Post-Election Australian Asset Market Outlook: Analyst Insights

Table of Contents

Impact of Government Policies on Key Sectors

The new government's policies will have a cascading effect across various sectors, creating both challenges and opportunities for investors. Understanding these impacts is crucial for successful portfolio management in the post-election Australian asset market.

Infrastructure Spending

The government's commitment to infrastructure spending promises significant ripple effects. Increased investment in roads, rail, and utilities will translate into:

- Increased demand for construction materials: Expect growth in the mining and manufacturing sectors supplying these materials. Companies involved in the production of steel, cement, and aggregates are likely to see increased demand.

- Potential for growth in related industries: This includes engineering firms, construction companies, and logistics providers. Look for companies positioned to benefit from major infrastructure projects.

- Risk assessment of project delays: Investors need to assess the risks associated with potential project delays due to bureaucratic hurdles, supply chain issues, or labor shortages.

- Potential for increased employment: Large-scale infrastructure projects often lead to increased employment opportunities, boosting economic activity in related regions. This has knock-on effects for the broader economy and consumer spending.

Keyword integration: Australian infrastructure investment, post-election infrastructure projects, infrastructure asset market.

Energy and Resources

The government's stance on energy and resources will significantly shape the Australian energy market and the resources sector outlook. This includes:

- Impact on mining stocks: The policies concerning coal, iron ore, and other resources will influence the performance of mining stocks. Investors need to monitor any changes in regulations, export restrictions, and global demand.

- Potential for growth in the renewable energy sector: Increased investment in renewable energy sources (solar, wind, hydro) presents significant growth opportunities for companies involved in these sectors. This includes manufacturers, developers, and related service providers.

- Regulatory changes and their effect on profitability: Changes in environmental regulations, carbon pricing mechanisms, and mining royalties will directly affect the profitability of companies within this sector. Thorough due diligence is essential.

- Carbon pricing implications: The government's approach to carbon pricing will have a significant impact on the cost of energy production and the competitiveness of various energy sources. This should be a key factor in investment decisions.

Keyword integration: Australian energy market, resources sector outlook, post-election mining investments.

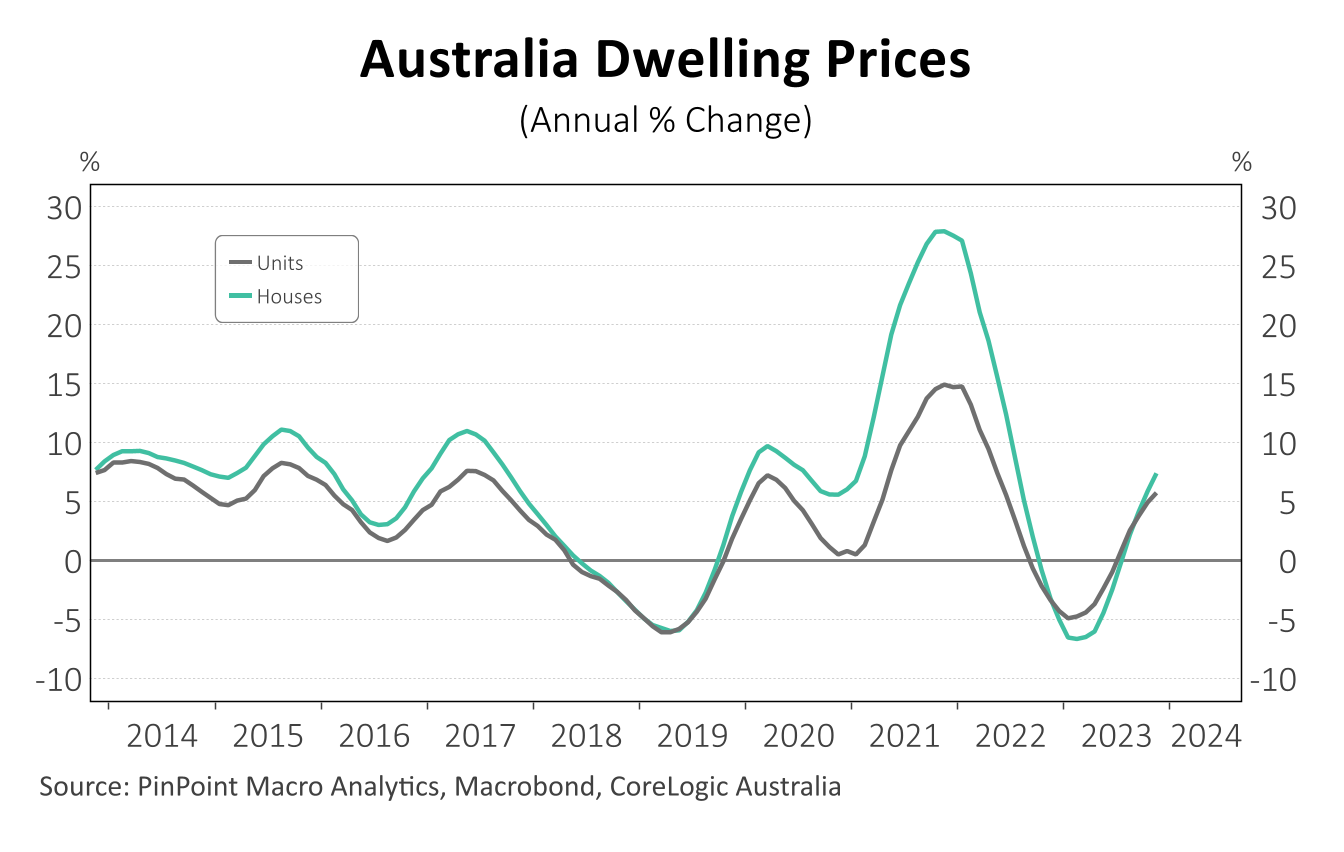

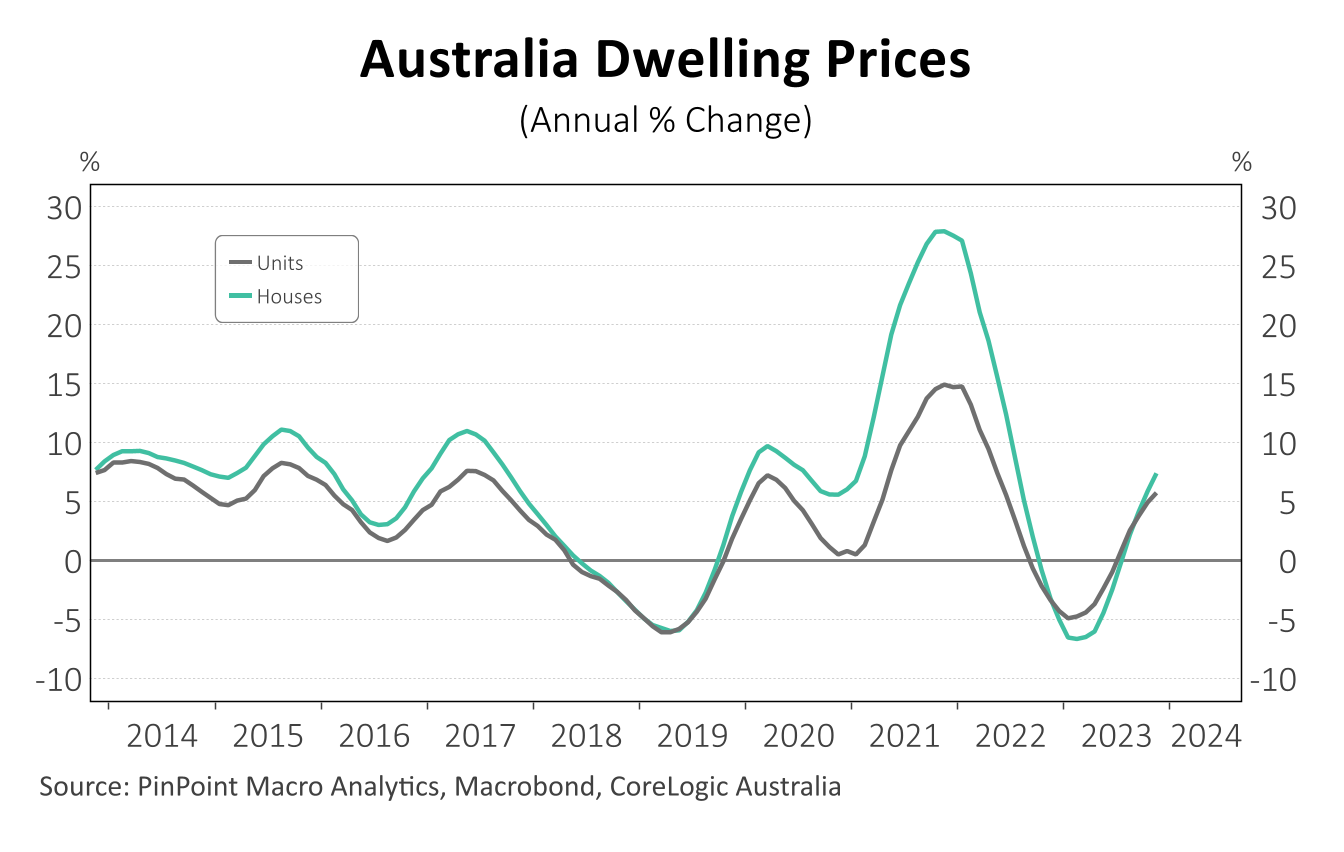

Housing Market

Government policies concerning interest rates, housing affordability, and incentives will heavily influence the Australian property market. The post-election housing predictions are complex and depend on several interacting factors:

- Potential for price increases or decreases: Depending on the government's actions, we could see either a rise or fall in house prices. Interest rate changes play a significant role here.

- Impact on property investment: Changes in lending regulations, taxes, and government incentives will all directly influence the attractiveness of property investment.

- Rental market trends: Government policies can impact the availability and affordability of rental properties, affecting both tenants and landlords.

- Influence of government incentives: First-home buyer schemes or other incentives could stimulate demand in certain segments of the housing market.

Keyword integration: Australian property market, post-election housing predictions, housing asset values.

Economic Forecasts and Interest Rate Predictions

Understanding the broader economic landscape is vital for making sound investment choices within the post-election Australian asset market.

GDP Growth Projections

Economic forecasts provide insights into future growth and its impact on different asset classes. Several factors influence post-election GDP growth in Australia:

- Short-term vs. long-term growth projections: Analysts often offer varying projections depending on the timeframe. Understanding the nuances of short-term versus long-term predictions is crucial.

- Factors influencing GDP growth: These factors include government spending, consumer confidence, global economic conditions, and commodity prices.

- Impact on investment strategies: Growth projections influence investment strategies, with higher growth generally favoring equities and riskier assets.

Keyword integration: Australian economic outlook, post-election GDP growth, economic forecasts Australia.

Interest Rate Scenarios

The Reserve Bank of Australia's (RBA) actions will significantly impact asset prices. Post-election monetary policy and interest rate predictions Australia are crucial to assess:

- Potential for rate hikes or cuts: The RBA's response to inflation and economic growth will determine whether interest rates rise or fall.

- Impact on borrowing costs: Changes in interest rates affect borrowing costs for businesses and consumers, influencing investment and spending decisions.

- Effect on different asset classes (bonds, equities): Rising interest rates generally favor bonds, while falling rates may favor equities.

Keyword integration: Australian interest rates, post-election monetary policy, interest rate predictions Australia.

Investment Strategies and Opportunities

Navigating the post-election Australian asset market requires a strategic approach.

Diversification Strategies

Diversification is key to mitigating risk. Effective post-election portfolio diversification in the Australian context should consider:

- Asset allocation adjustments: Rebalancing your portfolio based on the expected performance of different asset classes is essential.

- Sector-specific strategies: Focusing investments on sectors expected to benefit from government policies can enhance returns.

- Risk mitigation techniques: Employing strategies to protect your portfolio from market downturns is crucial, especially in uncertain times.

Keyword integration: Australian investment strategies, post-election portfolio diversification, asset allocation Australia.

High-Growth Sectors

Identifying high-growth assets Australia is crucial for maximizing returns. Several sectors hold significant promise post-election:

- Technology: The technology sector continues to present significant growth opportunities, particularly in areas such as fintech and digital transformation.

- Healthcare: An aging population and advancements in medical technology drive continued growth in the healthcare sector.

- Renewable energy: Government support for renewable energy sources presents strong growth prospects for this sector.

Keyword integration: Australian growth sectors, post-election investment opportunities, high-growth assets Australia.

Conclusion: Post-Election Australian Asset Market Outlook: A Summary and Call to Action

The Post-Election Australian Asset Market Outlook presents a complex picture. Government policies will significantly shape the performance of various sectors, and understanding the potential impacts on infrastructure spending, energy and resources, and the housing market is crucial for informed investment decisions. Economic forecasts and interest rate scenarios further complicate the picture, highlighting the need for well-informed, diversified investment strategies focusing on high-growth sectors. Remember that this is a dynamic landscape; staying abreast of market developments is essential.

To navigate this complex post-election Australian asset market outlook effectively, we strongly recommend consulting with a qualified financial advisor. They can provide personalized guidance tailored to your risk tolerance and investment goals. Don't hesitate to seek expert advice to help you optimize your investment strategy in this evolving environment.

Featured Posts

-

Stock Market Today Dow And S And P 500 Live Updates For May 5

May 05, 2025

Stock Market Today Dow And S And P 500 Live Updates For May 5

May 05, 2025 -

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Allegations

May 05, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Allegations

May 05, 2025 -

Onde Ver Portuguesa X Corinthians Online Transmissao Paulistao

May 05, 2025

Onde Ver Portuguesa X Corinthians Online Transmissao Paulistao

May 05, 2025 -

Emma Stone And Emma Thompsons Fierce Showdown In New Cruella Trailer

May 05, 2025

Emma Stone And Emma Thompsons Fierce Showdown In New Cruella Trailer

May 05, 2025 -

First Round Nhl Playoffs Matchups Predictions And Analysis

May 05, 2025

First Round Nhl Playoffs Matchups Predictions And Analysis

May 05, 2025

Latest Posts

-

Is The Gigabyte Aorus Master 16 Worth It Performance And Fan Noise Tested

May 06, 2025

Is The Gigabyte Aorus Master 16 Worth It Performance And Fan Noise Tested

May 06, 2025 -

Building The Everything App A Comparison Of Sam Altmans And Elon Musks Strategies

May 06, 2025

Building The Everything App A Comparison Of Sam Altmans And Elon Musks Strategies

May 06, 2025 -

Gigabyte Aorus Master 16 In Depth Review Of Performance And Cooling

May 06, 2025

Gigabyte Aorus Master 16 In Depth Review Of Performance And Cooling

May 06, 2025 -

High Quality Goods At Low Prices Your Guide To Smart Spending

May 06, 2025

High Quality Goods At Low Prices Your Guide To Smart Spending

May 06, 2025 -

The Everything App Sam Altman And Elon Musks Tech Battle

May 06, 2025

The Everything App Sam Altman And Elon Musks Tech Battle

May 06, 2025