Palantir Technologies Stock: Buy Or Sell? A Data-Driven Investment Guide

Table of Contents

Understanding Palantir Technologies and its Business Model

Palantir Technologies is a prominent player in the big data analytics market, known for its sophisticated software platforms that help organizations integrate, analyze, and act on massive datasets. The company operates primarily through two core product platforms:

-

Gotham: This platform is specifically designed for government agencies and focuses on national security, defense, and intelligence applications. Gotham's data integration capabilities are crucial for counterterrorism efforts, crime prevention, and other critical government functions.

-

Foundry: Aimed at the commercial sector, Foundry offers a similar powerful data integration and analysis capability, helping businesses in various industries gain valuable insights from their data. This platform empowers organizations to make better decisions through improved data analysis and visualization.

Key Features and Advantages:

- Unparalleled Data Integration: Palantir excels at integrating data from disparate sources, a crucial capability in today's complex data landscape. This allows for a holistic view of information and more effective analysis.

- Powerful Analytical Capabilities: The platforms leverage advanced algorithms and machine learning to provide powerful analytical tools, delivering actionable intelligence.

- Strong Government Partnerships: Palantir boasts significant government contracts, providing a stable revenue stream and highlighting the importance of its technology in critical applications.

- Growing Commercial Presence: The company's commercial partnerships are expanding, signifying the increasing demand for its data analytics solutions across various industries.

- SaaS Business Model: Palantir operates on a software-as-a-service (SaaS) model, generating recurring revenue and fostering long-term relationships with clients.

Analyzing Palantir's Financial Performance

Evaluating Palantir's financial performance requires a deep dive into key metrics to understand its growth trajectory and profitability. Analyzing recent earnings reports provides insight into the company's progress:

- Revenue Growth: Examine the year-over-year revenue growth rate to gauge the company's ability to expand its customer base and increase sales. Consistent and substantial revenue growth is a positive sign.

- Profitability: Assess Palantir's profitability using metrics such as gross margin, operating margin, and net income. A move towards profitability is a crucial indicator of long-term financial health.

- Cash Flow: Analyze Palantir's cash flow from operations, which reflects its ability to generate cash from its core business. Strong positive cash flow demonstrates financial stability.

- Debt Levels: Evaluate the company's debt-to-equity ratio to understand its financial leverage. High debt levels could pose a risk, while a conservative debt strategy signifies financial prudence.

- Key Financial Ratios: Consider ratios like the Price-to-Sales (P/S) ratio and the Price-to-Earnings (P/E) ratio, comparing them to industry averages and historical trends to determine if Palantir is overvalued or undervalued.

Evaluating Palantir's Valuation and Growth Prospects

Determining whether Palantir stock is a buy or sell often hinges on its valuation and future growth potential. Several methods can be used to assess its valuation:

- P/E Ratio: Compares the stock price to its earnings per share. A high P/E ratio suggests investors expect high future growth.

- PEG Ratio: Adjusts the P/E ratio for the company's growth rate, providing a more comprehensive view of valuation.

- Discounted Cash Flow (DCF) Analysis: A more complex method that projects future cash flows and discounts them back to their present value to estimate the intrinsic value of the company.

Growth Prospects and Market Potential:

- Big Data Analytics Market: The market for big data analytics is booming, offering significant growth opportunities for Palantir.

- Artificial Intelligence (AI) Integration: Palantir's integration of AI capabilities further enhances its platform's value and competitive advantage.

- Government Spending: Continued government investment in national security and intelligence will sustain demand for Palantir's Gotham platform.

- Competition: Analyzing the competitive landscape, including competitors like Databricks and Snowflake, is crucial to assess Palantir's market share and potential for future growth.

Assessing the Risks and Rewards of Investing in Palantir Stock

Like any investment, Palantir stock carries both risks and rewards:

Potential Risks:

- Competition: The big data analytics market is competitive, with established players and emerging startups vying for market share.

- Regulatory Hurdles: Government regulations and potential changes in policy could impact Palantir's government contracts and overall business.

- Economic Downturn: A recession or economic slowdown could reduce demand for Palantir's services, particularly in the commercial sector.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts, making it vulnerable to changes in government spending priorities.

Potential Rewards:

- High Growth Potential: The big data analytics market offers significant growth potential, and Palantir is well-positioned to capitalize on it.

- Market Leadership: Palantir has established itself as a leader in big data analytics, particularly in the government sector.

- Technological Innovation: The company's continuous investment in research and development could lead to further innovation and market expansion.

Considering Alternative Investments

Before making any investment decision, remember to diversify your portfolio. Consider other investment options such as:

- Other Technology Stocks: Explore other companies in the big data analytics or broader technology sector, such as Databricks or Snowflake.

- Index Funds and ETFs: Diversify your investment strategy by including index funds or ETFs that track the broader market or specific sectors.

Conclusion

Deciding whether to buy or sell Palantir Technologies stock requires a thorough understanding of its business model, financial performance, valuation, and associated risks. While Palantir boasts impressive technology and a strong government presence, the competitive landscape and economic uncertainties necessitate careful consideration. This data-driven approach to investment analysis helps you make a more informed decision. Ultimately, the decision to buy or sell Palantir Technologies stock is a personal one, based on your risk tolerance and investment goals. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions regarding Palantir Technologies stock or any other technology stocks.

Featured Posts

-

New France Poland Friendship Treaty A Closer Look At The Agreement

May 09, 2025

New France Poland Friendship Treaty A Closer Look At The Agreement

May 09, 2025 -

Should You Buy Palantir Stock In 2024 Investment Outlook

May 09, 2025

Should You Buy Palantir Stock In 2024 Investment Outlook

May 09, 2025 -

Dijon Explication D Un Accident Rue Michel Servet

May 09, 2025

Dijon Explication D Un Accident Rue Michel Servet

May 09, 2025 -

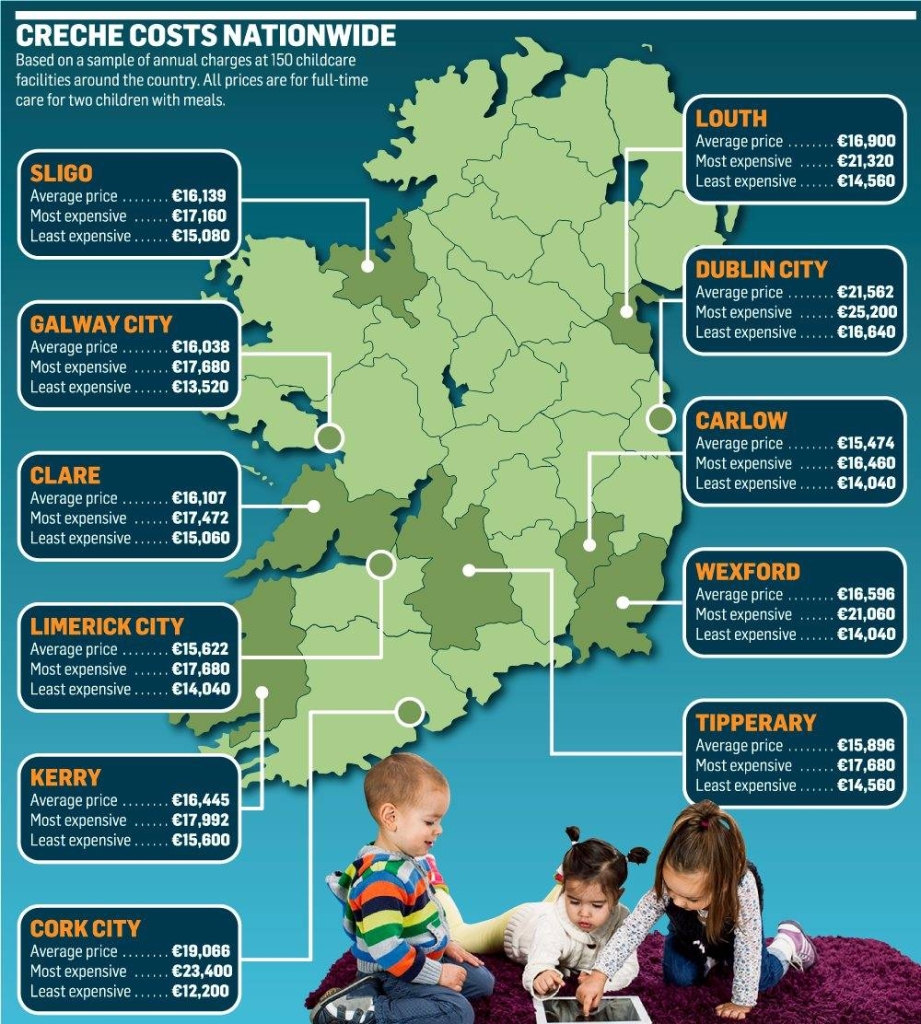

The High Cost Of Childcare One Mans Experience With Babysitters And Daycare

May 09, 2025

The High Cost Of Childcare One Mans Experience With Babysitters And Daycare

May 09, 2025 -

Police Intercept Suspected Madeleine Mc Cann Imposter In Uk

May 09, 2025

Police Intercept Suspected Madeleine Mc Cann Imposter In Uk

May 09, 2025