Palantir Stock Investment: Weighing The Risks And Rewards In 2025

Table of Contents

Understanding Palantir's Business Model and Growth Potential

Palantir's business model centers around providing data analytics platforms to government and commercial clients. Its success hinges on its ability to leverage advanced technologies to solve complex data challenges, offering significant growth potential but also presenting certain vulnerabilities.

Palantir's Government Contracts: A Foundation for Stability

Government contracts form a substantial portion of Palantir's revenue, providing a degree of stability in an otherwise volatile market.

- Significant Revenue Stream: Government contracts represent a consistent and substantial revenue source, providing a bedrock for the company's financial performance.

- Long-Term Partnerships: Palantir cultivates long-term relationships with key government agencies, ensuring recurring revenue streams and fostering trust.

- High-Value Contracts: These contracts often involve large-scale projects with substantial financial implications, contributing significantly to the company's bottom line.

- Risk of Funding Fluctuations: Government spending can fluctuate based on political priorities and budget cycles, creating uncertainty in future contract awards.

- Contract Renewal Challenges: Securing contract renewals requires ongoing performance and adaptation to changing government needs. Failure to do so could negatively impact revenue.

- Key Clients: Palantir works with major intelligence agencies and defense departments worldwide, showcasing the significance of its government partnerships.

Expanding into the Commercial Sector: Opportunities and Challenges

While government contracts are crucial, Palantir's expansion into the commercial sector is key to its long-term growth and valuation.

- Strategic Partnerships: Palantir has forged partnerships with leading companies across various industries, opening doors to new markets.

- Successful Implementations: The successful implementation of Palantir's platforms in diverse commercial sectors demonstrates its versatility and effectiveness.

- Competitive Landscape: The commercial data analytics market is highly competitive, with established players and emerging startups vying for market share.

- Client Acquisition: Attracting and retaining commercial clients requires a strong sales team, effective marketing, and a compelling value proposition.

- Growth Potential: The commercial sector offers immense growth potential for Palantir, but success requires overcoming challenges and proving its value proposition to a diverse client base.

Technological Innovation and Future Product Roadmap

Palantir's continued investment in research and development is crucial for maintaining its competitive edge.

- AI and Machine Learning Integration: Palantir is heavily investing in AI and machine learning to enhance its platforms' capabilities and offer more sophisticated solutions.

- New Product Releases: Regular updates and new product releases keep Palantir at the forefront of data analytics innovation, attracting new clients and retaining existing ones.

- Improved User Experience: Enhancements to user experience and interface design make the platforms more accessible and easier to use, improving adoption rates.

- R&D Spending: Significant investment in R&D indicates Palantir's commitment to technological advancement and long-term growth. This spending must, however, translate into tangible improvements and revenue generation.

Assessing the Risks of Investing in Palantir Stock

While Palantir offers exciting possibilities, potential investors must carefully consider the associated risks.

Valuation Concerns and Stock Price Volatility

Palantir's stock price has experienced significant volatility, raising concerns about its valuation.

- High P/E Ratio: A high price-to-earnings ratio can indicate potential overvaluation, making the stock susceptible to price corrections.

- Market Sentiment: Investor sentiment towards Palantir can dramatically impact its share price, leading to sudden and unpredictable fluctuations.

- Revenue Growth: While revenue is growing, consistent and sustainable growth is essential to justify the current valuation.

- Financial Metrics Analysis: Closely monitoring key financial metrics like revenue growth, profitability, and cash flow is crucial for assessing the stock's value.

Competition and Market Saturation

The data analytics market is crowded, presenting a competitive challenge for Palantir.

- Established Competitors: Palantir faces competition from established tech giants with significant resources and market presence.

- Emerging Competitors: New entrants into the market could disrupt Palantir's growth trajectory.

- Market Saturation: The potential for market saturation in certain segments could limit Palantir's expansion opportunities.

- Disruptive Technologies: The emergence of new technologies could render Palantir's existing platforms obsolete.

Geopolitical Risks and Regulatory Hurdles

Geopolitical events and regulatory changes can impact Palantir's business.

- International Relations: Geopolitical instability can affect contracts and operations in certain regions.

- Sanctions and Regulations: Compliance with international sanctions and data privacy regulations is critical.

- Legal and Ethical Concerns: Palantir's data analytics work raises ethical and legal concerns that need careful consideration.

Weighing the Rewards: Potential for High Returns

Despite the risks, Palantir's potential for high returns makes it an attractive option for certain investors.

Long-Term Growth Prospects in Data Analytics

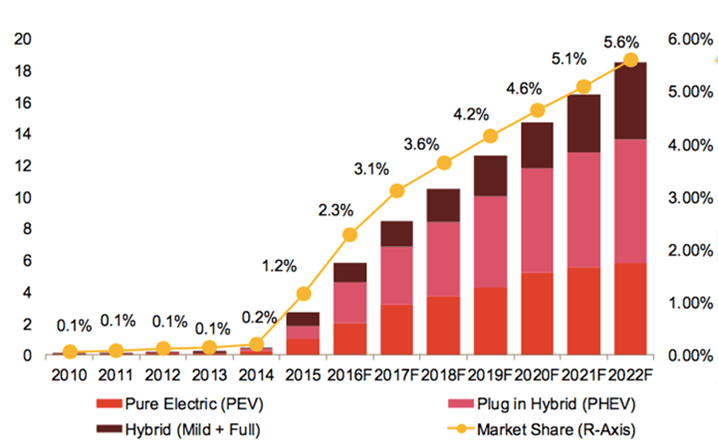

The data analytics market is expected to experience significant long-term growth, presenting opportunities for Palantir.

- Market Expansion: The continued growth of data generation and the increasing demand for data-driven insights create a vast market for Palantir's services.

- Market Share Capture: Palantir's innovative technology and strong client relationships position it to capture significant market share.

- Future Trends: Emerging trends in data analytics, such as AI and cloud computing, will shape Palantir's future prospects.

Potential for Increased Profitability and Shareholder Value

Palantir is focused on improving its profitability and increasing shareholder value.

- Cost Reduction: Efficient operations and cost management are crucial for improving profitability margins.

- Revenue Growth Strategies: Strategic partnerships, market expansion, and new product development are key to revenue growth.

- Shareholder Returns: Potential dividend payouts or stock buybacks could benefit investors.

Attractive Investment for Growth-Oriented Investors

Palantir stock is suitable for investors with a high risk tolerance and a long-term investment horizon.

- Growth Potential: The potential for significant returns is attractive to investors seeking high growth.

- Risk Tolerance: Investing in Palantir requires a high degree of risk tolerance due to its stock price volatility.

- Long-Term Strategy: A long-term investment strategy is recommended to weather short-term market fluctuations and benefit from long-term growth.

Conclusion: Making Informed Decisions on Your Palantir Stock Investment

Investing in Palantir stock presents both significant opportunities and substantial risks. The company's strong government contracts provide a foundation for stability, while its expansion into the commercial sector offers considerable growth potential. However, investors must carefully consider the challenges of valuation, competition, and geopolitical risks. A thorough understanding of Palantir's business model, financial performance, and the broader market landscape is crucial before making any investment decision. Remember to conduct your own due diligence and consult with a qualified financial advisor before investing in Palantir stock or any other security. Careful consideration of both the rewards and risks associated with a Palantir stock investment is paramount to making an informed and prudent choice.

Featured Posts

-

The 25m Financial Challenge Facing West Ham United

May 10, 2025

The 25m Financial Challenge Facing West Ham United

May 10, 2025 -

Delay Of Farcical Misconduct Proceedings Urged By Nottingham Families

May 10, 2025

Delay Of Farcical Misconduct Proceedings Urged By Nottingham Families

May 10, 2025 -

Uk Immigration New Visa Policies Target Nigerians And Other High Risk Nationalities

May 10, 2025

Uk Immigration New Visa Policies Target Nigerians And Other High Risk Nationalities

May 10, 2025 -

Bmw Porsche And Beyond Analyzing The Complexities Of The Chinese Automotive Market

May 10, 2025

Bmw Porsche And Beyond Analyzing The Complexities Of The Chinese Automotive Market

May 10, 2025 -

Zayava Stivena Kinga Mask Ta Tramp Posibniki Putina

May 10, 2025

Zayava Stivena Kinga Mask Ta Tramp Posibniki Putina

May 10, 2025