Palantir Stock Outlook: A Pre-May 5th Investment Analysis

Table of Contents

Palantir's Recent Performance and Key Financials (Pre-May 5th)

Q4 2022 Earnings and Revenue Growth:

Palantir's Q4 2022 earnings report offers crucial insights into its financial performance. Analyzing Palantir earnings and PLTR revenue growth is paramount for understanding the company's trajectory. While specific numbers will need to be updated closer to May 5th based on the latest releases, here's what to look for:

- Key revenue figures: Examine the total revenue generated during Q4 2022 and compare it to previous quarters and the same period last year.

- Year-over-year growth percentages: Calculate the percentage increase or decrease in revenue compared to Q4 2021. This indicates growth momentum.

- Profit margins: Analyze profit margins to understand the company's profitability and efficiency. Look for trends in gross margin, operating margin, and net margin.

- Surprises: Pay close attention to any unexpected developments revealed in the earnings report, such as significant contract wins or losses, changes in guidance, or any other announcements that may impact investor sentiment.

Government vs. Commercial Revenue Streams:

Understanding the breakdown of Palantir revenue between government and commercial sectors is vital. Revenue diversification is a key factor in evaluating stability and growth potential.

- Percentage of revenue from government contracts: A significant portion of Palantir's revenue comes from government contracts. Analyze the proportion and its stability.

- Percentage from commercial clients: The growth of Palantir's commercial client base indicates its ability to expand beyond government reliance.

- Projected growth in both sectors: Look for management commentary on the projected growth rates for both government and commercial segments. This provides insight into future expectations.

Key Metrics and Indicators:

Beyond revenue, several key performance indicators (KPIs) are crucial for a thorough Palantir investment assessment.

- Customer churn: A low churn rate indicates high customer satisfaction and retention. Monitor this metric for signs of customer loyalty.

- Average contract value (ACV): Higher ACV reflects stronger customer relationships and the potential for increased revenue per customer.

- Backlog: A substantial backlog indicates future revenue streams and a strong pipeline of opportunities. Analyze trends in backlog growth.

Factors Influencing Palantir Stock Price Before May 5th

Macroeconomic Factors:

Broader economic conditions significantly impact Palantir stock.

- Interest rate hikes: Rising interest rates generally impact tech stocks negatively, increasing borrowing costs.

- Inflation: High inflation erodes purchasing power and may affect government spending, impacting Palantir's contracts.

- Recessionary fears: Economic uncertainty can cause investors to become risk-averse, negatively impacting the tech stock outlook, including Palantir.

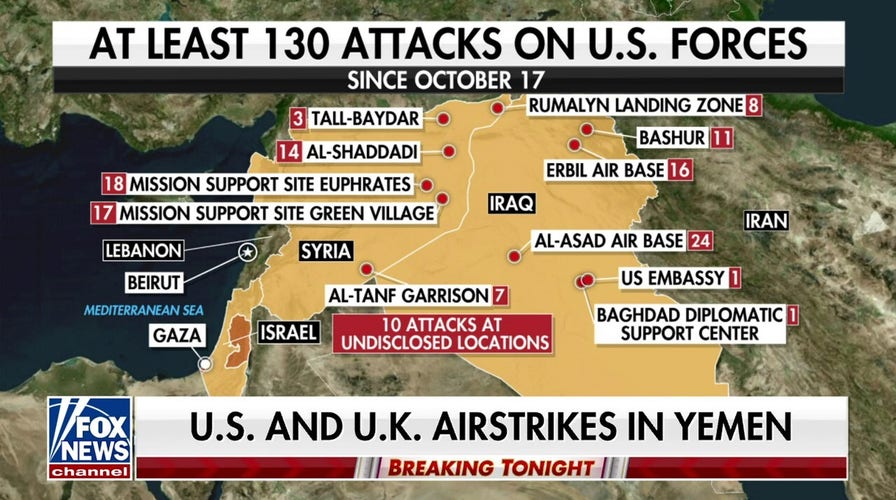

Geopolitical Events and Their Influence:

Geopolitical instability can significantly impact Palantir stock price.

- Specific events: Keep an eye on major geopolitical events such as international conflicts or policy changes that may affect government spending on defense and intelligence technologies.

- Potential impact on government contracts: Geopolitical events can directly influence the award and renewal of Palantir's government contracts.

- Overall market sentiment: Geopolitical uncertainty often creates negative market sentiment, affecting even strong companies.

Competition and Market Share:

Analyzing Palantir's competitive landscape is crucial.

- Palantir competitors: Identify key competitors in the data analytics market and their market strategies.

- Market share: Track Palantir's market share and its ability to maintain or increase its position against competitors.

- Competitive advantages of Palantir: Assess Palantir's technological advantages, proprietary algorithms, and strategic partnerships.

Investment Strategies and Potential Risks (Pre-May 5th)

Buy, Hold, or Sell Recommendation:

Based on the analysis (remember to update with current data closer to May 5th), a recommendation can be made. Disclaimer: This is not financial advice.

- Reasons for the recommendation: Clearly articulate the rationale for the buy, hold, or sell recommendation based on the analysis of Palantir stock performance, future prospects, and risks.

- Potential risks and rewards: Outline the potential rewards of the investment, but also the inherent risks.

- Possible exit strategies: If recommending a buy, suggest potential exit strategies based on price targets or specific events.

Potential Risks and Mitigation Strategies:

Investing in PLTR stock carries inherent risks.

- Market volatility: The technology sector is known for its volatility. Consider diversification to mitigate this risk.

- Dependence on government contracts: Palantir's reliance on government contracts exposes it to budget cuts or changes in government priorities.

- Competition: Intense competition in the data analytics market presents a challenge for maintaining market share.

- Risk management: Diversify your portfolio and set stop-loss orders to manage potential losses.

Conclusion: Making Informed Decisions on Palantir Stock Before May 5th

This pre-May 5th analysis of Palantir stock highlights the importance of considering recent financial performance, macroeconomic factors, geopolitical events, and competitive dynamics. Remember, investing always carries risk. The provided recommendation (remember to update with current data closer to May 5th and include a clear disclaimer) should be considered alongside your own due diligence. Before making any Palantir investment, conduct thorough research by consulting reputable financial news sources, reviewing Palantir's investor relations page, and monitoring any significant announcements leading up to and after May 5th. Continue researching Palantir stock and related news to stay informed and make the most suitable decision for your investment portfolio.

Featured Posts

-

Analyzing Brobbeys Impact A Strength Advantage In The Europa League

May 10, 2025

Analyzing Brobbeys Impact A Strength Advantage In The Europa League

May 10, 2025 -

Strictly Scandal Wynne Evans Presents New Evidence To Clear His Name

May 10, 2025

Strictly Scandal Wynne Evans Presents New Evidence To Clear His Name

May 10, 2025 -

Skepticism Remains Analyzing The Impact Of Trumps Houthi Truce On Shipping

May 10, 2025

Skepticism Remains Analyzing The Impact Of Trumps Houthi Truce On Shipping

May 10, 2025 -

A Canadian Billionaire Emerges Comparing Investment Strategies With Warren Buffett

May 10, 2025

A Canadian Billionaire Emerges Comparing Investment Strategies With Warren Buffett

May 10, 2025 -

Dakota Johnson Paaiskejo Tiesa Apie Kraujingas Plintos Nuotraukas

May 10, 2025

Dakota Johnson Paaiskejo Tiesa Apie Kraujingas Plintos Nuotraukas

May 10, 2025