Pound Strengthens As Traders Reduce Expectations Of BOE Interest Rate Cuts

Table of Contents

Economic Data Points to a Stronger Pound

Recent positive UK economic indicators have significantly boosted investor confidence and fueled the pound's rise. Stronger-than-expected GDP growth figures suggest a resilient UK economy, countering previous concerns about a potential recession. Coupled with this, falling unemployment rates point towards a robust labor market, further solidifying the positive narrative surrounding the UK economy.

- GDP Growth: The latest GDP figures surpassed analyst predictions, signaling a healthier economic outlook than previously anticipated. This positive data directly impacts the GBP exchange rate, making it more attractive to investors.

- Unemployment Rate: A decline in the UK unemployment rate indicates a thriving labor market, contributing to increased consumer spending and overall economic stability. This strength reduces the perceived risk associated with investing in the pound.

- Retail Sales: Improved retail sales figures suggest increased consumer confidence and spending, further bolstering the overall economic health of the UK and supporting the GBP's value.

These positive economic indicators, including robust GDP growth, a falling unemployment rate, and improved retail sales figures, collectively paint a picture of a healthier UK economy, making the pound a more attractive investment and driving up its value. The interplay between the UK economy, GDP growth, unemployment rate, and inflation directly impacts the GBP exchange rate.

Shifting Inflation Expectations

Changes in inflation forecasts significantly influence the BOE's monetary policy decisions. If inflation is easing faster than anticipated, the need for further interest rate cuts diminishes, supporting the pound's strength. The BOE's monetary policy is intrinsically linked to inflation rate targets, and a more favorable inflation outlook reduces the likelihood of further rate reductions.

- Easing Inflation: Recent data suggests that UK inflation, while still elevated, is declining more rapidly than initially projected. This positive trend reduces pressure on the BOE to implement further rate cuts.

- Global Inflation Trends: The impact of global inflation trends on the UK's economic outlook is also crucial. A moderation in global inflation can positively influence UK inflation expectations, further supporting the pound.

- BOE Interest Rates: The market’s reduced expectation of further BOE interest rate cuts directly contributes to increased demand for the pound. Lower interest rates generally make a currency less attractive, whereas stability or a less aggressive lowering of rates can improve investor confidence.

The interplay between the UK inflation rate, BOE interest rates, and global inflation trends significantly influences the GBP forecast and the overall market sentiment surrounding the pound.

Market Sentiment and Trader Behavior

Traders' reduced expectations of BOE rate cuts are a significant driver of the pound's recent appreciation. This shift in market sentiment reflects a growing confidence in the UK economy's resilience and its ability to weather potential economic headwinds. Lower expectations of rate cuts generally lead to increased demand for the pound, as investors seek to capitalize on its strengthening value.

- GBP Trading: Increased activity in GBP trading reflects the growing interest and confidence in the pound’s potential for further growth.

- Forex Market: The forex market's response to the reduced expectations of BOE rate cuts demonstrates the significant impact of monetary policy decisions on currency values.

- Speculative Trading: While speculative trading can introduce volatility, the current trend indicates a prevailing positive sentiment among traders regarding the pound’s future.

The interplay between GBP trading, the forex market, and market sentiment shapes the pound's value.

Potential Risks and Future Outlook for the Pound

While the outlook for the pound is currently positive, several potential risks could affect its strength. Geopolitical uncertainty, a potential global economic slowdown, or unexpected shifts in inflation could all impact the GBP outlook.

- Geopolitical Uncertainty: Global events and geopolitical risks can create volatility in the currency markets and influence the pound's performance.

- Global Economic Slowdown: A global economic slowdown could negatively impact the UK economy and put downward pressure on the pound.

- Unexpected Inflation Shifts: Unexpected spikes in inflation could force the BOE to reconsider its monetary policy, potentially leading to further rate cuts and weakening the pound.

Despite these risks, the current economic indicators suggest a cautiously optimistic outlook for the pound sterling forecast, but constant monitoring of the global economy and potential currency risks is crucial.

Conclusion

The pound's recent strengthening is a result of several converging factors: robust UK economic data, easing inflation expectations, and a shift in market sentiment away from anticipating further BOE interest rate cuts. The interplay between the UK economy, inflation, and trader behavior is crucial in shaping the GBP exchange rate. While the outlook is currently positive, potential risks remain. Stay tuned for further updates on the pound's performance and the evolving outlook for BOE interest rate cuts. Monitor our website for the latest analysis and insights on GBP trading and the UK economy.

Featured Posts

-

Auto Dealers Double Down Against Ev Mandate Requirements

May 25, 2025

Auto Dealers Double Down Against Ev Mandate Requirements

May 25, 2025 -

Los Mellizos De Alberto De Monaco Celebran Su Primera Comunion

May 25, 2025

Los Mellizos De Alberto De Monaco Celebran Su Primera Comunion

May 25, 2025 -

Delayed Promotions Accenture To Advance 50 000 Staff Members

May 25, 2025

Delayed Promotions Accenture To Advance 50 000 Staff Members

May 25, 2025 -

Understanding The Hells Angels Motorcycle Club

May 25, 2025

Understanding The Hells Angels Motorcycle Club

May 25, 2025 -

Update Teen Released On Bail Rearrested For Fatal Shop Stabbing

May 25, 2025

Update Teen Released On Bail Rearrested For Fatal Shop Stabbing

May 25, 2025

Latest Posts

-

Elever Des Enfants Avec Un Grand Ecart D Age Le Temoignage De Melanie Thierry Et Raphael

May 25, 2025

Elever Des Enfants Avec Un Grand Ecart D Age Le Temoignage De Melanie Thierry Et Raphael

May 25, 2025 -

Melanie Thierry Et Raphael Les Defis D Une Famille Nombreuse Avec De Grands Ecarts D Age

May 25, 2025

Melanie Thierry Et Raphael Les Defis D Une Famille Nombreuse Avec De Grands Ecarts D Age

May 25, 2025 -

Melanie Thierry Et Raphael Parentalite Et Ecart D Age Entre Leurs Enfants

May 25, 2025

Melanie Thierry Et Raphael Parentalite Et Ecart D Age Entre Leurs Enfants

May 25, 2025 -

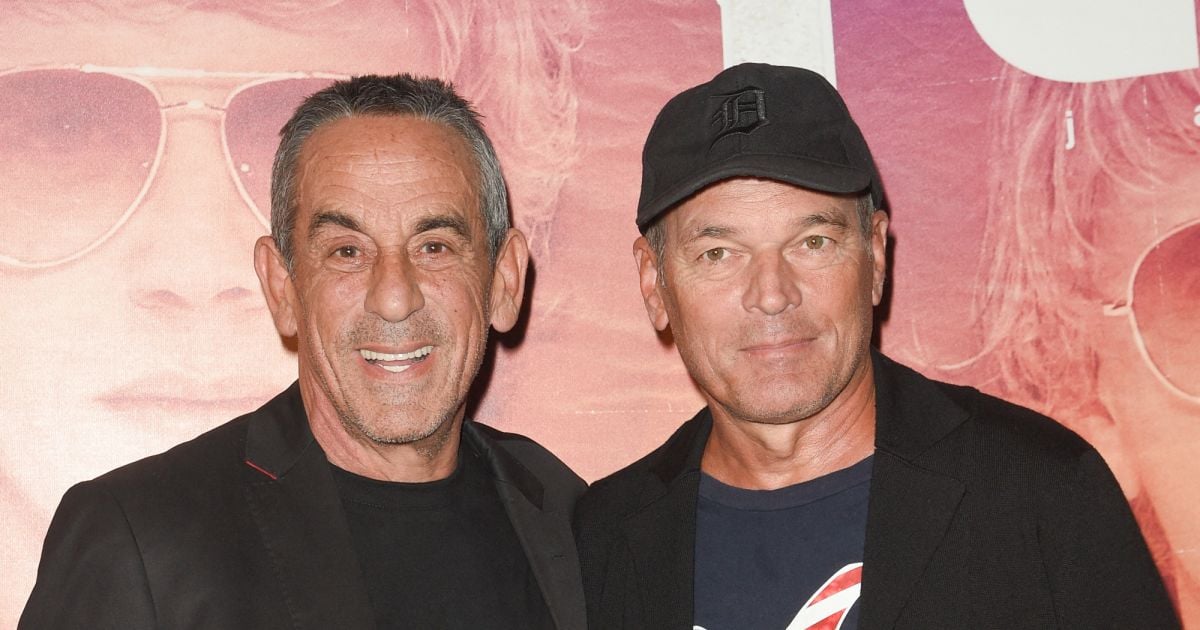

Thierry Ardisson Et Laurent Baffie Les Raisons D Une Possible Separation Machisme Et Connerie Au C Ur Du Debat

May 25, 2025

Thierry Ardisson Et Laurent Baffie Les Raisons D Une Possible Separation Machisme Et Connerie Au C Ur Du Debat

May 25, 2025 -

Les Blagues De Laurent Baffie Ardisson Dement Les Accusations De Machisme

May 25, 2025

Les Blagues De Laurent Baffie Ardisson Dement Les Accusations De Machisme

May 25, 2025