Palantir Stock Down 30%: Is This A Buying Opportunity?

Table of Contents

Analyzing the 30% Drop in Palantir Stock

Several factors have contributed to the recent significant decrease in Palantir stock. Understanding these contributing elements is crucial to assessing the current investment landscape surrounding PLTR stock.

Macroeconomic Factors

The current macroeconomic environment has significantly impacted growth stocks like Palantir. Several factors are at play:

- High Inflation and Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes to combat inflation have increased borrowing costs and reduced investor appetite for riskier assets, including many technology stocks. This has led to a broad market sell-off, impacting even fundamentally strong companies.

- Economic Uncertainty: Global economic uncertainty, stemming from geopolitical tensions and supply chain disruptions, further contributes to investor risk aversion. Investors are seeking safer havens, leading to capital flight from growth stocks like Palantir.

- Overall Market Sentiment: Negative market sentiment towards tech stocks in general, fueled by concerns about slowing growth and potential recession, has further exacerbated the decline in Palantir stock price. Data shows a general downward trend in many tech company valuations.

Company-Specific Factors

While macroeconomic factors play a role, company-specific issues also impact Palantir stock performance.

- Slower-Than-Expected Revenue Growth: Recent earnings reports may have revealed slower-than-anticipated revenue growth compared to investor expectations, leading to a sell-off. This could be attributed to various factors, impacting the overall investor confidence in PLTR stock.

- Increased Competition: Palantir operates in a competitive market, facing competition from established players and emerging startups. Increased competition can pressure margins and potentially slow growth, impacting the perception of Palantir stock.

- Government Contract Dependence: Palantir's significant reliance on government contracts exposes it to potential changes in government spending and policy, introducing volatility to its revenue stream and impacting investor confidence in the Palantir stock price. However, successful expansion into commercial sectors could mitigate this risk.

Investor Sentiment and Market Volatility

Investor sentiment plays a crucial role in driving short-term stock price fluctuations.

- Increased Short Selling: A surge in short-selling activity can amplify downward pressure on the Palantir stock price, as short sellers bet against the stock's future performance.

- Negative Analyst Ratings: Negative analyst ratings and downgrades can further contribute to a negative investor sentiment and lead to increased selling pressure on PLTR stock.

- Market Volatility: The inherent volatility of the technology sector makes Palantir stock susceptible to short-term fluctuations, irrespective of the underlying fundamentals of the business. This volatility can significantly impact investor decisions regarding PLTR stock.

Assessing the Potential for a Buying Opportunity

Despite the recent drop, several factors suggest a potential buying opportunity for long-term investors.

Valuation Metrics

Evaluating Palantir's current valuation is essential.

- Price-to-Sales Ratio (P/S): Comparing Palantir's P/S ratio to its historical values and industry competitors can indicate whether the stock is currently undervalued. A lower P/S ratio than historical averages or competitors could suggest a buying opportunity.

- Price-to-Earnings Ratio (P/E): Analyzing the P/E ratio in the context of the company’s growth trajectory provides insights into its valuation relative to its earnings. A lower P/E than peers could signal undervaluation.

- Discounted Cash Flow Analysis: More sophisticated valuation methods like discounted cash flow analysis (DCF) can provide a more comprehensive assessment of Palantir's intrinsic value. This approach considers the long-term cash flows the company is expected to generate, offering a more robust valuation measure.

Long-Term Growth Prospects

Palantir's long-term growth prospects remain strong.

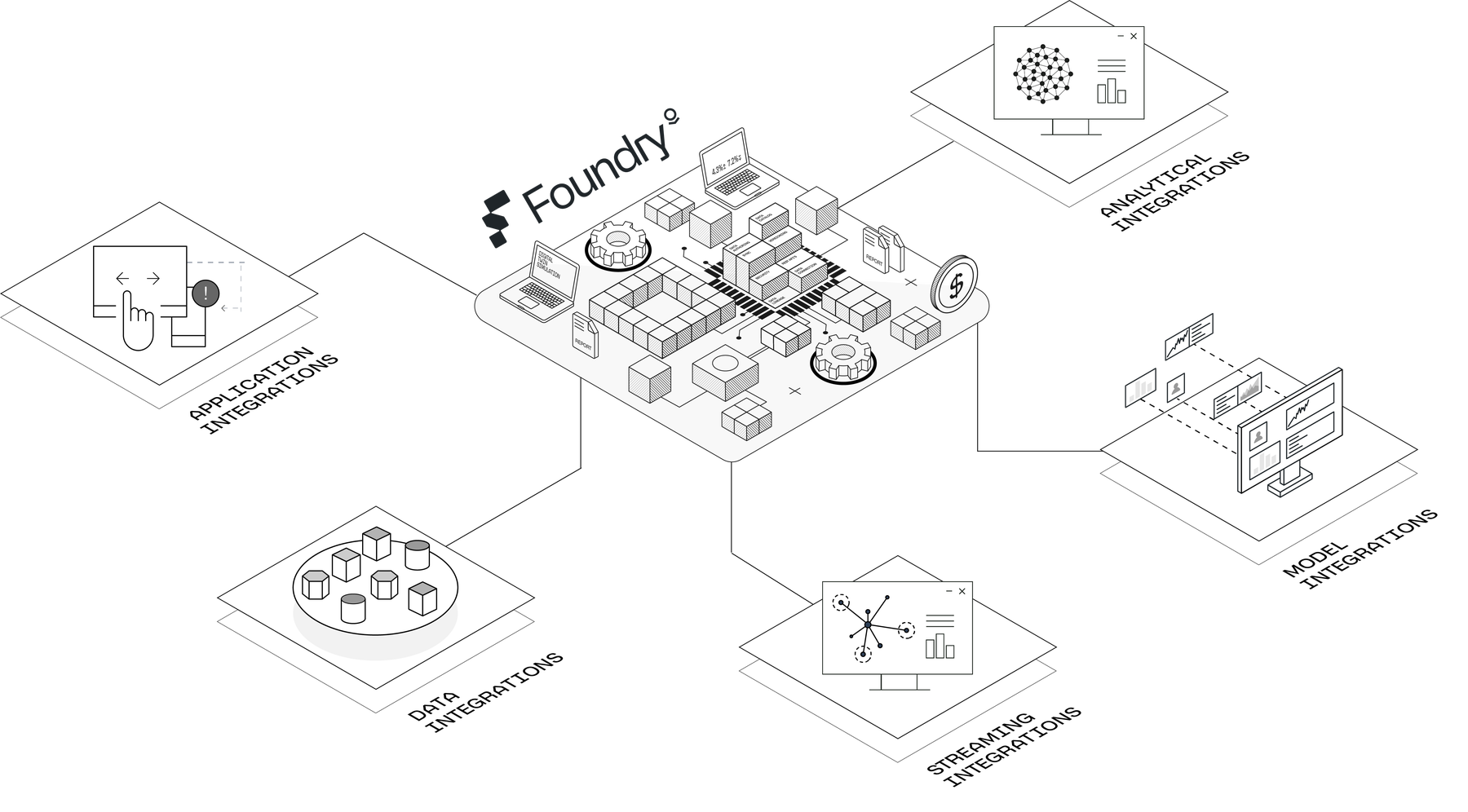

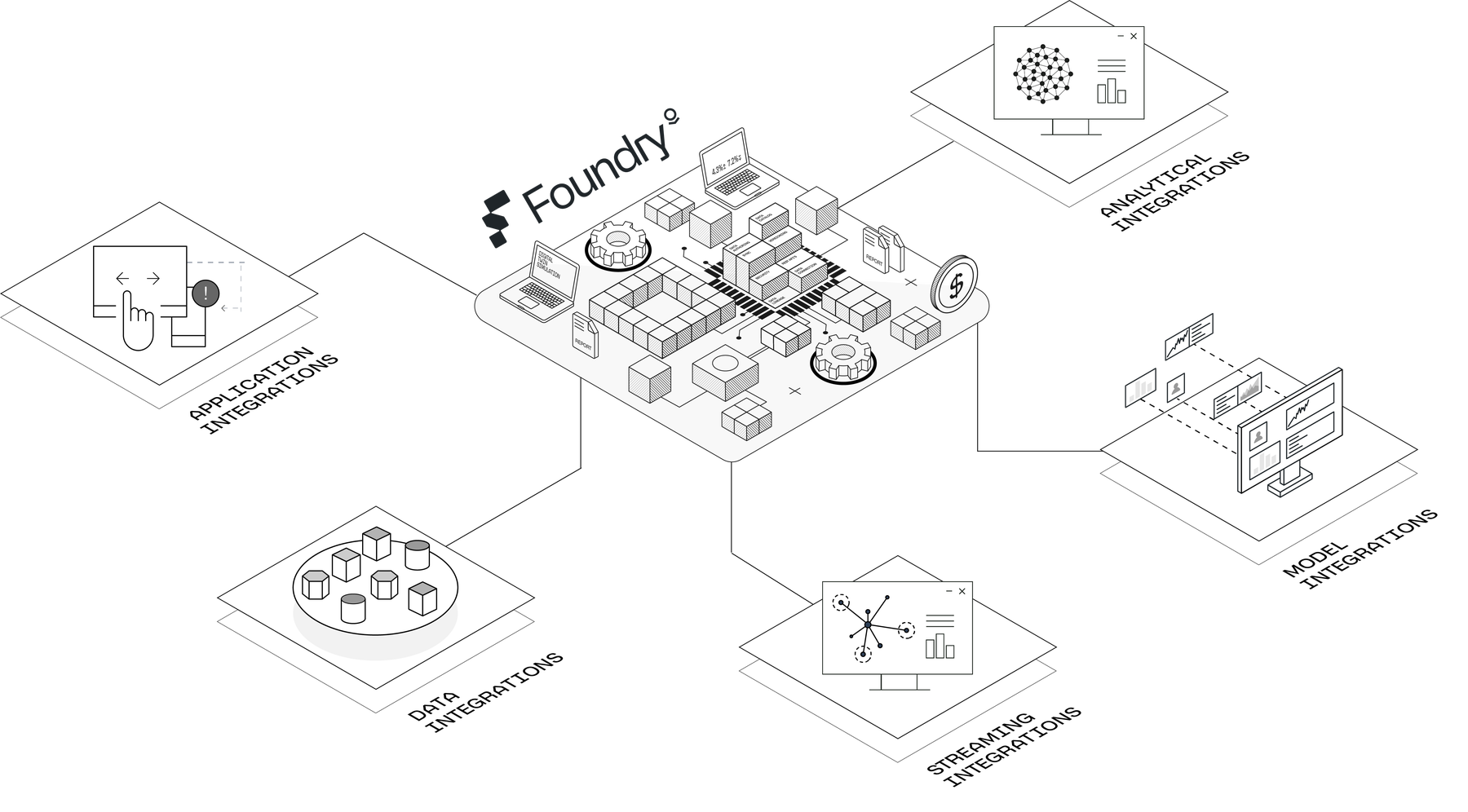

- Big Data Analytics Market: Palantir is well-positioned in the rapidly growing big data analytics market, which offers significant potential for future revenue growth.

- Government and Commercial Contracts: Continued growth in both government and commercial contracts will be key to the long-term success of Palantir.

- Technological Innovation: Palantir's ongoing investment in research and development positions it to remain a leader in data analytics and artificial intelligence.

Risk Assessment

Investing in Palantir involves significant risk.

- High Volatility: Palantir stock remains highly volatile and susceptible to market fluctuations.

- Government Contract Dependence: Dependence on government contracts introduces significant regulatory and political risk.

- Competition: Intense competition in the data analytics market represents a continuous challenge.

Investing in Palantir requires a high-risk tolerance. Diversification within a larger portfolio is crucial to mitigate these risks.

Conclusion

The 30% drop in Palantir stock price has created a potential buying opportunity for long-term investors who can tolerate high risk. While macroeconomic factors and company-specific issues contributed to the decline, Palantir's strong long-term growth prospects and potentially undervalued valuation offer a compelling case for consideration. However, the inherent volatility and risks associated with Palantir stock cannot be ignored. Before investing in Palantir stock, it is vital to conduct thorough due diligence, considering your own risk tolerance and investment goals. Consult with a financial advisor to make informed decisions. Remember, the current state of Palantir stock is just one snapshot in time.

Featured Posts

-

Dakota Johnson Ir Kraujingos Plintos Nuotraukos Visa Istorija

May 09, 2025

Dakota Johnson Ir Kraujingos Plintos Nuotraukos Visa Istorija

May 09, 2025 -

Whittier Rally Supports American Samoan Family Facing Voter Fraud Charges

May 09, 2025

Whittier Rally Supports American Samoan Family Facing Voter Fraud Charges

May 09, 2025 -

Two Stocks Poised To Surpass Palantirs Value In 3 Years

May 09, 2025

Two Stocks Poised To Surpass Palantirs Value In 3 Years

May 09, 2025 -

Predicting Future Stock Value Will These 2 Stocks Beat Palantir In 3 Years

May 09, 2025

Predicting Future Stock Value Will These 2 Stocks Beat Palantir In 3 Years

May 09, 2025 -

Exploring Jeanine Pirros Life From Education To Net Worth And Beyond

May 09, 2025

Exploring Jeanine Pirros Life From Education To Net Worth And Beyond

May 09, 2025