Potential Sale Of UTAC: Update On Chinese Buyout Firm's Plans

Table of Contents

The Chinese Buyout Firm: Identity and Investment Strategy

While the specific name of the Chinese buyout firm remains undisclosed at this time, sources suggest it is a large private equity firm with a history of significant investments in international technology companies. Their investment strategy generally focuses on acquiring companies with high growth potential in emerging markets, particularly those with strong intellectual property and a skilled workforce. This aligns perfectly with UTAC's profile, making this acquisition a potentially lucrative move for the Chinese firm.

- Investment History: The firm has a proven track record of successful acquisitions in the software and hardware sectors.

- Past Acquisitions: Their portfolio includes notable successes such as the acquisition of [Company A] in 2020 and [Company B] in 2022, both of which experienced significant growth following the investment. However, they also experienced a less successful venture with [Company C] in 2021, highlighting the inherent risks in such large-scale acquisitions.

- Keywords: [Buyout Firm Name (if available)], Chinese investment strategy, private equity acquisition, cross-border M&A, international expansion.

UTAC's Current Situation and Valuation

UTAC, a leading provider of [UTAC's industry and products/services], currently holds a strong market position. However, recent financial reports indicate a need for significant capital investment to fuel further expansion and compete effectively against larger players in the market. This makes the potential acquisition particularly attractive as it provides access to much-needed capital and resources.

- Financial Health: UTAC's Q3 2023 earnings report showed [Insert relevant financial data, e.g., revenue growth, profit margins].

- Market Position: UTAC holds approximately [Percentage]% market share, placing it as a [Position, e.g., major player, niche leader] within the [Industry] sector.

- Valuation: Although the exact valuation remains confidential, industry analysts estimate UTAC's worth to be in the range of [Dollar amount] to [Dollar amount], based on recent comparable acquisitions.

- Keywords: UTAC financials, UTAC valuation, UTAC market share, UTAC competitive analysis, technology sector valuation.

Potential Implications of the UTAC Acquisition

The potential UTAC acquisition carries both significant benefits and risks. For UTAC, the deal promises access to substantial capital for expansion into new markets and potentially groundbreaking technological advancements. However, challenges remain, including navigating cultural differences, integrating operations, and complying with complex regulatory hurdles.

- Benefits for UTAC: Increased market share, access to new technologies, enhanced R&D capabilities, and expanded global reach.

- Risks for UTAC: Potential cultural clashes between management teams, regulatory scrutiny concerning data security and intellectual property, and the potential for job displacement.

- Impact on Stakeholders: UTAC's employees may face uncertainty regarding job security and future opportunities, whilst customers could experience changes in product offerings and support services. Competitors will likely need to reassess their strategies in light of this potential shift in the market.

- Geopolitical Implications: This acquisition could raise concerns about data security and intellectual property transfer, leading to potential regulatory scrutiny from various governmental bodies.

- Keywords: UTAC benefits, UTAC risks, Chinese investment implications, cross-border acquisition, regulatory challenges, data security concerns.

Timeline and Next Steps in the UTAC Sale Process

The timeline for the UTAC sale process remains uncertain, although industry insiders suggest that the deal could potentially close within the next [Timeframe, e.g., 6-12 months]. Several regulatory approvals are required, including [List specific regulatory approvals, e.g., antitrust clearances].

- Regulatory Approvals: Securing necessary approvals from regulatory bodies in both China and [UTAC's country of origin] will be a critical step.

- Potential Roadblocks: Potential delays could arise from lengthy regulatory review processes, unforeseen legal challenges, or difficulties in reaching a final agreement on the terms of the acquisition.

- Next Steps: The next steps will likely involve finalizing due diligence, negotiating the final terms of the agreement, and obtaining all necessary approvals.

- Keywords: UTAC timeline, UTAC deal completion, regulatory approval, acquisition process, antitrust regulations.

Conclusion: The Future of UTAC and Chinese Investment

The potential sale of UTAC to a Chinese buyout firm represents a significant event with far-reaching consequences for the company, its stakeholders, and the broader technological landscape. While the acquisition offers substantial opportunities for growth and expansion, potential challenges related to regulatory hurdles, cultural integration, and geopolitical considerations cannot be ignored. The successful completion of this deal hinges on careful navigation of these complexities.

To stay informed about further developments regarding the UTAC acquisition and the implications of increased Chinese investment in the technology sector, be sure to check back for future articles and updates on this evolving story. Subscribe to our newsletter to stay up-to-date on the latest news and analysis of this significant UTAC sale and other important developments in international business.

Featured Posts

-

Nba Probe Into Ja Morant Incident What We Know So Far

Apr 24, 2025

Nba Probe Into Ja Morant Incident What We Know So Far

Apr 24, 2025 -

Ev Mandates Face Renewed Pushback From Car Dealerships

Apr 24, 2025

Ev Mandates Face Renewed Pushback From Car Dealerships

Apr 24, 2025 -

Chat Gpt Ceo Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025

Chat Gpt Ceo Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025 -

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025 -

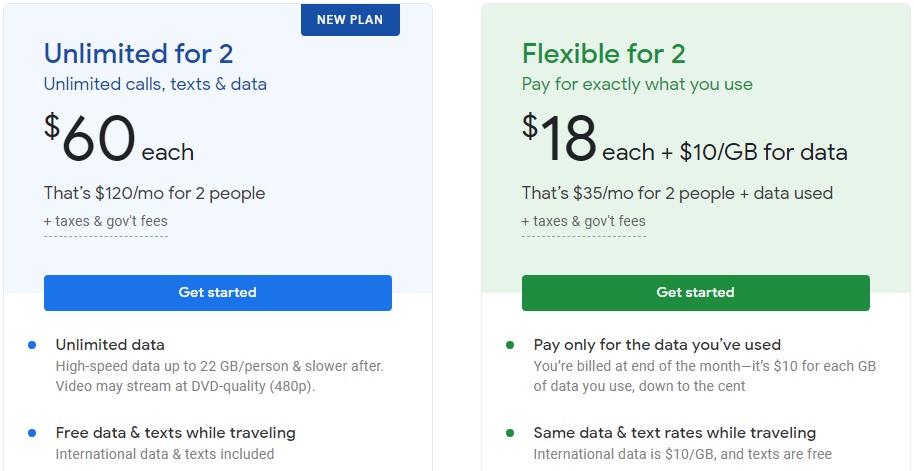

Google Fi 35 Unlimited A Comprehensive Guide

Apr 24, 2025

Google Fi 35 Unlimited A Comprehensive Guide

Apr 24, 2025