Point72 Traders Exit As Emerging Markets-Focused Fund Closes

Table of Contents

Reasons Behind the Fund Closure

Several factors contributed to the closure of Point72's emerging markets fund. These include underperformance against benchmarks, increased market volatility, significant investment losses, potential flaws in risk management, and a shift in Point72's overall investment philosophy.

-

Underperformance: The fund consistently underperformed compared to its benchmarks and competitor funds specializing in emerging markets investments. This persistent underperformance eroded investor confidence and ultimately led to the decision to close the fund.

-

Market Volatility: Emerging markets are inherently volatile, subject to sudden shifts driven by geopolitical instability, macroeconomic fluctuations, and unpredictable regulatory changes. Recent events, such as escalating trade wars and rising interest rates in developed economies, exacerbated this volatility, impacting the fund's performance.

-

Significant Investment Losses: The fund suffered significant losses in specific sectors within emerging markets. These losses, potentially stemming from poor investment decisions or unforeseen events, further contributed to the fund's poor performance and the ultimate decision to close.

-

Risk Management Failures: Analysis suggests that the fund may have had weaknesses in its risk management strategies. Insufficient diversification, inadequate stress testing, or a failure to accurately assess geopolitical risks could have amplified losses during periods of market turbulence.

-

Shifting Investment Philosophy: Point72 may have reassessed its overall investment strategy, deciding to reallocate capital away from emerging markets to other areas perceived as offering better risk-adjusted returns. This strategic shift underscores the dynamic nature of the hedge fund industry and its constant adaptation to changing market conditions.

The Exodus of Point72 Traders

The closure of the fund triggered an exodus of key portfolio managers and traders from Point72. This talent migration highlights the competitive landscape within the hedge fund industry and the attractiveness of alternative opportunities for experienced professionals.

-

Departure of Key Personnel: Several experienced portfolio managers and traders, known for their expertise in emerging markets, left Point72 following the fund's closure. This loss of institutional knowledge and market insight represents a significant blow to the firm.

-

Impact on Future Investments: The departure of these skilled professionals reduces Point72's capacity and expertise in navigating the complexities of emerging markets investments. Their departure could impact the firm’s ability to successfully invest in these markets in the future.

-

Hedge Fund Competition: The competitive nature of the hedge fund industry plays a significant role in this talent migration. Rival firms aggressively recruit top talent, offering attractive compensation packages and promising career advancement opportunities.

-

Attractive Job Offers: Departing traders likely received compelling offers from competing hedge funds, private equity firms, or other financial institutions, making it difficult for Point72 to retain them.

-

Broader Trend: The movement of talent within the financial sector is a common occurrence, but the scale of departures following the fund's closure highlights the significant impact of this event.

Implications for the Emerging Markets Investment Sector

The closure of Point72's emerging markets fund and the subsequent trader exodus have broader implications for the investment sector. The event could impact investor sentiment, potentially leading to further fund closures and a shift in investment strategies.

-

Impact on Investor Sentiment: The closure may negatively impact investor sentiment towards emerging markets, prompting some investors to reduce their exposure to these regions. This could lead to capital flight and decreased investment opportunities in certain emerging economies.

-

Potential for Further Closures: Other hedge funds or institutional investors may re-evaluate their strategies in emerging markets, potentially leading to further fund closures or reduced investment allocations.

-

Shift in Investment Strategies: This event may trigger a shift in investment strategies by other hedge funds and institutional investors, with a greater emphasis on risk management and diversification across geographies.

-

Opportunities for Savvy Investors: The increased risk aversion may create opportunities for investors who can carefully assess and manage the risks associated with emerging market investments, identifying undervalued assets and potentially higher returns.

-

Macroeconomic and Geopolitical Factors: The future of emerging market investments will depend heavily on the interplay of macroeconomic factors, geopolitical stability, and the evolving regulatory environment in these regions.

Conclusion

The closure of Point72's emerging markets-focused fund and the subsequent departures of key traders represent a significant event in the hedge fund industry and the broader investment landscape. The reasons behind this shift are complex, involving underperformance, market volatility, and the evolving investment philosophies of major players. This event underscores the inherent risks and challenges in navigating the dynamic world of emerging markets investments. Staying informed about these trends is crucial for making informed investment decisions and understanding the complexities of the Point72 case and the wider emerging market investment landscape. Continue to monitor emerging market trends to refine your own investment strategies and successfully navigate this dynamic sector.

Featured Posts

-

Sinners How Cinematography Showcases The Mississippi Deltas Expanse

Apr 26, 2025

Sinners How Cinematography Showcases The Mississippi Deltas Expanse

Apr 26, 2025 -

Selling Sunset Star Speaks Out Against La Fire Price Gouging

Apr 26, 2025

Selling Sunset Star Speaks Out Against La Fire Price Gouging

Apr 26, 2025 -

Los Angeles Wildfires And The Ethics Of Disaster Gambling

Apr 26, 2025

Los Angeles Wildfires And The Ethics Of Disaster Gambling

Apr 26, 2025 -

Harvard Universitys Challenges Insights From A Conservative Professor

Apr 26, 2025

Harvard Universitys Challenges Insights From A Conservative Professor

Apr 26, 2025 -

Saving Harvard A Conservative Academics Proposal

Apr 26, 2025

Saving Harvard A Conservative Academics Proposal

Apr 26, 2025

Latest Posts

-

Chillin In Alaska Ariana Biermanns Couples Trip

Apr 27, 2025

Chillin In Alaska Ariana Biermanns Couples Trip

Apr 27, 2025 -

Ariana Biermanns Alaskan Vacation With Her Partner

Apr 27, 2025

Ariana Biermanns Alaskan Vacation With Her Partner

Apr 27, 2025 -

Alaska Adventure Ariana Biermanns Romantic Trip

Apr 27, 2025

Alaska Adventure Ariana Biermanns Romantic Trip

Apr 27, 2025 -

Ariana Biermanns Alaskan Adventure A Romantic Getaway

Apr 27, 2025

Ariana Biermanns Alaskan Adventure A Romantic Getaway

Apr 27, 2025 -

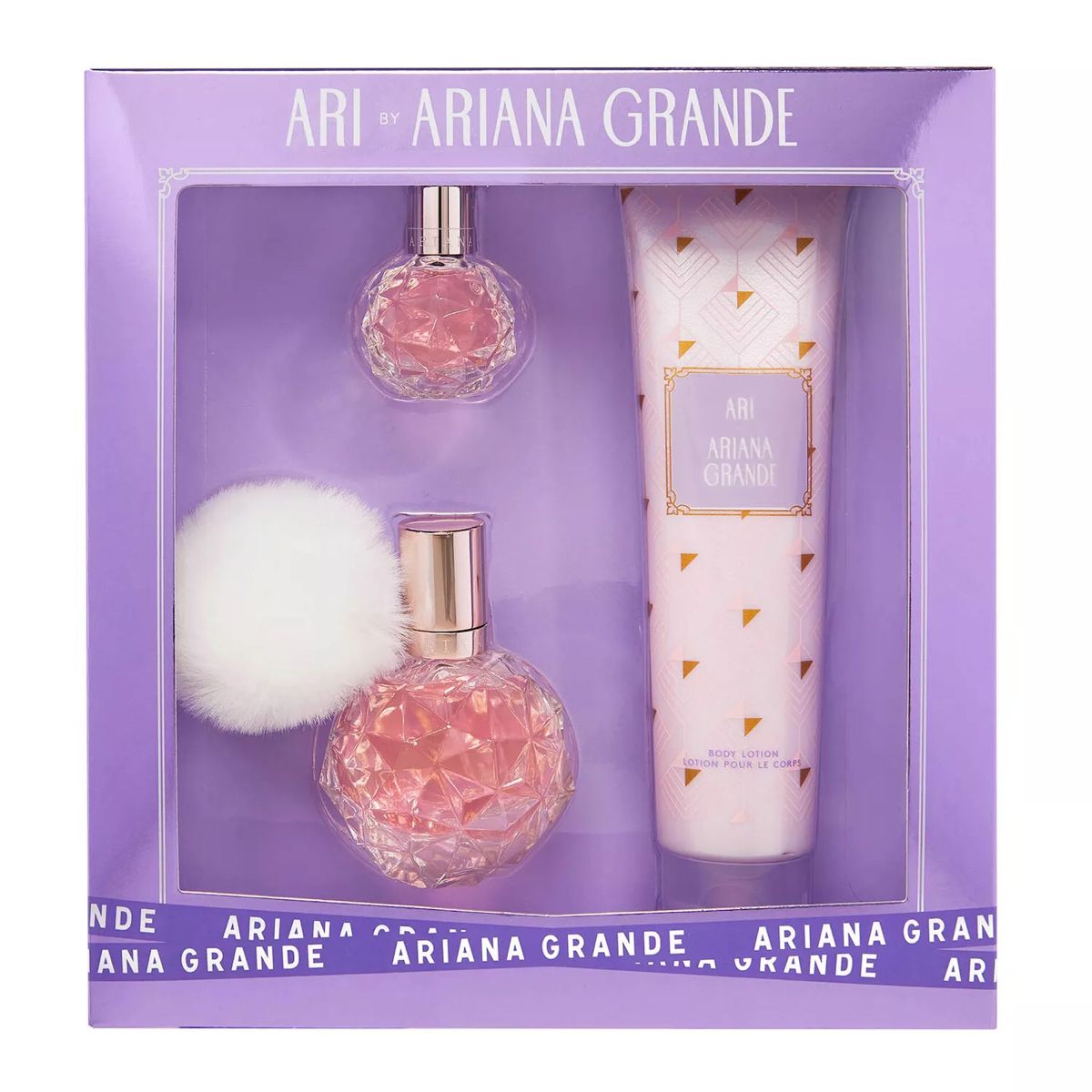

Ariana Grande Lovenote Fragrance Set Online Shopping Guide And Price Check

Apr 27, 2025

Ariana Grande Lovenote Fragrance Set Online Shopping Guide And Price Check

Apr 27, 2025