Palantir's Q1 2024 Earnings: A Deep Dive Into Government And Commercial Performance

Table of Contents

Palantir's Q1 2024 Government Sector Performance

Government Revenue Growth and Key Contract Wins

Palantir's government sector continues to be a significant driver of revenue. While precise figures await official release, early indications suggest robust growth compared to Q1 2023 and preceding quarters. This growth is likely fueled by several factors, including renewed emphasis on national security and an increasing reliance on data-driven decision-making within government agencies.

- Contract Wins: Specific contract details often remain confidential due to security concerns. However, press releases and investor calls usually reveal high-level information about significant contract wins, often highlighting their strategic importance to Palantir's overall growth. Look for mentions of large-scale deployments or expansions of existing contracts.

- Percentage Growth: Expect analysts to closely scrutinize the percentage increase in government revenue year-over-year and quarter-over-quarter. Strong growth in this sector signifies Palantir's continued success in securing and maintaining crucial government partnerships.

- Geographical Distribution: Palantir's government contracts extend beyond US borders. The company's international presence and the success of its platforms in diverse geopolitical environments will be important factors in analyzing the overall performance. Note any significant growth in specific regions.

Government Sector Margin Analysis

Analyzing the profit margins from government contracts is vital to understanding Palantir's overall financial health. High margins indicate efficient operations and strong pricing power.

- Gross Margin Percentage: This metric reflects the profitability of Palantir's government services before accounting for operating expenses. A high gross margin percentage usually indicates efficient delivery of services and effective cost management.

- Operating Margin Percentage: This metric considers operating expenses such as research and development, sales and marketing, and general administrative costs. Changes in operating margin can highlight adjustments in operational efficiency or strategic spending.

- Margin Changes: Any significant changes in gross or operating margins compared to previous quarters or the same period last year will require careful examination. Factors like contract complexity, changes in service delivery models, and increased competition could influence these margins.

Future Outlook for Palantir in the Government Sector

Palantir's future performance in the government sector hinges on several factors. Maintaining existing contracts and securing new ones are paramount.

- Projected Revenue Growth: Analysts' predictions for government revenue growth will be closely watched. Factors impacting this growth include government budget allocations, geopolitical developments, and competition from other technology providers.

- Market Share Expansion: Palantir's strategies for expanding its market share will be a key focus. This might involve developing new capabilities, forging strategic alliances, or penetrating new government agencies.

- Potential Risks and Mitigation Strategies: Analyzing potential risks such as budget cuts, changing regulatory landscapes, or emerging technologies is crucial. Understanding Palantir's mitigation strategies for these risks is vital for assessing the long-term outlook.

Palantir's Q1 2024 Commercial Sector Performance

Commercial Revenue Growth and Customer Acquisition

The commercial sector represents a crucial growth opportunity for Palantir. Analyzing revenue growth and customer acquisition provides insights into the success of its expansion strategy.

- New Commercial Clients: Identifying key new commercial clients and the industries they represent is essential. This showcases the breadth and depth of Palantir's commercial reach. Examples include large enterprises in finance, healthcare, or manufacturing.

- Percentage Growth: Tracking the percentage growth in commercial revenue helps assess the trajectory of this sector. Strong growth reflects the efficacy of Palantir's commercialization efforts and market penetration.

- Industries Served: The diversity of industries served by Palantir's commercial offerings is a strong indicator of its adaptability and market relevance.

Commercial Sector Margin Analysis

Profit margins in the commercial sector provide valuable insights into Palantir's pricing strategies and operational efficiency.

- Gross and Operating Margin Percentages: Similar to the government sector analysis, examining gross and operating margin percentages in the commercial sector helps gauge profitability and efficiency.

- Margin Changes: Significant changes in margins require careful examination. Factors such as pricing strategies, competition, and operating costs will influence the margins.

Future Outlook for Palantir in the Commercial Sector

The commercial sector presents significant growth potential for Palantir. Its success depends on expanding its client base and market penetration.

- Projected Revenue Growth: Analysts' projections for commercial revenue growth indicate the anticipated trajectory of this sector. This will be influenced by factors such as market demand, competition, and Palantir's strategic initiatives.

- Market Penetration Strategies: Understanding Palantir's strategies for penetrating new commercial markets is crucial. This might include targeted marketing campaigns, strategic partnerships, or development of new product offerings tailored to specific industries.

- Risks and Opportunities: Identifying potential risks and opportunities is crucial for assessing the future of Palantir's commercial sector. This might include emerging technologies, competitive pressures, and economic fluctuations.

Conclusion: Key Takeaways from Palantir's Q1 2024 Earnings Report

Palantir's Q1 2024 earnings report offers a mixed bag. While the government sector continues to deliver strong performance, the success and growth trajectory of the commercial sector will be crucial to the company's long-term financial health. Analyzing the revenue growth, profitability margins, and future outlook in both sectors provides a thorough picture of Palantir's current standing and its future prospects. Stay informed about future Palantir earnings reports and analyses to gain deeper insights into the company's performance and strategic direction. Subscribe to our newsletter for updates on future Palantir's Q1 2024 earnings and other key financial reports.

Featured Posts

-

Barys San Jyrman Rhlt Nhw Ktabt Altarykh Alawrwby

May 09, 2025

Barys San Jyrman Rhlt Nhw Ktabt Altarykh Alawrwby

May 09, 2025 -

High Potential Episode Count Will There Be A Season 2

May 09, 2025

High Potential Episode Count Will There Be A Season 2

May 09, 2025 -

Young Thugs Uy Scuti Release Date Hints And Fan Reactions

May 09, 2025

Young Thugs Uy Scuti Release Date Hints And Fan Reactions

May 09, 2025 -

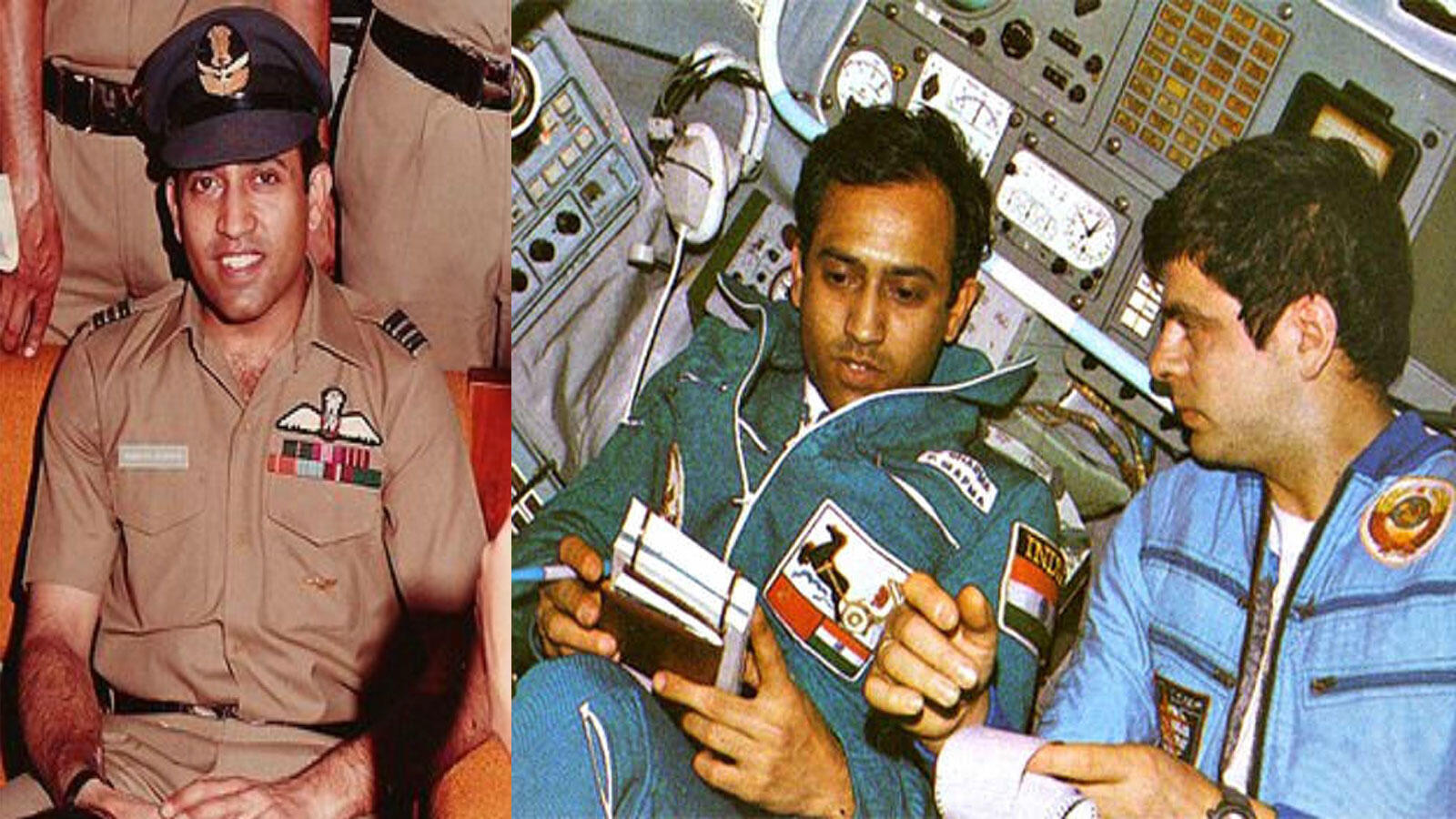

Rakesh Sharma What Happened After Indias First Space Mission

May 09, 2025

Rakesh Sharma What Happened After Indias First Space Mission

May 09, 2025 -

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

May 09, 2025

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

May 09, 2025