Palantir Stock: Buy Before May 5th Earnings Report? A Detailed Look

Table of Contents

H2: Palantir's Recent Performance and Market Position

Palantir's recent performance has been a mixed bag. While the company has shown consistent revenue growth, driven largely by its government contracts and growing commercial business, profitability remains a key area of focus for investors. Analyzing the company's financial performance requires a detailed look at its key performance indicators (KPIs). Understanding Palantir's position within the competitive big data and government contracting landscape is equally crucial for evaluating Palantir stock price potential.

- Recent contract wins and losses: Palantir has secured several significant contracts recently, notably expanding its presence in various government agencies and private sector companies. However, tracking the specifics of contract wins and losses is vital for understanding revenue streams.

- Competition analysis: Palantir faces stiff competition from established players like Databricks and Snowflake, as well as emerging startups in the data analytics market. This competitive pressure needs to be factored into any Palantir stock investment strategy.

- Market share trends: Examining Palantir's market share trends within its target sectors helps determine its growth potential and competitive positioning. Understanding its market penetration and expansion plans will offer a clearer view of future prospects.

- Key performance indicators (KPIs): Close monitoring of KPIs such as revenue growth, operating margins, customer acquisition costs, and customer churn is essential for evaluating the health and potential of the business. Analyzing these metrics in conjunction with the broader market context will give a holistic view of Palantir's position.

H2: Factors to Consider Before Investing in Palantir Stock

Before investing in Palantir stock, potential investors need to carefully weigh several critical factors. The company's high valuation relative to earnings presents a significant risk, alongside its dependence on government contracts. These factors can lead to substantial volatility in the PLTR stock price.

- High valuation relative to earnings: Palantir's stock price is often considered high relative to its earnings, raising concerns about its valuation. This needs to be considered in the context of projected future growth and the overall market sentiment.

- Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts. This dependence creates vulnerability to changes in government spending and procurement policies, potentially impacting future growth and the PLTR stock price.

- Competition in the data analytics market: The data analytics market is highly competitive. Palantir needs to consistently innovate and adapt to maintain its market share and fend off competitors. This competitive landscape must be analyzed when considering Palantir stock.

- Potential for future revenue growth: While revenue growth has been positive, future growth projections are crucial for determining the long-term prospects of Palantir stock. Analyzing projections and comparing them to competitors will give context.

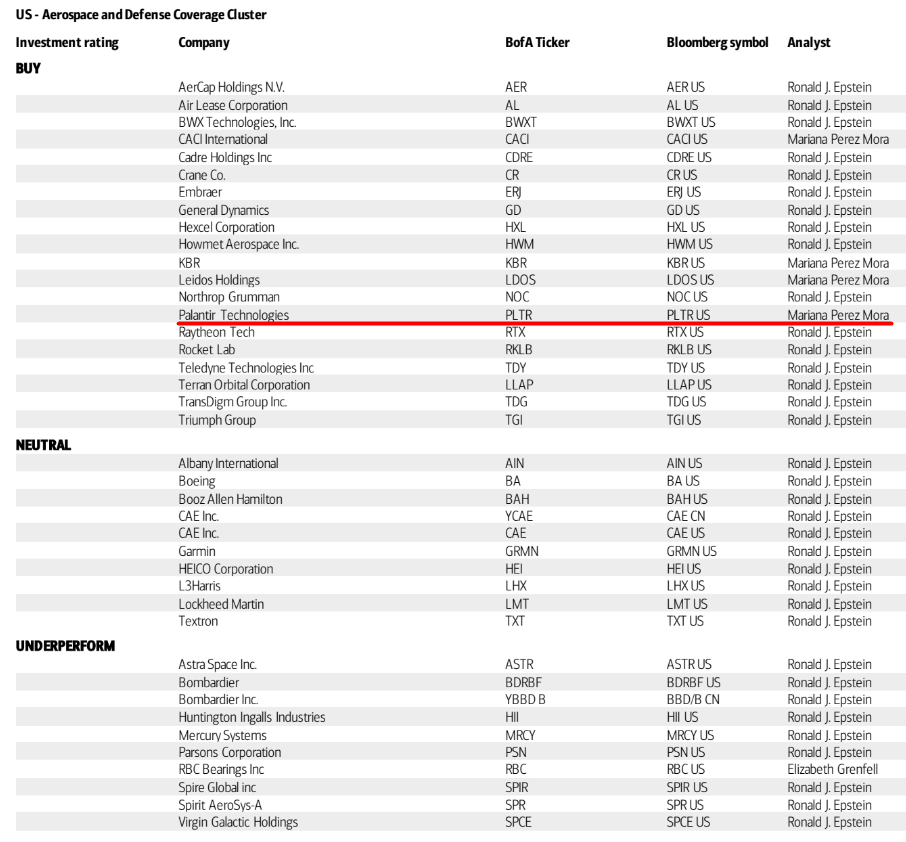

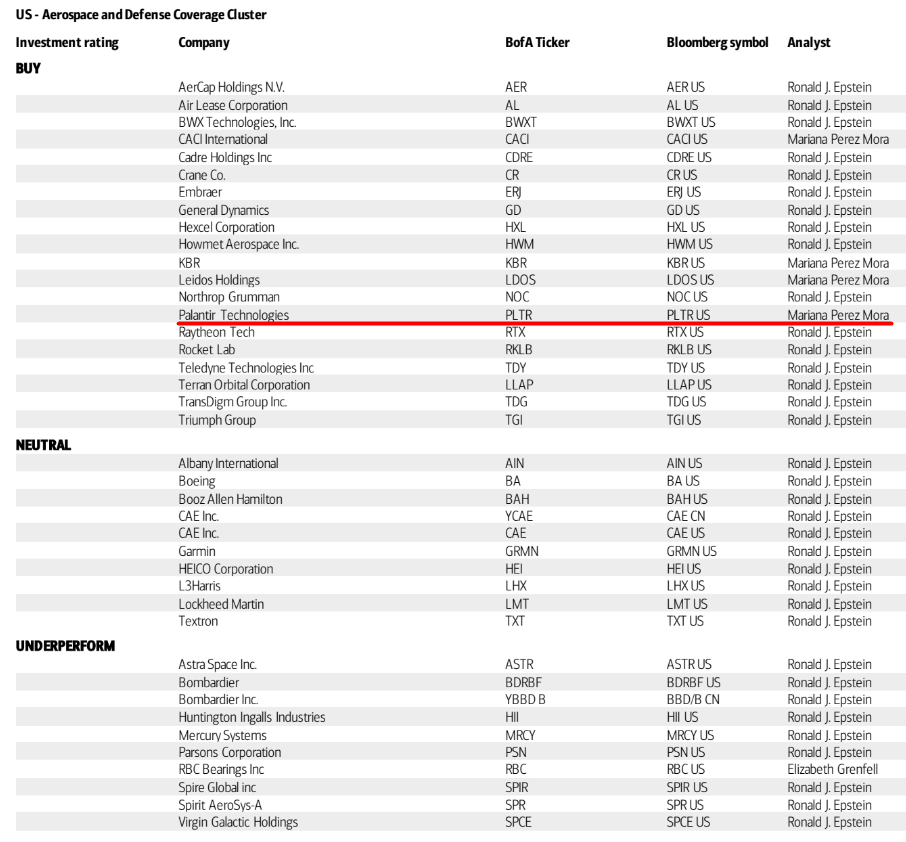

- Analyst ratings and price targets: Examining analyst ratings and price targets for PLTR stock provides valuable insight into market sentiment and expectations surrounding future performance. These should be considered alongside your own due diligence.

H2: Analyzing the May 5th Earnings Report's Potential Impact

The May 5th earnings report will be a critical event for Palantir stock. Investors will closely scrutinize the reported figures to gauge the company's progress and future outlook. Key metrics like revenue growth, profitability, and forward guidance will heavily influence the stock price's reaction.

- Revenue growth expectations: Analysts' expectations for revenue growth will significantly influence the market's reaction to the earnings report. Exceeding expectations is likely to boost Palantir stock, while falling short might lead to a sell-off.

- Profitability outlook: Investors are keen to see progress towards profitability. The company's profitability trajectory will be a key factor in determining the long-term valuation of Palantir stock.

- Guidance for future quarters: Palantir's guidance for future quarters is arguably the most important aspect of the earnings report. This guidance will provide insights into the company's anticipated revenue growth, profitability, and overall performance.

- Any significant announcements or news: Any unexpected announcements or news, such as new partnerships, major contract wins, or significant strategic initiatives, will likely influence the PLTR stock price.

H2: Alternative Investment Strategies for Palantir Stock

Given the volatility of Palantir stock, investors might consider alternative strategies to mitigate risk. Dollar-cost averaging, for instance, can help reduce the impact of short-term price fluctuations. Waiting for a potential pullback after the earnings report could also be a strategic approach.

- Dollar-cost averaging explained: This involves investing a fixed amount of money at regular intervals, regardless of the stock price. This strategy helps reduce the risk of investing a large sum at a market peak.

- Strategies for managing risk: Effective risk management strategies include diversifying your portfolio, setting stop-loss orders, and only investing an amount you are comfortable potentially losing.

- Setting stop-loss orders: A stop-loss order automatically sells your shares if the price falls below a predetermined level, limiting potential losses.

- Diversification of portfolio: Diversifying your investment portfolio by including other assets can reduce the overall risk associated with investing in Palantir stock.

Conclusion

Deciding whether to buy Palantir stock before the May 5th earnings report requires careful consideration of several factors. While Palantir's growth potential is undeniable, the high valuation, dependence on government contracts, and competitive market landscape present significant risks. The earnings report will be pivotal, influencing market sentiment and impacting the Palantir stock price. Investors should consider alternative strategies like dollar-cost averaging and risk management techniques to mitigate potential losses. Ultimately, conducting thorough research and understanding your risk tolerance are paramount before making any investment decisions. Make informed decisions about Palantir stock, research Palantir stock thoroughly, and consider your Palantir stock investment strategy carefully. Remember, this analysis is not financial advice, and you should always conduct your own due diligence before investing in Palantir stock or any other security.

Featured Posts

-

3 6

May 09, 2025

3 6

May 09, 2025 -

Madeleine Mc Cann Imposter Charged With Stalking Full Story

May 09, 2025

Madeleine Mc Cann Imposter Charged With Stalking Full Story

May 09, 2025 -

Meta And Whats App Learning From The 168 Million Spyware Case

May 09, 2025

Meta And Whats App Learning From The 168 Million Spyware Case

May 09, 2025 -

150 Million Whistleblower Reward The Credit Suisse Case

May 09, 2025

150 Million Whistleblower Reward The Credit Suisse Case

May 09, 2025 -

Elon Musks Net Worth Falls Below 300 Billion Tesla Tariffs And Market Volatility

May 09, 2025

Elon Musks Net Worth Falls Below 300 Billion Tesla Tariffs And Market Volatility

May 09, 2025