Palantir Technologies Stock: Investment Analysis And Future Outlook

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's revenue streams are multifaceted, offering both stability and growth potential. Understanding these diverse sources is crucial for assessing the company's overall financial health and future prospects.

Government Contracts: A Foundation of Stability

A significant portion of Palantir's revenue stems from government contracts, predominantly with intelligence agencies and defense departments worldwide. These contracts often involve high-value, long-term partnerships, providing a relatively stable revenue base.

- High-value, long-term contracts: These contracts ensure a consistent revenue stream, reducing reliance on short-term projects.

- Government regulations and budget constraints impact growth: Government procurement processes can be lengthy and complex, potentially impacting revenue predictability. Budgetary decisions also influence the scale and timing of future contracts.

- Focus on national security and data analytics: Palantir's expertise in data integration and analysis is highly valued in national security applications, driving demand for its services.

Commercial Partnerships: Fueling Future Growth

While government contracts form a crucial part of Palantir's business, the company is aggressively pursuing growth in the commercial sector. This diversification strategy aims to reduce reliance on government funding and tap into the vast potential of various industries.

- Growing adoption of data analytics across sectors: Businesses across finance, healthcare, and energy are increasingly recognizing the value of data-driven decision-making. This trend fuels demand for Palantir's platform.

- Competition from established tech giants: Palantir faces stiff competition from established players like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure. Differentiation through specialized solutions and superior data integration capabilities is key to success.

- Focus on data integration and operational efficiency for businesses: Palantir's platform aims to streamline data management and improve operational efficiency for businesses, leading to increased productivity and cost savings.

Foundry Platform: The Engine of Innovation

Palantir's flagship platform, Foundry, is a crucial driver of revenue and future growth. This scalable data integration and analytics platform empowers organizations to harness the power of their data for informed decision-making.

- Scalable data integration and analytics: Foundry's ability to handle massive datasets and diverse data sources is a key differentiator.

- AI-powered insights and decision-making tools: The platform incorporates advanced AI and machine learning capabilities to extract actionable insights from complex data.

- Ease of use and adaptability across industries: Foundry's user-friendly interface and adaptability make it suitable for a wide range of industries and use cases.

Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is vital for assessing its investment potential. Examining key metrics provides insights into its growth trajectory and future prospects.

Revenue Growth and Profitability: A Closer Look

Palantir has demonstrated consistent revenue growth, albeit with varying profitability margins. Understanding these trends is crucial for evaluating the company's financial health and long-term sustainability.

- Year-over-year revenue growth comparison: Tracking year-over-year revenue growth helps assess the company's ability to expand its customer base and increase sales.

- Profitability margins and their trajectory: Analyzing profitability margins (gross, operating, and net) reveals the efficiency of Palantir's operations and its ability to generate profits.

- Cash flow analysis and debt levels: A strong cash flow position is essential for sustainable growth and financial stability. Analyzing debt levels helps assess the company's financial risk.

Stock Valuation and Comparables: Assessing the Price

Evaluating Palantir's stock valuation requires comparing it to its peers and industry benchmarks. Metrics such as the Price-to-Sales (P/S) ratio provide insights into whether the stock is overvalued or undervalued.

- Comparison with similar data analytics companies: Benchmarking Palantir against similar companies helps assess its relative valuation and growth potential.

- Analysis of its P/S ratio and other valuation metrics: The P/S ratio, along with other valuation metrics, provides a relative measure of the company's worth compared to its revenue.

- Potential for future price appreciation or depreciation: Based on the company's financial performance, market conditions, and industry trends, investors can predict potential price movements.

Risks and Challenges: Navigating the Path Ahead

While Palantir presents significant potential, investors must also acknowledge inherent risks and challenges. A comprehensive risk assessment is critical for making informed investment decisions.

Competition and Market Saturation: A Crowded Field

The data analytics market is highly competitive, with established tech giants and emerging players vying for market share. Palantir needs to continuously innovate and adapt to maintain its competitive edge.

- Competition from established tech companies (e.g., AWS, Google): These companies possess vast resources and established market positions, creating significant competition for Palantir.

- Market saturation in specific industries: In some industries, the market for data analytics solutions may be nearing saturation, limiting Palantir's growth potential in those sectors.

- Potential for technological disruption: Rapid technological advancements could render Palantir's current technology obsolete, necessitating continuous investment in research and development.

Dependence on Government Contracts: A Double-Edged Sword

Palantir's significant reliance on government contracts exposes it to political and budgetary uncertainties. Diversifying its revenue streams is crucial to mitigate this risk.

- Political and budgetary uncertainty: Changes in government priorities or budgetary constraints could significantly impact Palantir's revenue.

- Contract renewal risks: Failure to secure contract renewals could negatively impact revenue and growth prospects.

- Geographic concentration of revenue streams: Over-reliance on contracts from specific geographic regions exposes the company to geopolitical risks.

Data Privacy and Security Concerns: Protecting Sensitive Information

Palantir handles sensitive data, making data privacy and security paramount. Maintaining robust security measures and complying with regulations is essential for building and maintaining customer trust.

- Regulatory compliance requirements: Palantir must comply with various data privacy and security regulations, such as GDPR and CCPA.

- Data breaches and security vulnerabilities: The risk of data breaches and security vulnerabilities poses a significant threat to Palantir's reputation and business operations.

- Maintaining customer trust and confidence: Protecting customer data is crucial for building and maintaining trust, a vital asset in the data analytics industry.

Conclusion: Weighing the Potential of Palantir Technologies Stock

Palantir Technologies stock presents a compelling investment opportunity for those interested in the data analytics sector. Its innovative platform, growing commercial partnerships, and long-term growth potential offer substantial rewards. However, its reliance on government contracts and competition from tech giants pose significant risks. The company's financial performance, while showing promising trends, requires careful monitoring. Before investing in Palantir Technologies stock, thorough due diligence is crucial, considering the risks and the company's unique market position. Conduct your own research and consult with a financial advisor to make an informed decision about including Palantir Technologies stock in your investment portfolio. Remember to always carefully assess your risk tolerance before investing in any stock, including Palantir Technologies.

Featured Posts

-

Mariah The Scientist And Young Thug A New Song Snippet Hints At Commitment

May 09, 2025

Mariah The Scientist And Young Thug A New Song Snippet Hints At Commitment

May 09, 2025 -

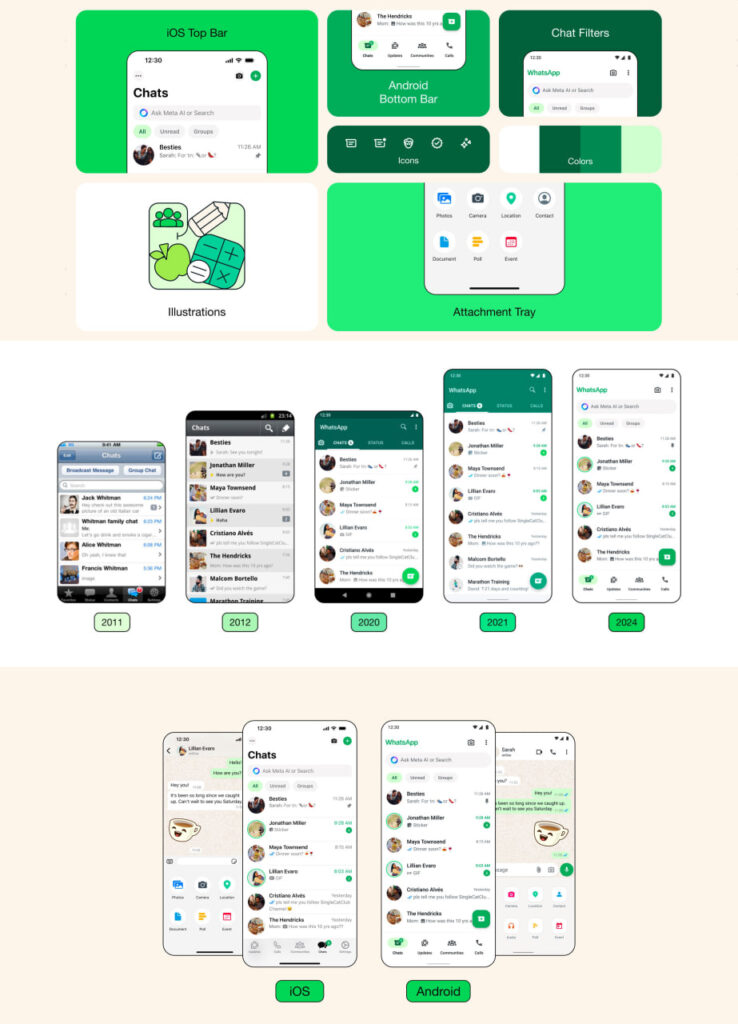

Gen Z And Smartphones Androids Design Update Vs I Phones Grip

May 09, 2025

Gen Z And Smartphones Androids Design Update Vs I Phones Grip

May 09, 2025 -

Cybercriminal Nets Millions Through Executive Office365 Account Breaches

May 09, 2025

Cybercriminal Nets Millions Through Executive Office365 Account Breaches

May 09, 2025 -

F1 75 Launch Doohans Direct Response To Colapintos Question

May 09, 2025

F1 75 Launch Doohans Direct Response To Colapintos Question

May 09, 2025 -

How Trumps Billionaire Circle Fared After Liberation Days Tariff Policies

May 09, 2025

How Trumps Billionaire Circle Fared After Liberation Days Tariff Policies

May 09, 2025