Palantir Stock: Should You Buy In 2025?

Table of Contents

Palantir's Business Model and Recent Performance

Understanding Palantir's current state is paramount to assessing its future. The company primarily operates through two platforms: Gotham and Foundry.

Understanding Palantir's Data Analytics Platforms

-

Palantir Gotham: This platform is primarily focused on government and intelligence agencies, providing powerful data integration and analytics capabilities for national security and defense. It leverages advanced data analytics to help organizations combat terrorism, cybercrime, and other threats. Its success hinges on securing lucrative government contracts.

-

Palantir Foundry: Designed for commercial clients, Foundry offers a comprehensive data integration and analytics platform that helps businesses make better decisions using their data. This is a key aspect of Palantir's growth strategy, as it targets a vast and expanding market for big data analytics solutions. This SaaS (Software as a Service) model provides recurring revenue streams, crucial for long-term stability.

-

Financial Performance: Palantir's recent financial reports reveal a mixed picture. While revenue growth has been impressive, profitability remains a challenge. Investors need to carefully analyze key performance indicators (KPIs) such as revenue growth rate, operating margins, and customer acquisition costs to assess the company's long-term financial sustainability. Careful scrutiny of the balance sheet for debt levels and cash flow is also necessary. Examining the breakdown of revenue from government versus commercial clients is also critical to understand the diversification of their income streams.

Growth Potential and Future Outlook for Palantir

Palantir operates within a rapidly expanding market for big data analytics, artificial intelligence (AI), and machine learning (ML). This provides significant growth potential, but also intense competition.

Market Opportunities and Competitive Landscape

-

Market Expansion: Palantir has the opportunity to expand into new markets, such as healthcare and finance, leveraging its existing technology to address the unique data challenges in these sectors.

-

Competitive Advantages: Palantir's proprietary technology and intellectual property provide a competitive edge, but giants like AWS, Microsoft Azure, and Google Cloud Platform pose significant challenges. Palantir's success will depend on its ability to maintain its technological advantage and adapt to evolving market demands.

-

AI and ML Integration: The integration of AI and ML into Palantir's platforms is crucial for maintaining its competitiveness and unlocking new possibilities. This requires significant investment in research and development, impacting profitability in the short term but potentially yielding substantial long-term rewards.

Risks and Challenges Associated with Investing in Palantir Stock

Investing in Palantir involves considerable risk, primarily due to its high valuation and historically volatile stock price.

Valuation and Stock Price Volatility

-

Stock Price Fluctuations: Palantir's stock price has been highly volatile, making it a risky investment for those with a low risk tolerance. News events, financial reports, and overall market sentiment can significantly impact the stock price.

-

Valuation Multiples: High valuation multiples raise concerns about whether the current stock price accurately reflects the company's long-term growth prospects. Careful comparison with similar companies in the data analytics space is necessary to assess if it is overvalued.

-

Macroeconomic Factors: Global economic downturns or changes in government spending can negatively impact Palantir's performance, as government contracts and commercial client spending are often affected by such factors.

Should You Buy Palantir Stock in 2025? A Balanced Perspective

The decision of whether to buy Palantir stock in 2025 is highly dependent on your individual investment goals and risk tolerance.

-

Investment Strategy: Aggressive investors with a long-term horizon might find the potential rewards of Palantir appealing, despite the inherent risks. Conservative investors might prefer to allocate their capital elsewhere.

-

Recommendation: Given the volatility and uncertain profitability, a cautious approach is warranted. Thorough due diligence, including a review of financial statements, competitor analysis, and market projections, is crucial before investing. Consider diversifying your portfolio to mitigate risk.

Conclusion:

Palantir presents a fascinating investment opportunity, with immense potential for growth in the rapidly expanding data analytics market. However, the significant risks associated with its volatile stock price and high valuation cannot be ignored. Weigh the pros and cons of Palantir stock carefully, considering your investment goals and risk tolerance before making a decision. Consider your investment goals before buying Palantir stock, and learn more about Palantir before making a Palantir investment. Remember, investing in any stock, especially a high-growth technology company like Palantir, requires careful consideration and thorough research. Don't invest more than you are comfortable losing.

Featured Posts

-

Draisaitls Injury Update On Edmonton Oilers Leading Goal Scorer

May 10, 2025

Draisaitls Injury Update On Edmonton Oilers Leading Goal Scorer

May 10, 2025 -

Aoc Delivers Sharp Rebuttal To Jeanine Pirros Claims

May 10, 2025

Aoc Delivers Sharp Rebuttal To Jeanine Pirros Claims

May 10, 2025 -

Nottingham Attack Survivors First Interview I Wish He D Taken Me Instead

May 10, 2025

Nottingham Attack Survivors First Interview I Wish He D Taken Me Instead

May 10, 2025 -

Edmonton Unlimiteds Global Impact Strategy Scaling Tech And Innovation

May 10, 2025

Edmonton Unlimiteds Global Impact Strategy Scaling Tech And Innovation

May 10, 2025 -

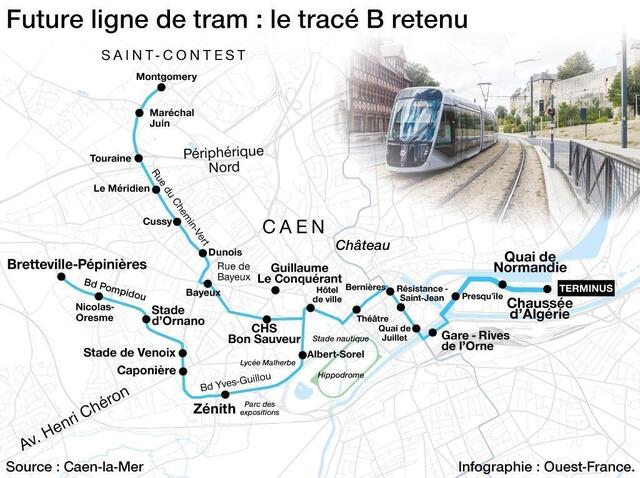

3e Ligne De Tram A Dijon Concertation Et Prochaines Etapes

May 10, 2025

3e Ligne De Tram A Dijon Concertation Et Prochaines Etapes

May 10, 2025