Private Credit Career: 5 Do's & Don'ts For Applicant Success

Table of Contents

5 Do's for a Winning Private Credit Job Application

Do 1: Tailor Your Resume and Cover Letter to Each Private Credit Role

Your resume and cover letter are your first impression – make it count. Generic applications rarely succeed in the competitive private credit job market. Each application should be meticulously tailored to the specific job description and the firm's investment strategy.

- Highlight relevant skills and experience: Focus on achievements directly relevant to the job requirements. Don't just list your responsibilities; showcase your impact.

- Quantify achievements: Instead of saying "managed a portfolio," say "managed a $50 million portfolio, achieving a 12% annualized return." Use numbers to demonstrate your success.

- Use keywords from the job description: Scan the job description for keywords and incorporate them naturally into your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application.

- Showcase understanding of private debt instruments: Demonstrate your familiarity with direct lending, mezzanine debt, distressed debt, unitranche, and other relevant instruments.

- Mention relevant software proficiency: Highlight your expertise in financial modeling software like Argus, Bloomberg Terminal, and other relevant tools used in private credit analysis.

Demonstrating a deep understanding of the specific role and the firm's investment thesis is crucial. For instance, if a firm focuses on senior secured lending to middle-market companies, your resume should emphasize experience in this area. Use strong action verbs (e.g., "analyzed," "underwrote," "negotiated") and quantifiable achievements to paint a compelling picture of your capabilities.

Do 2: Network Strategically Within the Private Credit Industry

Networking is paramount in securing a private credit job. It's not just about handing out resumes; it's about building genuine relationships and learning about hidden opportunities.

- Attend industry events: Conferences, seminars, and networking events offer valuable opportunities to meet professionals and learn about open positions.

- Connect with professionals on LinkedIn: Actively engage with professionals in private credit on LinkedIn. Join relevant groups and participate in discussions.

- Conduct informational interviews: Reach out to professionals for informational interviews to learn about their experiences and gain insights into the industry.

- Leverage alumni networks: If you have an alumni network, leverage it to connect with professionals who graduated from your university and are working in private credit.

- Join relevant professional organizations: Membership in organizations like the Association for Corporate Growth (ACG) can expand your network and provide access to valuable resources.

Building a strong network can lead to referrals, which significantly increase your chances of landing an interview. Networking provides valuable insights into the industry and helps you uncover hidden job opportunities not publicly advertised.

Do 3: Master the Fundamentals of Private Credit Investing

A strong foundational knowledge of private credit principles is non-negotiable. You need to demonstrate a deep understanding of the industry's intricacies.

- Understand different private debt strategies: Familiarize yourself with senior secured, unitranche, subordinated debt, mezzanine financing, and distressed debt strategies.

- Know key financial metrics: Master key credit analysis metrics such as Loan-to-Value (LTV), Debt Service Coverage Ratio (DSCR), and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA).

- Be familiar with credit risk assessment and underwriting processes: Understand the steps involved in assessing credit risk and underwriting loans.

- Stay updated on market trends and regulatory changes: Keep abreast of current events and regulatory changes affecting the private credit market.

To master these fundamentals, explore industry publications like Debtwire, Private Debt Investor, and GlobalCapital, and consider taking online courses specializing in private credit and alternative lending.

Do 4: Prepare for Behavioral and Technical Interview Questions

Interview preparation is crucial. You should be ready to answer both behavioral and technical questions confidently.

- Practice common interview questions: Prepare answers to common behavioral questions like "Tell me about a time you failed" and "Describe a challenging situation you overcame." Practice your responses to technical questions like "Walk me through a credit analysis."

- Research the firm's investment strategy and recent transactions: Demonstrate your understanding of the firm's investment focus and recent activities. This shows your genuine interest.

- Prepare questions to ask the interviewer: Asking insightful questions demonstrates your engagement and curiosity.

- Develop examples showcasing analytical and problem-solving skills: Prepare specific examples from your experience to highlight your analytical and problem-solving abilities.

Practice your answers with a friend or career counselor to build confidence and refine your responses. Thorough preparation significantly increases your chances of success.

Do 5: Showcase Your Passion for the Private Credit Industry

Genuine enthusiasm is contagious. Let your passion for private credit investing shine through during your application process.

- Demonstrate genuine interest in private credit investing: Express your interest in the firm's investment strategy and the specific role you're applying for.

- Express enthusiasm for the firm's investment philosophy: Show that you understand and appreciate the firm's approach to investing.

- Highlight any relevant personal projects or extracurricular activities: If you have any personal projects or extracurricular activities that demonstrate your interest in finance or investing, be sure to mention them.

Showing genuine interest can make all the difference. Your passion will be evident in your responses, and it will resonate with the interviewer.

5 Don'ts for a Private Credit Job Application

Don't 1: Submit a Generic Resume and Cover Letter

A generic application shows a lack of effort and significantly reduces your chances of success. Each application should be tailored to the specific opportunity.

- Avoid using the same resume and cover letter for multiple applications. Each application should be unique and specifically address the requirements of the particular job.

- Don't rely on generic templates. Use a template as a starting point, but personalize it significantly to reflect your unique experience and skills.

- Don't include irrelevant information. Only include information that is directly relevant to the job description.

Don't 2: Neglect Networking Opportunities

Networking is crucial, yet often overlooked. Don't underestimate its power in securing a private credit job.

- Don't underestimate the importance of networking. Actively seek out opportunities to meet professionals in the industry.

- Don't be afraid to reach out to professionals in the industry. Informational interviews can provide valuable insights and connections.

- Don't miss networking events. These events provide excellent opportunities to meet people and learn about job opportunities.

Don't 3: Lack Understanding of Private Credit Principles

A strong understanding of private credit fundamentals is essential. Don't attempt to bluff your way through technical questions.

- Don't attempt to apply without a solid understanding of fundamental concepts. Invest time in learning the key concepts and principles of private credit investing.

- Don't bluff your way through technical questions. Honesty is always the best policy. If you don't know the answer, admit it and offer to research it.

Don't 4: Underprepare for Interviews

Thorough interview preparation is crucial for success. Don't go into an interview unprepared.

- Don't go into an interview unprepared. Research the firm and the interviewer, and practice your answers to common interview questions.

- Don't fail to research the company. Understand their investment strategy, recent transactions, and company culture.

- Don't forget to practice your answers. Practice your responses to common interview questions out loud to build confidence.

Don't 5: Appear Uninterested or Disengaged

Your enthusiasm is infectious. Let your passion for the industry shine through during the interview.

- Don't appear apathetic during the interview. Show genuine interest in the opportunity and the firm.

- Don't fail to express genuine enthusiasm. Your passion for private credit will make a lasting impression.

Conclusion

Securing a successful private credit career requires strategic planning and diligent effort. By following these five "Do's" and avoiding the five "Don'ts," you significantly increase your chances of landing your dream job. Remember to tailor your applications, network strategically, master the fundamentals, prepare thoroughly for interviews, and showcase your passion for the private credit industry. Start your journey towards a rewarding private credit career by following these guidelines. Begin your application process today and make your mark in the exciting world of private credit. Research private credit jobs and take the next step in your private credit career path.

Featured Posts

-

Ticketmaster Virtual Venue Simplifica La Compra De Tus Boletos

May 30, 2025

Ticketmaster Virtual Venue Simplifica La Compra De Tus Boletos

May 30, 2025 -

Stock Market Today Dow And S And P 500 Live Updates May 29

May 30, 2025

Stock Market Today Dow And S And P 500 Live Updates May 29

May 30, 2025 -

Ulasan Lengkap Kawasaki W175 Cafe Gaya Retro Dengan Teknologi Modern

May 30, 2025

Ulasan Lengkap Kawasaki W175 Cafe Gaya Retro Dengan Teknologi Modern

May 30, 2025 -

Nueva Pelicula De Accion De Jin En Run Bts

May 30, 2025

Nueva Pelicula De Accion De Jin En Run Bts

May 30, 2025 -

Coldplay Concert Jins We Ll Return Soon Message To Bts Army

May 30, 2025

Coldplay Concert Jins We Ll Return Soon Message To Bts Army

May 30, 2025

Latest Posts

-

2025 Love Moto Stop Cancer Online Auction Items Up For Auction

May 31, 2025

2025 Love Moto Stop Cancer Online Auction Items Up For Auction

May 31, 2025 -

Donate And Bid 2025 Love Moto Stop Cancer Online Auction

May 31, 2025

Donate And Bid 2025 Love Moto Stop Cancer Online Auction

May 31, 2025 -

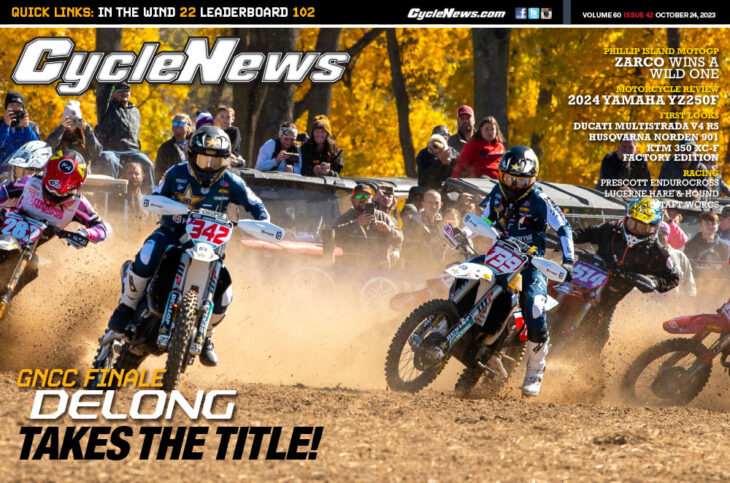

Cycle News Magazine In Depth Look At Issue 17 2025

May 31, 2025

Cycle News Magazine In Depth Look At Issue 17 2025

May 31, 2025 -

Cycle News Magazine Issue 12 2025 New Bikes Gear And Racing Highlights

May 31, 2025

Cycle News Magazine Issue 12 2025 New Bikes Gear And Racing Highlights

May 31, 2025 -

Love Moto Stop Cancer 2025 Online Auction Live

May 31, 2025

Love Moto Stop Cancer 2025 Online Auction Live

May 31, 2025