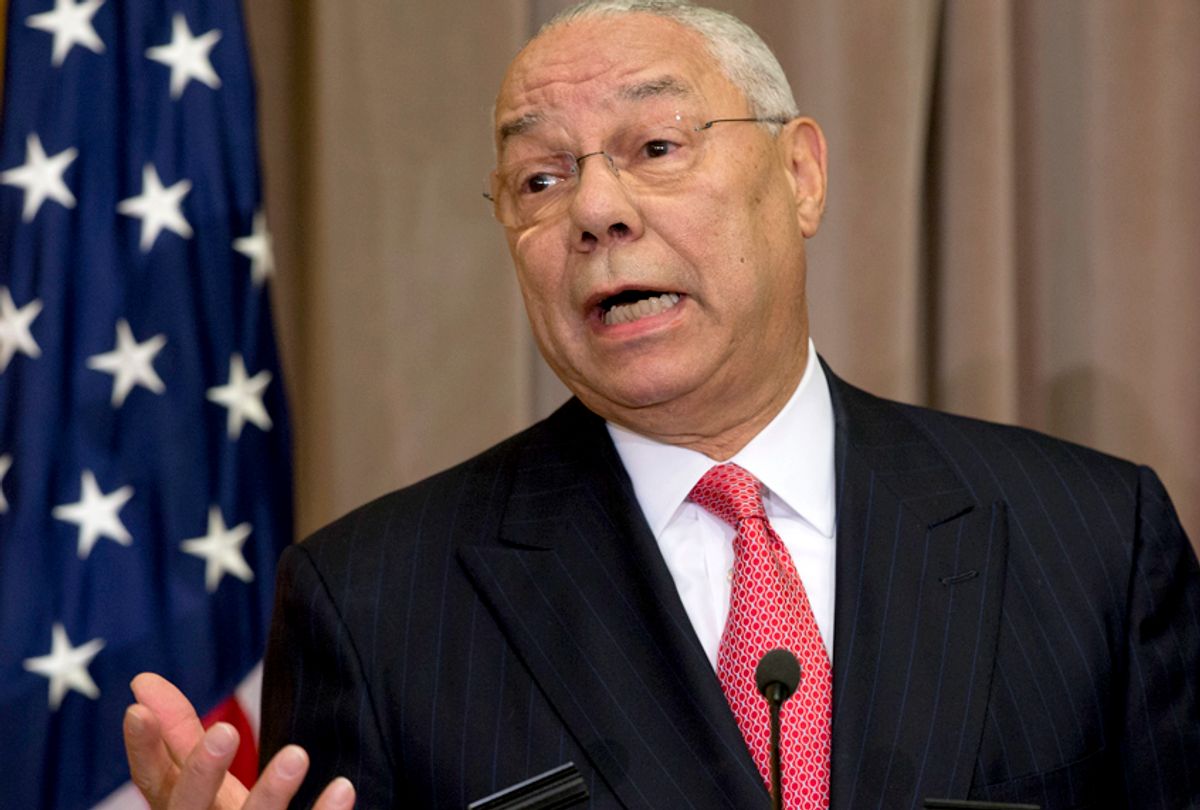

Powell Warns: Tariffs Could Jeopardize Federal Reserve Objectives

Table of Contents

Federal Reserve Chairman Jerome Powell has issued a stark warning: escalating tariffs pose a serious threat to the Federal Reserve's ability to achieve its macroeconomic objectives. This article delves into the specific ways tariffs could undermine the Fed's goals, examining the potential ripple effects on inflation, employment, and overall economic stability. Understanding Powell's concerns is crucial for investors, businesses, and policymakers alike. The impact of tariffs on the US economy is a complex issue with far-reaching consequences.

Inflationary Pressures from Tariffs

Tariffs, essentially taxes on imported goods, exert significant inflationary pressure on the US economy. This pressure stems from two primary sources: increased costs for consumers and businesses, and disruptions to global supply chains.

Increased Costs for Consumers and Businesses

Tariffs directly increase the price of imported goods, leading to higher consumer prices and reduced purchasing power. This effect is felt across various sectors.

- Example: Tariffs on steel and aluminum raise the cost of manufacturing automobiles, leading to higher car prices. This increased cost is then passed onto the consumer. Similarly, tariffs on raw materials used in manufacturing electronics will increase the cost of those goods.

- Impact: Reduced consumer spending, a potential decrease in economic growth, and a squeeze on household budgets. This can lead to a slowdown in overall economic activity.

Supply Chain Disruptions

The imposition of tariffs can severely disrupt global supply chains. Businesses are forced to adapt, often leading to increased costs and uncertainty.

- Example: Tariffs on Chinese goods may lead US businesses to relocate sourcing to other countries, adding significant transportation costs, delays, and potential quality control issues. This adds complexity and expense to the supply chain.

- Impact: Increased production costs for businesses, potentially impacting inflation and significantly reducing business investment. Uncertainty around supply chains makes it difficult to plan for the future.

Impact on Employment and Economic Growth

The negative effects of tariffs extend beyond inflation to impact employment and overall economic growth. Job losses and retaliatory measures from other countries pose significant threats.

Job Losses in Tariff-Sensitive Sectors

Industries heavily reliant on imported goods or exports are particularly vulnerable to job losses due to reduced competitiveness and decreased demand.

- Example: Tariffs on agricultural products could lead to reduced exports and subsequent farm job losses. Similarly, manufacturing sectors reliant on imported components could face layoffs.

- Impact: Increased unemployment, reduced economic growth, and potential social unrest in affected communities. These job losses can have a cascading effect on local economies.

Retaliatory Tariffs and Global Trade Wars

Imposing tariffs often provokes retaliatory measures from other countries, escalating into trade wars that harm global economic growth. This tit-for-tat response creates a negative feedback loop.

- Example: A tariff on US goods imposed by a trading partner could reduce US exports, hurt domestic jobs, and damage the US's international standing. The resulting trade war impacts both countries involved and can spill over to other economies.

- Impact: Reduced global trade, a negative impact on US GDP, and increased uncertainty in the global marketplace. This uncertainty makes it difficult for businesses to plan long-term investments.

Challenges for the Federal Reserve's Monetary Policy

The inflationary pressures and economic uncertainty created by tariffs present significant challenges for the Federal Reserve's monetary policy, making it harder to achieve its dual mandate of price stability and maximum employment.

Difficulty in Achieving Price Stability

Inflationary pressures caused by tariffs make it more challenging for the Fed to maintain price stability. The Fed may have to choose between combating inflation and supporting economic growth.

- Example: The Fed might be forced to raise interest rates to combat inflation, potentially slowing economic growth and increasing borrowing costs for businesses and consumers. This creates a difficult balancing act for the central bank.

- Impact: Potential conflict between the Fed's dual mandate of price stability and maximum employment. The Fed could face criticism for either failing to control inflation or stifling economic growth.

Uncertainty and Reduced Investment

The uncertainty surrounding tariffs creates volatility in financial markets and discourages business investment, hindering economic expansion. This uncertainty is a major concern for policymakers.

- Example: Businesses may postpone investment decisions due to uncertainty about future trade policies. This hesitancy to invest can lead to a decrease in capital expenditures and long-term growth.

- Impact: Reduced capital expenditure, slower economic growth, and a potential downward spiral in economic activity. The lack of investment leads to less innovation and fewer job opportunities.

Conclusion

Chairman Powell's warning about the detrimental effects of tariffs on the Federal Reserve's objectives is a serious call to action. The inflationary pressures, job losses, and uncertainty generated by tariffs create significant challenges for the Fed in achieving its goals of price stability and maximum employment. Understanding the potential consequences of escalating trade disputes is crucial for all stakeholders. Ignoring the impact of tariffs on the US economy could have severe long-term consequences. Staying informed about the Federal Reserve’s pronouncements on tariffs and their potential impact on economic policy is vital for navigating the current economic landscape. Therefore, pay close attention to future statements regarding the impact of Powell's warnings on tariffs and their effect on the Federal Reserve's objectives.

Featured Posts

-

Moto Gp Argentina 2025 Tanggal Waktu And Jadwal Sprint Race

May 26, 2025

Moto Gp Argentina 2025 Tanggal Waktu And Jadwal Sprint Race

May 26, 2025 -

Rising Gold Prices A Response To Trumps Protectionist Policies

May 26, 2025

Rising Gold Prices A Response To Trumps Protectionist Policies

May 26, 2025 -

Hoka Cielo X1 2 0 Running Shoe Review A Speedier Run Experience

May 26, 2025

Hoka Cielo X1 2 0 Running Shoe Review A Speedier Run Experience

May 26, 2025 -

Analysis Of Nationwide Tennis Participation Reaching 25 Million Players By August 2024

May 26, 2025

Analysis Of Nationwide Tennis Participation Reaching 25 Million Players By August 2024

May 26, 2025 -

De Minaurs Madrid Open Campaign Ends In Straight Sets Defeat Swiatek Advances

May 26, 2025

De Minaurs Madrid Open Campaign Ends In Straight Sets Defeat Swiatek Advances

May 26, 2025

Latest Posts

-

Transfer Race Heats Up Arsenal And Newcastle Vie For Ligue 1 Star

May 28, 2025

Transfer Race Heats Up Arsenal And Newcastle Vie For Ligue 1 Star

May 28, 2025 -

Ligue 1 Talent Arsenal And Newcastle To Compete For Signing

May 28, 2025

Ligue 1 Talent Arsenal And Newcastle To Compete For Signing

May 28, 2025 -

Man Utd Interference In Liverpools 25m Transfer Pursuit

May 28, 2025

Man Utd Interference In Liverpools 25m Transfer Pursuit

May 28, 2025 -

Arsenal And Newcastle Target Promising Ligue 1 Youngster

May 28, 2025

Arsenal And Newcastle Target Promising Ligue 1 Youngster

May 28, 2025 -

Liverpool Eye Two Wingers Contract Negotiations With Salah Take Center Stage

May 28, 2025

Liverpool Eye Two Wingers Contract Negotiations With Salah Take Center Stage

May 28, 2025