Podcast: Riding The Wave Of Low Inflation

Table of Contents

The Causes of Low Inflation

Several interconnected factors contribute to the current low inflation environment.

Global Economic Factors

The global economy has experienced periods of slowdown, impacting demand and subsequently, inflation. Decreased consumer and business demand leads to reduced pressure on prices, a phenomenon often referred to as demand-pull inflation. Conversely, cost-push inflation, driven by rising production costs, is less prevalent due to globalized supply chains and technological advancements.

- Global Economic Slowdown: Reduced economic activity in key global markets lessens demand for goods and services.

- Decreased Demand: Lower consumer confidence and spending contribute to lower price pressures.

- Technological Advancements: Automation and innovation often lead to increased efficiency and lower production costs, suppressing inflation.

- Globalization: Increased competition from global markets keeps prices relatively low.

Monetary Policy Influence

Central banks play a significant role in managing inflation through monetary policy. Tools like interest rate adjustments and quantitative easing (QE) directly impact inflation levels.

- Interest Rate Adjustments: Lowering interest rates makes borrowing cheaper, stimulating spending and potentially increasing inflation. Conversely, higher rates curb spending.

- Quantitative Easing (QE): This involves central banks injecting liquidity into the market by purchasing assets, influencing inflation indirectly.

- Inflation Targeting: Many central banks have explicit inflation targets, aiming to maintain price stability within a specific range.

Supply-Side Factors

Increased productivity, automation, and intensified global competition have significantly impacted pricing and inflation.

- Productivity Gains: Higher productivity allows companies to produce more with fewer resources, potentially lowering costs and prices.

- Automation: Automation reduces labor costs and increases efficiency, contributing to lower prices for many goods.

- Global Competition: Increased global competition forces businesses to offer more competitive pricing to stay afloat.

- Supply Chain Efficiency: Optimized supply chains reduce costs associated with transportation and logistics, which contributes to lower prices.

Opportunities in a Low Inflation Environment

Low inflation presents several opportunities for both investors and consumers.

Investing Strategies

A low-inflation environment can be favorable for certain investment strategies.

- Bonds: Low inflation generally increases the attractiveness of fixed-income investments like bonds.

- Real Estate: Real estate can often perform well in a low-inflation environment, particularly if rental income keeps pace with or exceeds inflation.

- Equities: While not always guaranteed, certain equity sectors may benefit from low inflation, particularly those less sensitive to interest rate changes.

- Portfolio Diversification: It's crucial to diversify your investment portfolio to mitigate risk across various asset classes.

- Risk Management: Even in a low-inflation environment, it's essential to carefully assess and manage the risks associated with any investment.

Consumer Spending Habits

Low inflation can boost consumer purchasing power.

- Increased Purchasing Power: With prices remaining relatively stable, consumers can stretch their budgets further.

- Saving Strategies: Low inflation makes saving easier as the value of savings is less eroded over time.

- Budgeting: Careful budgeting allows consumers to maximize their spending and savings during periods of low inflation.

- Financial Planning: Long-term financial planning becomes more predictable in a stable, low-inflation environment.

Potential Risks and Challenges of Low Inflation

While low inflation often presents opportunities, it also carries potential risks.

Deflationary Risks

Persistent low inflation can potentially lead to deflation, a broad decline in prices.

- Deflation: Deflation can discourage spending as consumers anticipate further price drops, leading to a vicious cycle of decreased demand and further price declines.

- Economic Recession: Deflation can trigger an economic recession by reducing business investment and employment.

- Liquidity Trap: Deflation can make monetary policy less effective, as interest rates can't be lowered beyond zero.

Impact on Wages and Employment

Low inflation can affect wages, employment, and income inequality.

- Wage Growth: Low inflation may suppress wage growth, especially if productivity gains are not evenly distributed.

- Employment Rates: While not always a direct correlation, sustained low inflation can indicate a lack of economic dynamism, potentially impacting job creation.

- Income Inequality: Low inflation can exacerbate income inequality if wage growth lags behind productivity growth.

Conclusion: Navigating the Low Inflation Landscape

Understanding the dynamics of a low-inflation environment is critical for making informed financial decisions. This podcast has explored the multifaceted causes of low inflation, highlighting both the opportunities and the potential challenges. By understanding these dynamics, both investors and consumers can better position themselves to thrive in this economic climate.

To actively manage your finances in a low-inflation environment, consider diversifying your investment portfolio, adopting smart consumer spending habits, and staying informed about the latest economic trends. Subscribe to our podcast for further updates on low inflation and related economic topics! Share this article with your friends and family, and leave a comment below to share your thoughts and experiences in navigating the current low inflation environment. Learn how to thrive in low inflation – listen now and take control of your financial future!

Featured Posts

-

Psgs Path To A Historic 13th Ligue 1 Championship

May 27, 2025

Psgs Path To A Historic 13th Ligue 1 Championship

May 27, 2025 -

Stansted Airport Adds New International Route

May 27, 2025

Stansted Airport Adds New International Route

May 27, 2025 -

Xalkidiki Listes Epitithentai Se Katoikia

May 27, 2025

Xalkidiki Listes Epitithentai Se Katoikia

May 27, 2025 -

Billionaire Investor Eyes Hudsons Bay For New B C Shopping Mall

May 27, 2025

Billionaire Investor Eyes Hudsons Bay For New B C Shopping Mall

May 27, 2025 -

All Alien Movies Streaming On Hulu June 1st Your Guide

May 27, 2025

All Alien Movies Streaming On Hulu June 1st Your Guide

May 27, 2025

Latest Posts

-

Replay Loeil De Philippe Caveriviere Du 24 Avril 2025 Face A Philippe Tabarot Video

May 30, 2025

Replay Loeil De Philippe Caveriviere Du 24 Avril 2025 Face A Philippe Tabarot Video

May 30, 2025 -

Tunnel De Tende Le Ministre Tabarot Annonce Une Ouverture En Juin

May 30, 2025

Tunnel De Tende Le Ministre Tabarot Annonce Une Ouverture En Juin

May 30, 2025 -

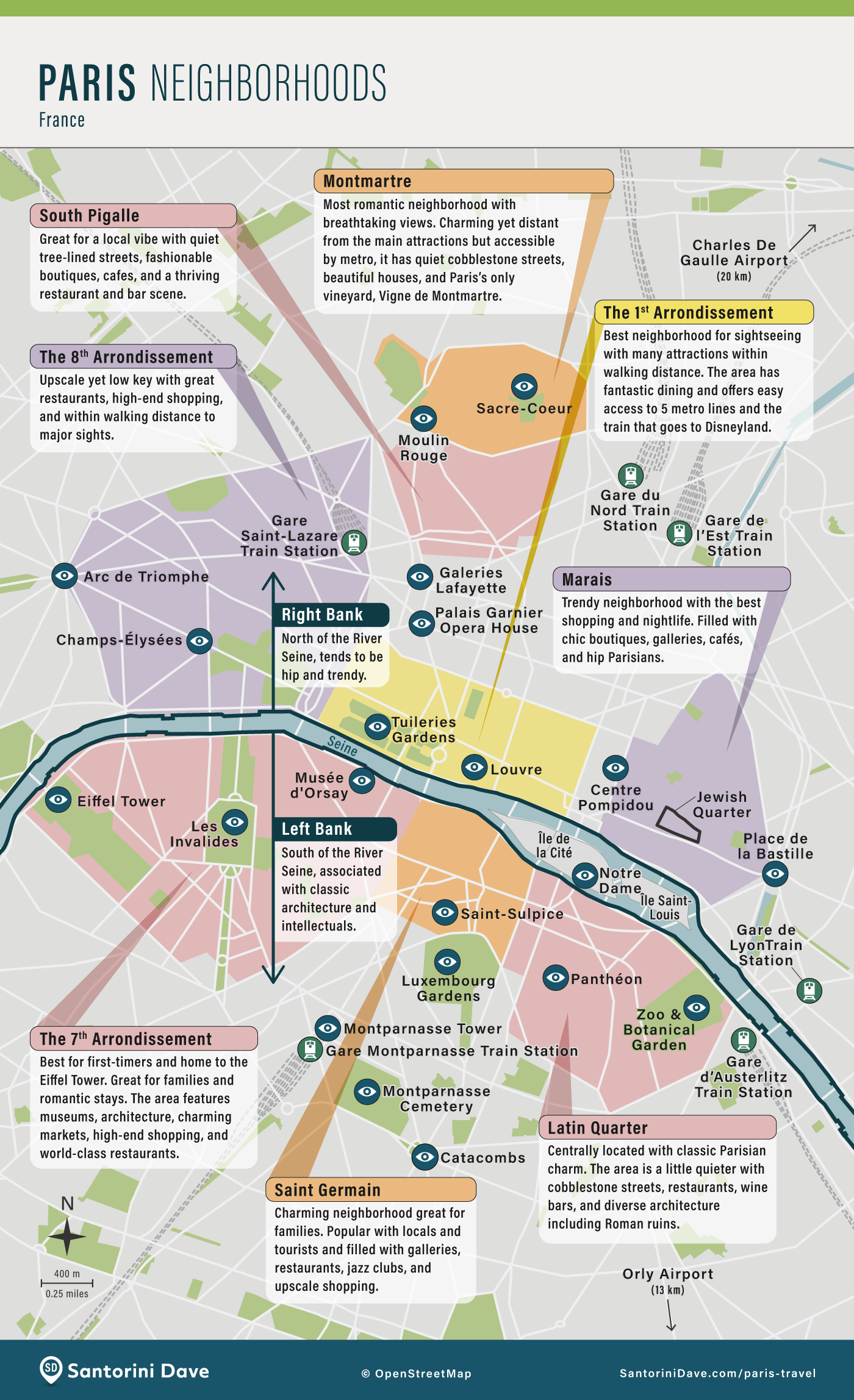

Exploring Paris A Guide To Its Most Popular Neighborhoods

May 30, 2025

Exploring Paris A Guide To Its Most Popular Neighborhoods

May 30, 2025 -

Paris Neighborhoods Choosing The Right Area For Your Trip

May 30, 2025

Paris Neighborhoods Choosing The Right Area For Your Trip

May 30, 2025 -

Finding The Perfect Parisian Neighborhood An Insiders Guide

May 30, 2025

Finding The Perfect Parisian Neighborhood An Insiders Guide

May 30, 2025