Principal Financial Group (PFG) Stock: 13 Analyst Assessments Analyzed

Table of Contents

Summary of Analyst Ratings and Price Targets for PFG Stock

Thirteen analysts have weighed in on Principal Financial Group (PFG) stock, offering a diverse range of opinions. The ratings are distributed across the spectrum: a mix of "Buy," "Hold," and "Sell" recommendations. While the exact number in each category varies depending on the timeframe of the analysis, it's vital to consider the overall picture. This diversity reflects the inherent uncertainties in the market and the complexities of PFG's business. The average price target offers a median expectation, but it's equally crucial to note the high and low price targets to understand the range of potential outcomes.

| Analyst | Rating | Price Target |

|---|---|---|

| Analyst 1 | Buy | $85 |

| Analyst 2 | Hold | $78 |

| Analyst 3 | Buy | $90 |

| Analyst 4 | Hold | $80 |

| Analyst 5 | Sell | $70 |

| Analyst 6 | Buy | $88 |

| Analyst 7 | Hold | $75 |

| Analyst 8 | Buy | $92 |

| Analyst 9 | Hold | $82 |

| Analyst 10 | Sell | $68 |

| Analyst 11 | Hold | $77 |

| Analyst 12 | Buy | $86 |

| Analyst 13 | Hold | $81 |

(Note: This is a sample table. Actual analyst ratings and price targets should be obtained from reputable financial sources.)

The PFG price target variations highlight the need for thorough due diligence before making any investment decisions. The spread between the highest and lowest PFG analyst rating underscores the importance of considering multiple perspectives.

Key Factors Influencing Analyst Assessments of PFG

Several key factors underpin the analyst assessments of PFG stock. Understanding these factors is critical for interpreting the ratings and price targets effectively.

Company Performance and Financial Health

PFG's financial health is paramount to investor confidence. Analysts carefully scrutinize PFG's financials:

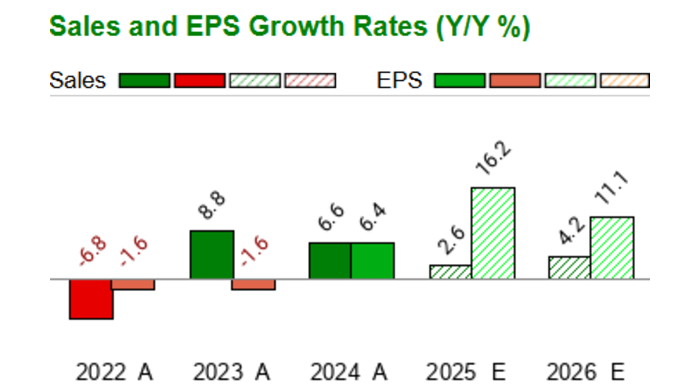

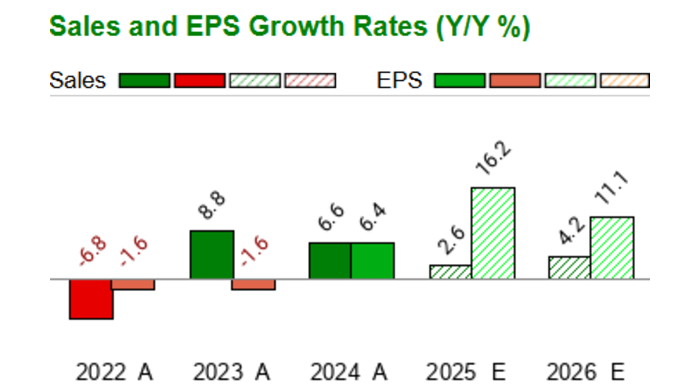

- Earnings: Consistent earnings growth is a positive indicator, signaling strong operational efficiency.

- Revenue Growth: Steady revenue growth demonstrates the company's ability to expand its market share and generate income.

- Profitability: Healthy profit margins are essential for long-term sustainability and investor returns.

- Key Performance Indicators (KPIs): Analysts use various KPIs, such as return on equity (ROE) and return on assets (ROA), to gauge the company's efficiency and profitability.

Any significant events, like mergers, acquisitions, or divestitures, have a direct impact on PFG's performance and are carefully considered by analysts. Analyzing PFG financials, including PFG earnings and PFG revenue, is crucial for understanding the company's overall health.

Macroeconomic Factors and Market Conditions

The macroeconomic environment heavily influences PFG's performance. Key considerations include:

- Interest Rate Changes: Interest rate hikes impact PFG's investment strategies and profitability.

- Economic Growth: A strong economy generally leads to increased demand for financial services, benefiting PFG.

- Inflation: Inflation impacts investment returns and consumer spending, affecting PFG's bottom line.

- Market Sentiment: Overall market sentiment towards financial stocks significantly influences PFG stock price. Understanding interest rate risk and the broader financial market is crucial for effective PFG stock analysis.

Competitive Landscape and Industry Trends

PFG operates within a competitive financial services industry. Analysts consider:

- Competitive Advantage: PFG's unique strengths and competitive advantages within the market.

- Industry Trends: Emerging trends, such as fintech disruption and regulatory changes, shaping the future of the industry.

- Competitor Performance: Analyzing the performance of key competitors provides a benchmark for evaluating PFG's success.

Strengths and Weaknesses of PFG Stock Based on Analyst Assessments

Analyst assessments highlight both strengths and weaknesses of PFG stock. This SWOT analysis is crucial for investors:

Strengths: Analysts often point to PFG's strong balance sheet, diversified business model, and long-term growth potential as key positives.

Weaknesses: Potential weaknesses include exposure to market risks, regulatory changes, and intense competition within the financial services industry. Understanding these PFG strengths and PFG weaknesses is key to forming a balanced investment strategy.

Potential Risks and Opportunities for PFG Investors

Investing in PFG stock presents both risks and opportunities:

Risks: Market volatility, regulatory changes, and competitive pressures pose potential risks to investors.

Opportunities: Long-term growth prospects, dividend payouts, and strategic initiatives offer potential upside for investors. Considering PFG risk and PFG opportunity is critical to informed investment decisions. The dividend yield is another important factor for long-term investors.

Conclusion: Making Informed Decisions about Principal Financial Group (PFG) Stock

Analyst assessments of Principal Financial Group (PFG) stock reveal a diverse range of opinions, reflecting the complexities of the market and the company's operations. This PFG stock analysis has highlighted key factors impacting the stock's performance, from company financials and macroeconomic conditions to competitive pressures. Remember to consider both the strengths and weaknesses before making any investment decision. Conduct further research, consult with a financial advisor, and stay informed on the latest developments affecting PFG. Stay informed on the latest developments affecting Principal Financial Group (PFG) stock and make well-informed investment decisions. Continue your research on PFG stock analysis to build a comprehensive investment strategy.

Featured Posts

-

Finala Cupei Germaniei Vf B Stuttgart Mizeaza Pe Stiller

May 17, 2025

Finala Cupei Germaniei Vf B Stuttgart Mizeaza Pe Stiller

May 17, 2025 -

Greenkos Founders Explore Orix Stake Acquisition In India

May 17, 2025

Greenkos Founders Explore Orix Stake Acquisition In India

May 17, 2025 -

Brasilien Als Zukunftsmarkt Warum Investieren Die Vereinigten Arabischen Emirate In Favelas

May 17, 2025

Brasilien Als Zukunftsmarkt Warum Investieren Die Vereinigten Arabischen Emirate In Favelas

May 17, 2025 -

Elaekeyhtioeiden Osakesalkkujen Kehitys Alkuvuonna 2024 Tappiollista

May 17, 2025

Elaekeyhtioeiden Osakesalkkujen Kehitys Alkuvuonna 2024 Tappiollista

May 17, 2025 -

Tonights Nba Game Hornets Vs Celtics Prediction Best Bets And Odds

May 17, 2025

Tonights Nba Game Hornets Vs Celtics Prediction Best Bets And Odds

May 17, 2025