Private Credit Jobs: 5 Crucial Do's And Don'ts For Success

Table of Contents

DO: Network Strategically within the Private Credit Industry

Networking is paramount in the close-knit world of private credit. Building strong relationships can open doors that formal applications might miss. Consider these key strategies for effective private credit networking:

- Attend industry conferences and events: Events like the SuperReturn conferences, industry-specific workshops, and smaller networking gatherings offer invaluable opportunities to meet professionals and learn about new developments in private credit.

- Actively engage on LinkedIn: LinkedIn is your professional digital storefront. Optimize your profile, connect with professionals in private credit, join relevant groups, and participate in discussions to enhance your visibility. Follow key influencers and firms in alternative lending and private equity.

- Informational interviews are key: Don't be afraid to reach out to people working in roles you aspire to. A brief informational interview can provide invaluable insights and potentially lead to future opportunities. Frame these as learning experiences for you, expressing genuine interest in their career path within private credit.

- Join relevant professional organizations: Organizations like the Alternative Credit Council and other regional or specialized groups provide networking opportunities and access to industry knowledge. Active participation demonstrates your commitment to the field.

- Leverage your existing network: Don't underestimate the power of your existing contacts. Reach out to friends, former colleagues, and family members – you never know who might have a connection within the private credit or investment management landscape.

DO: Tailor Your Resume and Cover Letter to Each Private Credit Application

A generic application won't cut it in the competitive private credit market. Each application needs to showcase your unique skills and experience in the context of the specific role and company.

- Highlight relevant skills and experiences, quantifying achievements: Instead of simply stating responsibilities, quantify your accomplishments. For example, instead of “Managed a portfolio of loans,” try “Managed a $50 million portfolio of loans, resulting in a 15% increase in portfolio returns.” This demonstrates your impact within private credit.

- Use keywords from the job description: Carefully review the job description and incorporate relevant keywords into your resume and cover letter. This helps applicant tracking systems (ATS) identify your application as a relevant match for private equity or alternative lending positions.

- Showcase your understanding of private credit markets and investment strategies: Demonstrate your knowledge of different private credit strategies, including direct lending, mezzanine financing, and distressed debt. Show your understanding of the unique aspects of private credit versus public markets.

- Customize your cover letter: Don't send a generic cover letter. Tailor each one to address the specific company and role, explaining why you're particularly interested in that opportunity. This shows initiative and genuine interest.

- Proofread meticulously!: Typos and grammatical errors can instantly disqualify you. Thorough proofreading is essential before submitting any application materials.

DO: Master the Art of the Private Credit Interview

The private credit interview is a crucial step in securing your dream job. Preparation is key to success.

- Practice answering common behavioral questions: Prepare for behavioral questions like "Tell me about a time you failed," "Describe a challenging situation and how you overcame it," and "Give me an example of a time you worked effectively in a team." Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Prepare for technical questions on credit analysis, financial modeling, and valuation: Expect questions on topics like discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, credit risk assessment, and different valuation methodologies used in private credit.

- Demonstrate your understanding of different private credit strategies: Showcase your knowledge of various strategies, including direct lending, mezzanine financing, and distressed debt investing. Explain the risks and rewards associated with each.

- Research the firm thoroughly and prepare insightful questions: Researching the firm's investment strategy, recent deals, and team members demonstrates your interest and initiative. Prepare thoughtful questions to ask the interviewer. This shows engagement and initiative.

- Show enthusiasm and passion for the industry: Your genuine enthusiasm for private credit will be evident in your responses and engagement throughout the interview process.

DON'T: Neglect Your Financial Modeling Skills

Proficiency in financial modeling is non-negotiable for a private credit role.

- Proficiency in Excel is non-negotiable: Practice building complex financial models, including LBO models, DCF models, and sensitivity analyses. Demonstrate a solid understanding of key financial metrics and ratios.

- Understand different valuation methodologies used in private credit: Familiarize yourself with various valuation techniques, including discounted cash flow, precedent transactions, and comparable company analysis. Understand their applications and limitations within the private credit context.

- Develop strong analytical skills to assess credit risk and investment opportunities: Practice analyzing financial statements, understanding credit metrics, and assessing the creditworthiness of borrowers.

- Familiarize yourself with relevant software: Familiarity with financial modeling software like Argus or Bloomberg Terminal can be a significant advantage.

- Showcase your modeling skills in your resume and during interviews: Highlight your modeling experience and accomplishments in your resume and be prepared to discuss your modeling skills in detail during interviews.

DON'T: Underestimate the Importance of Due Diligence

Due diligence extends beyond just researching potential employers; it also involves understanding the broader private credit landscape.

- Thoroughly research potential employers: Understand their investment strategies, recent deals, and team members. Demonstrate a keen understanding of their investment thesis and target market within the private debt space.

- Understand the regulatory landscape of the private credit industry: Familiarize yourself with relevant regulations and compliance requirements.

- Demonstrate a deep understanding of credit risk assessment and mitigation: Show your ability to identify, assess, and mitigate various credit risks. This includes understanding covenant structures and other risk mitigation techniques.

- Showcase your ability to analyze financial statements and other due diligence materials: Demonstrate your proficiency in analyzing financial statements, industry reports, and other relevant data.

- Develop strong research and analytical skills to assess potential investment opportunities: Practice analyzing market trends, identifying potential investment opportunities, and conducting thorough due diligence on potential investments.

Conclusion

Landing your dream private credit job is a challenging but achievable goal. By following these do's and don'ts, focusing on strategic networking, meticulous application preparation, and the development of strong financial modeling and analytical skills, you'll significantly improve your prospects. Remember that consistent effort in honing your skills and actively engaging in the private credit community will set you apart. Start building your private credit career today!

Featured Posts

-

The Enduring Appeal Of Dara O Briains Voice Of Reason

May 30, 2025

The Enduring Appeal Of Dara O Briains Voice Of Reason

May 30, 2025 -

Chokskifte Eller Realisme Dolbergs 25 Malssaeson

May 30, 2025

Chokskifte Eller Realisme Dolbergs 25 Malssaeson

May 30, 2025 -

Memorial Day Events In Des Moines A Complete Guide

May 30, 2025

Memorial Day Events In Des Moines A Complete Guide

May 30, 2025 -

Erstatter For Dolberg Fc Kobenhavns Jagt Pa En Ny Angriber

May 30, 2025

Erstatter For Dolberg Fc Kobenhavns Jagt Pa En Ny Angriber

May 30, 2025 -

Experience Bioluminescent Waves Best So Cal Beaches And Times

May 30, 2025

Experience Bioluminescent Waves Best So Cal Beaches And Times

May 30, 2025

Latest Posts

-

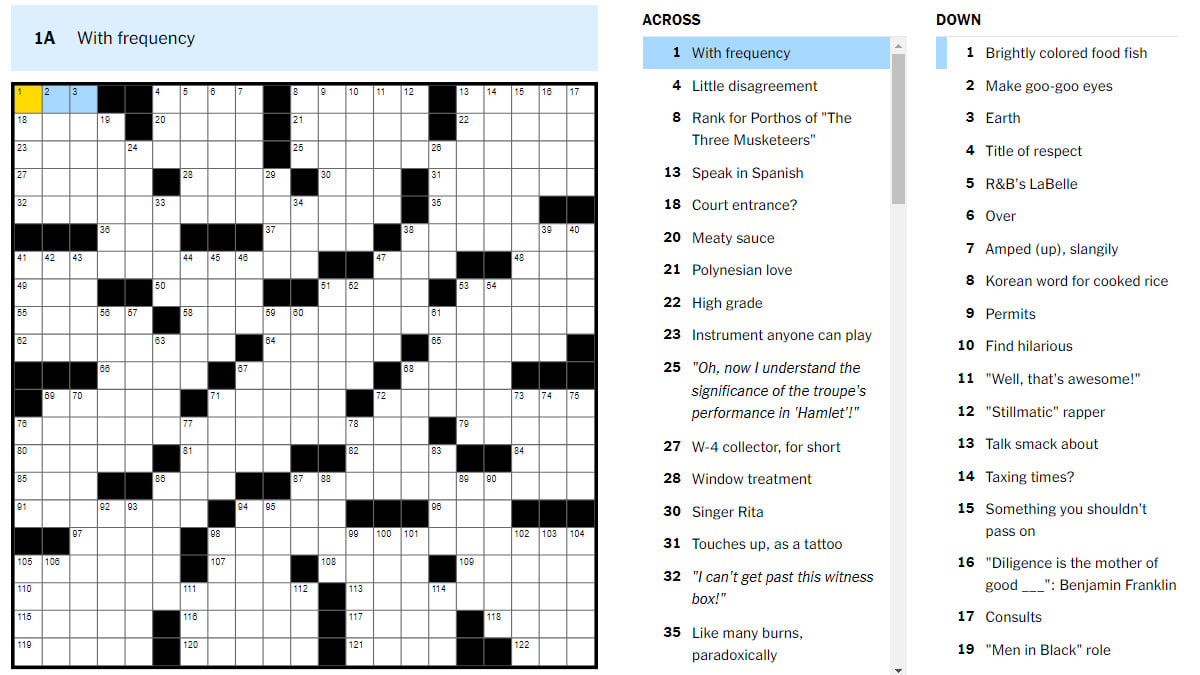

Nyt Mini Crossword March 24 2025 Hints To Help You Solve

May 31, 2025

Nyt Mini Crossword March 24 2025 Hints To Help You Solve

May 31, 2025 -

Almanac The Ultimate Guide To Daily News Sports And Jobs

May 31, 2025

Almanac The Ultimate Guide To Daily News Sports And Jobs

May 31, 2025 -

The Daily Almanac Your Go To For News Sports And Employment

May 31, 2025

The Daily Almanac Your Go To For News Sports And Employment

May 31, 2025 -

Nyt Mini Crossword Answers Today March 18 2025

May 31, 2025

Nyt Mini Crossword Answers Today March 18 2025

May 31, 2025 -

The Fentanyl Toxicity Report Princes Death On March 26th

May 31, 2025

The Fentanyl Toxicity Report Princes Death On March 26th

May 31, 2025