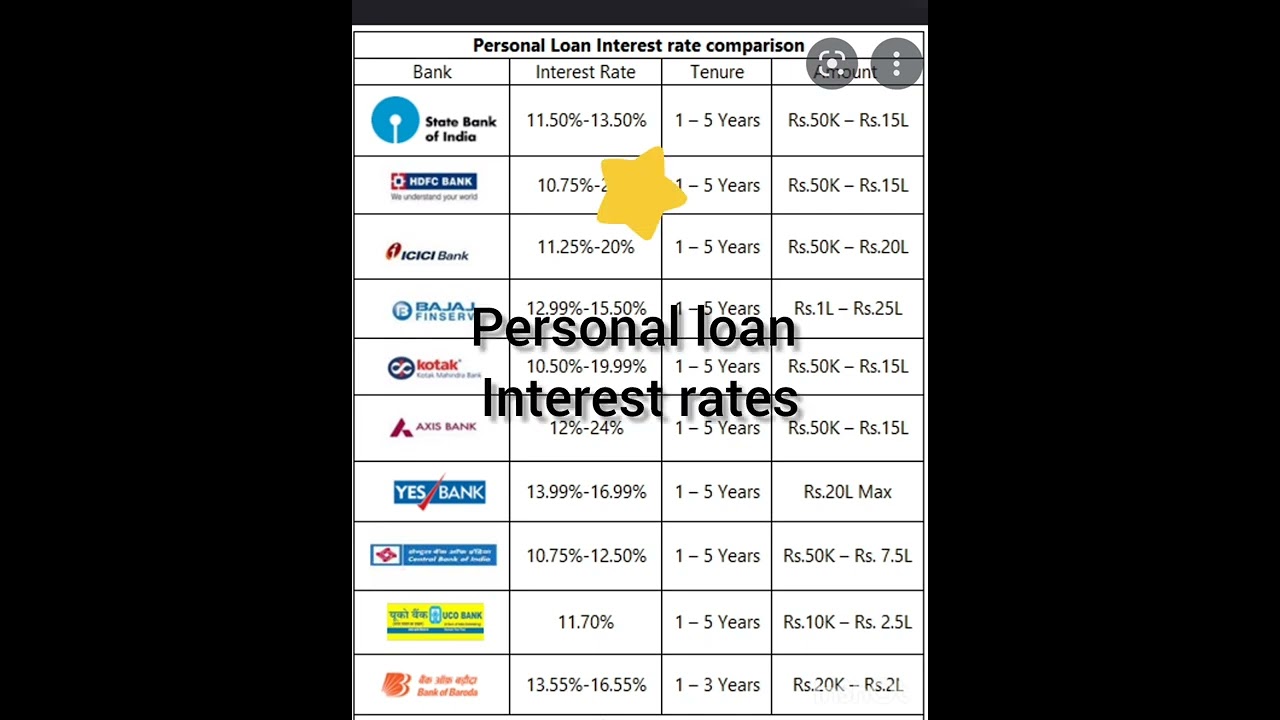

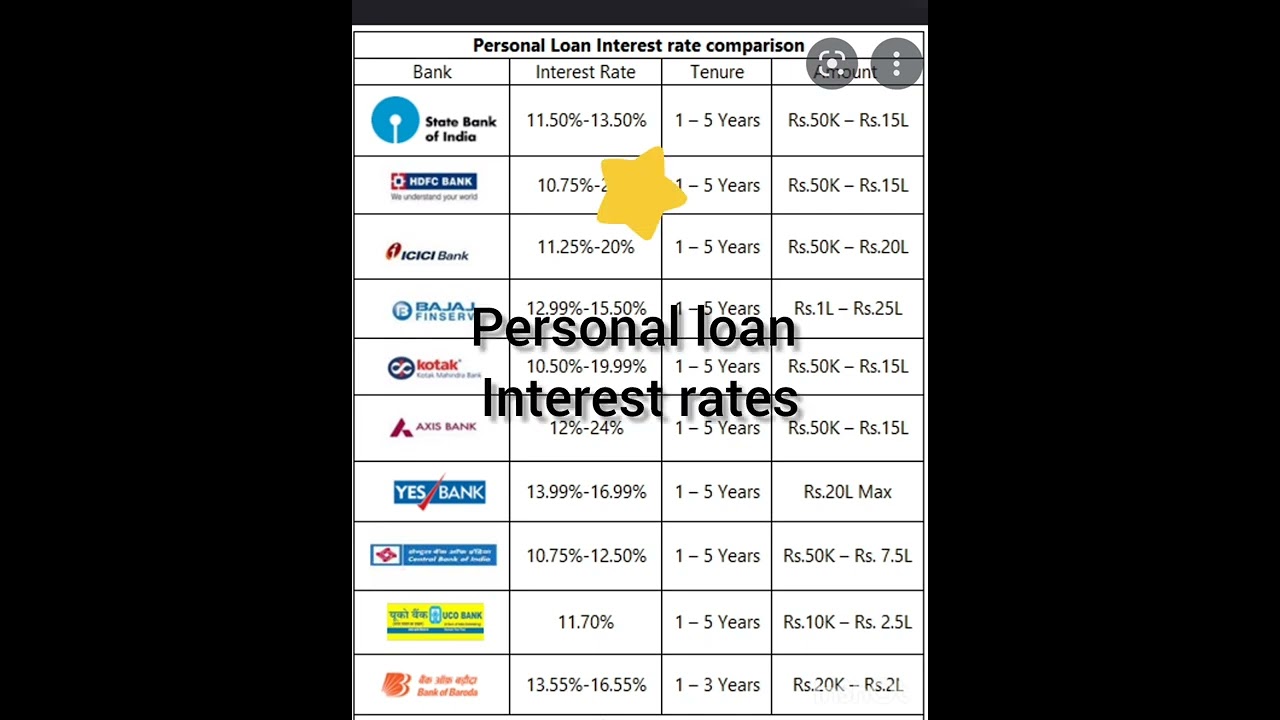

Personal Loan Interest Rates Today: A Quick Comparison

Table of Contents

Factors Affecting Personal Loan Interest Rates Today

Several factors interplay to determine the personal loan interest rates you’ll receive. Understanding these factors allows you to improve your chances of securing a lower rate.

Credit Score's Impact

Your credit score is arguably the most significant factor influencing your interest rate. Lenders use your credit history to assess your creditworthiness and risk. A higher credit score signifies lower risk, resulting in more favorable interest rates.

-

Credit Score Ranges and Interest Rates:

- 750+: Potentially the lowest interest rates available.

- 700-749: Favorable interest rates.

- 650-699: Higher interest rates than those with higher scores.

- Below 650: Significantly higher interest rates or potential loan rejection. These rates can drastically increase the overall cost of the loan.

-

Tips for Improving Your Credit Score:

- Pay bills on time consistently.

- Keep credit utilization low (ideally below 30%).

- Monitor your credit reports regularly for errors.

- Consider a secured credit card to build credit if you have limited history.

Loan Amount and Term

The amount you borrow and the repayment period (loan term) significantly affect your interest rate. Larger loan amounts and longer terms generally result in higher interest rates due to increased risk for the lender.

- Illustrative Examples:

- A $10,000 loan over 3 years might have a lower interest rate than a $20,000 loan over 5 years.

- A shorter loan term means higher monthly payments but lower overall interest paid.

Lender Type and Market Conditions

Different lenders offer varying personal loan interest rates. Banks, credit unions, and online lenders each have their own pricing models and criteria. Prevailing economic conditions also play a crucial role.

-

Lender Types:

- Banks: Often offer competitive rates but may have stricter eligibility requirements.

- Credit Unions: May offer lower rates to members, but membership requirements might apply.

- Online Lenders: Provide convenience and potentially competitive rates, but it's important to carefully compare fees and terms.

-

Market Trends: Inflation and central bank policies directly influence interest rates. Higher inflation generally leads to higher interest rates.

Your Income and Debt-to-Income Ratio

Lenders assess your income and debt-to-income (DTI) ratio to determine your ability to repay the loan. A higher DTI ratio (debt relative to income) suggests higher risk, potentially leading to a higher interest rate or even loan rejection.

- Improving Your DTI Ratio:

- Reduce existing debt (credit cards, other loans).

- Increase your income.

How to Compare Personal Loan Interest Rates Effectively

Comparing personal loan interest rates effectively is crucial to finding the best deal. Don't just focus on the advertised rate; consider the complete picture.

Using Online Comparison Tools

Online comparison tools streamline the process of finding competitive offers. However, use caution, and be aware of limitations.

- Reliable Comparison Sites: Several reputable websites provide comparison tools, but always verify information directly with the lender.

- Important Considerations: Pay close attention to fees (origination fees, prepayment penalties) as these can impact the overall cost.

Checking APR (Annual Percentage Rate)

The APR is a crucial factor to consider. It represents the annual cost of borrowing, including interest and fees. A higher APR means a more expensive loan.

- Understanding APR: It provides a standardized measure for comparing different loan offers.

- APR Impact: Even small differences in APR can significantly increase the total cost over the loan term.

Reading the Fine Print

Before signing any loan agreement, carefully review the terms and conditions.

- Key Clauses: Pay close attention to prepayment penalties, late payment fees, and other potential charges.

Conclusion: Finding the Best Personal Loan Interest Rates Today

Securing the best personal loan interest rates today requires understanding the various factors that influence them and employing effective comparison strategies. Your credit score, loan amount, lender type, market conditions, income, and DTI ratio all play a vital role. Remember to meticulously compare APRs and thoroughly read the fine print before committing to a loan. Start comparing personal loan interest rates today to find the best deal for your financial needs! Don't delay – securing the right personal loan can significantly impact your financial future.

Featured Posts

-

Bianca Censoris Revealing Outfit Fans React To Kanye Wests Wifes Style

May 28, 2025

Bianca Censoris Revealing Outfit Fans React To Kanye Wests Wifes Style

May 28, 2025 -

Nintendos Bold New Era A Calculated Gamble

May 28, 2025

Nintendos Bold New Era A Calculated Gamble

May 28, 2025 -

Arraez Vs Carpenter Phillies Mets Opener Showdown

May 28, 2025

Arraez Vs Carpenter Phillies Mets Opener Showdown

May 28, 2025 -

Ronaldodan Cok Cirkinsin Yorumlarina Net Bir Yanit

May 28, 2025

Ronaldodan Cok Cirkinsin Yorumlarina Net Bir Yanit

May 28, 2025 -

Bob Nuttings Ownership Hurting More Than Just Paul Skenes

May 28, 2025

Bob Nuttings Ownership Hurting More Than Just Paul Skenes

May 28, 2025

Latest Posts

-

Droits De Douane Calcul Declaration Et Reglementation

May 30, 2025

Droits De Douane Calcul Declaration Et Reglementation

May 30, 2025 -

Declaration De Philippe Tabarot Sur La Greve Et Les Revendications A La Sncf

May 30, 2025

Declaration De Philippe Tabarot Sur La Greve Et Les Revendications A La Sncf

May 30, 2025 -

Droits De Douane Mode D Emploi Et Procedures

May 30, 2025

Droits De Douane Mode D Emploi Et Procedures

May 30, 2025 -

Greve A La Sncf Le Depute Philippe Tabarot S Exprime Sur Les Revendications

May 30, 2025

Greve A La Sncf Le Depute Philippe Tabarot S Exprime Sur Les Revendications

May 30, 2025 -

Comprendre Les Droits De Douane Un Guide Pratique

May 30, 2025

Comprendre Les Droits De Douane Un Guide Pratique

May 30, 2025