Posthaste: Are Canadian Home Prices Entering A Correction?

Table of Contents

Rising Interest Rates and Their Impact on Affordability

The Bank of Canada's aggressive interest rate hikes are significantly impacting the Canadian housing market. Higher interest rates directly translate into increased mortgage payments, reducing affordability for many potential homebuyers. This is especially true for those with variable-rate mortgages, who are immediately impacted by rate changes.

- Statistics on interest rate hikes in Canada: The Bank of Canada has increased its benchmark interest rate by X percentage points since Y (Insert actual data here).

- Data on the percentage increase in mortgage payments: A Y% increase in interest rates can lead to a Z% increase in monthly mortgage payments (Provide data and source).

- Analysis of how affordability has changed for different income brackets: First-time homebuyers and those with lower incomes are disproportionately affected by reduced affordability, limiting their ability to participate in the market. (Provide data comparing affordability across income brackets, potentially using a chart).

These increased borrowing costs are squeezing buyer purchasing power, leading to a slowdown in demand and putting downward pressure on home prices. The relationship between Canadian interest rates and mortgage affordability is undeniable, acting as a major catalyst in the potential correction. Keywords: Canadian interest rates, mortgage affordability, housing market affordability, borrowing costs.

Inventory Levels and Market Supply

While still relatively low compared to historical averages, housing inventory across Canada is showing signs of increase. This increased supply, particularly in certain regions, is starting to alleviate some of the intense competition that fueled price escalation in previous years.

- Statistics on new housing starts: The number of new housing starts has increased/decreased by X% in the last year (Insert data and source).

- Data on unsold inventory: The number of unsold homes is rising/remaining stable in [mention specific regions]. (Include data and source).

- Regional differences in supply and demand: While some cities like Toronto and Vancouver remain competitive, other regions are witnessing a more pronounced shift towards a balanced market. (Provide regional data and analysis).

The increase in housing inventory Canada is a key factor influencing prices. This growing supply, while not yet substantial in all areas, weakens the seller's market and contributes to the potential for a correction in Canadian home prices. Keywords: Housing inventory Canada, housing supply, new home construction, unsold homes, real estate market inventory.

Shifting Buyer Demand and Consumer Confidence

Economic uncertainty, inflation, and a potential recession are impacting consumer confidence, leading to reduced buyer demand in the Canadian housing market. This decreased demand is another significant factor contributing to the cooling market.

- Statistics on consumer confidence indices: Consumer confidence has fallen by X% in the last [time period] (Insert data and source).

- Data on sales volume and transaction rates: Sales volume and transaction rates have declined significantly in [mention specific regions]. (Include data and source).

- Analysis of changes in buyer behaviour: Buyers are becoming more cautious, negotiating harder, and are less likely to engage in bidding wars. (Provide analysis of shifting buyer behaviour).

This shift in buyer sentiment and decreased transaction activity directly impacts home prices, contributing to the ongoing market correction. The reduced Canadian housing demand is a key factor that reinforces the likelihood of a correction. Keywords: Canadian housing demand, buyer sentiment, consumer confidence, real estate market trends, housing market slowdown.

Government Regulations and Policies

Government policies, such as stress tests and foreign buyer taxes, play a crucial role in shaping the Canadian housing market. While intended to cool the market and improve affordability, their actual impact is complex and multifaceted.

- Summary of recent government interventions: [Summarize recent policy changes and their stated objectives].

- Assessment of the effectiveness of these policies: [Analyze the effectiveness of these policies in achieving their objectives. Consider their impact on both affordability and market stability].

- Potential for future policy changes: [Speculate on potential future policy adjustments based on current market trends].

These policies have had some effect on moderating price increases, and the potential for future adjustments demonstrates the government's active role in shaping the market's trajectory. Keywords: Canadian housing policy, government regulations, real estate regulations, foreign buyer tax, stress test.

Conclusion: Summarizing the Canadian Housing Market Correction Outlook

In summary, rising interest rates, increasing housing inventory, shifting buyer demand, and government policies are all contributing to a cooling Canadian housing market. The evidence suggests that a correction, though not necessarily a crash, is underway. The severity and duration of this correction remain uncertain, and vary significantly across regions. While some areas may experience more substantial price declines than others, the overall trend points towards a period of market stabilization and reduced price growth.

The Canadian housing market is dynamic and complex. To stay informed about the potential for future Canadian home price corrections and make informed decisions, it's crucial to stay updated on the latest market news and analysis. Continue researching the Canadian housing market by consulting reputable sources like the Canadian Real Estate Association (CREA) and major financial news outlets. Stay informed, and make informed decisions about your future in the ever-evolving Canadian housing market.

Featured Posts

-

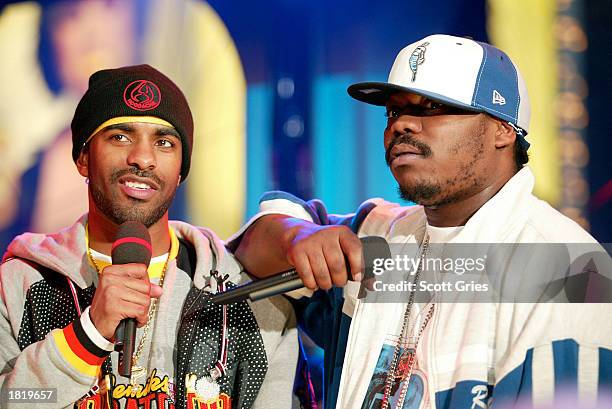

Beenie Mans New York Takeover Is This The Next Big Thing In It

May 22, 2025

Beenie Mans New York Takeover Is This The Next Big Thing In It

May 22, 2025 -

Abn Amro Ziet Occasionverkopen Flink Toegenemen

May 22, 2025

Abn Amro Ziet Occasionverkopen Flink Toegenemen

May 22, 2025 -

Negotiating Tariffs Switzerland And Chinas Joint Appeal

May 22, 2025

Negotiating Tariffs Switzerland And Chinas Joint Appeal

May 22, 2025 -

Lebanon County Pa Fbi Investigative Activity And Search Warrant

May 22, 2025

Lebanon County Pa Fbi Investigative Activity And Search Warrant

May 22, 2025 -

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

May 22, 2025

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

May 22, 2025

Latest Posts

-

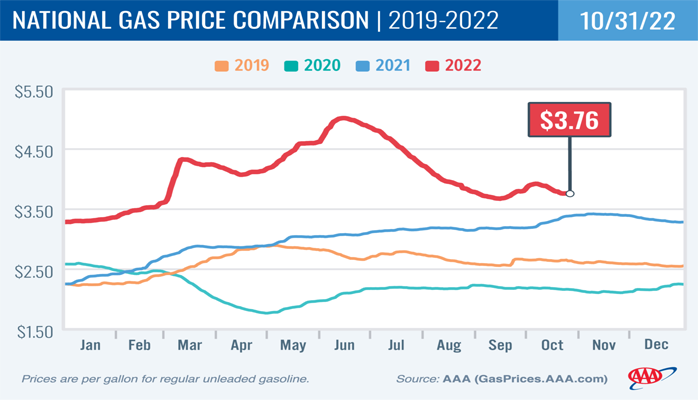

The 20 Cent Gas Price Jump Causes And Consequences

May 22, 2025

The 20 Cent Gas Price Jump Causes And Consequences

May 22, 2025 -

Virginia Experiences 50 Cent Drop In Gasoline Prices

May 22, 2025

Virginia Experiences 50 Cent Drop In Gasoline Prices

May 22, 2025 -

Rising Gas Prices A 20 Cent Per Gallon Increase And What It Means

May 22, 2025

Rising Gas Prices A 20 Cent Per Gallon Increase And What It Means

May 22, 2025 -

National Average Gas Price Nears 3 Amidst Economic Slowdown

May 22, 2025

National Average Gas Price Nears 3 Amidst Economic Slowdown

May 22, 2025 -

Analysis Average Gas Prices Rise By Nearly 20 Cents

May 22, 2025

Analysis Average Gas Prices Rise By Nearly 20 Cents

May 22, 2025