Palantir Technologies Stock: Should You Invest Before May 5th? Expert Analysis

Table of Contents

Palantir's Recent Performance and Financial Health

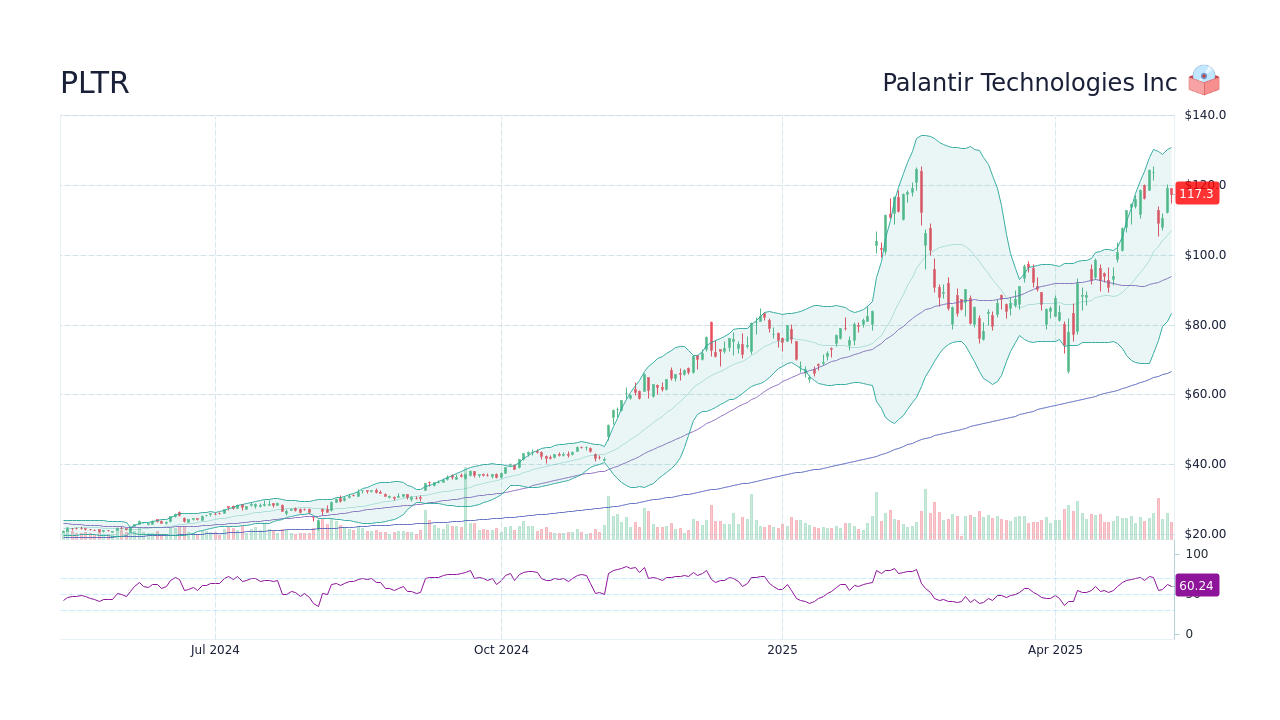

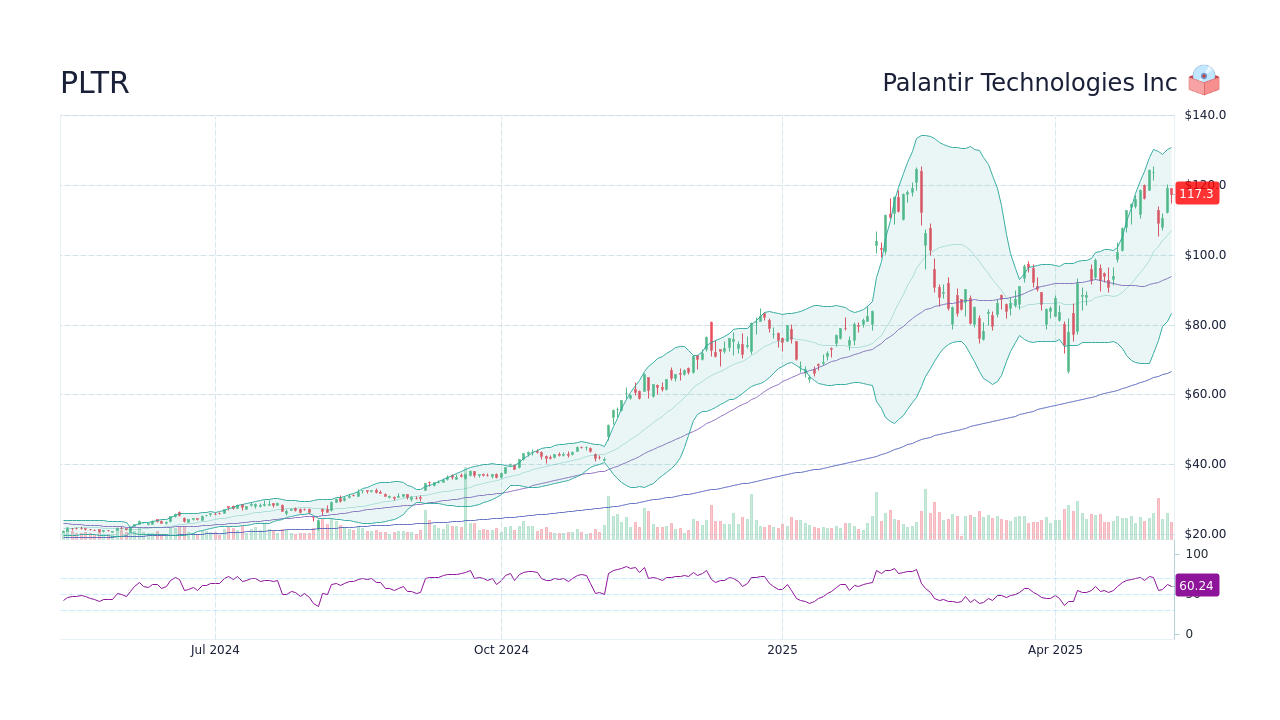

Understanding Palantir's financial health is crucial for any investment decision. Let's delve into their recent performance, analyzing key indicators to gauge their current standing. Analyzing recent quarterly earnings reports reveals valuable insights into the company's trajectory.

-

Revenue Growth: Comparing Palantir's revenue growth rate across recent quarters against previous years and industry benchmarks paints a clearer picture. A consistent upward trend signifies robust growth, while stagnation or decline warrants further investigation. For example, comparing Q4 2023 revenue against Q4 2022 revenue and comparing it to similar publicly traded data analytics companies provides valuable context.

-

Profitability: Profitability is paramount. Analyzing gross margin, operating margin, and net income provides insights into Palantir's efficiency and ability to generate profit. A shrinking margin might indicate rising costs or increased competition, while expansion suggests a healthy and profitable business model.

-

Significant Contracts: Winning major contracts, especially government contracts, heavily influences Palantir's revenue streams and overall financial stability. Conversely, losing key contracts can significantly impact the stock price. Examining the types and sizes of contracts secured and lost helps assess future revenue projections.

-

Debt and Cash Flow: High debt levels can be a major risk factor, impacting a company's financial flexibility. Analyzing debt-to-equity ratios and reviewing the company's cash flow statements (operating, investing, and financing activities) provides a more complete understanding of their financial health. Strong positive cash flow is a sign of financial strength.

(Include relevant charts and graphs visualizing financial data here. Mention any significant events affecting the stock price such as new product launches, partnerships, or regulatory changes.)

Market Sentiment and Analyst Predictions

Gauging market sentiment towards Palantir Technologies stock is essential. This involves analyzing news articles, analyst reports, and overall market trends. Positive sentiment often translates to increased investor confidence and a potential price rise, while negative sentiment can lead to decreased investor confidence and price drops.

-

Analyst Ratings: Leading financial analysts provide buy, sell, and hold recommendations, along with price targets. Aggregating these recommendations gives an overview of the overall market consensus. A high concentration of "buy" ratings generally suggests a positive outlook.

-

Price Targets: Analyst price targets indicate the predicted future price of the stock. These targets vary based on individual analyst assessments and their expectations for future company performance. A consistently high average price target can indicate potential for significant growth.

-

Catalysts: Upcoming earnings reports, new product launches, major partnerships, and even geopolitical events can serve as catalysts, significantly impacting the Palantir Technologies stock price. Monitoring these potential catalysts is crucial for informed investment decisions.

(Include links to reputable sources for analyst ratings and predictions here.)

Key Risks and Potential Upside

Investing in any stock carries inherent risks. Understanding these risks before investing in Palantir Technologies stock is crucial for mitigating potential losses.

-

Competition: The big data analytics market is highly competitive. Palantir faces competition from established tech giants and emerging startups. Analyzing the competitive landscape is crucial for assessing the company's long-term viability.

-

Government Dependence: A significant portion of Palantir's revenue comes from government contracts. Changes in government policies or spending priorities can significantly impact their financial performance.

-

Valuation Concerns: Palantir's high Price-to-Earnings (P/E) ratio might raise concerns about its valuation. A high P/E ratio suggests that investors are willing to pay a premium for the company's growth potential, but it also carries greater risk.

-

Regulatory Hurdles: Data privacy regulations and other regulatory changes can pose significant challenges for Palantir's operations.

Potential Upside: Despite the risks, Palantir holds significant upside potential.

-

Market Growth: The big data and artificial intelligence (AI) markets are expanding rapidly, presenting significant growth opportunities for Palantir.

-

Strategic Partnerships: Strategic partnerships can open new markets and enhance Palantir's capabilities.

-

Technological Breakthroughs: Innovation and technological advancements can further solidify Palantir's position as a market leader.

May 5th and its Significance (Replace with actual date and significance if different)

(Specifically address the relevance of May 5th (or the actual date) to Palantir's stock price. This could be an earnings announcement, a product launch, or other significant event. Include bullet points outlining what is expected to happen, how this might impact the stock price, and potential positive and negative scenarios.)

Conclusion

This analysis has explored Palantir Technologies' recent performance, market sentiment, and potential risks and opportunities. While Palantir presents significant growth potential in the big data and AI markets, investing always involves risk. The significance of May 5th (or the actual date) should be carefully considered. Before making any investment decisions regarding Palantir Technologies stock, conduct thorough research and consult with a qualified financial advisor. Remember, this analysis is for informational purposes only and does not constitute financial advice. Carefully weigh the potential risks and rewards before investing in Palantir Technologies stock. Learn more about responsible Palantir Technologies stock investing today.

Featured Posts

-

Dogecoins Fate Tied To Elon Musk And Teslas Performance

May 10, 2025

Dogecoins Fate Tied To Elon Musk And Teslas Performance

May 10, 2025 -

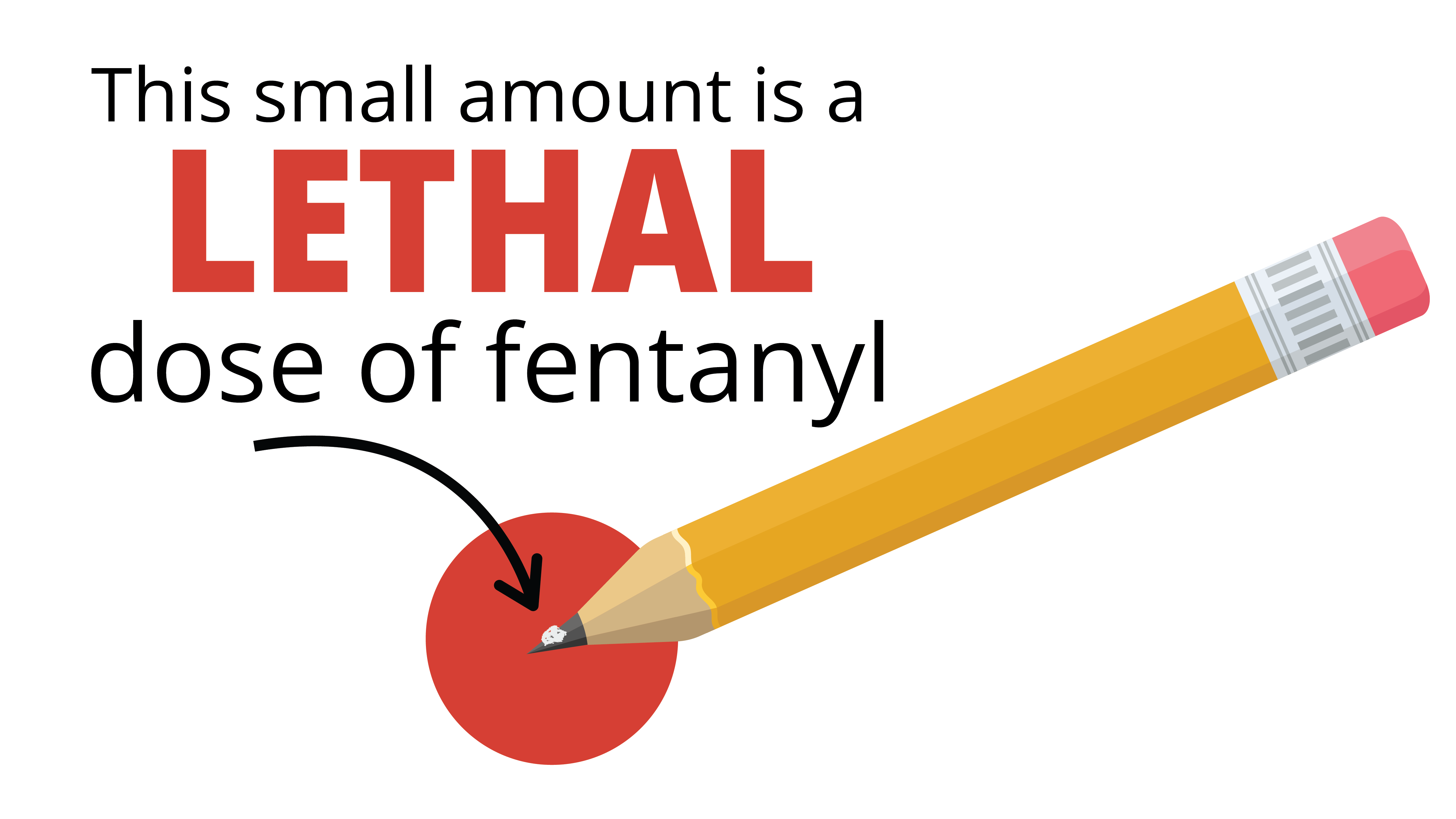

Record Fentanyl Seizure Announced Pam Bondis Update

May 10, 2025

Record Fentanyl Seizure Announced Pam Bondis Update

May 10, 2025 -

Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 10, 2025

Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 10, 2025 -

Dakota Johnson With Family At Materialist Premiere Photos

May 10, 2025

Dakota Johnson With Family At Materialist Premiere Photos

May 10, 2025 -

Fox News Hosts Sharp Rebuttal To Colleagues Trump Tariff Stance

May 10, 2025

Fox News Hosts Sharp Rebuttal To Colleagues Trump Tariff Stance

May 10, 2025