Posthaste: High Down Payments And The Canadian Dream Of Homeownership

Table of Contents

The Rising Cost of Entry: Understanding High Down Payment Requirements in Canada

Factors Contributing to Higher Down Payments

Several factors contribute to the increasingly high down payments required for Canadian homeownership.

- Escalating House Prices: Home prices in major Canadian cities like Toronto, Vancouver, and Montreal have skyrocketed in recent years, significantly increasing the amount needed for a down payment. The average home price in Toronto, for example, has far outpaced wage growth.

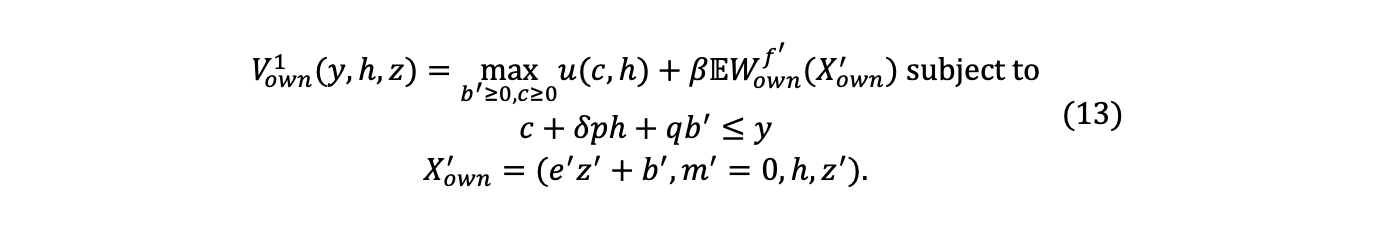

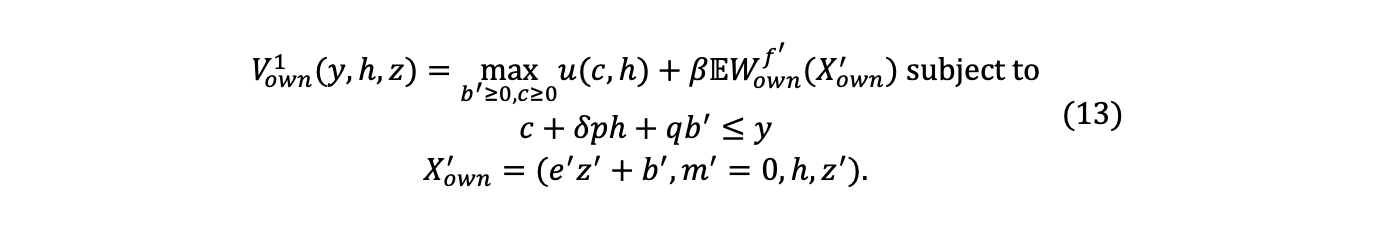

- Stricter Mortgage Rules: The Office of the Superintendent of Financial Institutions (OSFI) has implemented stricter mortgage rules, including a stress test that requires borrowers to qualify for a mortgage at a higher interest rate. This makes it harder for buyers to qualify for larger mortgages, necessitating larger down payments.

- Inflation's Impact: Inflation erodes the purchasing power of savings, meaning individuals need to save more to reach their down payment goals. The rising cost of living adds further pressure, making saving challenging for many.

Statistics paint a stark picture. The average down payment percentage for a home in Canada hovers around 20%, but this figure can be significantly higher in competitive markets. For first-time homebuyers, this represents a considerable financial hurdle. The impact on first-time homebuyers is particularly acute, often delaying their entry into the housing market for years.

The Impact of High Down Payments on Affordability

The need for a large down payment significantly impacts affordability.

- Extended Saving Timelines: Accumulating a substantial down payment can take years, delaying homeownership for many Canadians.

- Reduced Disposable Income: Saving aggressively for a down payment often means sacrificing other financial goals, such as travel, education, or retirement savings.

- Regional Variations: Affordability challenges vary across Canada. While major urban centers experience the most significant pressures, even smaller cities are facing increasing housing costs and higher down payment requirements.

Strategies for Navigating High Down Payment Hurdles

Saving Strategies for a Larger Down Payment

Despite the challenges, several strategies can help prospective homebuyers save for a larger down payment.

- Budgeting and Debt Reduction: Creating a detailed budget and aggressively paying down existing debt frees up more cash for savings.

- High-Yield Savings Accounts: Maximizing returns by utilizing high-yield savings accounts or Guaranteed Investment Certificates (GICs) accelerates savings growth.

- Investment Options: For longer-term savings, exploring investment options like Registered Retirement Savings Plans (RRSPs) or Tax-Free Savings Accounts (TFSAs) can provide higher returns but carries risk.

- Government Programs: The First-Time Home Buyer Incentive program offers assistance with down payments for eligible buyers.

Planning a longer-term savings strategy is crucial for success. Consistency and discipline are key to achieving down payment goals.

Exploring Alternative Financing Options

Several alternative financing options may help overcome high down payment hurdles.

- Shared Equity Mortgages: These mortgages involve a lender or government agency contributing a portion of the down payment in exchange for a share of the home's equity.

- Gifts from Family: Gifts from family members can significantly boost down payment savings.

- Leveraging RRSPs: While withdrawals from RRSPs are taxable, they can provide a crucial boost to down payment funds.

Thorough research and financial planning are essential before considering any alternative financing option to understand the associated implications and potential risks.

The Broader Implications of High Down Payments on the Canadian Housing Market

Impact on Housing Supply and Demand

High down payment requirements exacerbate existing imbalances in the housing market.

- Limited Housing Supply: High barriers to entry limit the number of potential homebuyers, impacting overall housing supply.

- Market Competitiveness: High down payments increase competition among buyers, driving up prices further.

- Socioeconomic Disparities: High down payment requirements disproportionately affect lower-income households and marginalized communities, creating further inequalities in homeownership.

Potential Long-Term Consequences for Economic Growth

The persistent challenge of high down payments has broader economic consequences.

- Reduced Consumer Spending: The significant financial commitment required for a down payment reduces disposable income, potentially impacting overall consumer spending.

- Decreased Mobility: The difficulty of securing a down payment can limit geographic mobility and hinder career advancement opportunities.

- Intergenerational Wealth Transfer: The high cost of homeownership can impact the ability to transfer wealth to future generations.

Conclusion

High down payments represent a significant challenge to achieving the Canadian dream of homeownership. The rising cost of housing, stricter mortgage rules, and inflation have created a complex landscape for aspiring homeowners. However, through strategic saving strategies, exploration of alternative financing options, and careful financial planning, it is possible to navigate these hurdles. Understanding the long-term implications of high down payment requirements is crucial for both individuals and policymakers. Start planning your path to homeownership today by strategically addressing high down payment challenges and seeking professional financial advice to create a realistic and sustainable plan.

Featured Posts

-

Is Daycare Always The Wrong Choice A Balanced Look

May 09, 2025

Is Daycare Always The Wrong Choice A Balanced Look

May 09, 2025 -

Daycare Concerns A Working Parents Perspective

May 09, 2025

Daycare Concerns A Working Parents Perspective

May 09, 2025 -

Academic Neglect The Misrepresentation Of Killers With Mental Health Issues

May 09, 2025

Academic Neglect The Misrepresentation Of Killers With Mental Health Issues

May 09, 2025 -

Analyzing Elon Musks Net Worth Change During Trumps First 100 Days In Office

May 09, 2025

Analyzing Elon Musks Net Worth Change During Trumps First 100 Days In Office

May 09, 2025 -

Doohans F1 Career Montoyas Comments On The Decision

May 09, 2025

Doohans F1 Career Montoyas Comments On The Decision

May 09, 2025