Podcast: Enjoy Low Inflation While It Lasts

Table of Contents

Understanding the Current Low Inflation Environment

Low inflation, characterized by a slow and steady increase in the general price level of goods and services, presents a unique opportunity for financial planning. Currently, we are experiencing a period of relatively low inflation rates. Several factors contribute to this environment, including global economic conditions, technological advancements that increase efficiency and reduce production costs, and changes in consumer behavior.

- Current inflation rates and comparison to historical data: While specific numbers vary by region and are constantly updated, comparing current inflation rates (like the Consumer Price Index or CPI) to historical data reveals the current relatively low levels. This allows us to appreciate the current favorable economic climate.

- Key indicators of low inflation (e.g., Consumer Price Index (CPI)): The CPI is a key indicator widely used to measure inflation. Monitoring its movement provides valuable insights into the overall price stability of the economy. Other indicators, such as the Producer Price Index (PPI), also provide a comprehensive view of inflation rates.

- Potential risks associated with prolonged low inflation (e.g., deflation): While low inflation is generally positive, prolonged periods can lead to deflation – a sustained decrease in the general price level. Deflation can discourage spending and investment, potentially harming economic growth.

Strategic Financial Moves During Low Inflation

Low inflation presents a window of opportunity to strengthen your financial position. With price increases subdued, you can make impactful moves toward your financial goals.

- Investing in assets that appreciate in value (e.g., real estate, stocks): Low inflation typically means low interest rates, which can make borrowing cheaper and boost asset prices. Real estate and stocks often perform well in low-inflation environments. However, it's crucial to conduct thorough research and diversify your investment portfolio.

- Paying down high-interest debt (e.g., credit card debt): Low interest rates might not directly affect high-interest debt, but the improved economic climate often provides more disposable income, allowing you to focus on debt reduction and improving your credit score.

- Saving and building an emergency fund: Periods of price stability are ideal for building a substantial emergency fund. With less worry about rapidly rising prices, you can allocate more of your income towards savings.

- Exploring fixed-income investments benefiting from low interest rates: Low interest rates can make fixed-income investments, such as bonds, less attractive in terms of yield. However, they offer relative stability during periods of low inflation and can play a role in a diversified portfolio.

Preparing for Potential Inflationary Shifts

While currently enjoying low inflation, it's crucial to remember that economic conditions are dynamic. Preparing for potential inflationary shifts is essential for long-term financial security.

- Diversifying investments to mitigate inflation risk: Diversification is key to managing inflation risk. Include assets that historically perform well during inflationary periods, such as commodities or inflation-protected securities.

- Monitoring economic indicators and news related to inflation: Stay informed about economic indicators such as the CPI, PPI, and interest rate changes. This will help you anticipate potential shifts in the inflation rate.

- Adjusting spending habits and budgeting strategies: Even during low inflation, maintaining a balanced budget and mindful spending habits are crucial. This will help you adapt quickly if inflation increases.

- Understanding inflation-protected securities: Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), are designed to adjust their value based on inflation, providing a hedge against rising prices.

Capitalize on Low Inflation Now – A Call to Action

Low inflation offers a valuable opportunity to improve your financial well-being. By strategically managing your debt, investing wisely, and preparing for potential future changes, you can significantly enhance your financial security. Seize this period of price stability to build a stronger financial foundation. Don't wait – start implementing the strategies discussed today! To learn more about navigating low inflation and other crucial financial planning topics, explore additional resources and consider listening to our podcast for in-depth analysis and expert advice. Start your low inflation planning today and build a more secure financial future.

Featured Posts

-

Mirnye Peregovory Davlenie Trampa Na Putina

May 27, 2025

Mirnye Peregovory Davlenie Trampa Na Putina

May 27, 2025 -

Understanding The Health Dangers Of Synthetic Hair Braids For Black Women

May 27, 2025

Understanding The Health Dangers Of Synthetic Hair Braids For Black Women

May 27, 2025 -

Mob Land Episode 9 Release Schedule And Streaming Options

May 27, 2025

Mob Land Episode 9 Release Schedule And Streaming Options

May 27, 2025 -

May 2025 Gucci Release Re Web Gradient Blue Gg Supreme 838949 Faev 58460

May 27, 2025

May 2025 Gucci Release Re Web Gradient Blue Gg Supreme 838949 Faev 58460

May 27, 2025 -

Nevidstupnist Putina Isw Pro Peremovini Z Ukrayinoyu

May 27, 2025

Nevidstupnist Putina Isw Pro Peremovini Z Ukrayinoyu

May 27, 2025

Latest Posts

-

De Laatste Dagen Van Het Derde Rijk Een Analyse Van Bert Natters Roman

May 31, 2025

De Laatste Dagen Van Het Derde Rijk Een Analyse Van Bert Natters Roman

May 31, 2025 -

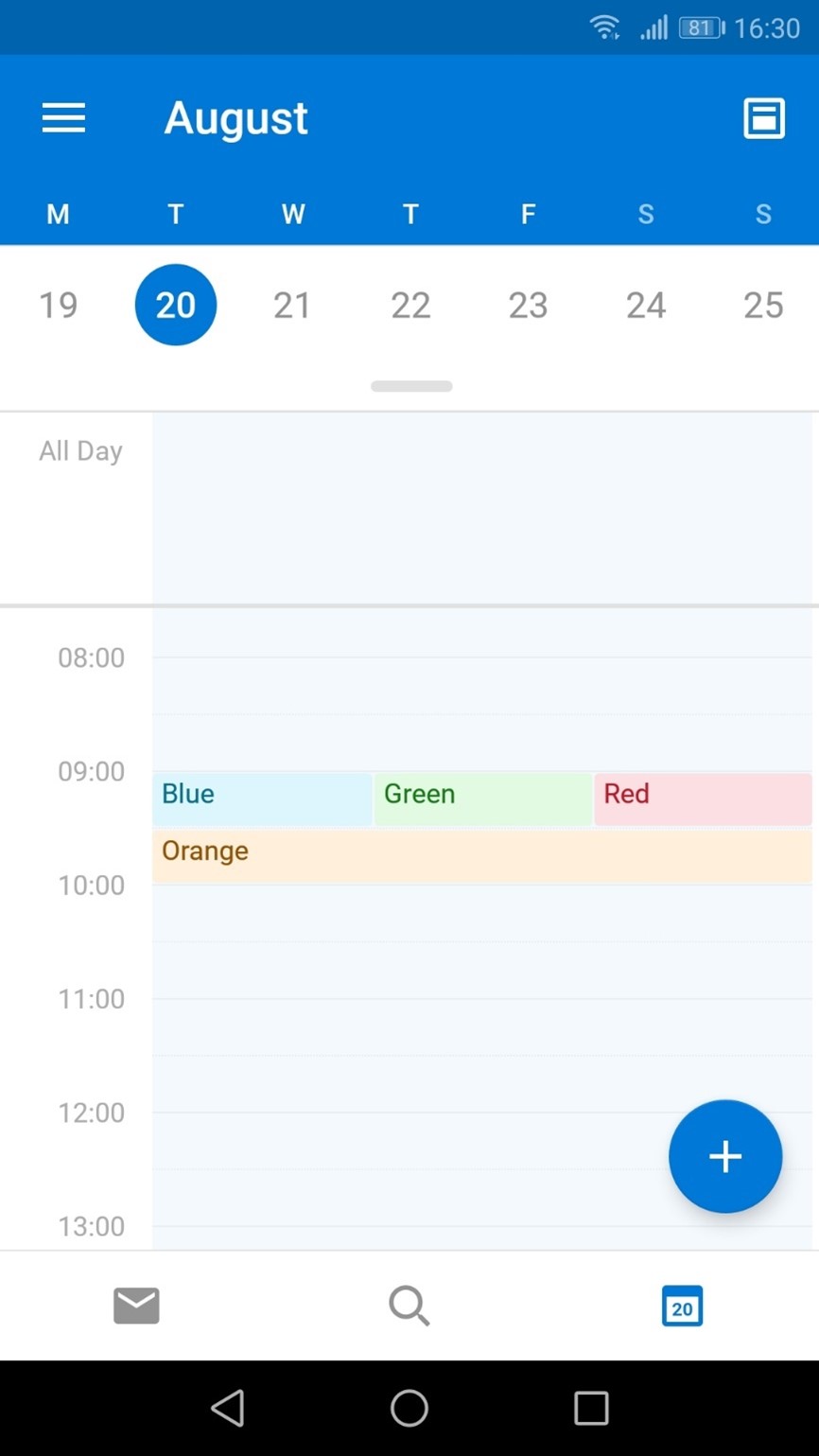

Understanding The Newest April Outlook Features

May 31, 2025

Understanding The Newest April Outlook Features

May 31, 2025 -

Recensie Bert Natters Concentratiekamproman Dodelijk Vermoeiend Maar Indrukwekkend

May 31, 2025

Recensie Bert Natters Concentratiekamproman Dodelijk Vermoeiend Maar Indrukwekkend

May 31, 2025 -

New In April Essential Outlook Updates

May 31, 2025

New In April Essential Outlook Updates

May 31, 2025 -

Latest April Outlook Updates And Features

May 31, 2025

Latest April Outlook Updates And Features

May 31, 2025