt Repayments and Increases: Monitoring Palantir's debt repayments and any significant increases in its debt load is critical. Understanding the reasons behind these changes – whether it's investments in growth initiatives or difficulties managing cash flow – informs a comprehensive assessment of the Palantir stock’s overall financial strength. Analyzing Palantir debt and cash flow in the context of its growth strategy is essential for a balanced perspective.

Market Analysis and Future Growth Potential

Analyzing the market landscape and Palantir's future growth potential is essential for a comprehensive investment assessment.

Industry Trends and Competition

The data analytics and AI market is highly competitive, with established players and emerging startups vying for market share.

- Key Competitors and Market Share: Palantir faces competition from companies like Microsoft, Google, and Amazon, which possess vast resources and established market presence. Assessing their market share and competitive strategies is key to understanding Palantir's position.

- Palantir's Unique Selling Propositions (USPs): Palantir's strength lies in its highly specialized platform and its ability to handle complex data analysis for government and commercial clients. Its focus on data integration and sophisticated analytical tools sets it apart from competitors offering more generalized solutions. A thorough comparison of Palantir competitors and their offerings helps reveal its unique strengths and potential vulnerabilities.

Growth Projections and Valuation

Analyst predictions for Palantir's future growth and its current valuation are crucial factors.

- Analyst Predictions: Consult reputable financial sources for forecasts on Palantir's revenue growth, earnings, and market share. These predictions, while not guarantees, provide insights into the market's expectations for the company's future.

- Valuation Metrics: Compare Palantir's Price-to-Earnings (P/E) ratio and other valuation metrics to its peers to determine whether it's currently overvalued or undervalued. This comparison will aid in understanding the relative value proposition of investing in Palantir stock. Analyzing Palantir valuation alongside its growth prospects is crucial in determining its investment worthiness.

Risks Associated with Investing in Palantir Stock

Investing in Palantir stock carries inherent risks that potential investors should carefully consider.

Geopolitical Risks and Government Contracts

Palantir's significant reliance on government contracts exposes it to geopolitical risks.

- Impact of Geopolitical Events: Changes in government priorities, budget cuts, or international conflicts can significantly impact Palantir's revenue streams. Understanding the potential impact of geopolitical events on Palantir's government contracts is crucial for a complete risk assessment.

- Revenue Concentration: The concentration of revenue from a limited number of government sources increases the vulnerability of Palantir stock to changes in those sources’ spending patterns or policy shifts. Diversification of its client base is a crucial factor mitigating this risk.

Technological Disruption and Competition

Rapid technological advancements and intensifying competition present significant risks.

- Emerging Technologies: New technologies and innovative solutions could disrupt Palantir's market position. Staying abreast of the latest advancements and their potential impact on Palantir’s technology is crucial for risk assessment.

- Increased Competition: The data analytics market is fiercely competitive, with established players and innovative startups constantly seeking to improve their offerings and capture market share. Assessing the competitive landscape and anticipating potential new entrants’ impact on Palantir stock is vital.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Our analysis reveals that Palantir presents a complex investment opportunity. While it exhibits impressive revenue growth and innovative technology, concerns remain regarding its profitability, reliance on government contracts, and the competitive landscape. The potential catalyst of [mention specific catalyst e.g., earnings report, product launch] could significantly impact the Palantir stock price, but this is not a guaranteed positive impact. Therefore, based on the information available, we cautiously suggest thorough due diligence before investing.

While this analysis provides valuable insights, remember to conduct thorough due diligence before investing in Palantir stock. Considering the potential risks and rewards, is buying Palantir stock before May 5th right for your portfolio? Consult a financial advisor to make the best decision for your specific circumstances.

Featured Posts

-

Su Viec Bao Hanh Tre O Tien Giang Bai Hoc Dat Gia Ve An Toan Tre Em

May 09, 2025

Su Viec Bao Hanh Tre O Tien Giang Bai Hoc Dat Gia Ve An Toan Tre Em

May 09, 2025 -

1078 2025

May 09, 2025

1078 2025

May 09, 2025 -

Barbashevs Overtime Goal Evens Series Knights Beat Wild 4 3

May 09, 2025

Barbashevs Overtime Goal Evens Series Knights Beat Wild 4 3

May 09, 2025 -

The Reach Of Divine Mercy Religious Groups In 1889

May 09, 2025

The Reach Of Divine Mercy Religious Groups In 1889

May 09, 2025 -

Fentanyl Crisis A Catalyst For Us China Trade Negotiations

May 09, 2025

Fentanyl Crisis A Catalyst For Us China Trade Negotiations

May 09, 2025