Pound Strengthens After UK Inflation Report, BOE Cuts Less Likely

Table of Contents

UK Inflation Report: Lower Than Expected Numbers

The Office for National Statistics (ONS) released UK inflation figures that were lower than anticipated by market analysts. This positive economic surprise sent shockwaves through the financial markets, boosting the Pound Sterling.

- Lower-than-anticipated inflation figures: The UK Consumer Price Index (CPI), a key measure of inflation, showed a [insert actual or hypothetical percentage] decrease, significantly lower than the [insert predicted percentage] forecast by economists. The Retail Price Index (RPI), another important inflation indicator, also showed a similar decline.

- Detailed breakdown of CPI and RPI figures: The decline in inflation wasn't uniform across all sectors. [Explain specific details, e.g., energy prices fell, food prices remained relatively stable, etc.]. This nuanced picture provides valuable insights into the underlying drivers of the inflation slowdown.

- Comparison with previous months and market expectations: Compared to the previous month's [insert previous month's CPI percentage], the current CPI figure represents a [insert percentage change] decrease. This substantial drop surprised many analysts who had predicted a more modest decline or even a slight increase.

- Impact on inflation forecasts for the remainder of the year: The lower-than-expected inflation figures suggest a more positive outlook for the UK economy in the coming months. However, uncertainties remain, and future inflation forecasts will depend on various factors, including global energy prices and supply chain dynamics. The consensus among economists is now shifting towards [mention the updated forecast].

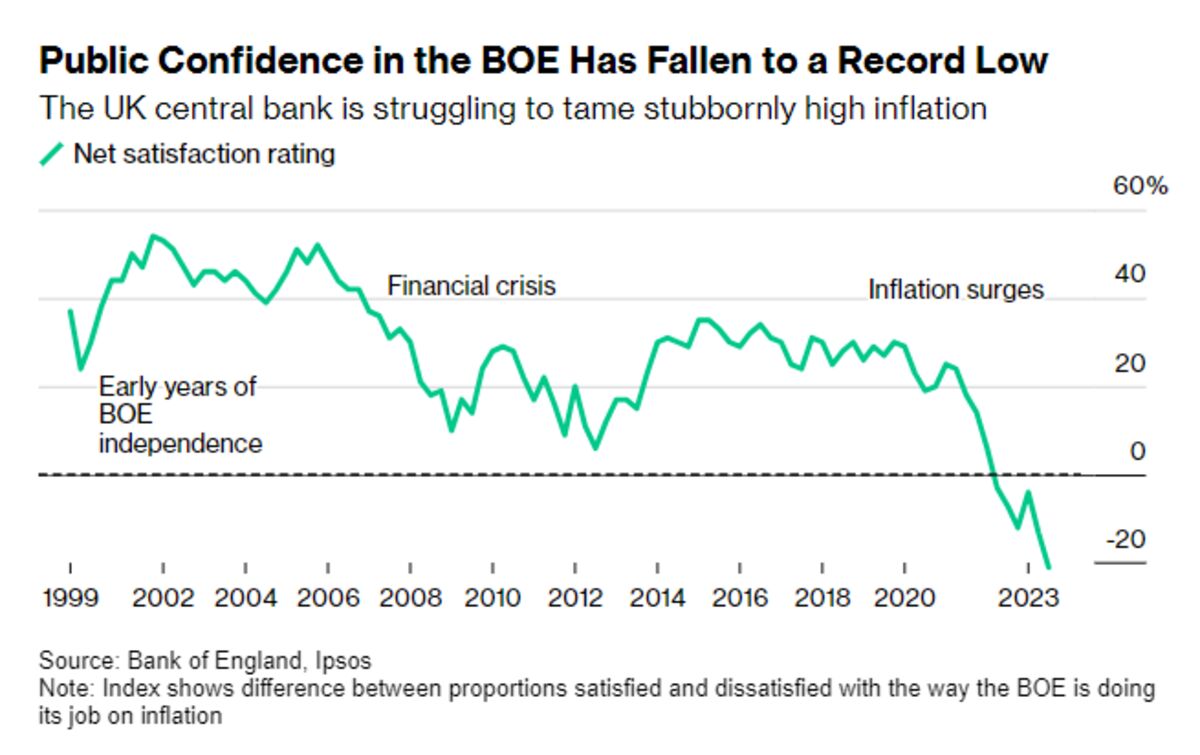

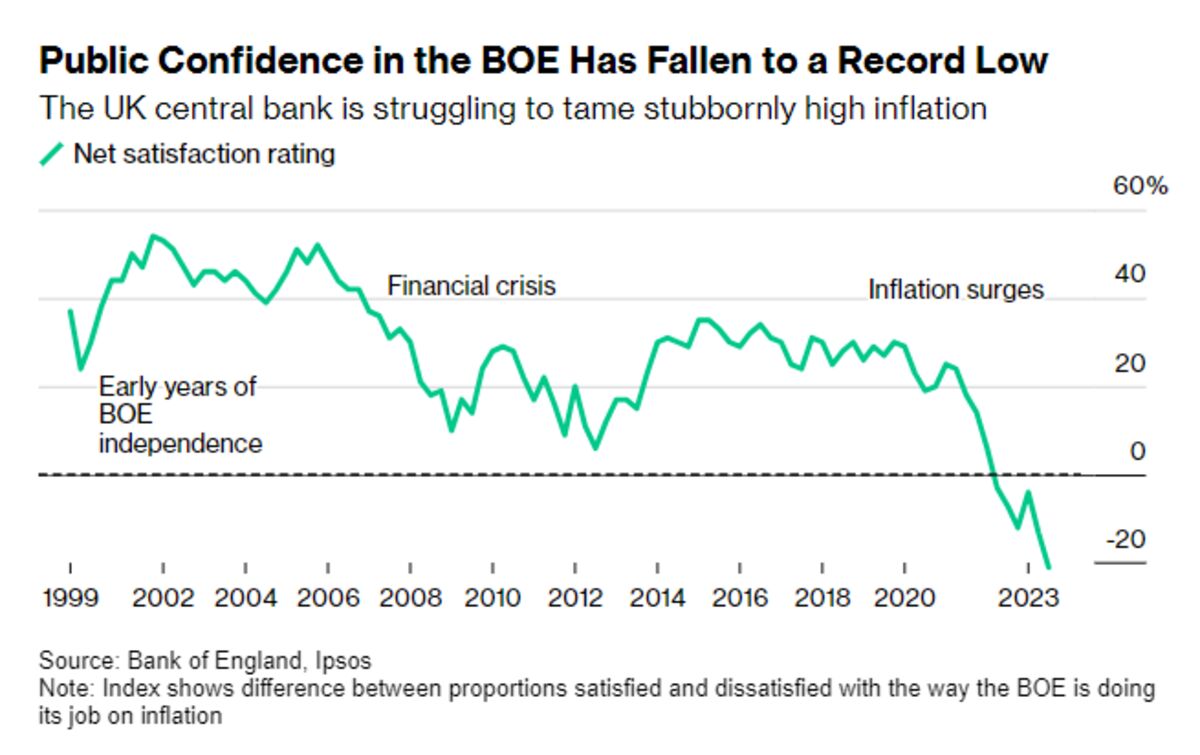

Impact on Bank of England (BOE) Monetary Policy

The unexpectedly low inflation figures have significantly altered the outlook for Bank of England monetary policy. The probability of further interest rate cuts by the BOE's Monetary Policy Committee (MPC) has diminished considerably.

- Reduced probability of further interest rate cuts: The BOE's primary mandate is to control inflation. Given the recent decline in inflation, the need for further interest rate cuts to stimulate the economy has lessened. The market is now pricing in a reduced chance of further cuts, potentially even anticipating future interest rate hikes.

- Analysis of the market's reaction to the inflation data and its effect on BOE rate hike expectations: The GBP/USD exchange rate, a key indicator of the pound's strength, surged following the inflation report's release, reflecting market confidence in the UK economy and reduced expectations of further rate cuts.

- Discussion of potential future interest rate hikes and their timeline: While further rate cuts are less likely, the possibility of future interest rate hikes is now being more seriously considered. The timing of any potential hike will depend on future economic data and the BOE’s assessment of inflation risks.

- Examination of the BOE's communication and forward guidance: Market participants will closely scrutinize any statements from the BOE regarding their future monetary policy decisions. The BOE's communication strategy will play a critical role in managing market expectations and maintaining stability in the financial markets.

Pound Sterling's Strength: Implications for Investors

The strengthening of the Pound Sterling has significant implications for investors, businesses, and consumers.

- Impact of the pound's strengthening on import and export prices: A stronger pound makes imports cheaper for UK consumers but makes UK exports more expensive for foreign buyers, potentially impacting UK businesses reliant on international trade.

- Attractiveness of UK assets for foreign investors: The improved economic outlook and the strengthening pound make UK assets more attractive to foreign investors, potentially leading to increased capital inflows.

- Opportunities and risks for traders in the GBP/USD and other currency pairs: Forex traders are closely monitoring the GBP/USD exchange rate and other currency pairs involving the GBP. The recent strengthening of the pound presents both opportunities and risks, requiring careful analysis and risk management.

- Potential impact on UK businesses and consumers: The effects on UK businesses and consumers will be complex and depend on their individual circumstances. For example, import-reliant businesses will benefit from lower costs, whereas export-oriented businesses might face challenges.

Conclusion

The unexpected decline in UK inflation has undeniably strengthened the Pound Sterling, significantly reducing the chances of further Bank of England interest rate cuts. This positive economic development carries significant implications for investors and businesses. The interplay between inflation, interest rates, and currency strength creates a dynamic and evolving environment for both domestic and international markets.

Call to Action: Stay informed about the latest developments impacting the Pound Sterling and the UK economy. Regularly monitor UK inflation reports, BOE announcements, and economic news to make sound investment decisions and adapt your business strategies accordingly. Learn more about navigating the changing landscape of GBP strength by subscribing to our newsletter for ongoing updates: [link to relevant content/news page].

Featured Posts

-

Trumps Campaign Against Elite Law Firms Faces New Court Loss

May 26, 2025

Trumps Campaign Against Elite Law Firms Faces New Court Loss

May 26, 2025 -

One Year Of Loss Jonathan Peretzs Strength And His Son

May 26, 2025

One Year Of Loss Jonathan Peretzs Strength And His Son

May 26, 2025 -

Kak Vyglyadyat Syn I Doch Naomi Kempbell Foto I Podrobnosti

May 26, 2025

Kak Vyglyadyat Syn I Doch Naomi Kempbell Foto I Podrobnosti

May 26, 2025 -

Hasil Latihan Bebas Moto Gp Inggris 2025 Fp 1 Jadwal Live Race Dan Jam Tayang Di Trans7

May 26, 2025

Hasil Latihan Bebas Moto Gp Inggris 2025 Fp 1 Jadwal Live Race Dan Jam Tayang Di Trans7

May 26, 2025 -

Lock Up Season 5 A Guide To The Best Action Episodes

May 26, 2025

Lock Up Season 5 A Guide To The Best Action Episodes

May 26, 2025

Latest Posts

-

Ipswich Town Player Performances Mc Kenna Positive Phillips And Cajuste Need Improvement

May 28, 2025

Ipswich Town Player Performances Mc Kenna Positive Phillips And Cajuste Need Improvement

May 28, 2025 -

Mc Kennas Strong Week Highlights Ipswich Towns Mixed Performance

May 28, 2025

Mc Kennas Strong Week Highlights Ipswich Towns Mixed Performance

May 28, 2025 -

Ipswich Towns Week In Review Mc Kenna Shines Phillips And Cajuste Struggle

May 28, 2025

Ipswich Towns Week In Review Mc Kenna Shines Phillips And Cajuste Struggle

May 28, 2025 -

Leeds United Transfer Update Phillips Future Uncertain

May 28, 2025

Leeds United Transfer Update Phillips Future Uncertain

May 28, 2025 -

The Kalvin Phillips To Leeds United Transfer Saga

May 28, 2025

The Kalvin Phillips To Leeds United Transfer Saga

May 28, 2025