Post-Pandemic Fiscal Policies: ECB Links To Continued Inflation

Table of Contents

Expansionary Fiscal Policies and Their Impact

The COVID-19 pandemic necessitated unprecedented intervention by governments across Europe. Expansionary fiscal policies, aimed at mitigating the immediate economic fallout, played a significant role in shaping the current inflationary environment.

Increased Government Spending

Governments across the Eurozone implemented substantial fiscal stimulus packages to support their economies. This involved a significant increase in government spending.

- Examples of spending: Furlough schemes, like Germany's Kurzarbeit, provided wage subsidies to businesses to retain employees. Many countries also distributed direct stimulus checks to households. Significant investments were made in healthcare infrastructure and pandemic-related research.

- Impact on aggregate demand: This surge in government spending dramatically increased aggregate demand. With increased disposable income and a relatively stable supply, this fueled inflationary pressures. The injection of funds into the economy, while necessary for short-term stability, also contributed to a significant increase in government debt. Managing this debt will be a key challenge in the coming years. Keywords: Fiscal stimulus, pandemic spending, government debt.

Low Interest Rates and Quantitative Easing (QE)

Simultaneously, the ECB implemented a policy of exceptionally low interest rates and engaged in large-scale quantitative easing (QE) programs.

- Mechanism of QE: The ECB purchased significant quantities of government and corporate bonds, injecting liquidity into the financial system. This increased the money supply.

- Impact on money supply and borrowing costs: This injection of liquidity lowered borrowing costs for businesses and consumers, further stimulating demand. The increased money supply, without a corresponding increase in the production of goods and services, contributed to inflationary pressures. Keywords: Quantitative easing, ECB monetary policy, low interest rate environment, money supply.

Supply Chain Disruptions and Inflationary Pressures

The pandemic exposed and exacerbated pre-existing vulnerabilities in global supply chains, adding another layer of complexity to the inflationary picture.

Pandemic's Effect on Global Supply Chains

The pandemic caused widespread disruptions to global supply chains. Lockdowns, border closures, and transportation bottlenecks led to significant shortages of goods and raw materials.

- Examples of shortages: The global semiconductor shortage significantly impacted the automotive industry and electronics production. Energy prices surged due to disruptions in oil and gas supply. Many industries faced shortages of raw materials and intermediate goods.

- Impact on production costs and prices: These shortages led to increased production costs and, consequently, higher prices for consumers. This cost-push inflation added to the demand-pull inflation already fueled by expansionary fiscal policies. Keywords: Supply chain bottlenecks, inflationary pressures, global supply chain disruptions.

The Role of Fiscal Policies in Exacerbating Shortages

While expansionary fiscal policies were intended to mitigate economic hardship, they inadvertently contributed to increased demand, further exacerbating existing supply chain issues and fueling inflation.

- Increased demand exceeding supply: The increased disposable income created by fiscal stimulus, coupled with supply chain bottlenecks, led to a situation where demand significantly outstripped supply for many goods.

- Impact on price levels: This imbalance between supply and demand pushed prices upward, contributing to a sharp increase in inflation. The interaction of demand-pull and cost-push inflation created a potent inflationary cocktail. Keywords: Demand-pull inflation, cost-push inflation, fiscal policy impact on inflation.

The ECB's Response and Future Outlook

Faced with persistent inflation, the ECB has shifted its monetary policy stance.

Monetary Policy Tightening

The ECB has begun to tighten its monetary policy to combat inflation.

- Interest rate hikes: The ECB has implemented a series of interest rate hikes to reduce borrowing and cool down the economy.

- Potential impact on inflation and economic growth: While these measures aim to curb inflation, they also risk slowing economic growth and potentially triggering a recession. The delicate balancing act between controlling inflation and supporting economic growth is a central challenge for the ECB. Keywords: Interest rate hikes, monetary policy tightening, inflation control.

Challenges and Uncertainties

The ECB faces significant challenges in navigating this complex economic landscape.

- Risks of recession: Aggressive monetary tightening increases the risk of a recession in the Eurozone.

- Potential for stagflation: The simultaneous occurrence of high inflation and slow economic growth, known as stagflation, is a significant concern.

- Uncertainty in the global economy: Geopolitical instability and ongoing supply chain disruptions add further uncertainty to the outlook. Keywords: Stagflation risk, economic slowdown, ECB challenges.

Conclusion

Post-pandemic fiscal policies, particularly those implemented by the ECB, have played a significant role in the current inflationary environment in Europe. While initially designed to mitigate the economic fallout of the pandemic, these policies, combined with supply chain disruptions, have contributed to increased demand and persistent price increases. The ECB's response through monetary tightening presents a complex balancing act, with potential risks to economic growth. Further analysis and understanding of the interplay between these policies and inflation are crucial for effective economic management. To stay informed on the latest developments regarding post-pandemic fiscal policies and their effect on inflation, continue to follow reputable economic news sources and analyses of ECB monetary policy. Understanding the links between fiscal policy and inflation is essential for navigating this crucial period of economic uncertainty.

Featured Posts

-

Porsche Koezuti Modell F1 Motor Haja

Apr 29, 2025

Porsche Koezuti Modell F1 Motor Haja

Apr 29, 2025 -

Ariana Grande And Jeff Goldblum Team Up For I Dont Know Why

Apr 29, 2025

Ariana Grande And Jeff Goldblum Team Up For I Dont Know Why

Apr 29, 2025 -

9 Billion Dow Project In Alberta Delayed By Tariff Impacts

Apr 29, 2025

9 Billion Dow Project In Alberta Delayed By Tariff Impacts

Apr 29, 2025 -

Gript I Toploto Vreme Mnenieto Na Prof Iva Khristova

Apr 29, 2025

Gript I Toploto Vreme Mnenieto Na Prof Iva Khristova

Apr 29, 2025 -

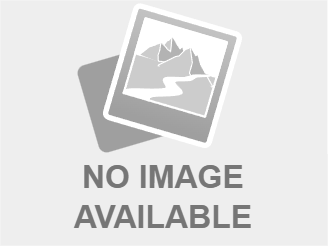

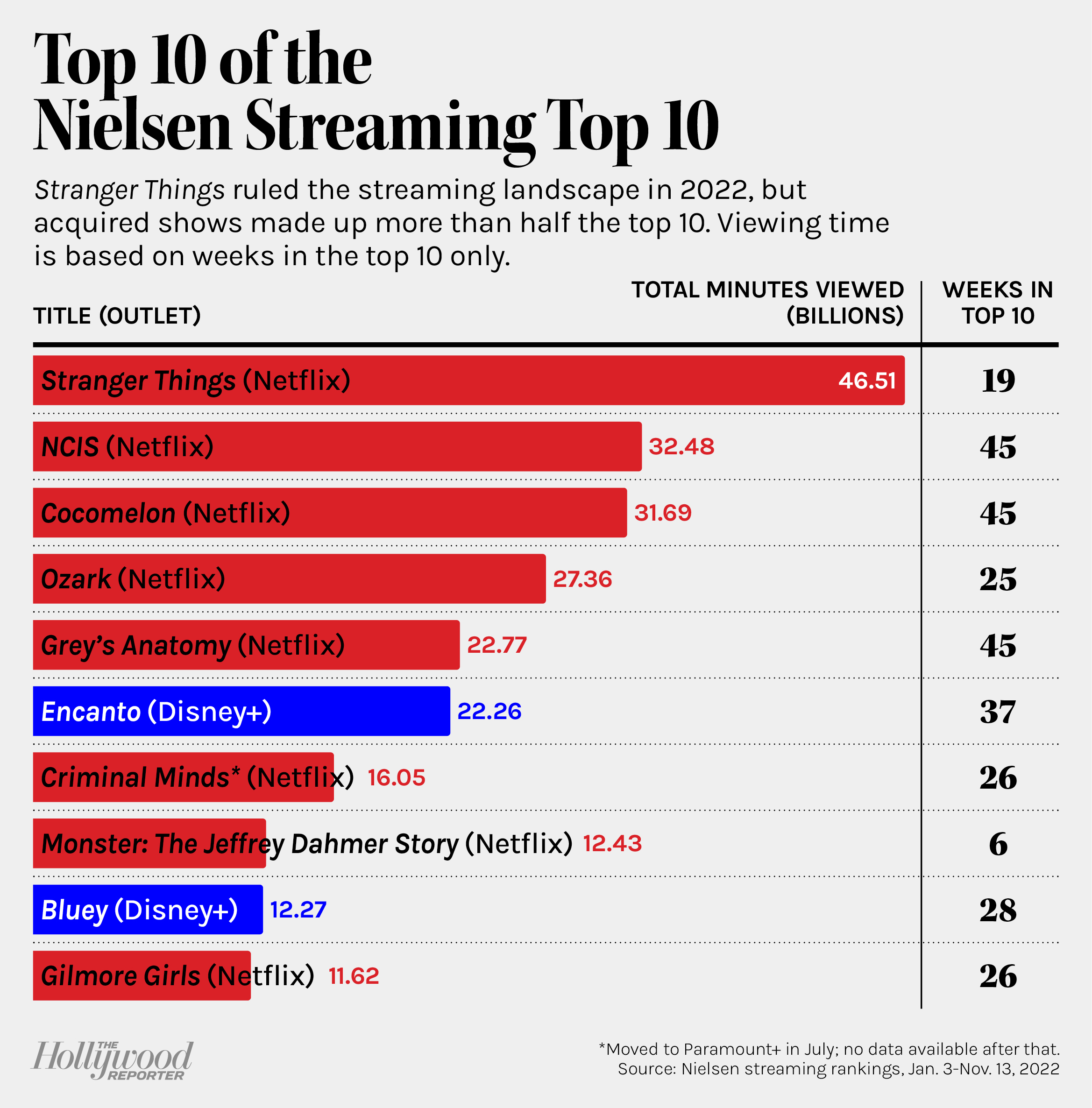

You Tube A New Home For Older Viewers Favorite Tv Shows

Apr 29, 2025

You Tube A New Home For Older Viewers Favorite Tv Shows

Apr 29, 2025