Palantir Stock Outlook: To Buy Or Not To Buy Before May 5th?

Table of Contents

Palantir's Recent Performance and Q4 2022 Earnings

Analyzing Palantir's (PLTR) recent performance is crucial for assessing its future potential. The Q4 2022 earnings report provides valuable insights into the company's trajectory. Let's examine key trends:

-

Revenue Growth: While Palantir has demonstrated consistent revenue growth, the rate of growth and the comparison to previous quarters and year-over-year performance are key indicators of its health. Examining this trend against industry benchmarks provides a comparative context for evaluating PLTR's performance. A slowing growth rate might signal market saturation or increased competition.

-

Profitability Margins and Operating Expenses: Understanding Palantir's profitability margins is crucial. Changes in operating expenses, particularly research and development (R&D) and sales & marketing, can indicate strategic shifts and their impact on profitability. Investors should look for a healthy balance between growth investments and profitability.

-

Key Performance Indicators (KPIs): Tracking KPIs like customer acquisition cost (CAC), customer lifetime value (CLTV), and customer churn provides insights into the sustainability of Palantir's business model. High customer churn could signal problems with customer satisfaction or product efficacy.

-

Macroeconomic Factors: The impact of macroeconomic factors, such as inflation and interest rate hikes, on Palantir's performance cannot be ignored. These broader economic conditions significantly influence both government spending (a significant revenue source for Palantir) and overall market sentiment.

Future Growth Prospects and Potential Catalysts for Palantir Stock

Palantir's future growth hinges on several factors. Its long-term strategy and market positioning are critical considerations:

-

Government Contracts: Government contracts remain a significant revenue stream for Palantir. Future contract wins and renewals directly impact revenue projections. The pipeline of potential government contracts is therefore an essential factor to monitor.

-

Commercial Market Penetration: Expanding into the commercial market presents significant growth potential. Success in this sector will depend on Palantir's ability to adapt its offerings and effectively compete with established players.

-

Technological Innovations: Palantir's continued investment in R&D and technological innovation is crucial for maintaining its competitive edge. New product offerings and enhancements to existing platforms are essential for attracting and retaining customers.

-

Strategic Partnerships: Strategic partnerships and collaborations can significantly accelerate growth and market penetration. Alliances with established technology companies can broaden Palantir's reach and provide access to new markets and resources.

Risks and Challenges Facing Palantir and their Impact on Stock Price

Despite its potential, Palantir faces several risks that could impact its stock price:

-

Competition: The data analytics market is intensely competitive. Established players and new entrants pose a constant threat to Palantir's market share.

-

Government Contract Dependence: Reliance on government contracts exposes Palantir to the variability of government funding cycles and political shifts. Diversifying revenue streams is crucial to mitigate this risk.

-

Data Privacy and Security: Concerns about data privacy and security are paramount in the data analytics industry. Data breaches or privacy violations could severely damage Palantir's reputation and negatively impact its business.

-

Valuation Concerns: Palantir's valuation is a point of contention among investors. A potential stock price correction is a risk to consider, especially in a volatile market environment.

Analyzing Palantir's Valuation and Comparing it to Competitors

Evaluating Palantir's valuation is critical for determining its investment potential. Analyzing key financial metrics provides a clearer picture:

-

P/E Ratio and Other Metrics: Comparing Palantir's price-to-earnings (P/E) ratio and other valuation metrics (such as price-to-sales) to its competitors offers insights into whether it is overvalued or undervalued. This comparison should account for differences in growth rates and risk profiles.

-

Market Capitalization: Palantir's market capitalization reflects investor sentiment and expectations for future growth. Comparing its market cap to that of its competitors can help gauge its relative valuation. A high market capitalization might suggest that the market is optimistic about its future, while a low market capitalization could indicate a potential buying opportunity.

Conclusion

The Palantir stock outlook before May 5th presents a complex picture. While the company shows promise in terms of growth potential and technological innovation, significant risks remain. The dependence on government contracts, competition in the data analytics market, and valuation concerns all need careful consideration. The May 5th date could be a significant turning point, influenced by factors such as earnings reports and market sentiment.

Ultimately, the decision of whether to buy Palantir stock before May 5th is a personal one based on your risk tolerance and investment strategy. This analysis provides valuable insights, but remember to conduct your own thorough research and consider consulting with a financial advisor before making any investment decisions regarding Palantir stock or other related investments. Remember to carefully weigh the potential rewards against the considerable risks inherent in investing in Palantir stock.

Featured Posts

-

Ray Epps Defamation Lawsuit Against Fox News Over January 6th Allegations

May 09, 2025

Ray Epps Defamation Lawsuit Against Fox News Over January 6th Allegations

May 09, 2025 -

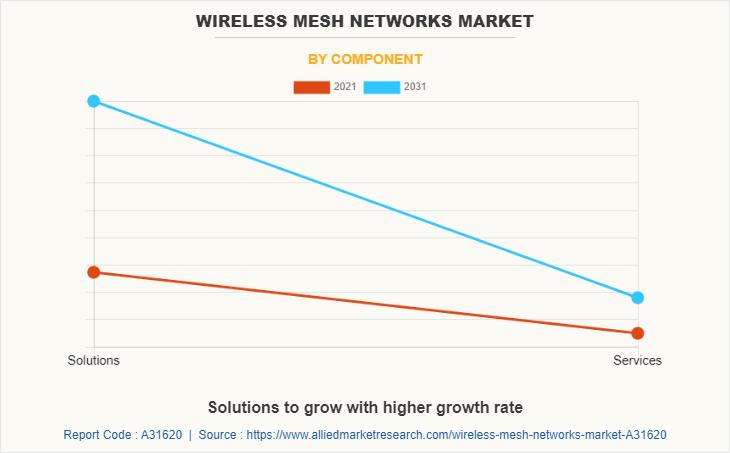

Projections For The Wireless Mesh Networks Market 9 8 Cagr And Beyond

May 09, 2025

Projections For The Wireless Mesh Networks Market 9 8 Cagr And Beyond

May 09, 2025 -

Noviy Naplyv Ukrainskikh Bezhentsev Germaniya Otsenivaet Riski Svyazannye S Deystviyami S Sh A

May 09, 2025

Noviy Naplyv Ukrainskikh Bezhentsev Germaniya Otsenivaet Riski Svyazannye S Deystviyami S Sh A

May 09, 2025 -

Ftcs Appeal Against Microsofts Activision Blizzard Buyout

May 09, 2025

Ftcs Appeal Against Microsofts Activision Blizzard Buyout

May 09, 2025 -

The Trade Wars Impact On Crypto One Cryptocurrency Poised For Success

May 09, 2025

The Trade Wars Impact On Crypto One Cryptocurrency Poised For Success

May 09, 2025