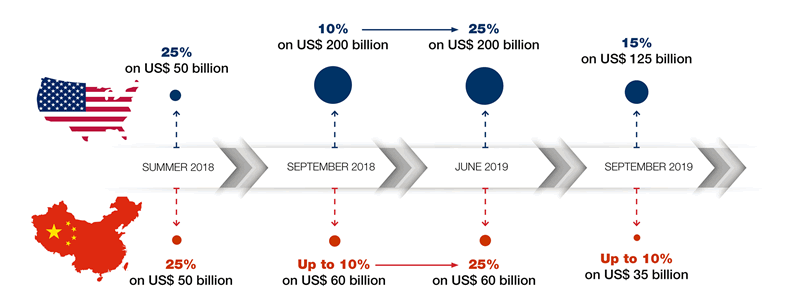

Persistent Trade War: Analysts Forecast 30% Tariffs On Chinese Imports Until 2025

Table of Contents

The 30% Tariff Forecast: A Deep Dive

Methodology and Sources

The 30% tariff forecast stems from a convergence of analyses from several leading economic forecasting firms, including [Insert Name of Firm 1] and [Insert Name of Firm 2]. Their methodologies generally rely on a combination of factors:

- Analysis of current tariff structures: Examining existing tariffs and their impact on trade flows.

- Modeling of future trade negotiations: Simulating potential outcomes of ongoing and future trade talks between the US and China.

- Assessment of geopolitical factors: Considering the influence of broader geopolitical dynamics on trade relations.

- Review of economic indicators: Analyzing key economic indicators like inflation, GDP growth, and consumer spending.

These firms considered various economic indicators, such as inflation rates in both countries, the performance of key export sectors in China, and shifts in global supply chains. While specific reports may be behind paywalls, the consensus among these analysts points towards a sustained period of high tariffs. [Insert link to relevant public reports if available].

Products Affected

The 30% tariff is expected to impact a wide array of Chinese imports. Major product categories include:

- Electronics: Smartphones, laptops, consumer electronics components.

- Textiles and Apparel: Clothing, fabrics, footwear.

- Machinery: Industrial machinery, manufacturing equipment.

- Furniture: Home furnishings, office furniture.

- Toys and Games: A broad range of consumer products.

Specific products will be affected based on the specifics of the tariff schedules, and some exemptions or changes may occur, but the overall impact on these sectors is projected to be substantial.

Economic Impact of Prolonged Tariffs

Inflationary Pressures

The sustained 30% tariffs on Chinese imports will undoubtedly exert significant inflationary pressure on the US economy. Consumers can expect to see price increases in various sectors:

- Electronics: Increased prices on smartphones and laptops.

- Apparel: Higher costs for clothing and footwear.

- Furniture: More expensive home furnishings.

These price increases will likely impact consumer spending and could contribute to a slowdown in economic growth. [Insert link to relevant economic data and reports supporting potential price increases]. The ripple effect throughout the supply chain means inflation may be felt more widely.

Impact on Businesses

American businesses reliant on Chinese imports will face significant challenges. These include:

- Increased input costs: Higher prices for raw materials and components.

- Reduced competitiveness: Higher production costs, making it harder to compete with rivals.

- Supply chain disruptions: Delays and uncertainties in sourcing goods.

Chinese businesses will also suffer, experiencing reduced export revenues and potentially needing to adjust production strategies to account for diminished US demand. Businesses may need to explore various mitigation strategies:

- Diversifying sourcing: Exploring alternative suppliers outside of China.

- Cost-cutting measures: Implementing efficiency improvements to offset increased costs.

- Investing in automation: Reducing reliance on labor-intensive processes.

Geopolitical Implications

The persistent trade war carries significant geopolitical consequences:

- Strained US-China relations: Further deterioration of diplomatic ties.

- Impact on global trade relations: Uncertainty and decreased international trade cooperation.

- Potential for escalation: The risk of further tariff increases or trade restrictions.

The prolonged conflict could slow global economic growth and increase instability in the international trading system.

Potential Scenarios and Future Outlook

Best-Case Scenario

A best-case scenario involves a negotiated agreement between the US and China, leading to a significant reduction in tariffs before 2025. This might be triggered by:

- A shift in political leadership in either country.

- A significant economic downturn impacting both economies.

- Increased pressure from other global powers to de-escalate.

Such a scenario would lead to lower inflation, increased consumer spending, and boosted economic growth.

Worst-Case Scenario

A pessimistic outlook sees the 30% tariffs persisting or even increasing, leading to:

- Increased inflation and reduced consumer spending.

- Significant supply chain disruptions.

- Long-term damage to US-China relations.

- Increased global economic instability.

This could have a devastating impact on numerous economic sectors and potentially lead to global recessionary pressures.

Conclusion

The forecast of a 30% tariff on Chinese imports until 2025 paints a concerning picture. The potential economic and geopolitical consequences are significant, ranging from increased inflation and supply chain disruptions to strained international relations and reduced global growth. The prolonged nature of this persistent trade war necessitates careful monitoring and proactive strategies from businesses and policymakers alike.

Stay updated on the persistent trade war by following relevant economic news and reports. Monitor the impact of these China tariffs on your industry and business. Learn more about the 2025 trade outlook and its potential implications for your sector. Understanding the evolving dynamics of this US-China trade relationship is crucial for navigating the challenges and opportunities ahead.

Featured Posts

-

Ofcom Regulation Royal Mails Plea For Change

May 19, 2025

Ofcom Regulation Royal Mails Plea For Change

May 19, 2025 -

Postoje Li Sanse Za Popravak Marka Bosnjaka Analiza Kladionica

May 19, 2025

Postoje Li Sanse Za Popravak Marka Bosnjaka Analiza Kladionica

May 19, 2025 -

Unc Tar Heels Sports Roundup March 3 9

May 19, 2025

Unc Tar Heels Sports Roundup March 3 9

May 19, 2025 -

Nyt Connections Puzzle 674 Solutions April 15th

May 19, 2025

Nyt Connections Puzzle 674 Solutions April 15th

May 19, 2025 -

North Carolina Tar Heels Sports Roundup March 10 16

May 19, 2025

North Carolina Tar Heels Sports Roundup March 10 16

May 19, 2025