Podcast: Forget Everything You Know About Money

Table of Contents

Debunking Common Financial Myths

Many of us operate on outdated financial advice, hindering our progress towards financial freedom. This podcast directly confronts these misconceptions, starting with some of the most pervasive myths.

The Myth of the "Safe" Investment

The idea of a truly "risk-free" investment is often a misconception. While savings accounts and CDs (Certificates of Deposit) are considered relatively safe, they often offer paltry returns, especially in low-interest-rate environments. Their low returns often fail to outpace inflation, meaning your money loses purchasing power over time.

- Limitations of Savings Accounts and CDs: Low interest rates rarely keep pace with inflation, eroding your savings' purchasing power.

- Understanding Risk Tolerance and Asset Allocation: Your investment strategy should align with your risk tolerance. Diversifying your portfolio across different asset classes is crucial to mitigating risk.

- Alternative Investment Options: Explore options like index funds, ETFs (Exchange Traded Funds), bonds, and real estate to potentially achieve higher returns, while still considering your risk profile.

The "Get Rich Quick" Scheme Fallacy

The allure of instant wealth is tempting, but "get-rich-quick" schemes rarely deliver on their promises. These schemes often prey on individuals' desire for rapid financial gains, leading to significant financial losses.

- Common Scams and Fraudulent Investment Opportunities: Be wary of unsolicited investment offers promising unusually high returns with minimal risk. Thorough research is vital.

- Importance of Long-Term Financial Planning and Patience: Building wealth is a marathon, not a sprint. Sustainable growth requires a long-term perspective and disciplined saving and investing.

- Value of Due Diligence and Independent Research: Always independently verify any investment opportunity before committing your funds. Consult with a qualified financial advisor.

The Danger of Ignoring Debt

High-interest debt, like credit card debt, can be crippling. Ignoring it only exacerbates the problem. Understanding and actively managing debt is crucial for financial health.

- Debt Management Strategies: Explore methods like the debt snowball (paying off smallest debts first for motivation) and the debt avalanche (paying off highest-interest debts first for faster savings).

- Importance of Budgeting and Creating a Realistic Debt Repayment Plan: A well-defined budget is fundamental to debt management. Allocate funds specifically for debt repayment.

- Benefits of Seeking Professional Financial Advice: A financial advisor can help create a personalized debt reduction strategy tailored to your financial situation.

Building a Solid Financial Foundation

Once you've addressed existing debt and debunked harmful myths, you can focus on building a robust financial foundation.

The Power of Budgeting and Saving

Effective budgeting and consistent saving are cornerstones of financial security. They allow you to control your finances and achieve your financial goals.

- Budgeting Methods: Explore the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt repayment) or zero-based budgeting (allocating every dollar).

- Setting Financial Goals (Short-Term and Long-Term): Defining clear goals – from a down payment on a house to retirement – provides direction and motivation.

- Power of Compound Interest: The magic of compound interest allows your earnings to generate further earnings, significantly accelerating wealth accumulation over time.

Investing for the Future

Investing your savings wisely is crucial for long-term wealth creation. Diversification across different asset classes reduces risk.

- Different Investment Strategies: Explore stocks (ownership in companies), bonds (loans to companies or governments), and real estate (property investment).

- Risks and Rewards of Different Investment Options: Understand the potential for both gains and losses associated with each investment type.

- Index Funds and ETFs as Diversified Investment Options: These offer diversified exposure to a broad market segment, simplifying investment and reducing risk.

Protecting Your Assets

Protecting your assets through insurance and estate planning is as important as accumulating them.

- Different Types of Insurance: Consider health, life, and disability insurance to safeguard against unforeseen events.

- Importance of Having a Will and Estate Plan: A will ensures your assets are distributed according to your wishes, while estate planning protects your family's financial future.

- Benefits of Working with a Financial Planner: A financial planner can provide guidance on insurance, estate planning, and other financial matters.

Conclusion

This podcast, "Forget Everything You Know About Money," challenges conventional financial wisdom and provides you with the tools and knowledge to build a strong financial foundation. By debunking common myths and exploring innovative strategies, we empower you to take control of your finances and achieve your financial goals. Listen now and start your journey to financial freedom! Don't forget to subscribe to "Forget Everything You Know About Money" for more insightful episodes on personal finance and wealth building! Learn how to truly Forget Everything You Know About Money and start building a better financial future.

Featured Posts

-

Severe Storm Alerts Know The Difference Between Active And Expired In The Carolinas

May 31, 2025

Severe Storm Alerts Know The Difference Between Active And Expired In The Carolinas

May 31, 2025 -

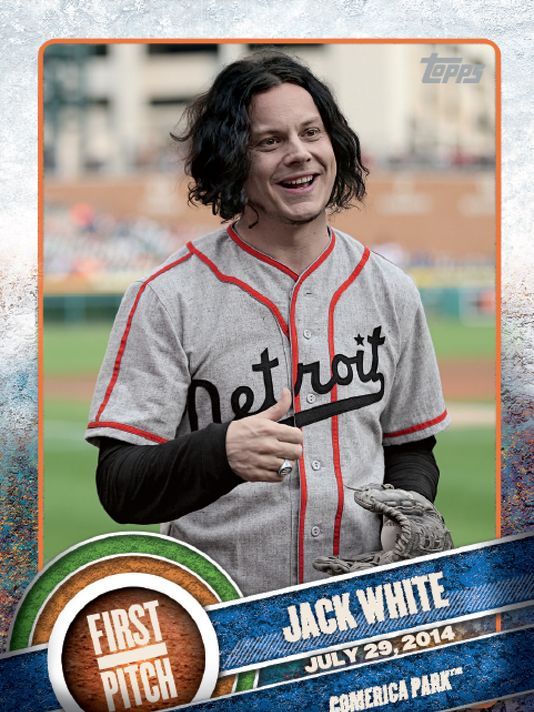

Detroit Tigers Game Features Jack White Baseball Discussion And Hall Of Fame Reflections

May 31, 2025

Detroit Tigers Game Features Jack White Baseball Discussion And Hall Of Fame Reflections

May 31, 2025 -

Newly Discovered Mayan City 3 000 Year Old Pyramids And Canal System

May 31, 2025

Newly Discovered Mayan City 3 000 Year Old Pyramids And Canal System

May 31, 2025 -

Brandon Inge Back In The Dugout One Night Kalamazoo Game

May 31, 2025

Brandon Inge Back In The Dugout One Night Kalamazoo Game

May 31, 2025 -

Building A Good Life Strategies For Wellbeing And Success

May 31, 2025

Building A Good Life Strategies For Wellbeing And Success

May 31, 2025