Posthaste: Navigating The New Trade Landscape After The Tariff Ruling In Canada

Table of Contents

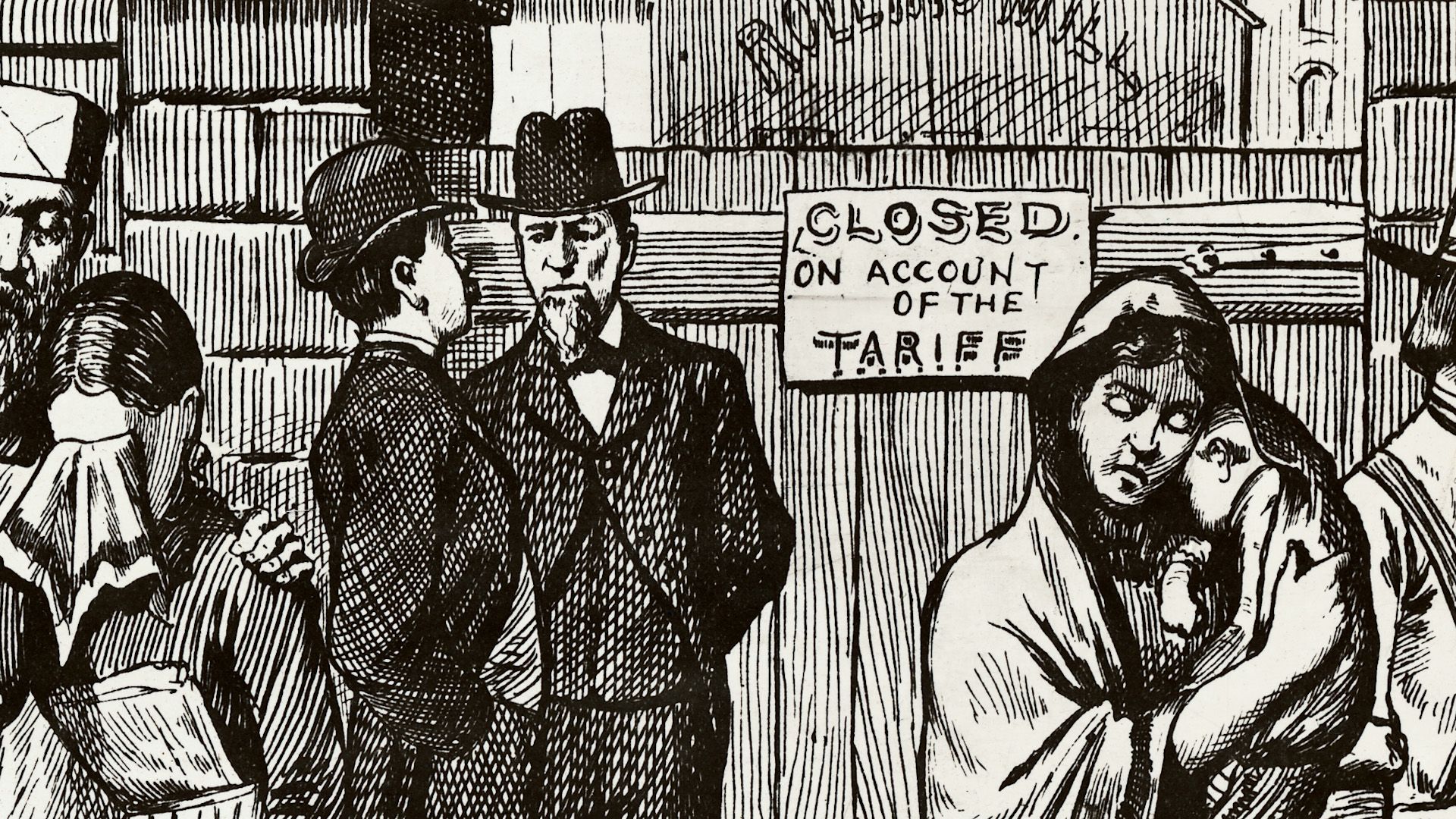

Understanding the Impact of the Canadian Tariff Ruling

On [Insert Date of Ruling], the Canadian government implemented a new tariff ruling affecting [Specify affected goods, e.g., steel imports from certain countries]. This ruling, detailed in [Insert Link to Government Source Document], has significantly altered the Canadian trade landscape. The consequences are far-reaching, impacting numerous sectors and presenting both challenges and opportunities for Canadian businesses involved in Import/Export Canada.

- Impact on specific industries: The automotive, agriculture, and manufacturing sectors are particularly vulnerable, facing increased input costs and reduced competitiveness in global markets. The Canada import tariffs are heavily impacting these sectors' ability to remain profitable.

- Increased costs for businesses and consumers: Higher import costs translate directly into increased prices for businesses and consumers, potentially dampening domestic demand and economic growth. Understanding these cost implications for Canadian export challenges is paramount.

- Potential for retaliatory tariffs from other countries: The new tariff regulations Canada has implemented may provoke retaliatory measures from other nations, further complicating the trade environment and impacting Canadian export opportunities.

- Changes in supply chains and logistics: Businesses are forced to reassess their supply chains, seeking alternative suppliers and transportation routes to minimize disruptions and costs. This necessitates careful review of Canadian import tariffs and their effects.

- Long-term economic effects: The long-term economic impact remains uncertain, with potential effects ranging from job losses in affected sectors to broader inflationary pressures throughout the economy. Analysis of these impacts is crucial for informing future trade policies.

Strategies for Businesses to Adapt to the New Trade Landscape

Facing this new reality, Canadian businesses need to adopt proactive strategies to mitigate the negative impacts of the new tariffs. Successfully navigating the challenges requires agility and a strategic approach to Canadian import strategies and export solutions Canada.

- Diversifying import sources: Reducing reliance on single suppliers by exploring alternative sources for raw materials and goods is crucial to mitigate supply chain risks. This diversification will help buffer your business against future tariff impacts.

- Negotiating with suppliers for better pricing: Engaging in proactive negotiations with suppliers to secure more favorable pricing terms is essential in managing increased costs associated with Canadian import tariffs.

- Exploring alternative transportation routes: Investigating alternative shipping routes and logistics providers can help minimize transport costs and improve efficiency. This requires a thorough review of transportation options and their implications for Canadian export challenges.

- Investing in automation and technology to increase efficiency: Automation and technological advancements can significantly improve efficiency, thereby offsetting rising input costs and enhancing competitiveness.

- Seeking government assistance programs: Explore available government programs and initiatives designed to assist businesses affected by the new tariffs. Understanding these programs is key to mitigating the impact of the new tariffs.

- Reviewing and updating trade compliance policies and procedures: Ensure that your company's trade compliance policies and procedures are up-to-date and aligned with the new tariff regulations Canada. This proactive approach will minimize the risk of penalties and legal issues.

The Role of Government in Supporting Canadian Businesses

The Canadian government's response to the tariff ruling is critical in helping businesses navigate this challenging period. The availability of government support can greatly influence how effectively businesses adapt.

- Available financial assistance programs: The government should offer financial assistance programs to help affected businesses offset increased costs and maintain competitiveness. These programs are crucial to mitigating the impacts of Canadian import tariffs and export challenges.

- Trade dispute resolution mechanisms: Efficient and transparent trade dispute resolution mechanisms are crucial to addressing concerns and ensuring fair treatment for Canadian businesses.

- Government initiatives to promote diversification and competitiveness: Initiatives promoting diversification and competitiveness within affected sectors are vital for long-term resilience. These initiatives should focus on supporting businesses impacted by the new tariff regulations Canada.

- Advocacy efforts by trade associations and lobbying groups: Trade associations and lobbying groups have a crucial role to play in advocating for their members' interests and securing government support.

- Potential for future policy changes: The government may need to consider further policy changes to address the longer-term consequences of the tariff ruling and support impacted sectors. These changes will need to focus on alleviating the pressure of Canada import tariffs.

Navigating the Legal and Regulatory Framework

Understanding the legal and regulatory landscape surrounding the tariff ruling is vital for compliance and risk mitigation. Navigating this framework is crucial for all businesses impacted by the Canada Tariff Ruling.

- Compliance requirements: Businesses must ensure strict compliance with all applicable regulations and reporting requirements. Non-compliance can lead to penalties and legal action.

- Dispute resolution processes: Businesses should understand the available dispute resolution processes in case of disagreements with government agencies or trading partners. This includes clear understanding of the Canadian import regulations and dispute processes.

- Potential legal challenges and remedies: Businesses should explore potential legal challenges and remedies available to them if they feel unfairly impacted by the ruling.

- Importance of seeking legal advice: Seeking advice from legal professionals specializing in international trade law is highly recommended to ensure compliance and protect your business's interests. This is paramount for understanding the legal implications of tariffs within the Canadian context.

Conclusion

The Canada Tariff Ruling presents significant challenges but also opportunities for adaptation and strategic growth. Understanding the impact on your business, implementing effective strategies, and leveraging available government support are crucial for navigating this new trade landscape. Proactive measures are necessary to minimize the negative effects of increased Canadian import tariffs and export challenges. By diversifying supply chains, negotiating with suppliers, exploring alternative transportation routes, and investing in automation, businesses can enhance their resilience. Remember to actively seek government assistance programs and stay informed about evolving trade policies. Don't wait – adapt to the new Canadian trade landscape today! Visit [Link to Government Resource Website] and [Link to Relevant Trade Association Website] to learn more and develop a posthaste strategy for your business. Understand the impact of the Canada Tariff Ruling and navigate the Canadian import/export challenges effectively.

Featured Posts

-

Minnesota Air Quality Crisis Canadian Wildfire Smoke Impact

May 31, 2025

Minnesota Air Quality Crisis Canadian Wildfire Smoke Impact

May 31, 2025 -

Weak Spending And Tariffs Contribute To 0 2 Shrinkage Of U S Economy

May 31, 2025

Weak Spending And Tariffs Contribute To 0 2 Shrinkage Of U S Economy

May 31, 2025 -

Devoir De Justice Pour Les Etoiles De Mer Une Nouvelle Perspective Sur Les Droits Du Vivant

May 31, 2025

Devoir De Justice Pour Les Etoiles De Mer Une Nouvelle Perspective Sur Les Droits Du Vivant

May 31, 2025 -

Analisis Singel Baru Miley Cyrus End Of The World

May 31, 2025

Analisis Singel Baru Miley Cyrus End Of The World

May 31, 2025 -

Report Details High Fentanyl Levels In Princes System March 26th

May 31, 2025

Report Details High Fentanyl Levels In Princes System March 26th

May 31, 2025