Powell's Fed's Calculated Risk: Waiting Too Long To Cut Interest Rates?

Table of Contents

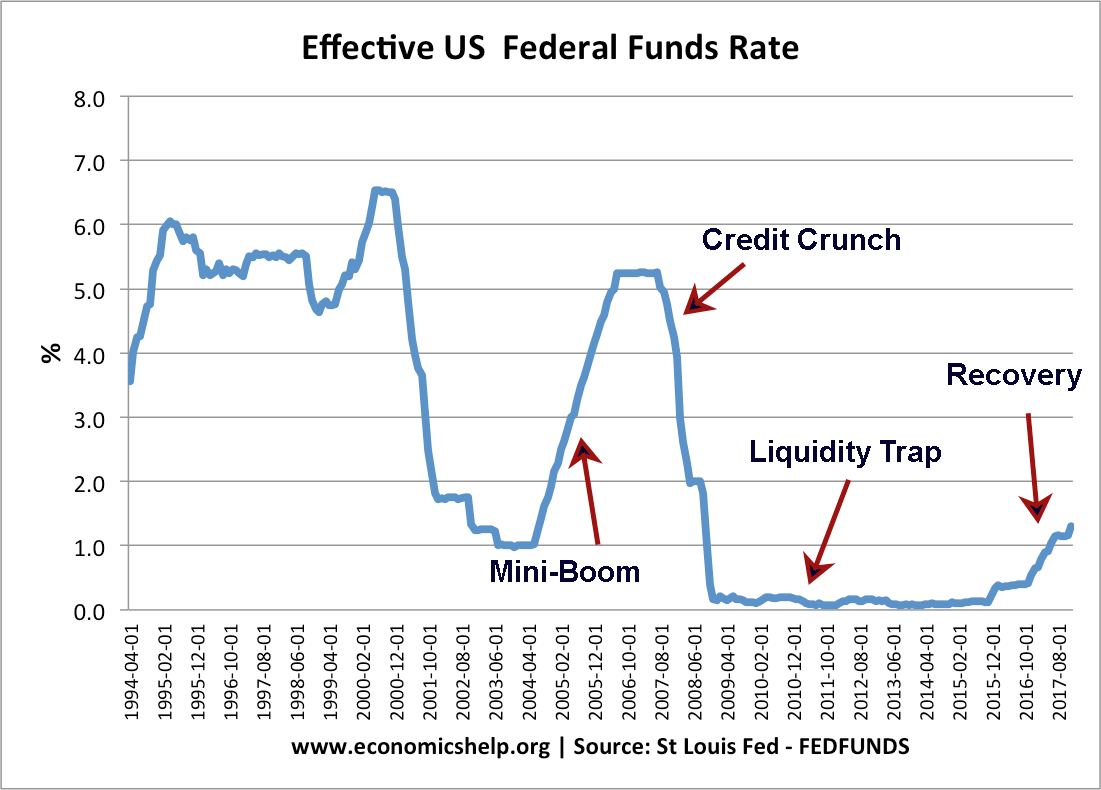

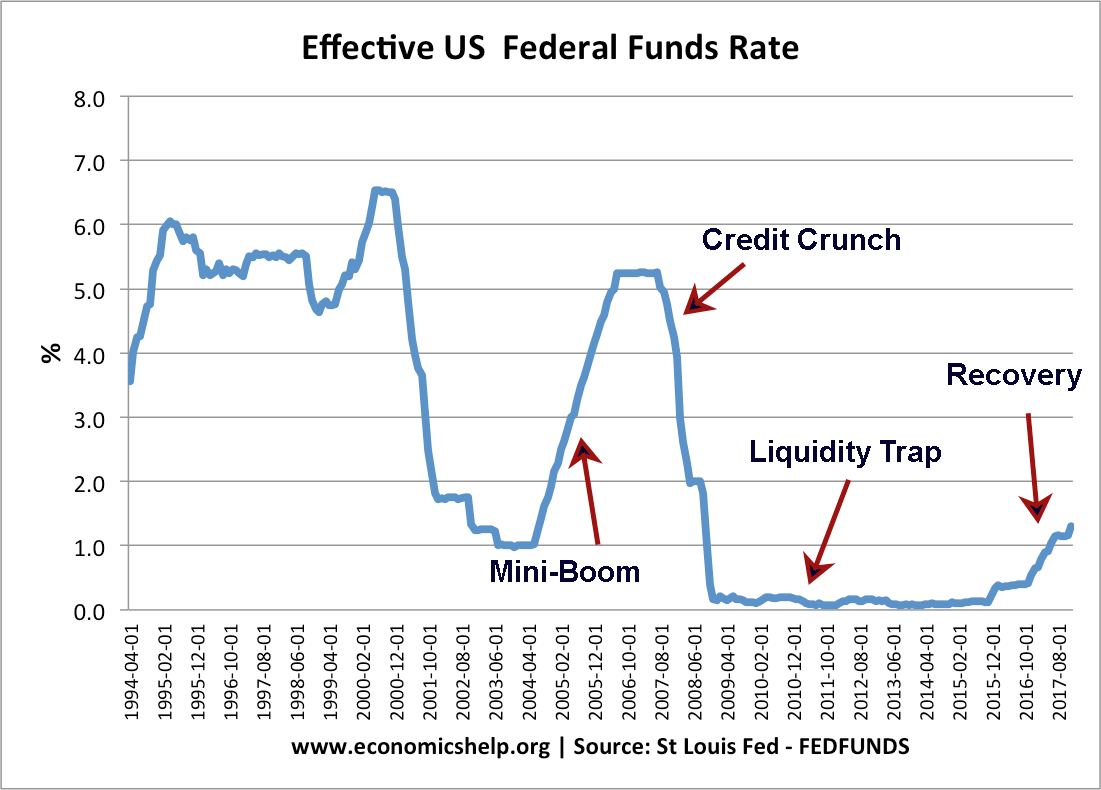

The Inflationary Pressure & The Fed's Response

Inflation, the persistent increase in the general price level of goods and services, has been a major challenge in recent years. The Consumer Price Index (CPI) and Producer Price Index (PPI) have shown significant increases, far exceeding the Fed's target rate. To combat this, the Fed implemented a series of aggressive interest rate hikes throughout 2022 and into 2023, aiming to cool down the overheating economy by making borrowing more expensive. This, in theory, should curb consumer spending and business investment, thus reducing demand and easing inflationary pressures.

- Inflation data points: CPI consistently above 2% target for an extended period, PPI showing similar trends.

- Sectors most affected: Housing, energy, and food prices have seen particularly sharp increases, impacting household budgets significantly.

- Impact of interest rate hikes: While some slowing of inflation is observed, the effectiveness of the hikes remains a subject of ongoing debate, with concerns that the impact on growth might be too severe.

The Risks of Delayed Interest Rate Cuts

The Fed's cautious approach to cutting interest rates presents considerable risks. Prolonging high interest rates for too long carries the potential to trigger a more severe and prolonged recession than might otherwise occur. Businesses might postpone investments, leading to job losses and a decrease in overall economic activity. A prolonged period of high interest rates could also lead to a deflationary spiral, where falling prices lead to reduced consumer spending and further economic contraction.

- Risks of deflationary spiral: High interest rates could suppress demand to the point where prices start falling, potentially leading to a vicious cycle of falling prices and reduced economic activity.

- Potential increase in unemployment figures: Economic slowdown due to high interest rates could result in layoffs and increased unemployment claims.

- Impact on consumer confidence and business sentiment: Uncertainty surrounding interest rates could negatively impact consumer confidence and business investment, slowing down overall economic growth.

Economic Indicators Pointing Towards a Rate Cut

Several key economic indicators are now providing signals that may support the case for interest rate cuts. Slowing GDP growth, decreased consumer spending, and a weakening housing market all suggest a cooling economy. Manufacturing activity is also showing signs of contraction, adding to the concerns of an economic downturn.

- Specific data points: Weakening GDP growth figures, declining consumer confidence index, shrinking housing starts data.

- Comparison to previous economic downturns: Current indicators show similarities to economic downturns of the past, raising concerns about the depth and duration of a potential recession.

- Analysis from leading economists: Many prominent economists are increasingly advocating for interest rate cuts, citing the risks of a prolonged recession.

Arguments Against Immediate Interest Rate Cuts

Despite the growing calls for rate cuts, some argue against immediate action. The primary concern is the risk of prematurely reigniting inflation. If interest rates are lowered too quickly, the reduced borrowing costs could stimulate demand, potentially pushing inflation back up again. Furthermore, there is the risk that further monetary policy easing might become ineffective, leading to a situation where the Fed has exhausted its policy tools without achieving its inflation targets.

- Potential inflationary pressures from supply chain issues: Supply chain bottlenecks and geopolitical instability could still fuel inflationary pressures.

- Risks of further monetary policy easing being ineffective: The effectiveness of further interest rate cuts might be limited if inflation is driven by factors beyond the Fed's control.

- Arguments for maintaining a hawkish stance: Some argue that the Fed should maintain a hawkish stance to ensure inflation is decisively brought under control before considering any rate cuts.

The Political Landscape and Interest Rate Decisions

The Fed operates with a mandate of maximum employment and price stability, but its decisions are inevitably influenced by the broader political climate. While legally independent, the Fed is acutely aware of the political ramifications of its actions. A perceived lack of action or overly aggressive policy can lead to political criticism, highlighting the delicate balancing act the Fed must perform.

- Potential political backlash against rate hikes or cuts: Both rate hikes and cuts can lead to political backlash depending on their impact on various sectors of the economy.

- The Fed's mandate and its independence from political influence: While the Fed aims to maintain its independence, political pressures can influence the timing and nature of its policy decisions.

Conclusion: Navigating Powell's Calculated Risk – The Path Forward

Powell's Fed faces a formidable challenge. The arguments for and against immediate interest rate cuts are compelling. The risk of prolonging high interest rates and deepening the recession is significant, yet the fear of reigniting inflation by cutting rates prematurely is equally concerning. Whether the Fed is waiting too long remains a subject of intense debate and hinges critically on how the economic indicators evolve in the coming months. A cautious approach seems likely, with potential for incremental adjustments rather than a sudden shift.

To stay abreast of the evolving situation and understand the implications of Powell's Fed's calculated risk, it is crucial to follow reliable economic news sources and analyze the latest data releases. Continue researching "Fed interest rate cuts" and "Powell's economic policy" to gain a more comprehensive understanding of this crucial economic juncture. The future direction of interest rates will significantly shape the global economic landscape, making informed understanding more crucial than ever.

Featured Posts

-

Palantir Stock Blowouts High Multiple And Future Prospects

May 07, 2025

Palantir Stock Blowouts High Multiple And Future Prospects

May 07, 2025 -

Dame Laura Kenny Olympic Gold Sir Chris Hoys Influence And Her New Chapter

May 07, 2025

Dame Laura Kenny Olympic Gold Sir Chris Hoys Influence And Her New Chapter

May 07, 2025 -

Xrp Etf Approval Potential For 800 M In Week 1 Inflows

May 07, 2025

Xrp Etf Approval Potential For 800 M In Week 1 Inflows

May 07, 2025 -

Ps 5 Vs Xbox Series S Which Console Should You Choose

May 07, 2025

Ps 5 Vs Xbox Series S Which Console Should You Choose

May 07, 2025 -

Srks Stunning Sabyasachi Ensemble At The Met Gala

May 07, 2025

Srks Stunning Sabyasachi Ensemble At The Met Gala

May 07, 2025

Latest Posts

-

Inter Milans Triumph Over Barcelona Securing A Champions League Final Spot

May 08, 2025

Inter Milans Triumph Over Barcelona Securing A Champions League Final Spot

May 08, 2025 -

76

May 08, 2025

76

May 08, 2025 -

Barcelonas Champions League Dream Ends Against Inter Milan

May 08, 2025

Barcelonas Champions League Dream Ends Against Inter Milan

May 08, 2025 -

How Inter Milan Beat Barcelona To Reach The Champions League Final

May 08, 2025

How Inter Milan Beat Barcelona To Reach The Champions League Final

May 08, 2025 -

Inter Milan Through To Champions League Final After Barcelona Win

May 08, 2025

Inter Milan Through To Champions League Final After Barcelona Win

May 08, 2025