Payden & Rygel: China To US Container Shipping Trends And Analysis

Table of Contents

Rising Shipping Costs and Their Impact

The cost of China to US container shipping has experienced significant fluctuations, impacting businesses across various sectors. Several factors contribute to this volatility:

Fuel Prices and Their Volatility

Fluctuating fuel prices directly affect shipping costs. Geopolitical events, oil production levels, and global demand all play a crucial role.

- Geopolitical Instability: Tensions in oil-producing regions can lead to price spikes, instantly increasing shipping costs. The 2022 Ukraine conflict, for example, significantly impacted fuel prices, cascading into higher freight rates.

- Oil Production and Demand: Changes in global oil production and consumption patterns directly correlate with fuel prices. Periods of high demand and limited supply result in higher prices.

- Fuel Surcharges: Shipping companies often implement fuel surcharges to offset the rising cost of fuel. However, the effectiveness of these surcharges in completely absorbing price volatility remains a topic of debate.

Port Congestion and Delays

Port congestion in both China and the US significantly impacts shipping times and costs.

- Labor Shortages: Labor disputes and a shortage of dockworkers in major ports contribute to delays and increased costs.

- Infrastructure Limitations: Insufficient port infrastructure, including inadequate berth capacity and outdated equipment, exacerbates congestion.

- Peak Season Effects: The surge in shipping volume during peak seasons (typically around holidays) often leads to significant port congestion and delays. Strategies like utilizing alternative ports or optimizing cargo scheduling are crucial during these periods.

Increased Demand and Limited Capacity

A mismatch between surging demand and available shipping capacity has driven up freight rates.

- E-commerce Boom: The rapid growth of e-commerce and increased consumer spending have fueled demand for container shipping.

- Container Shortages: A global shortage of shipping containers has constrained capacity, leading to higher prices.

- Vessel Availability: Limited vessel availability, due to factors such as shipyard capacity constraints, also contributes to the capacity crunch.

Technological Advancements and Their Influence

Technological advancements are reshaping the China to US container shipping landscape, boosting efficiency and transparency.

Digitalization and Supply Chain Visibility

Technology is enhancing transparency and efficiency in the shipping process.

- Blockchain Technology: Blockchain provides secure and transparent tracking of shipments, improving visibility throughout the supply chain.

- Data Analytics: Data analytics enables the optimization of shipping routes, prediction of potential disruptions, and more efficient resource allocation.

- Real-time Tracking Systems: Real-time tracking systems facilitate better communication between shippers, carriers, and other stakeholders.

Automation in Ports and Warehouses

Automation is improving efficiency and reducing costs in ports and warehouses.

- Automated Container Handling Systems: Automated systems significantly increase port throughput, reducing congestion and delays.

- Robotics and AI in Warehouses: Robotics and artificial intelligence are streamlining warehouse operations, improving efficiency, and reducing labor costs.

- Future Automation: Further automation in various aspects of the shipping process holds the potential for significant improvements in efficiency and cost reduction, though it also raises concerns about potential job displacement.

Geopolitical Factors and Trade Relations

Geopolitical factors and trade relations significantly influence China to US container shipping.

US-China Trade Tensions

Trade policies and tariffs between the US and China have impacted shipping volumes and costs.

- Trade Wars: Trade wars and protectionist policies have led to uncertainty and disruptions in supply chains.

- Navigating Trade Uncertainties: Businesses need to develop strategies to navigate these uncertainties, such as diversification of sourcing and shipping routes.

- Political Instability: Political instability can impact shipping routes, schedules, and overall costs.

Global Supply Chain Disruptions

Global events beyond bilateral trade relations can disrupt China to US container shipping.

- Pandemics: The COVID-19 pandemic highlighted the vulnerability of global supply chains, causing significant disruptions to shipping.

- Natural Disasters: Natural disasters, such as earthquakes or hurricanes, can also disrupt shipping routes and schedules.

- Building Resilience: Businesses need to develop strategies to build resilience and mitigate risks associated with global supply chain disruptions.

Conclusion

The China to US container shipping market is complex and dynamic. Understanding trends in shipping costs, technological advancements, and geopolitical influences is crucial for businesses. By leveraging insights and adopting strategies to mitigate risks, companies can navigate this market effectively and optimize their supply chains. To stay informed on the latest developments in China to US container shipping, continue researching current market trends and consult with logistics professionals like Payden & Rygel for expert guidance.

Featured Posts

-

Ufc 313 Pereira Vs Ankalaev This Weekends Fight Card

May 19, 2025

Ufc 313 Pereira Vs Ankalaev This Weekends Fight Card

May 19, 2025 -

Accountability Sought Restaurant Owners Stolen Dream

May 19, 2025

Accountability Sought Restaurant Owners Stolen Dream

May 19, 2025 -

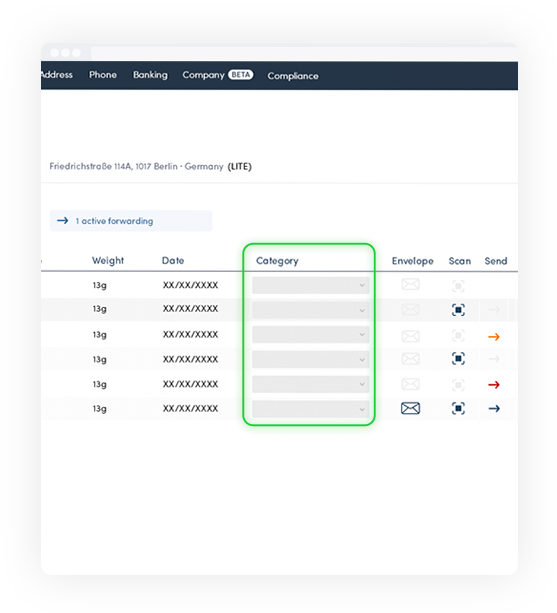

Royal Mails Solar Powered Digital Postboxes A New Era In Postal Delivery

May 19, 2025

Royal Mails Solar Powered Digital Postboxes A New Era In Postal Delivery

May 19, 2025 -

New Photo Jennifer Lawrence And Cooke Maroney Following Second Baby Reports

May 19, 2025

New Photo Jennifer Lawrence And Cooke Maroney Following Second Baby Reports

May 19, 2025 -

Reduced Library Services The Fallout From The Trump Era

May 19, 2025

Reduced Library Services The Fallout From The Trump Era

May 19, 2025