Powell Warns: Tariffs Could Jeopardize Fed's Economic Objectives

Table of Contents

Federal Reserve Chairman Jerome Powell has issued a stark warning: escalating tariffs could seriously jeopardize the Fed's economic objectives. His concerns highlight the complex interplay between trade policy and monetary policy, with potentially significant consequences for American businesses and consumers. This article delves into Powell's concerns and explores the potential ramifications of tariffs on the US economy. The impact of tariffs extends far beyond simple trade balances, affecting everything from inflation and economic growth to investment and job creation. Understanding these implications is crucial for navigating the current economic landscape.

Tariffs and Inflation: A Direct Threat to the Fed's Mandate

Tariffs directly increase the cost of imported goods, leading to higher inflation. This is because tariffs act as a tax on imports, increasing the price consumers pay for those goods. This direct inflationary pressure puts the Fed in a difficult position. The Fed's dual mandate is to promote maximum employment and price stability. However, tariffs make achieving price stability much more challenging.

- Increased prices for consumers: Higher prices for imported goods translate directly to higher prices for consumers, reducing their purchasing power.

- Reduced purchasing power: As prices rise, consumers can afford less, potentially leading to decreased consumer spending and economic slowdown.

- Potential for wage-price spirals: If businesses pass on increased costs due to tariffs through higher prices, workers may demand higher wages to compensate for the reduced purchasing power, creating a wage-price spiral that further fuels inflation.

- Difficulty for the Fed to maintain its inflation target: The Fed aims to keep inflation at around 2%. Tariffs make achieving this target significantly more difficult, forcing the Fed to potentially take actions that could negatively impact economic growth.

The Fed uses measures like the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) index to track inflation. These metrics are now significantly impacted by the inflationary pressure stemming from tariffs, creating a complex challenge for the central bank.

The Impact of Tariffs on Economic Growth and Investment

The uncertainty created by tariffs discourages business investment and slows economic expansion. Businesses become hesitant to invest in expansion or new projects when facing unpredictable trade policies and increased costs. This uncertainty is a significant drag on economic growth.

- Reduced business confidence: Tariffs create uncertainty about future costs and market access, leading to reduced business confidence and investment.

- Decreased capital expenditure: Businesses are less likely to invest in new equipment, facilities, or technology when facing higher input costs and uncertain market conditions.

- Supply chain disruptions: Tariffs disrupt established supply chains, forcing businesses to seek alternative, often more expensive, suppliers.

- Negative impact on GDP growth: Reduced investment and consumer spending directly translate to slower GDP growth, potentially leading to job losses and reduced economic prosperity.

The ripple effects of reduced investment are far-reaching. Less investment means fewer jobs are created, and the overall economic prosperity suffers. The negative impact on GDP growth is a major concern for policymakers and economists alike.

Powell's Dilemma: Balancing Monetary Policy with Trade Policy

The Fed's primary tools are monetary policy levers like interest rates and money supply. However, tariffs are a fiscal policy issue, primarily under the control of the legislative and executive branches of government. This creates a significant dilemma for Powell and the Federal Reserve.

- Monetary policy focuses on interest rates and money supply: The Fed can adjust interest rates to influence borrowing and lending, and manage the money supply to impact inflation and economic activity.

- Tariffs are a fiscal policy issue, outside the Fed's direct control: The Fed cannot directly influence tariff policy; it can only react to its consequences.

- The Fed's ability to counteract tariff-induced economic shocks is limited: While the Fed can attempt to mitigate some of the negative effects, its ability to fully counteract the economic shocks caused by tariffs is limited.

- Potential for conflict between the Fed's objectives and the administration's trade policies: The Fed's pursuit of price stability and maximum employment may conflict with the administration's trade policy objectives, leading to difficult choices and potential policy trade-offs.

Coordinating monetary policy with often unpredictable trade policies presents a significant challenge.

The Role of the Federal Reserve in a Trade War

The Fed's role in mitigating trade war impacts is primarily reactive. They can adjust interest rates to counter inflationary pressures or stimulate economic growth, but these actions have limitations. The Fed’s communication strategy during periods of trade tension is also crucial; clear and transparent communication helps to manage market expectations and maintain confidence. Analyzing potential scenarios and preparing appropriate response strategies is a key part of the Fed’s ongoing work.

Conclusion

Chairman Powell's warnings regarding the detrimental impact of tariffs on the Fed's economic objectives underscore the importance of considering the interconnectedness of trade and monetary policy. The potential for increased inflation, slower economic growth, and reduced investment highlights the significant risks associated with escalating trade conflicts. The Fed's ability to counteract these negative effects is limited, emphasizing the need for a comprehensive and coordinated approach to address trade-related challenges.

Call to Action: Understanding the potential consequences of tariffs on the US economy is crucial. Stay informed about the latest developments in trade policy and the Fed's response to Powell's warnings about tariffs jeopardizing economic objectives to make informed financial decisions and advocate for sound economic policies.

Featured Posts

-

Extreme Price Hike Broadcoms V Mware Proposal Costs At And T 1 050 More

May 25, 2025

Extreme Price Hike Broadcoms V Mware Proposal Costs At And T 1 050 More

May 25, 2025 -

Mynamynw Ybqa Fy Mwnakw Tjdyd Aleqd Lmwsm Akhr

May 25, 2025

Mynamynw Ybqa Fy Mwnakw Tjdyd Aleqd Lmwsm Akhr

May 25, 2025 -

Community Gathers For Craig Mc Ilquhams Memorial Service On Sunday

May 25, 2025

Community Gathers For Craig Mc Ilquhams Memorial Service On Sunday

May 25, 2025 -

Bradford And Wyoming Counties Under Flash Flood Warning Until Tuesday

May 25, 2025

Bradford And Wyoming Counties Under Flash Flood Warning Until Tuesday

May 25, 2025 -

When Someone Disappears Practical Steps And Resources

May 25, 2025

When Someone Disappears Practical Steps And Resources

May 25, 2025

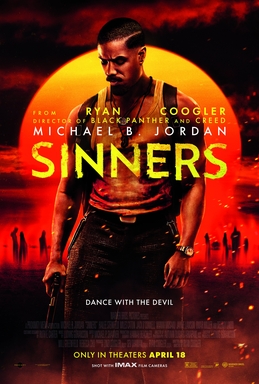

Get Ready The Horror Film Sinners Filmed In Louisiana Is Almost Here

Get Ready The Horror Film Sinners Filmed In Louisiana Is Almost Here

Sinners Louisianas Newest Horror Film Hits Theaters

Sinners Louisianas Newest Horror Film Hits Theaters

Sinners New Horror Movie Filmed In Louisiana Coming Soon To Theaters

Sinners New Horror Movie Filmed In Louisiana Coming Soon To Theaters